Turning up the temperature

plus: what's ahead this week, market flush, GDP, PCE and more

“Coming back to where you started is not the same as never leaving.” – Terry Pratchett ||

Hey everyone!! So good to be back home and back at my desk, but Malta was just lovely – it feels like time has stood still there. And I’m grateful for the break, it turns out I needed it more than I realized. I’m back with more energy and optimism than when I left, still worried about the macro setup but excited about the crypto market outlook over the coming months.

Tomorrow I’ll publish my expectations for Q4, which will explain why.

A long newsletter today, there is SO much to catch up on, and even so, I’ll have to push some updates to tomorrow. It’s going to be a busy week/month/quarter.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

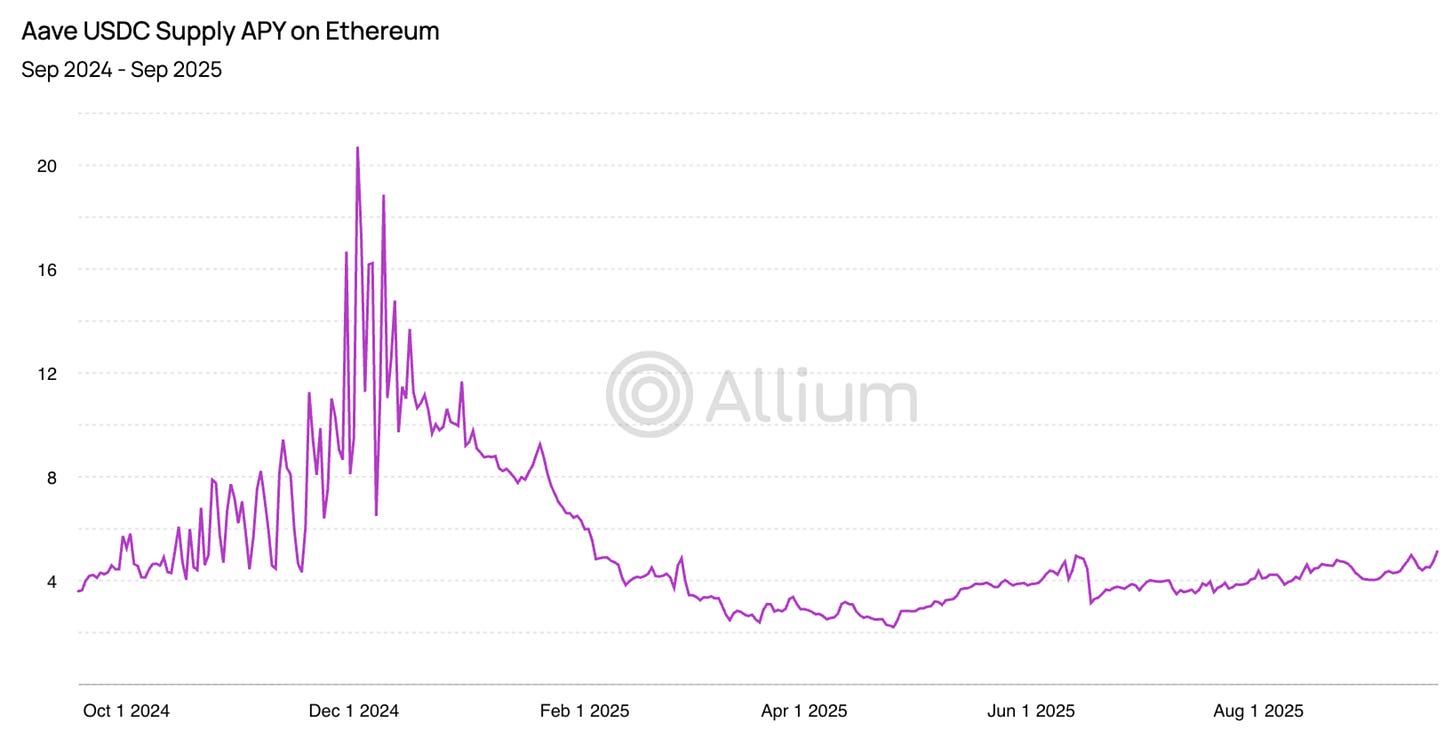

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: jobs data, shutdown, confidence, Japan elections and more

Turning up the temperature

Macro-Crypto Bits: GDP, PCE, markets, Vanguard

WHAT I’M WATCHING:

Coming up:

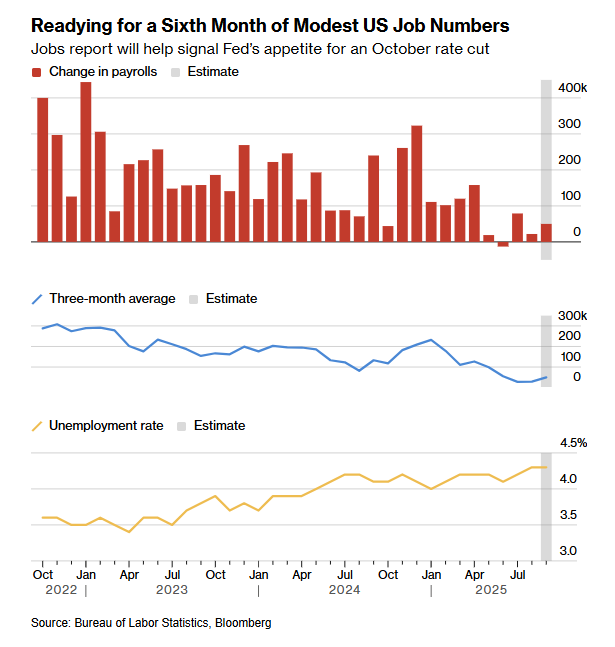

The big deal this week is the flurry of US jobs data, ending with the official employment report due on Friday – unless, that is, the government shuts down on Tuesday, in which case, maybe not.

