Wednesday, Dec 6, 2023

key signals, "digital gold" and global conflict, bank stablecoins, and a satisfying vent at wilful misdirection

“We must plan for freedom, and not only for security, if for no other reason than that only freedom can make security secure.” – Karl Popper ||

Hi all! You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now ($12/month as of January), with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

Programming note: It’s a public holiday where I live on Friday, so this newsletter will take a short break, back in your inbox on Saturday! I also have to miss next Wednesday’s publication. I know, I know, great timing, right?

IN THIS NEWSLETTER:

Key signals

“Digital gold” and global conflict

Bank stablecoins are here

Dear FT editorial board - what will it take?

WHAT I’M WATCHING:

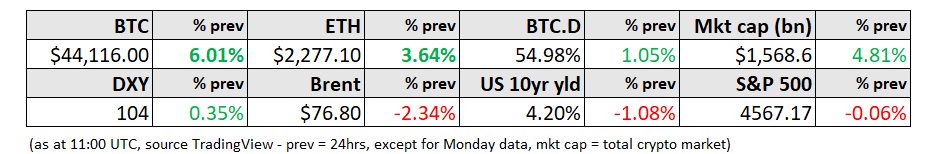

Key signals

BTC yesterday reached a new 2023 high, almost reaching $44,500.

(chart via TradingView)

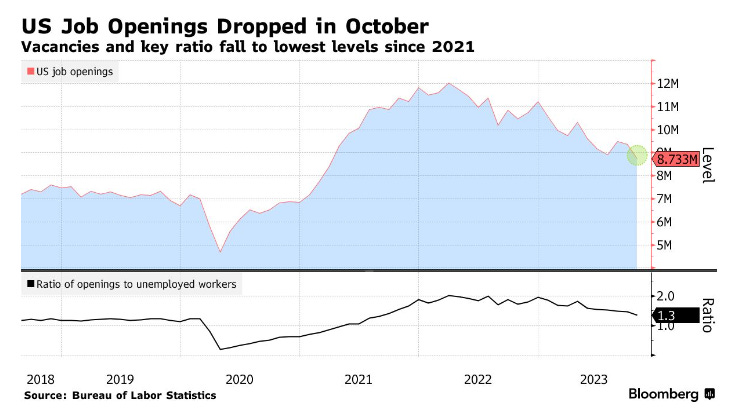

US job openings for the month of October fell to the lowest level since early 2021. This is not yet job market contraction, but it is a signal things are cooling.

(chart via Bloomberg)

The job openings data further adds to expectations that US rate hikes are done. The yield on US 10-year treasuries dipped below 4.2% for the first time since early September.

(chart via TradingView)

The Brent crude benchmark continues to slide, and is now at its lowest since July – it doesn’t look like it is at all pricing in the odds of supply disruption.

(chart via TradingView)

“Digital gold” and global conflict

Earlier this week, two key market peaks were scaled, both of which send a disquieting message.

One was the price of gold, which early on Monday morning reached an all-time high.

The other was the price of bitcoin, which yesterday reached its high point for 2023.