Wednesday, Jan 3, 2024

the crypto market drop, Bitcoin's birthday, ETF comments, inflation, Bitcoin miners

“It is the framework which changes with each new technology and not just the picture within the frame.” – Marshall McLuhan ||

Hello everyone! So much going on! My poor self-imposed word limit on these emails is feeling ignored, as are all the topics I wanted to get to but ran out of room…

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month ($90/year) for the next few days, going up to $12/month ($108/year) on January 7.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER:

The crypto market drop

Happy 15th Birthday, Bitcoin!

More crypto education is urgently needed

Bitcoin miners and the options market

US manufacturing weakness with climbing inflation

WHAT I’M WATCHING:

The crypto market drop

Yesterday I wrote about how the ETF speculation felt a bit overstretched. Well, this morning the market dropped sharply, losing over 7.5% in just two hours. As I type, the BTC price is down 6.7% over the past 24 hours.

(chart via TradingView)

There hasn’t been any ETF news out that I can see, and anyway, it’s too early for the SEC to be at the office.

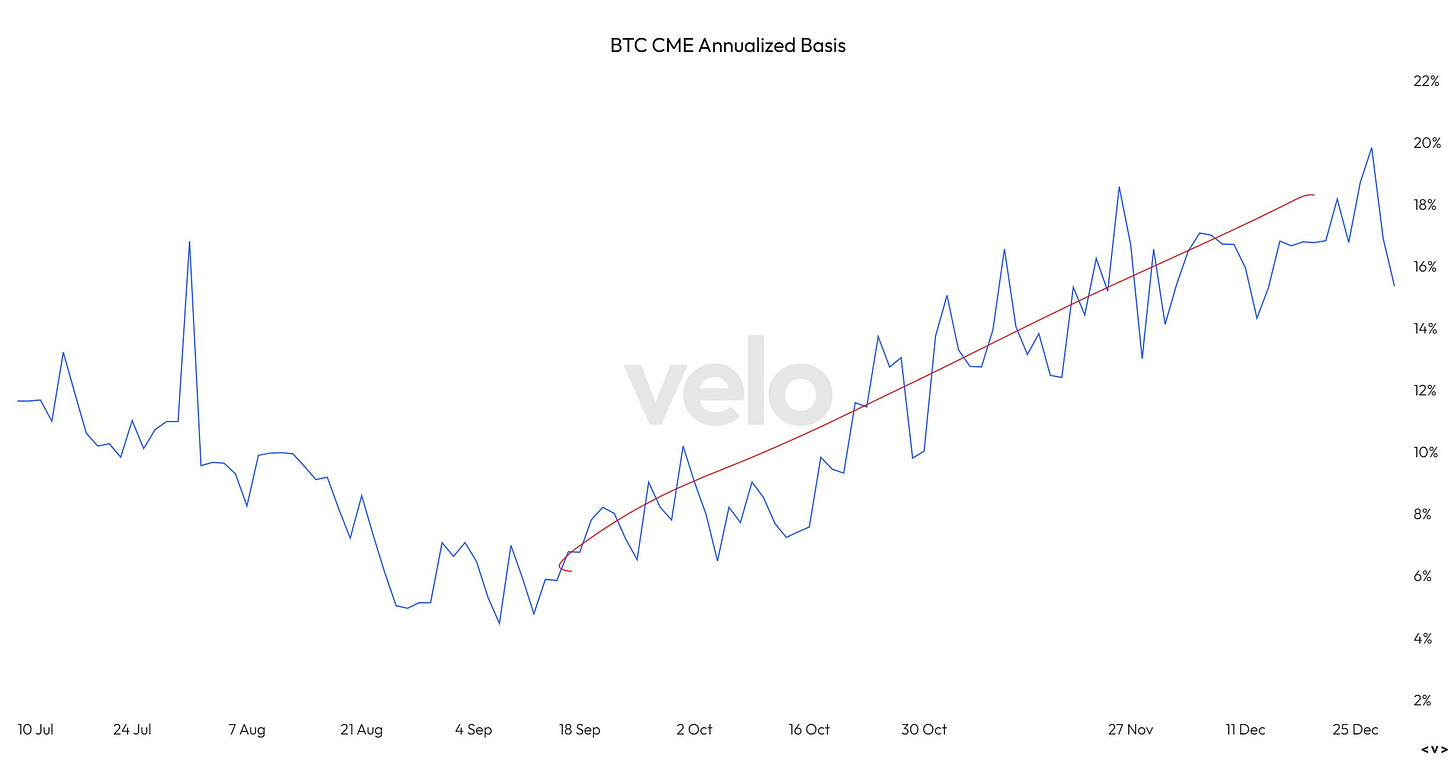

A more likely reason for the drop is an overheated market. BTC basis – the spread between the futures price and the spot price, and an indicator of trader sentiment – had reached stretched levels, even on the usually sober CME.

(chart via velodata)

For a less “sober” chart, the BTC basis on Binance might have a data error, because it doesn’t look right:

(chart via The Block Data)

Some attribute the turn to a report published earlier today by crypto marketplace Matrixport suggesting that the SEC will reject the current batch of BTC spot ETF proposals for political reasons. This may have triggered some position unwinds (which then led to other position unwinds and a sharp move down, such is the nature of leveraged markets) – but it doesn’t feel convincing enough for a fundamental position shift.

The report posits that “all applications fall short of a critical requirement that must be met before the SEC approves”, but doesn’t say what the missed requirement is. The report goes on to say that a likely reason for rejection is that most of the voting commissioners are Democrats – in other words, rejection would be political. This is obviously possible, but it would be risky and could end up being subject to judicial scrutiny.

Plus, if this were mainly an ETF-driven correction, we’d probably see BTC drop faster than other crypto assets. We’re not seeing that. While BTC is down around 7% over the past 24 hours as I type, SOL, DOT and LINK are down 14%, XRP and ADA have lost 12%, AVAX has fallen 13%, DOGE is 10% lower, ETH is down 8%.

Just as the sharp runup yesterday felt overdone, so does this correction. As far as I can tell, there has been no change to the likelihood of a BTC spot ETF approval. That said, the market should be prepared for the SEC to be irrational here – it’s unlikely, but it’s not out of the question. Even the excellent Bloomberg ETF analysts I mentioned in yesterday’s report have reminded us that their probability of approval in early January is “only” 90%. In other words, there is, in their estimation, a 10% probability that the SEC digs in.

If this happens, we should get a detailed document explaining why, which will help the industry prepare and refile. If adjusting and refiling isn’t an option, we could see more industry lawsuits against the regulator.

A worst-case scenario, depressing but always wise to contemplate, would be rejection of the BTC spot ETFs and cancellation of the futures ETFs. That way the SEC could gamely try to ward off accusations of being inconsistent. I don’t think the SEC has ever insisted on an ETF closure before (that I could find, anyway), and it would be an astonishingly risky move on the part of the regulator.

If we do get a bad outcome, it’s more likely to be a delay. ARK/21Shares would have to withdraw their application, I expect, and refile with a promise of expedited consideration. I’m not a securities lawyer, but I imagine that’s possible?

Happy 15th Birthday, Bitcoin!

On January 3, 2009, the first BTC was mined in what is known as the Genesis Block, or Block #0. It is the only block to not be linked to a previous one, and was generated by the Bitcoin protocol itself. It has no transaction output, but did “create” 50 new bitcoins as the miner reward. Unlike with subsequent blocks, these were not spendable.