Two BTC influences to watch

one onchain, one macro - and, crypto in China

“I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretence of exact knowledge that is likely to be false.” ― Friedrich Hayek ||

Hi everyone! I hope you’re all doing well, and getting ready for a hectic December.

A late send today as I gave a talk at a business school this morning and I’ve been away from my desk. Back to a normal schedule tomorrow, hopefully, it’s been a fractured week!

Below, I talk a bit about BTC’s pullback, and what signals I’m keeping an eye on.

I also revisit my theory that we will soon start to see rumblings about crypto regulation out of China.

There won’t be an audio today, due to a schedule squeeze (and, with so many charts, it’ wouldn’t make a good read).

Yesterday, I hopped on last minute as a substitute host for Scott Melker’s Macro Monday show, always fun to be on – you can see that here.

Programming note: this newsletter will be taking off the Thanksgiving break, so no newsletter Thursday-Saturday – back on Monday!

IN THIS NEWSLETTER:

Two BTC influences to watch: one onchain and one macro

China’s crypto signpost?

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Two BTC influences to watch: one onchain and one macro

I wrote yesterday about the difficulty BTC could have in breaking through the $100,000 resistance barrier, and how the longer it took, the firmer it could get as traders start to doubt that it will. I also pointed out signs of market bullishness medium term, and how there are as yet no signs the bull run is anywhere near over. I mean, my X feed is not yet full of excited traders showing off their lambos. Sure, perhaps the crypto community has matured, but somehow I doubt it 😜 .

(chart via TradingView)

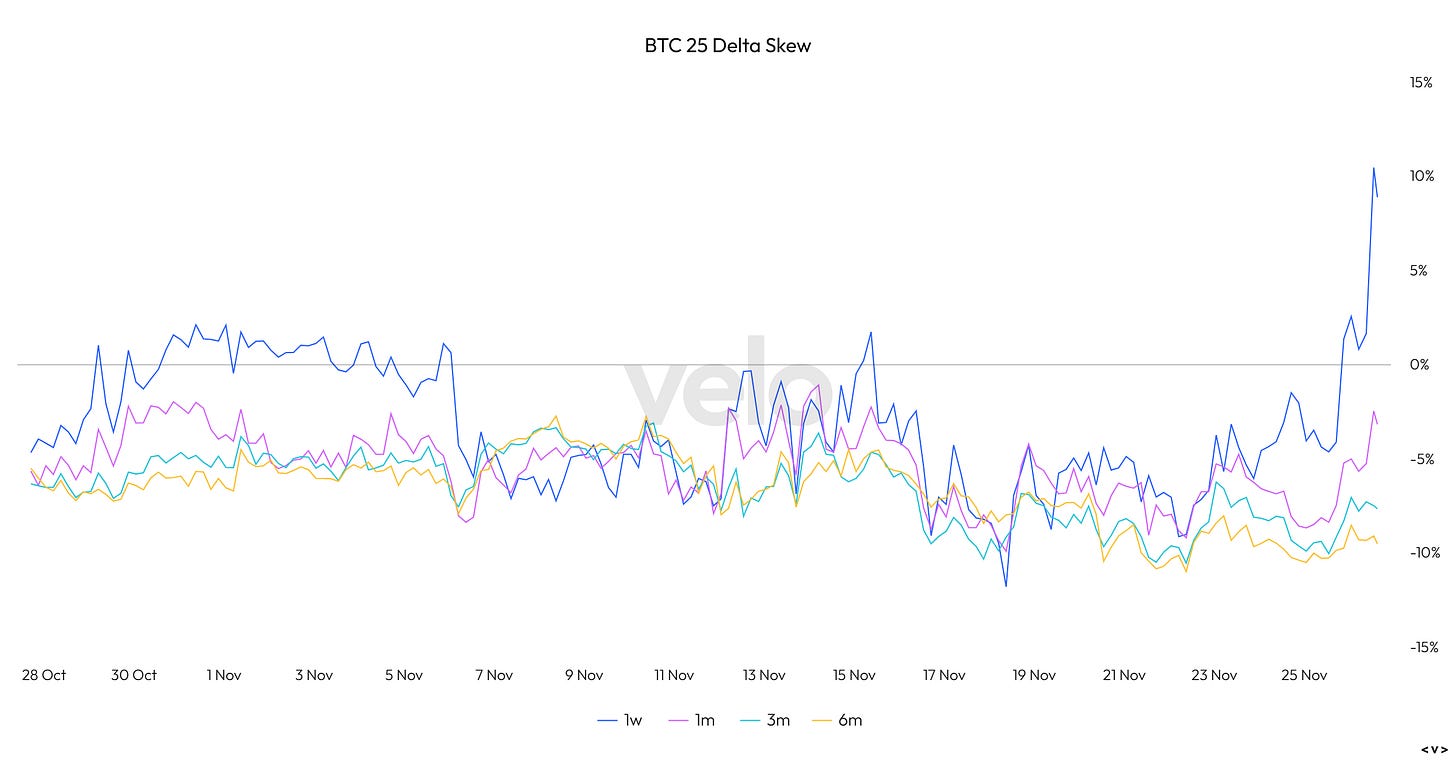

As BTC retreats from $100,000, short-term traders are scrambling to protect downside, with demand for bearish puts shooting up relative to that for more bullish calls. But looking out three to six months, optimism is keeping skew (the implied volatility for puts minus that for calls at various expiries) negative.

(chart via velo.xyz)

So, what factors to watch now? As always, there are many, and they are diverse, but I’m looking at two in particular.