Tuesday, Nov 8, 2022

“May your choices reflect your hopes, not your fears.” – Nelson Mandela ||

Hello everyone! You’re reading the premium daily Crypto is Macro Now newsletter, where I look at crypto and macro markets and pick at themes that highlight the growing overlap between the two. Nothing I say is investment advice, but nevertheless I hope you find this useful – if so, please consider sharing with your friends and colleagues.

MARKETS

Well, that was nice while it lasted. The crypto market rally over the past few days gave us a glimmer of hope that the bottom was behind us, but drama is never far away in crypto. Early this morning BTC dropped over 6% in three hours, with half of that coming in a hair-raising 15-minute window. ETH followed a similar pattern, and the total crypto market cap dipped back below $1 trillion.

(chart via TradingView)

The jitters stem from a CoinDesk article published six days ago revealing a sizeable FTT (the exchange token issued by FTX) position on the balance sheet of Alameda Research, a trading company affiliated with FTX. Concerns started circulating that Alameda’s capital was not “safe”, given that a chunk of it was based on a token created by a sister company, rather than on a more independent and resilient asset. This prompted a rare tweet from the CEO of Alameda Research who assured us that the firm’s various corporate entities had over $10 billion in assets that were not reflected in the data shared in the CoinDesk article.

Binance CEO CZ added fuel to the embers when he tweeted that Binance was planning to dump its FTT holdings, to which Alameda’s CEO responded with an offer to buy them all at $22. Nevertheless, the token plummeted in the early hours of today, briefly dropping below $15 before recovering to just over $18 at time of writing.

So why would this impact the rest of the crypto market? The concern is the stress this could put on various counterparties and consequently asset prices, as loans could be called, positions liquidated and user withdrawal requests flood in.

BTC liquidations were relatively muted for a move of this size, which suggests that it was largely spot-driven. Data from Coinglass shows that FTX and Coinbase saw outflows of roughly $400 million and $600 million worth of BTC respectively over the past 24 hours.

(chart via Coinglass)

According to a Dune Analytics dashboard created by @1chioku, FTX suffered net outflows of almost $1 billion over the past week not including bitcoin holdings, half of that over the past 48 hours. However, another dashboard by @21shares shows that FTX still holds over $1.2 billion worth of Ethereum-based tokens, and it probably also has a considerable amount of other tokens as well as fiat in its bank accounts, so its insolvency is not a likely outcome. In both cases, it seems the data does not yet reflect the market moves of this morning.

If FTX emerges bruised but intact on the other side of this turmoil, that will be a strong signal that market infrastructure fragility has largely been flushed out, perhaps setting the stage for a stronger rebound. If not, well, that would be really bad for the market as a whole. In my opinion, the media and certain Twitter commentators are blowing this out of proportion, with some framing it as an attack on FTX from its main competitor Binance. While some snark has been exchanged, even CZ has been trying to walk back that impression, as the reputation of the market as a whole is at stake.

---

On top of all this drama, we have the US midterm elections today. It will take some time (possibly days) for the results to be confirmed, but it looks likely that the Republican Party will gain ground and take control of the House of Representatives and probably also the Senate.

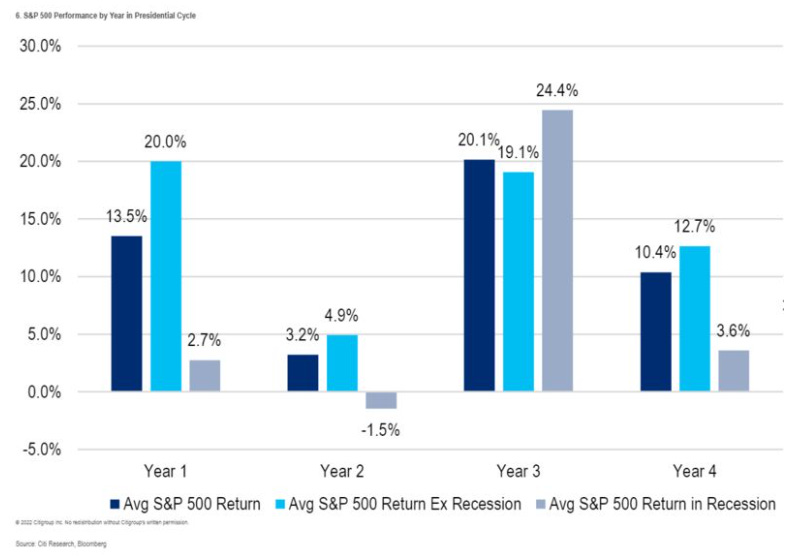

Whatever the outcome, we could see a sentiment bounce as one level of uncertainty is removed from the short-term outlook, and stocks could benefit from the stalling of any plans to raise taxes, tighten regulation or boost fiscal stimulus. According to a chart produced by Citi and shared by Bloomberg, the S&P 500 has typically performed best in the years following midterms.

