We need this narrative shakeout

plus: why this rout is strange, and what's next

“If you do not use tools, they use you.” – Ralph Waldo Emerson ||

Hi all! This newsletter is late today due to internet outage issues, and then I was invited onto Yahoo Finance TV to talk markets. So, let’s just focus that I’m getting anything out at all, ok? 😋

Of course, the topic of the day is the continued crypto depression as this does feel like a new phase – below, I rehash the drivers, highlight what’s strange, and look what I think is coming next.

Tomorrow, I should be able to catch up on some of the hectic activity in stablecoin land – there have been some twists to the tale.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

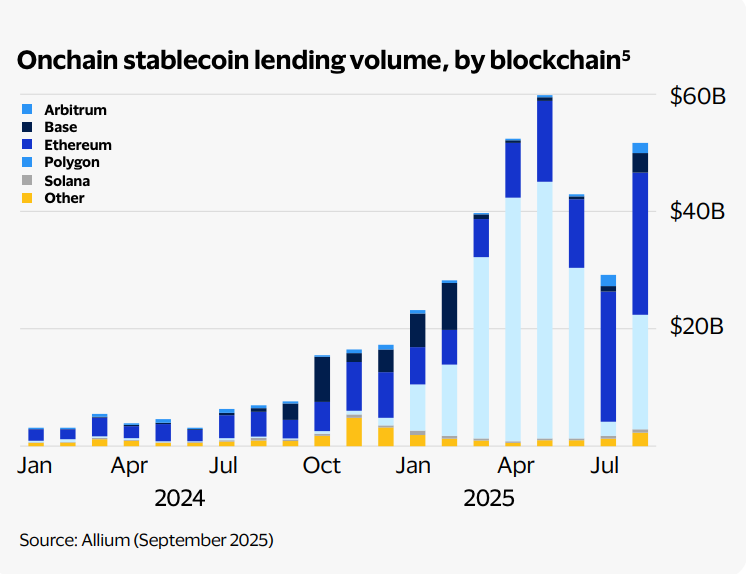

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The strangest crypto rout

We need this narrative shakeout

What’s next, a phase or a trend?

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

WHAT I’M WATCHING:

The strangest crypto rout

While corrections are a regular feature of crypto markets, there is much that is strange about this one.

First, the headlines I’ve been skimming this morning seem to imply that the crypto rout is feeding the stock market weakness. That is just extraordinary – this little niche market can drag down equity sentiment? I’d say that shows we’ve arrived.

(Bloomberg headline from earlier today)

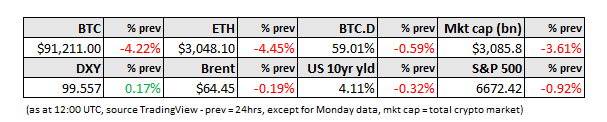

It’s also incorrect – it’s not crypto dragging down equities, it’s crypto acting as a leading indicator. Liquidity concerns have been building, and as you’re possibly tired of hearing me explain, BTC is one of the most sensitive assets to liquidity (more on what is driving this correction below).

Another aspect that is weird is that the large crypto assets – BTC and ETH – are falling relative to the overall market. Normally, when the crypto market is heading down, you get rotation into the larger and “safer” crypto assets. Not this time. Now, there’s rotation out of BTC and ETH into traditional safe assets, and since equities and bonds aren’t doing so great either, that’s probably cash. This is further confirmation that crypto natives are no longer in the driver’s seat, and that crypto has become a macro market.