Wednesday, August 21, 2024

Jackson Hole, the DNC platform, gold

“There is nothing like returning to a place that remains unchanged to find the ways in which you yourself have altered.” – Nelson Mandela ||

Hello everyone, I hope you’re all well!

I managed to get the audio version done today, but I’m still using the same platform and it’s challenging, so there will probably be glitches today. In the spirit of personal growth, I’m working on chilling more about that and recording through flubs and mistakes, because I have to get the process faster.

Below I scratch my head at all the fuss around what Powell will say at Jackson Hole. I also point out that politics is more important for crypto markets, at least for now, and why the absence of any mention of crypto in the DNC platform is not a big deal. Plus, gold is telling us something.

If you find Crypto is Macro Now in any way useful or informative, would you mind sharing it with your friends and colleagues, and maybe encouraging them to subscribe? ❤ I’d be really grateful!

IN THIS NEWSLETTER:

Jackson Hole: Why the fuss?

The DNC Platform

Gold is telling us something

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

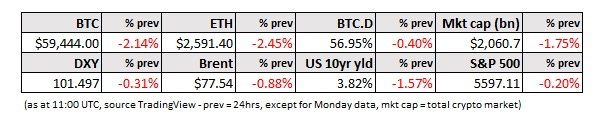

WHAT I’M WATCHING:

Jackson Hole: Why the fuss?

The central bank symposium at Jackson Hole kicks off tomorrow, and you would think from media coverage that there was nothing else going on that could influence markets. The DNC convention in Chicago, the release of its platform, the possibility of a ceasefire agreement in the Middle East – none of these factors are getting nearly as much breathless coverage, and the confabulation hasn’t even started yet.

This is bewildering, for many reasons:

1) Central bankers are getting more market attention than politicians, when fiscal spending has had and will continue to have a much greater impact on the economy than monetary policy.

After all, we have just gone through the steepest hiking cycle in decades, and yet recession signals have been indecisively flashing “maybe” for the past year and a half. Financial conditions according to the Chicago Fed are easier today than they were before the Fed started hiking in March 2022.

(chart via the Chicago Fed)