Unhelpful institutional hype

plus: China's priorities, complacency, prediction markets, sanctions and more

“Those who speak most of progress measure it by quantity and not by quality.” – George Santayana ||

Hello everyone! I hope you’re all doing well. How did Halloween sneak up on us so fast this year? Scary.

Last night I had the pleasure of chatting to Maggie Lake on her Market House show – we touched on gold, macro, BTC, risk sentiment, shifting horizons and a lot more. You can see the replay on Substack, or on YouTube.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

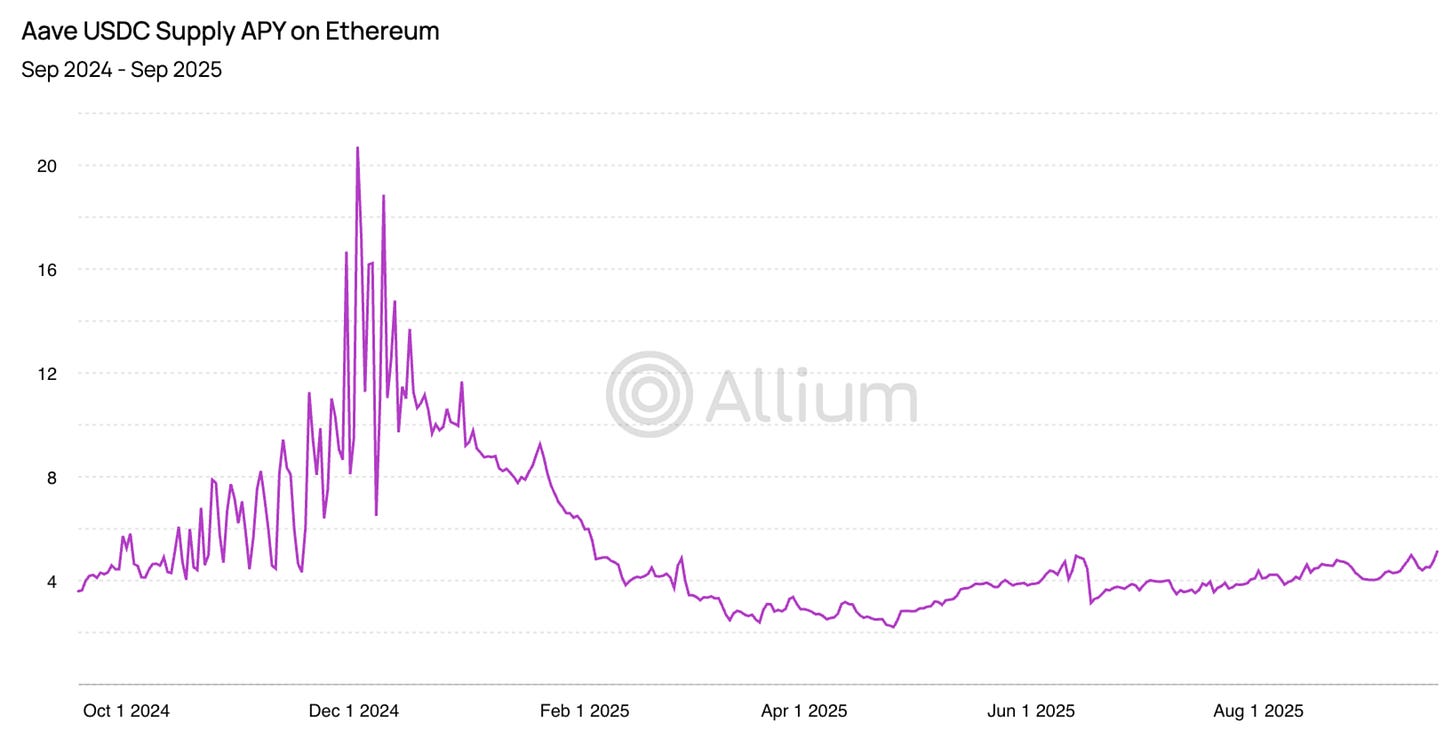

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Unhelpful institutional hype

China’s priorities for the next five years

Macro-Crypto Bits: complacency, CPI

Also: sanctions, prediction markets, Hong Kong ETFs

WHAT I’M WATCHING:

Unhelpful institutional hype

Regular readers will know I’m allergic to baseless hype and breathless froth. There’s plenty of it in our industry: you can see it on X, in price pumps, in the blind tribalism of some of the discourse. It’s also, disappointingly, in some high-profile venture capital reports, even though you’d think they’d care more about their reputation for vision and clear-eyed analysis than about getting investor fund in the door.