US, China and crypto markets

plus, what's ahead for the coming week

“There never was a good war or a bad peace.” – Benjamin Franklin ||

Hi all! What an amazing day. I’m sure I’m not the only one checking my X feed every 10 minutes – the remaining 20 hostages are now in Israel, and even I am starting to believe that the war might actually be over. Staggeringly amazing. What a day.

So much is going on that I’m pushing quite a bit of commentary to tomorrow, in the interests of newsletter length and timing. The Dutch seizure of a Chinese company, the Nobel Prize for Economics, gold, Luxembourg buying BTC, North Dakota’s stablecoin, bank stablecoins and the federal workforce reduction are just some of the topics on my list…

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

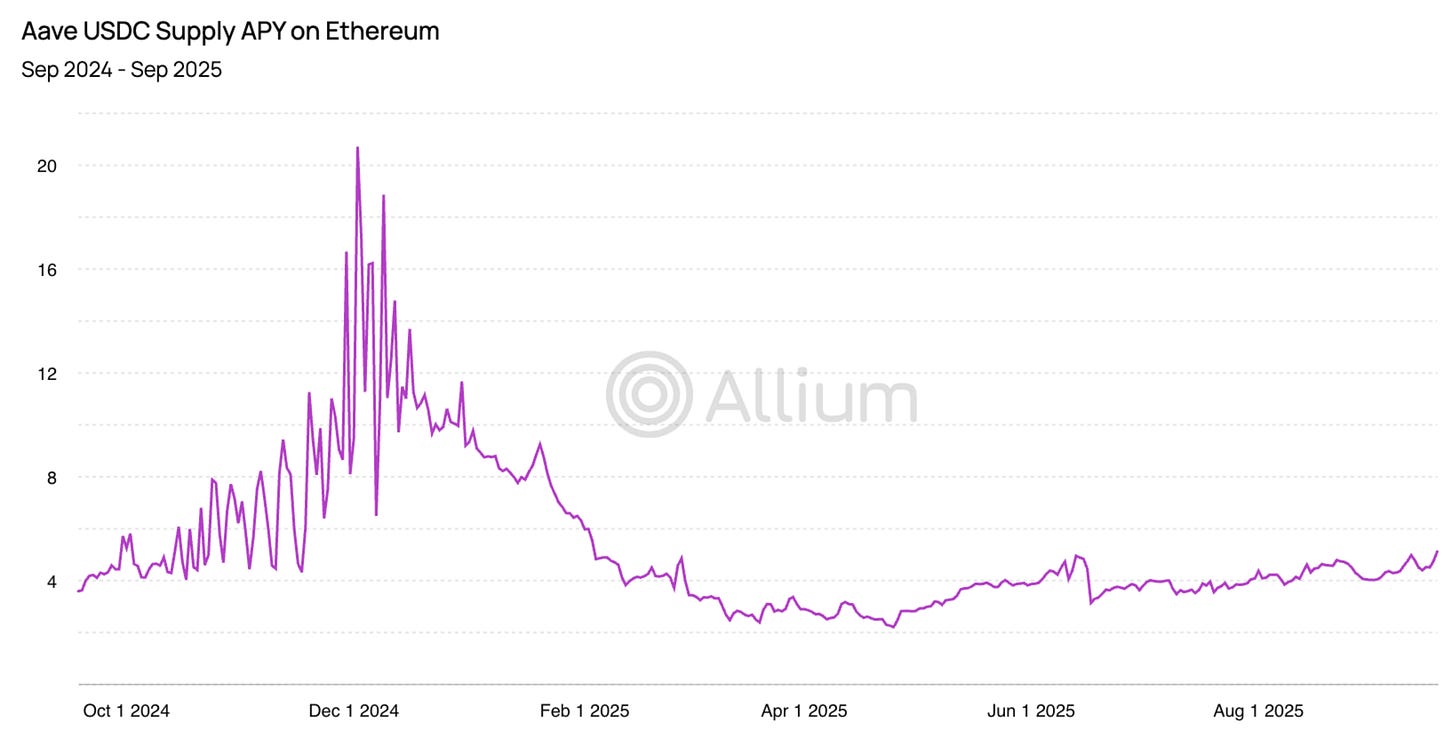

Allium provides vetted blockchain data to answer your hardest macro questions, like:

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: some big geopolitical events, a lot of economics meetings, Q3 earnings and China activity

US and China: Scoring points and own-goals

Crypto markets: misconceptions and lessons learned

WHAT I’M WATCHING:

Coming up:

This will still be a light week for economic releases due to the continuing shut-down of the US government. It is a big week for economics conferences, though! And there are some significant geopolitical events worth pointing out. Plus, Q3 earnings in the US.

