Tuesday, Oct 4, 2022

“Coming back to where you started is not the same as never leaving.” – Terry Pratchett ✶

This is the premium daily Crypto is Macro Now email, with market commentary and news insight. I’m Noelle – I’ve been writing crypto newsletters for over six years now, first for CoinDesk and more recently for Genesis Global Trading. Now that I’m focusing on independent research (the topic hint is in the title!), it felt natural to continue. I hope you find this useful - if so, please consider sharing.

MARKETS

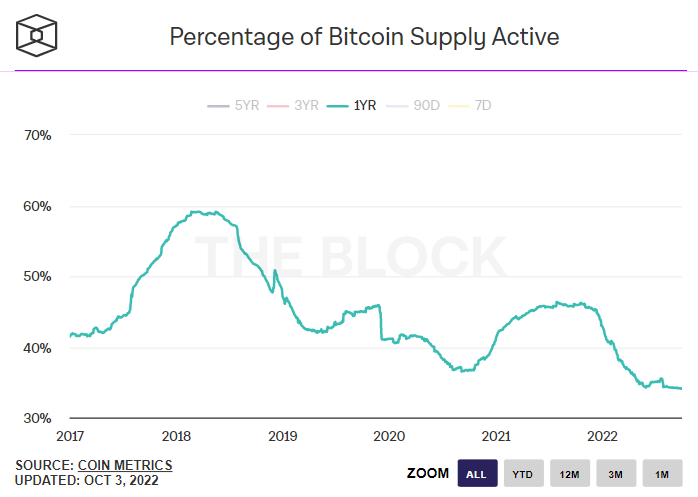

Yesterday felt like a “reset” day, with stocks and crypto gaining while the US and UK 10-year yields as well as the DXY continued to unwind their late September spikes.

One possible trigger for this is the ISM Manufacturing Purchasing Managers Index (PMI) for September, which came in yesterday at 50.9 – not only the lowest since May 2020, but also well below the 52.2 expected and 52.8 in August. Anything below 50 is considered a contraction.

The measure of new orders fell to 47.1, its lowest level since the early days of the pandemic and its third drop in the past four months. The index of export orders contracted by the most in more than two years, hit by the strong dollar and weakening economies elsewhere. A manufacturing employment gauge contracted for the fourth time this year. And a measure of prices paid for materials used in the production process retreated for the sixth month in a row, to the lowest level since June 2020.

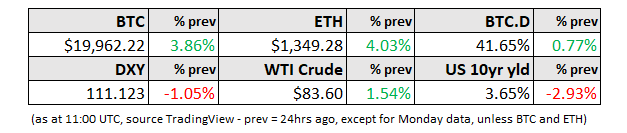

All in all, the data delivered strong signs of a weakening economy, which the market seems to have taken as confirmation that the end of rate hikes is near. The impending slowdown has shifted the market-priced probability of a 75bp hike in November down to 56%.

(chart via the CME)

By now, though, we’ve been through enough of these hope rallies to know that there could still be some surprises in sticky employment and inflation – today we get the US job openings and labor turnover data (JOLTS).

Correlations: relevant but not intrinsic

There have been some interesting moves in BTC correlations over the past few weeks. Yes, we all know that “BTC is a macro asset” and is highly correlated to the S&P 500 – but it’s worth revisiting why that happened, and why I believe it started unwinding a while ago.

