Tuesday, Sept 27, 2022

“We have no future because our present is too volatile. ... We have only risk management.” – William Gibson

Trouble in the Baltic Sea. This morning, Nord Stream AG confirmed that its three pipelines (two for Nord Stream 1, shut down in August, and one for Nord Stream 2 which was suspended after Russia’s invasion of Ukraine) suffered “unprecedented” damage. Danish and Swedish authorities have confirmed leaks from the pipelines into the Baltic Sea, which could interrupt some shipping lanes.

Given escalating international tension over the war in Ukraine, many are assuming the leaks are deliberate. The Kremlin has said it is “not ruling out” sabotage, and clips of Biden from back in February promising to shutter Nord Stream 2 are all over Twitter. The concern is that even speculation on sabotage initiated by the US could add further fuel to the escalation that Putin has been mobilizing for, especially since it is not clear now what form this might take.

However, collective opinion tends to latch on to easy assumptions in times of stress and uncertainty – and while haste is an advantage in conflict, it can lead to incorrect conclusions. If the US wanted to provoke Russia into a rash action, it is unlikely that an environmentally damaging pipeline leak would be the trigger of choice, especially since all the pipelines were shut anyway. It also does not make much tactical sense to inflict significant economic damage on to one of its main trading partners, just as the US braces for a slowdown. And just a few days ago, Russia said that it had thwarted a planned Ukrainian attack on infrastructure delivering energy to Turkey and Europe. So, not good for the energy supply (very little chance of any of the pipelines being operational by winter, even were the war to come to a swift end) or for the already strained geopolitics in the region.

