Tuesday, Sept 24, 2024

why are markets sleepy?

“That men do not learn very much from the lessons of history is the most important of all the lessons of history.” – Aldous Huxley ||

Hi everyone! A late send today, apologies, and a relatively short email, but since yesterday’s was long, it sort of averages out? Autumn brings many wonderful things, but it also seems to trigger flu season 🤒.

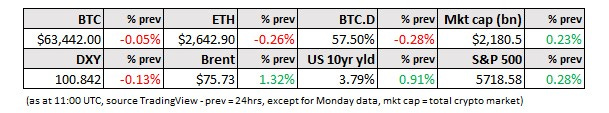

Below, I ask why markets are not more excited about US rate cuts – there was a small bump right after the FOMC announcement, but not much since then. I also look at BTC drivers: tailwinds continue to pile up, and although it has done better than stocks over the past few days, it’s muted performance is still puzzling.

IN THIS NEWSLETTER:

Waiting for more

But the liquidity…

If you’re not a premium subscriber, I hope you’ll consider becoming one! It’s the price of a couple of New York coffees a month, and you get ~daily commentary on how macro moods are influencing crypto markets, and also on how crypto is impacting the macro economy.

WHAT I’M WATCHING:

Waiting for more

Since last week’s substantial US rate cut, one that just a few days earlier was deemed out-of-the-question by market consensus, US stock markets have… well, they haven’t done very much.

The hours after the FOMC statement were dominated by the usual whiplash, and the day after opened higher. But since then, the main indices have been range-bound. On Thursday, the S&P 500 opened 1.8% higher than at 1:55pm on Wednesday, just before news broke of the 50bp cut. Since then, it has eked out a paltry 0.2%.

(chart via TradingView)

This is strange. The stock market was not expecting a 50bp cut – the bond market is usually more sensitive to rate concerns and faster to price in mood shifts, and even it went into the FOMC meeting reflecting only 60/40 odds, the closest (ie. the most confused) day-before read in decades. Most economists had pencilled in 25bp.

With this degree of surprise, you would think there would be more excitement about easing conditions, especially with a few Fed officials yesterday reminding us there’s plenty of room to cut more.

So, what is holding markets back?