Today, the remaining Israeli hostages were freed. Amazing.

World leaders will gather later in Egypt for a “peace summit” – from what I can tell, the attendee list includes the UK’s Prime Minister Keir Starmer, Canada’s Prime Minister Mark Carney and President of the Palestinian Authority Mahmoud Abbas. Not, apparently, Israeli Prime Minister Benjamin Netanyahu nor Hamas leadership nor Saudi Crown Prince Mohammed bin Salman.

Today kicks off the annual meetings in Washington DC of the IMF and World Bank, attended by finance ministers and central bank governors from more than 190 countries – expect lots of trade talk and wringing of hands but nothing either useful or concrete. It’s also a week for G7 and G20 meetings in Washington, and the annual event of the IIF which kicks off tomorrow (more on this lower down), so I expect traffic will be even worse than usual.

It’s also the kickoff of Blockwork’s Digital Asset Summit in London, which goes on until Wednesday.

And we get the continuation of the annual meeting in Philadelphia of the National Association of Business Economics (NABE), which started on Sunday and goes on until Tuesday.

US bond markets are closed today for Columbus Day.

On Tuesday, the IMF releases its World Economic Outlook, which I suppose I’ll have to look at, although the institution’s economists don’t have a great track record in forecasting.

Tuesday also kicks off the annual meeting of the Institute of International Finance (IIF), also in Washington DC, which brings together central bankers, economists, policymakers and analysts from all around the world. Notable to see Circle as a platinum sponsor. Some of the sessions sound interesting, especially those focusing on stablecoins, crypto policy, new trade rules, the dollar and the impact of AI – these continue until Friday.

The IIF is hosting a separate event on stablecoins, deposit tokens and CBDCs – there’s probably a video link somewhere, I couldn’t find it though, sorry.

Also, Fed Chair Jerome Powell will take the stage at the NABE event.

Argentinian President Javier Milei visits the White House.

And President Prabowo Subianto of Indonesia – the world’s most populous Muslim country – visits Israel.

As if that all weren’t enough, we get Q3 earnings from JPMorgan, Goldman Sachs, Citi, Wells Fargo, BlackRock and others.

On Wednesday, G7 finance ministers meet to discuss, among other things, what to do with seized Russian assets.

We get China’s PPI and CPI, with an expected slowdown in the ongoing disinflation.

And we get the Federal Reserve’s Beige Book, which gives business commentary on economic conditions from the central bank various regions. Also, we should get the NY Empire State Manufacturing Index.

Reporting Q3 earnings, we have Morgan Stanley, Bank of America and ASML.

On Thursday, we get earnings from BNY Mellon, US Bancorp, Charles Schwab and others.

And on Friday, we hear from more on Q3 including State Street, American Express, Truist and Fifth Third.

US and China: Scoring points and own-goals

On Thursday, China’s Ministry of Commerce (MOFCOM) published a new framework for rare earth exports, requiring any company – anywhere in the world – to get authorization from the Chinese government to export any product that contains 0.1% or more of China-sourced rare earths or that were produced using the country’s technology.

It also expanded the list of export-restricted rare earths, banned their export for use by foreign militaries, and added extra layers of scrutiny for use in chips and AI development.

Since China supplies around 90% of the world’s refined rare earths, which are essential components of the tech supply chain, this was taken as a body blow to global trade.

As you can imagine, President Trump did not take the news well (he was probably at the time sore about not winning the Nobel Peace Prize). He fired off a social post promising 100% tariffs on all imports from China, and saying that he didn’t want to meet with President Xi this week after all. Plus, the US will add “large scale” export controls on pretty much everything.

The biggest surprise here is that China’s move was taken as a surprise.