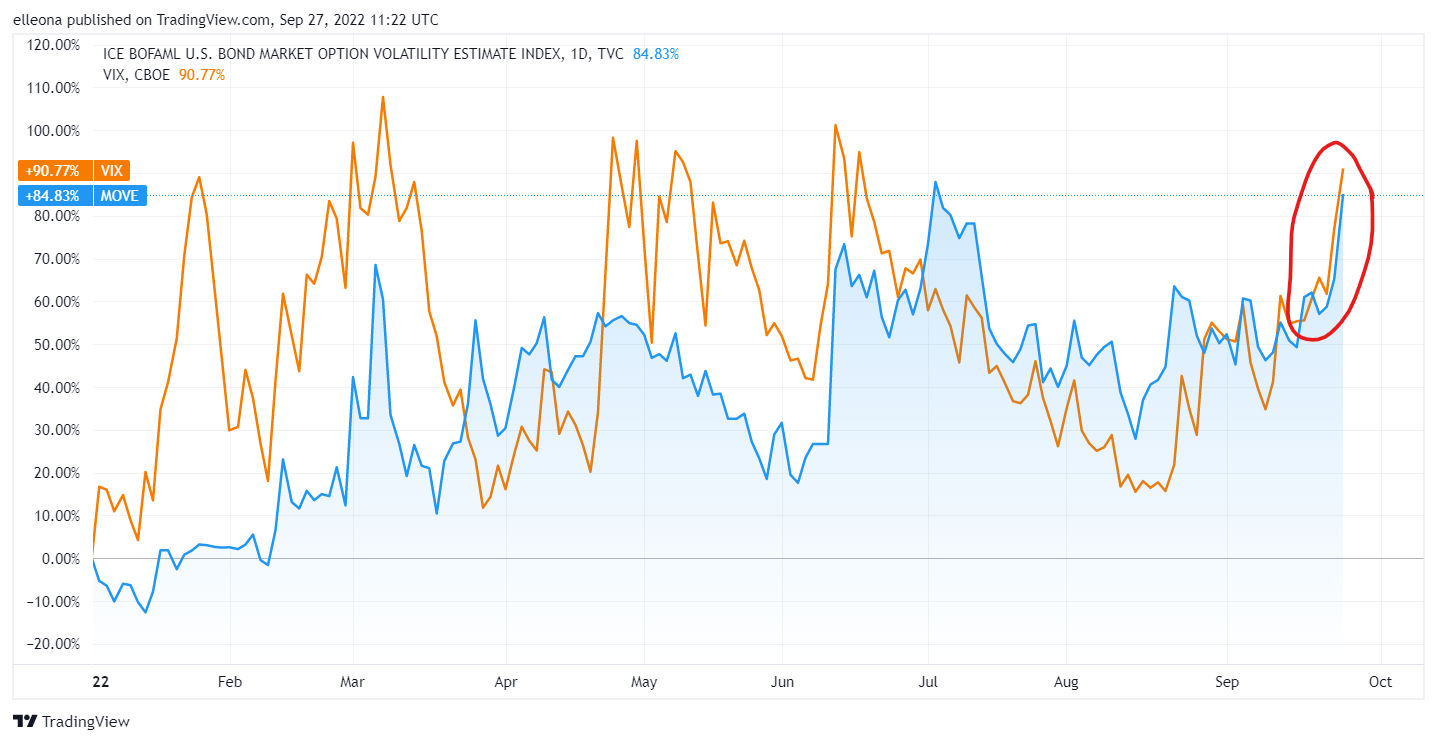

According to the ICE-BofA MOVE Index, US bond market volatility is at its highest since 2009 when looked at on a monthly basis (this involves some smoothing). This is not good, especially given the backdrop of strains in the UK gilt market, and especially given the US bond market’s supposed status as the world’s “safe haven”.

The volatility is even higher than during the peak of the pandemic market stress. The VIX, however, is still well below its pandemic peak. This is weird.

Looking at the relative moves over the past year, the MOVE has increased by much more than the VIX. This does not signal high confidence in US debt.

True, any percentage increase comparison depends a lot on the start date. Taking the MOVE vs the VIX year-to-date, we see they have increased by roughly the same amount. That is also very unnerving, for the world’s “safe haven” market. Maybe it’s time to re-think what we mean by “safe haven”? (All charts via Tradingview.)

The OECD Interim Economic Outlook is out. The report forecasts US headline inflation falling from 6.2% to 3.4% in ’23. The Fed is targeting core PCE, not headline CPI, but it looks like the OECD thinks it’s achievable.

Yesterday, the IMF released two reports on crypto regulation, pointing to the Financial Stability Board as the ideal regulator for a global framework. Some of the suggested measures include a common categorization and additional requirements for “riskier” entities. The FSB was set up by the G20 in the wake of the 2008 crisis to monitor and make recommendations about the global financial system. It is not a regulator – the best it can do is advise, but its recommendations are generally taken seriously by its 68 member institutions. However, it has been criticized in the past for the opacity of its internal processes. Some are likely to point out that a global framework could open up new avenues of investment. Others may raise objections that an unelected group – arguably interested in maintaining the status quo – decide on rules impacting innovation.

Walmart continues the march of big-name brands into the metaverse, with the launch of Walmart Land (a virtual merchandise store) and Walmart’s Universe of Play (toy worlds and games). This move is more interesting than many I’ve seen in that it seems to be more than just marketing. It seems to be actual retail (which Walmart knows something about) for a virtual world combined with brand engagement. It would be good to see more initiatives like this, that could actually grow because they’re useful and fun rather than just cool to look at, since the growing awareness is likely to bring funding and footfall to the concept.

Aspen Creek Digital Corp. (ACDC) has raised $8 million from investors including Galaxy Digital and Polychain Capital, showing that fresh financing for the industry is not out of the question. Funding for capital-intensive businesses whose profitability depends on the price of BTC has been constrained as lending in the industry contracts and available funding gets more expensive. This has prompted concerns that miners could be forced to sell their BTC holdings, adding sell pressure to an already muted market. ACDC apparently secured the power and machines for its second farm before seeking the financing. It will be co-located with a solar farm in Texas, and will be able to sell excess power to the grid.