Later today, we get the Bank of Japan Summary of Opinions, which shares details of discussions at the latest central bank policy meeting which should give some insight into the likelihood of rate moves in coming months, as well as inflation and growth forecasts.

We also get China’s Purchasing Managers Index for September, which is expected to show yet another month of slowing economic activity.

On Tuesday, we get the latest Consumer Board Consumer Confidence read – it’s not expected to be optimistic.

We also get the first of the week’s US jobs data, the JOLTS report which tracks job openings, hirings and separations – consensus forecasts point to continued softening.

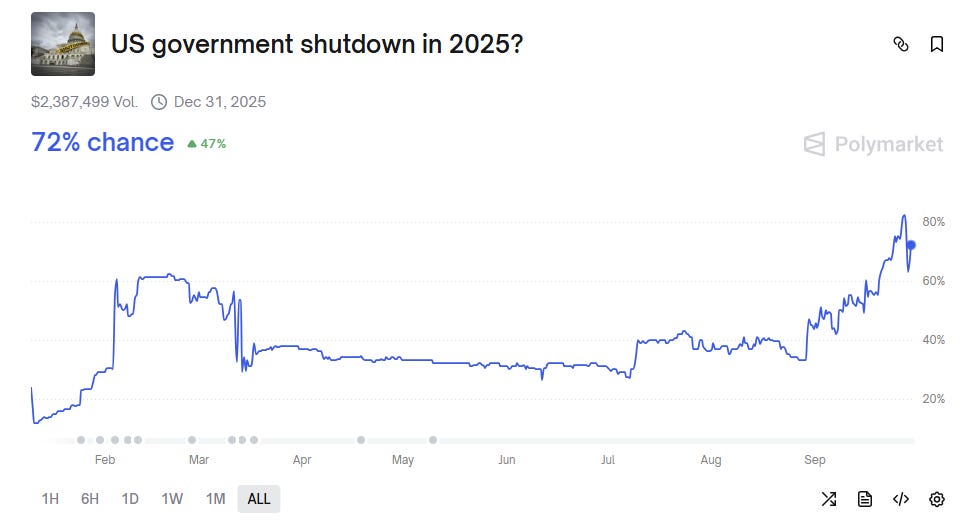

And Tuesday is the deadline for an agreement on a Congressional spending package – if no agreement is reached, which looks likely, the US government has to suspend all non-essential services until funding is resumed, possibly including economic data releases. As I type, Polymarket has the odds of a shutdown at over 70%.

(chart via Polymarket)

On Wednesday we get the private ADP payroll read, expected to show a slight softening from to 53,000 from 54,000 in August. If the government has shut down, this could be the main jobs data of the week – if not, that comes on Friday.

We also get S&P Global as well as ISM Purchasing Managers Index for the US manufacturing sector, expected to be largely unchanged.

OPEC+ meets, with a possible change to production quotas and perhaps a revision of output forecasts now that sanctions against Iran have kicked in again.

And Chinese as well as Hong Kong markets are shut for National Day – China’s stock market will remain closed until Wednesday, October 8th.

On Thursday, we get the Challenger report on US job cuts in September, as well as the weekly report on unemployment claims.

And on Friday, we get the US jobs report for September. Again, maybe, if the government hasn’t shut down. Or maybe even if so, we don’t yet have details on the BLS’s contingency plans. Consensus forecasts point to a soft but positive gain in payrolls.

(chart via Bloomberg)

To round off the week, on Saturday, Japan holds leadership elections for its ruling Liberal Democratic Party, with a potential renegotiation of the US trade deal hanging in the balance. One of the top contenders to lead Japan’s ruling Liberal Democratic Party (LDP), Sanae Takaichi, is talking about a trade deal renegotiation.

ALSO: Introducing a new quarterly feature, I’ve been typing up my thoughts on what’s coming in Q4, in crypto, macro and tokenization – I’ll be sharing this over the next few days.

Turning up the temperature

Last week brought even more signs that the likelihood of armed conflict is ratcheting up. Markets are only partially reflecting this, but most investors still seem oblivious.

The EU-Russia

The number of alleged Russian drones flying over military and energy installations in Norway, Sweden, Finland, Denmark, Germany, and Lithuania is escalating while ringing plenty of alarm bells here in Europe, especially given what looks like US disinterest in what the moves imply. These come on top of earlier reports of Russian fighter jets in Estonian airspace and drones over Poland.