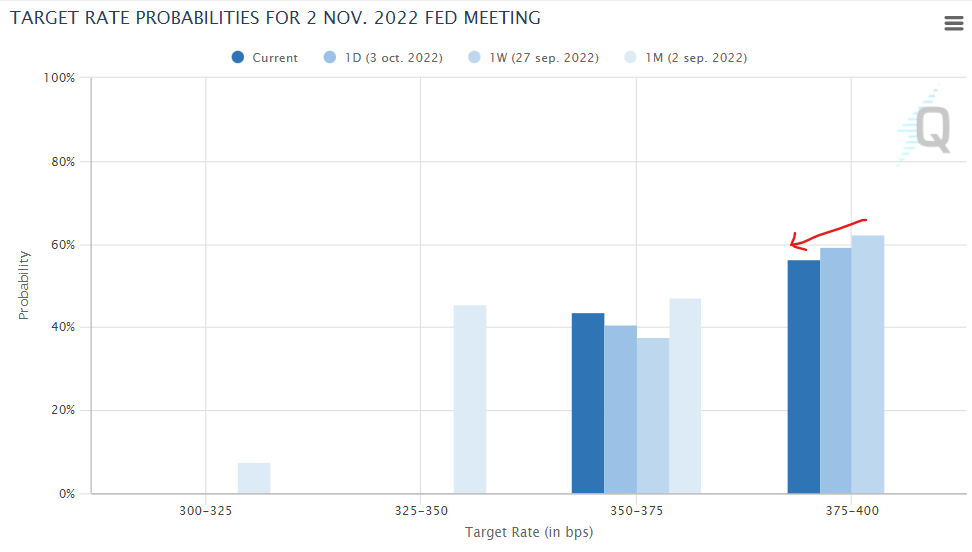

For years, observers of the crypto markets were proclaiming “the institutions are coming!”. And then, late last year, they did. Many larger macro investors started to see BTC and others as alternative high-volatility assets. They did not really care about the seizure and censorship resistance, they wanted the upside potential, and because crypto assets were treated as high-risk vehicles, they started to behave as such. This accelerated as the “great divestment” kicked in along with growing fears of the monetary tightening impact. The 60d correlation with the S&P 500 shot up as markets tumbled, moving from close to 0 up to a high of over 70 in just a few weeks.

(chart via Coin Metrics)

Then May’s Terra implosion hit crypto even more than rates fears were hitting stocks at the time. The 60d BTC-S&P 500 correlation dropped to a local low of 0.33 as macro investors exited. Since then, the correlation started to head up again as virtually all assets continue to be buffeted by macro and monetary uncertainty. But this does not mean that BTC is condemned to always act as a risk proxy.

Here we have two well-worn investment adages competing for relevance:

1) Correlation does not imply causation.

2) In times of fear, all correlations go to 1.

Both are true. The summer climb in BTC-S&P correlation was not necessarily due to macro investors treating crypto as a risk asset – many had already divested, and while speculative trading will always be a feature of crypto markets, the strong flows of funds either in or out have been largely absent.

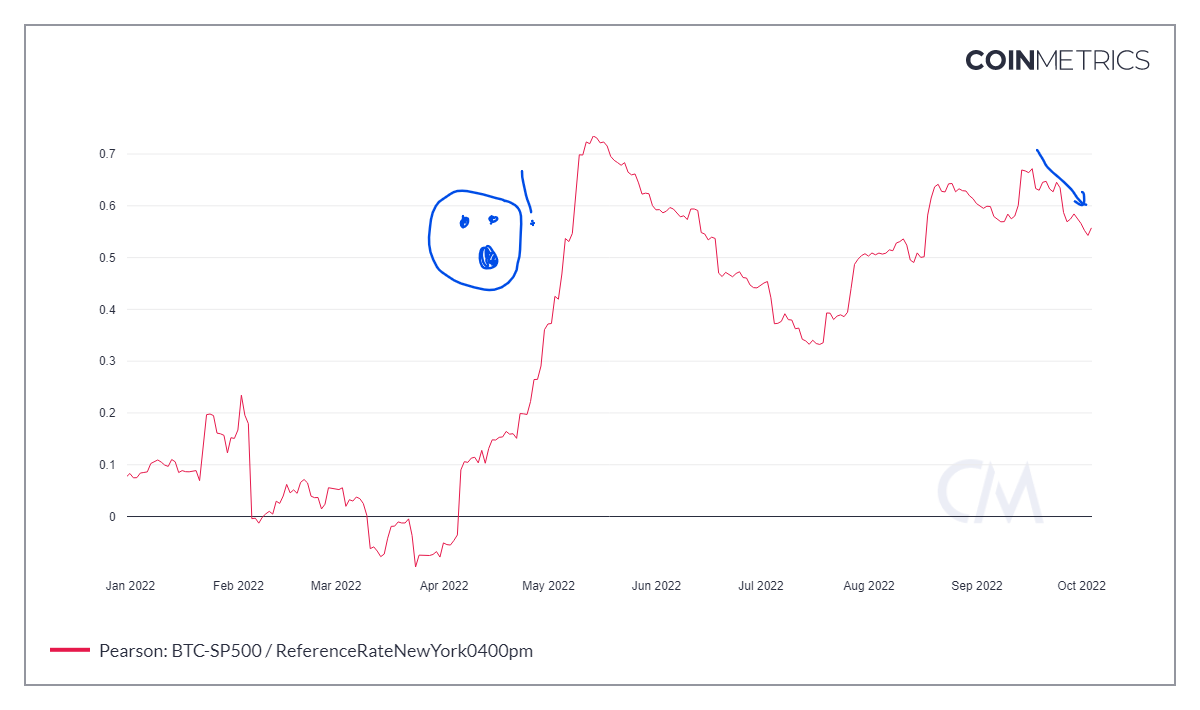

Meanwhile, accumulation has continued. The percentage of BTC that has not moved in over a year is now at the all-time high of over 65%.

