Tuesday, Oct 31, 2023

bitcoin anniversary, institutions coming back, crypto merging with tradfi, Twitter decline

“Fear is the main source of superstition, and one of the main sources of cruelty. To conquer fear is the beginning of wisdom.” – Bertrand Russell ||

Hello everyone, and Happy Halloween if you celebrate it! Although I confess I’ve never understood why we say “happy” Halloween, since it’s about being scary and scared and generally uncomfortable. This is usually good – discomfort can make us feel alive and empowered, and there are few things more fundamental to a fulfilled existence than overcoming fears, which is what Halloween is all about. But “good” and “happy” are two very different things.

So, I take that back and instead I wish you an “empowered Halloween!”. It doesn’t have the same alliteration, though, which is a pity.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now, with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

Programming note: While much of the world celebrates Halloween, here in Spain we celebrate All Saints’ Day on November 1st, when we pay our respects to the dead. It’s a national holiday here, so this email will take a break tomorrow, but back in your inboxes on Thursday!

**ANNIVERSARY** On October 31, 2008, Satoshi Nakamoto shared the Bitcoin white paper for the first time. Fifteen years later, millions of people around the world know his name.

IN THIS NEWSLETTER:

Signs the institutions are coming back into the crypto market

What crypto merging with finance could look like

Argentina needs dollars

Twitter declines

WHAT I’M WATCHING:

Signs the institutions are coming back into the crypto market

Bitcoin continues to bounce around $34,000 with a slight upward bias, despite grey clouds on the economic horizon and jitters in the stock market.

Clues are emerging as to the source of the crypto market support.

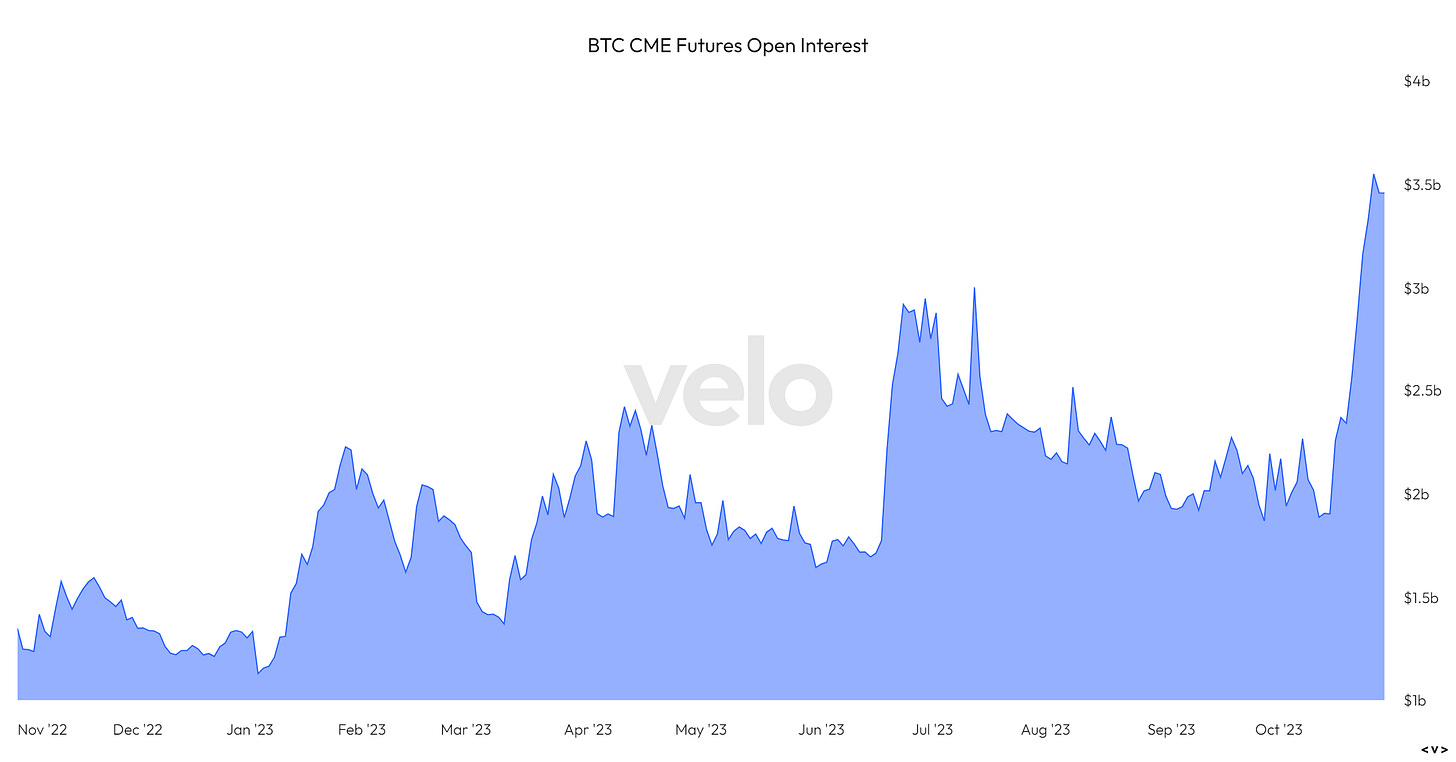

One is the recent surge to record levels (!) in BTC futures open interest on the CME, the preferred crypto derivatives exchange for US-based institutions.

(CME BTC futures open interest in USD terms, chart via velodata.app)

The surge has not been replicated on other platforms – open interest on Binance, for instance, has grown but not nearly to the same extent.

And in BTC terms (rather than USD terms), Binance futures OI has remained largely flat over the past couple of months, while that for the CME has shot up.