Stripe’s stablecoin bet is bigger than it seems

plus: bond sentiment shift

“As to the evil which results from a censorship, it is impossible to measure it, for it is impossible to tell where it ends.” – Jeremy Bentham ||

Hi everyone, I hope you’re all well!

Today, I look at the big step taken by Stripe in its acquisition of stablecoin platform Bridge – there’s more going on here than meets the eye.

I also squint at the bond market tealeaves and what they are saying about the creeping sentiment shift.

No audio today, but I should be able to squeeze part of today’s send into tomorrow’s recording.

IN THIS NEWSLETTER:

Bonds are signalling a sentiment shift

Stripe’s stablecoin bet is bigger than it seems

If you’re not a premium subscriber, I hope you’ll consider becoming one!

WHAT I’M WATCHING:

Bonds are signalling a sentiment shift

Finally, the bond market seems to be coming around to the idea that we might see a pause in rate cuts come November. Yields are climbing:

(chart via TradingView)

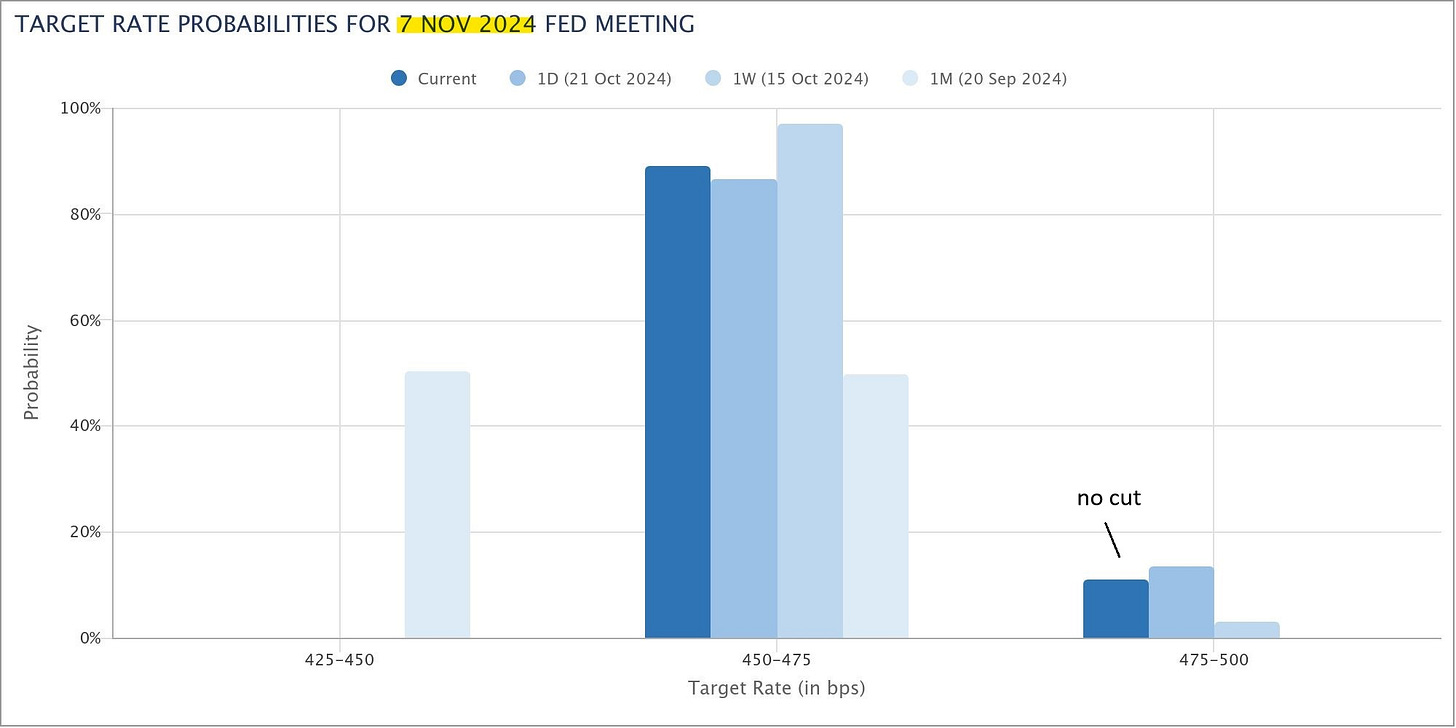

And CME futures-priced expectations now assign a more than 10% probability to no move at the next FOMC, vs almost 0% just a week ago.

(chart via CME FedWatch)

I’ve written before about how another cut in November made little sense, given the strength of the numbers (relevant for a “data dependent” Fed) and the risk of throwing more uncertainty on what is likely to be an already turbulent week post-election. When I wrote that in early October, markets were pricing in another two cuts at the next FOMC meeting.

What has prompted the sentiment shift, and what does it mean for crypto markets?