(chart by Citi via Bloomberg)

Then again, this cycle is unusual for many reasons, not least the looming recession, inflation pain and as-yet-uncertain fallout from the land war in Europe. It remains to be seen whether the recent and expected US rates tightening will have enough of an impact on inflation to avoid significant global instability (CPI data out on Thursday is likely to rattle markets but otherwise not give much of a clue).

Like stocks, bitcoin could benefit from the lower risk of fiscal expansion which could mean a lower-than-expected terminal fed funds rate and a slowdown or even reversal of the US dollar’s climb. The crypto bills with the most traction meandering their way through Congress should not be materially affected as they are bipartisan.

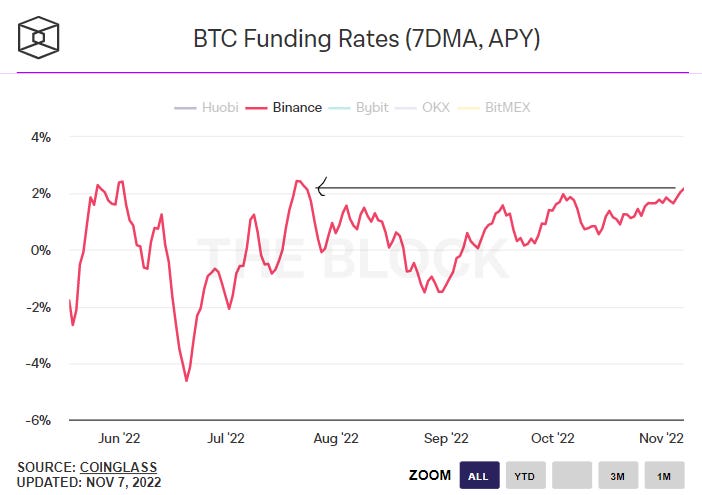

In what could be a reflection of the potentially optimistic outcome this week, BTC funding rates on Binance have reached their highest level since August and are currently higher than those for ETH (after dipping below earlier this month). This is far from conclusive, especially given the market moves today, but it is notable that so far BTC seems to have found a floor at around $19,700.

(chart via The Block Data)

NEWS

Bipartisan crypto policy. A report uncannily appropriate for midterm election day informs us that Paul Ryan, the former speaker of the US House of Representatives, is joining a group curated by crypto-focused venture capital firm Paradigm and composed of past leaders of congressional campaign committees for both parties. The aim is, as with other policy groups, to help shape the outcome of crypto legislation in Washington. This is encouraging as there are several regulatory initiatives underway that will impact our industry, and the broader the range of informed voices as to political process, influence as well as crypto industry interests, hopefully the more balanced the outcome.

Euro stablecoins? Circle plans to add support for a Solana-based version of its euro-backed stablecoin EUROC next year. This makes sense for Circle: EUROC has attracted scant demand so far (its market cap is ~$80 million and daily volume is usually less than $1 million), so adding another source of potential demand could boost adoption. Solana-based USDC accounts for just over 10% of the total USDC market cap of ~$42.7 billion. What’s more, the eventual implementation of MiCA could increase demand for euro crypto settlement. According to Chainalysis’ 2022 Geography of Crypto report, central/northern/western Europe is still the world’s largest cryptocurrency market thanks largely to DeFi, where EUROC could find good market fit (more than larger competitors EURT and EURS) given the current decentralized application preference for sister stablecoin USDC. And now that EU interest rates are no longer negative and certain to increase further, Circle could benefit from the revenue stream.

(chart via Chainalysis)

Also…

Since the above news pales in action-packed flair compared to the market comment above, I’m sharing a screenshot of the blood moon eclipse that I sat watching earlier today. That may sound dull since celestial bodies tend to not move at high speed, but I can assure you it was quite dramatic, especially since it was the last full total lunar eclipse we will see until 2025. It’s also refreshingly humbling to look up and feel part of a universe that marches to a rhythm totally unrelated to markets or elections or chaotic social media. Just sayin’. It was beautiful.

(screenshot via CNN-News18)