Wednesday, April 10, 2024

Fed's "restrictive" policy, geopolitical criss-crossing, Hong Kong

“Money often costs too much.” – Ralph Waldo Emerson ||

Hello everyone! I hope you’re all doing well! I’m told that today is National Hug Your Dog Day, which I of course approve of but I have no idea why you need a special day for that. It is a special day for me because I think it’s the first time I get to mention Vanuatu in this newsletter.

If you find this useful, would you mind liking below, and sharing it with your friends and colleagues? ❤

IN THIS NEWSLETTER:

Federal Reserve policy is “restrictive”? Really?

Diplomatic criss-crossing amid building tensions

Hong Kong positioning

Low-altitude economy

Watch that beat

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content. And there’s a free trial!

WHAT I’M WATCHING:

Federal Reserve policy is “restrictive”? Really?

If you’ve sat in on any of the recent FOMC press conferences, you’ll have heard Chair Powell insist that the US central bank’s interest rate policy is restrictive, by which we can assume he means it is dampening economic activity.

In January:

“Our strong actions have moved our policy rate well into restrictive territory, and we’ve been seeing the effects on economic activity and inflation.”

In March:

“Our restrictive stance of monetary policy has been putting downward pressure on economic activity and inflation.”

Let’s look at just how restrictive that monetary policy has been:

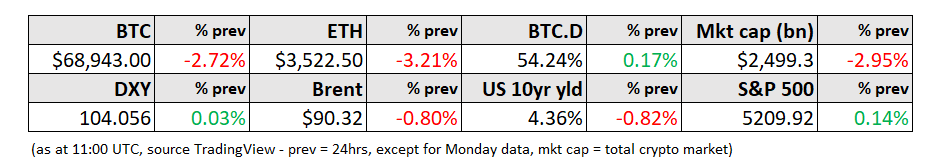

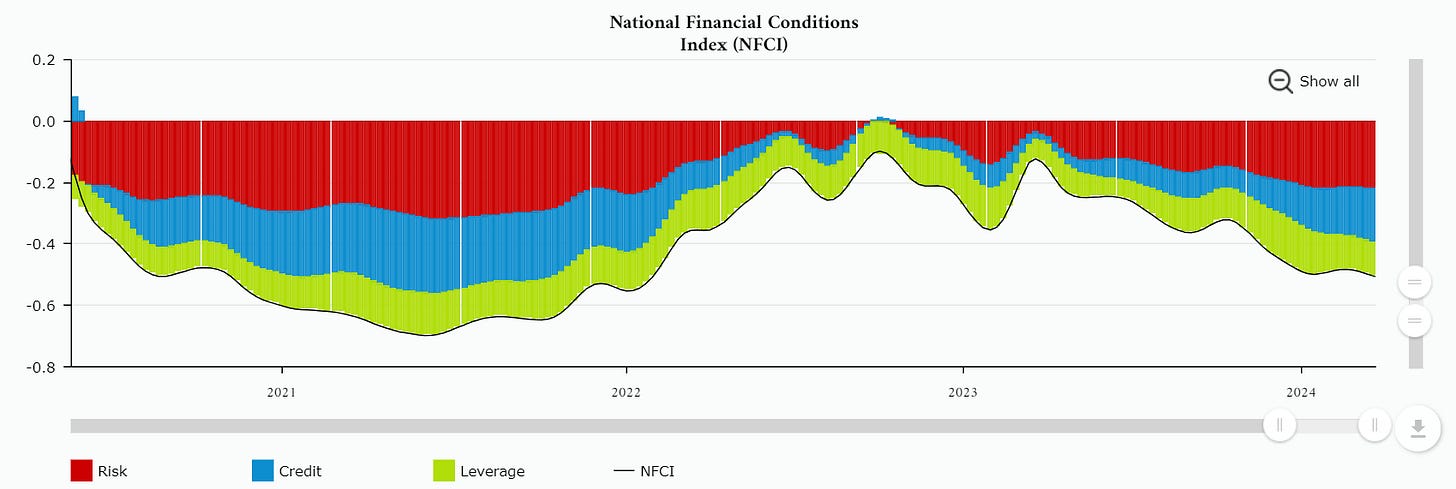

Financial conditions are as loose as they were at the beginning of 2022, before the rate hikes started.

(chart via the Chicago Fed)

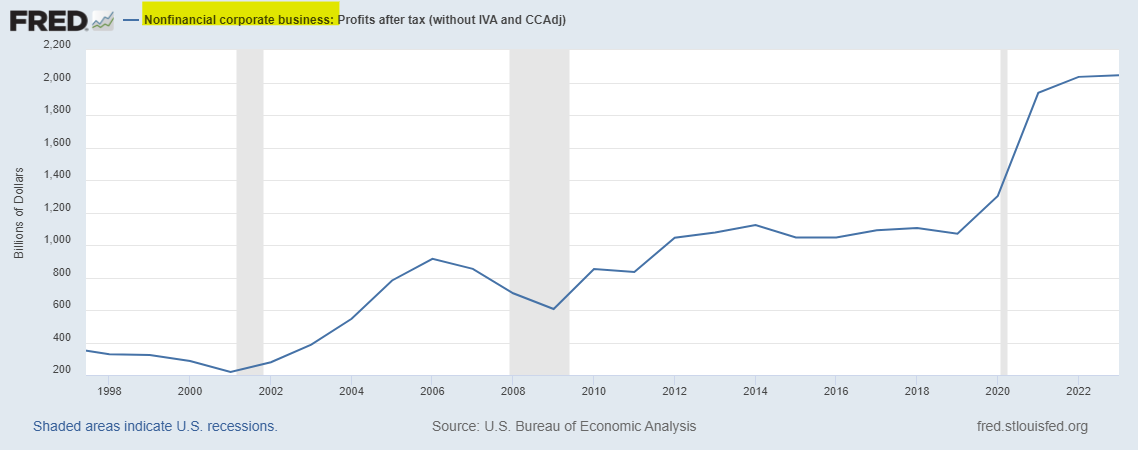

Overall nonfinancial profits are holding steady, and are roughly double what they were the year before the pandemic.

(chart via the St. Louis Fed)

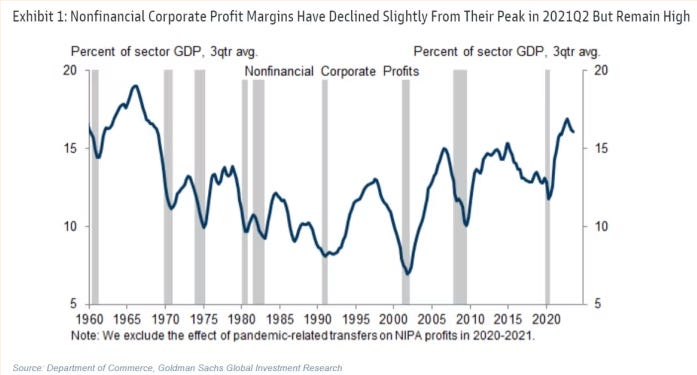

Profit margins are also holding up (calculated as profits/sector GDP). The three-quarter average has dipped slightly but, even after the steepest tightening cycle since the 1980s, is still higher than for most of the past 50 years.

(chart by Goldman Sachs via the FT)

Annualized growth in consumer credit is picking up and is currently higher than it was before the pandemic.