(this chart via The Block Research shows the % of BTC that has moved in the past year)

The more short-term macro investors exit the crypto market, the more pricing power they cede to longer-term participants with possibly different investment theses. This is against low volumes, however, and while accumulation behaviour may play more or less of a role in the correlation’s rise and fall, it will never be predominant – prices are set by the last trade, at least one side of which is likely to have a short-term, perhaps trading-oriented view.

So, the correlation is a feature, not a characteristic. Relevant, but not intrinsic.

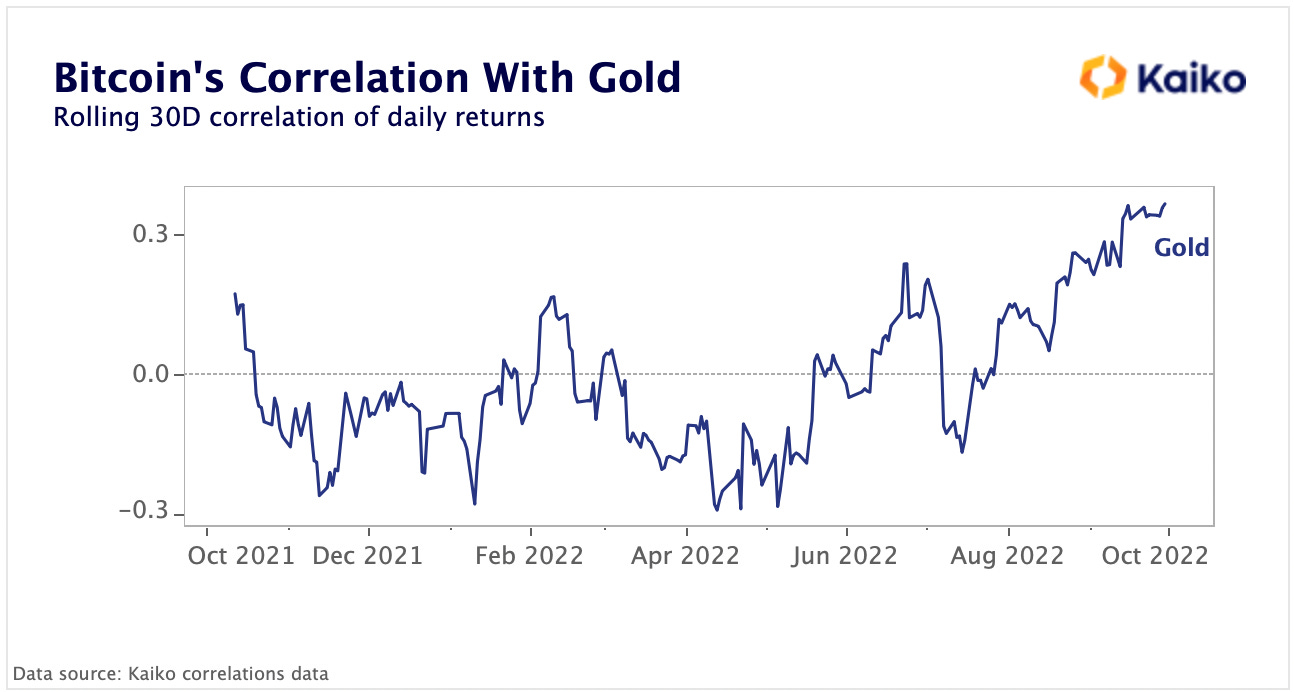

And what of the correlation with gold? Data provider Kaiko points out in its latest (and always excellent) newsletter that the correlation between the two supposed inflation hedges is at its highest level in over a year.

(chart by Kaiko)

Both BTC and gold have not exactly performed as inflation hedges of late – but this move against the backdrop of dollar strength, stubborn inflation and increasing uncertainty is worth keeping an eye on.

NEWS

The relationship between crypto mining and energy production intensifies. YPF – 51%-owned by the Argentinian government – is currently supplying power generated from waste gas to an undisclosed crypto mining company, and plans to start a second and much larger pilot before the end of the year. We have seen many examples recently of energy producers leaning on bitcoin mining for contamination mitigation as well as additional income – the involvement of state-owned companies is an intriguing twist.

The world continues to get more digital. A court has ruled that CFTC serving a summons and complaint to Ooki DAO members via the project’s help chat box is legal. In the past (which increasingly feels like a long time ago), they had to be served physically, limiting the jurisdictional reach. Now they can be sent electronically to anywhere and anyone, even non-persons and unregistered collectives. I still have to get my head around what this could mean for open access and project transparency. Law enforcement representatives should be able to do their job – the issue seems to be the blurring boundaries as to what that job is, and the extent of its reach.