Wednesday, Feb 1, 2023

How pissed off is Powell? BTC and central bank reserves. FOMO vs profit taking. The message from gold. Ethereum upgrades. More signs of risk-on sentiment.

“The secret of getting ahead is getting started.” – Mark Twain ||

Hi all, and welcome to the shortest month of the year! Which suggests that February might whizz by even faster than January, which on the one had is sad (time moves too fast) but on the other hand I am SO looking forward to not having to wear four layers of clothing to go outside. (I know, I live in Spain, I have no right to complain, but still…)

You’re reading the premium daily Crypto is Macro Now newsletter. Since many of you are new here, I’ll introduce myself again. I’m Noelle – I’ve been writing crypto-focused market insight newsletters for over six years now, first for CoinDesk and more recently for Genesis Trading. Now that I’m focusing on an independent research project (the topic is in the newsletter’s name), it felt only natural to continue. Nothing I say is investment advice! Nevertheless, if you find this useful, do share with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, do please consider subscribing to support my work (or try a free trial!). I’d really appreciate it. 😊

MARKETS

A talking-to

Fed day has arrived, although it is rare to see such conviction around a particular size hike going in, so the actual announcement is not what analysts are getting excited about. The uncertainty revolves around just how harsh will Chair Powell get in his words to the market, which has not been behaving as he would like. Futures pricing suggests expectations of rate cuts in H2, and the consequent pricing of treasuries and the dollar is effectively easing market conditions, not what the Fed wants at all.

Market expectations are largely being driven by positive economic indicators. Inflation has shown signs of easing, with CPI, PCE, producer prices and a host of other indices showing deceleration, in many cases faster than expected. Recent data also shows a softening in consumption and the housing market.

You’ll have seen by now that the Employment Cost Index that I talked about yesterday delivered some very good news, with a solid deceleration for Q4. The index increased by 1.0% quarter-on-quarter, vs 1.1% expected and 1.2% in Q3 – this represents the third consecutive quarter of slowing increases, for the first time since 2010, and pretty much locks in a 25bp hike in the next FOMC meeting in March.

Markets reacted with relief, but seemed to stop short of an outright celebration, and with good reason. The wage figures were good, yet far from good enough to ensure an orderly progress of inflation data down to the 2.0% target. The Q4 ECI marked the longest streak of increases above 1.0% since the 1990s.

(chart via Investing.com)

And the job market is still tight, as the labour data out later today (ADP nonfarm employment, JOLTs openings) is expected to show us, although consensus forecasts suggest a softening for both metrics.

What’s more, as I pointed out yesterday, signs are emerging in Europe that the inflation battle is far from won just yet. Couple that with further confirmation of China’s reopening, and there could be some CPI unease ahead.

Gold does glitter

This also seems to be the message that the gold price is sending, at least to those who associate gold with inflation hedges. While that may be the lore, many now accept that “inflation hedge” is a longer-term and possibly archaic concept, and the real threat is currency debasement (which usually but not always leads to inflation). Indeed, the gold price recently has been much more sensitive to rates expectations and FX movements, and its recent strong performance (+17% over the past three months!) is more likely to be a function of the declining US dollar and strong buying from central banks.

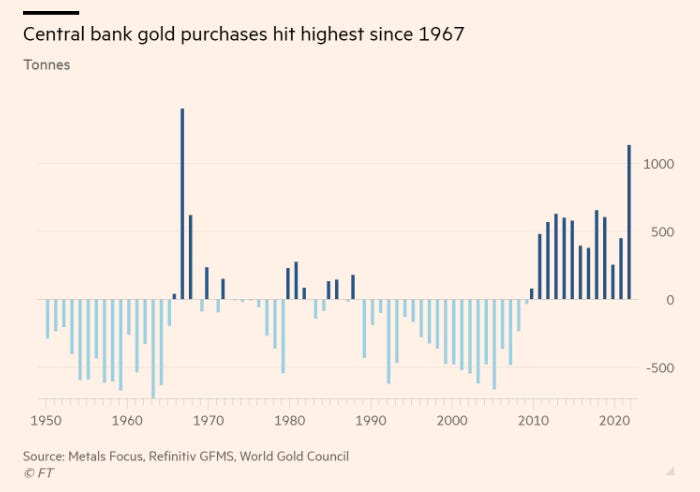

According to a report in the FT yesterday, last year gold demand reached its highest point in more than a decade, driven by a 55-year high in central bank purchases.

(chart via the FT) - edited, apologies for the misattribution

Analysts attribute this to the desire to diversify reserves away from the dollar, after the seizure of Russia’s central bank assets after the Ukraine invasion. A report published yesterday by the central bank think tank OMFIF showed that over 85% of respondents to a survey of 73 central bank reserve managers list inflation and geopolitical tensions as their main concerns, and more than 30% were planning to increase their holdings of the renminbi.

(chart via the OMFIF)

It's surprising that the percentage is not higher, given the shifting tides of global trade alliances. But gold was not an option on the survey – had it been, we would probably have seen an even greater percentage signal an intention to increase exposure to the neutral commodity.

And that’s the key: gold is neutral. With gold, central banks don’t have to choose another currency to park value in. They don’t have to make a strategic analysis of likely trade-based demand coupled with appreciation outlook – they can just buy some gold and hold it, knowing that if geopolitical tensions get much worse and/or the dollar continues to trend down, the price should continue to appreciate.

Does bitcoin glitter?

You can probably see by now where I’m going with this. What else can central banks park value in, without having to choose between other fiat currencies? Bitcoin has the added advantage of being much easier to sell (a market is always just a few clicks away, all day, every day). A few weeks ago, I wrote about what I see as a strong likelihood that we will see central banks hold BTC as reserves before long.

Of course, there are many obstacles still. Custody is complicated, even with the emergence of institutional-grade services – just as some central banks may not trust a US- or UK-based depository for their gold bars, so they may not trust a service provider that is not locally domiciled. Also, in many cases some laws may need to be passed or changed. And there’s the public perception – familiarity with bitcoin is increasing, but it is still relatively niche. Everyone understands gold, however. And to borrow an overused phrase from tech sourcing: no-one will get fired for buying gold.

Bitcoin is back

BTC closed out yesterday with the strongest January performance since 2013, and the strongest monthly performance – 39.8% – since October 2021 (39.9%), when the market was seized with ETF frenzy.

(table via bitcoinmonthlyreturn.com)

This has some consequences for the next phase, aside from making hodlers happy.