Wednesday, Jan 31, 2024

what JOLTS isn't saying, FOMC rotation, academics and BTC

“We make a living by what we get, but we make a life by what we give.” – Winston Churchill ||

Hello everyone, and welcome to the last day of January! How’s 2024 going for you so far?

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but I don’t give trading ideas, and NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Note: I’m speaking at BlockWorks’ upcoming Digital Asset Summit conference in London on March 18-20. Normally I say no to conferences, but this is one of the very few worth travelling for. If you’re thinking of going, it’d be great to say hi, and here’s a discount code you can use: CIMN10.

IN THIS NEWSLETTER

What the JOLTS report is not saying

The potential impact of FOMC rotation

Bitcoin ETFs: What academics think

WHAT I’M WATCHING

What the JOLTS report is not saying

Sigh, will the jobs market never weaken?

I’m not being serious with that question – the jobs market is weakening, but the shift has not yet made it to the headline figures.

Yesterday we got the latest Job Openings and Labor Turnover Survey (JOLTS) figures for December, and they came in at 9.03 million, notably higher than the average forecast of 8.75 million and higher than November’s 8.93 million.

US companies are not slowing down their search for workers, which suggests a still-tight labour market.

Only, there are a handful of very meaningful caveats on that.

1) The survey asks a sample of roughly 21,000 non-agricultural businesses about their hiring and firing plans. This is a small sample – compare it to the payrolls survey, which canvasses around 122,000 businesses and agencies, covering 666,000 worksites.

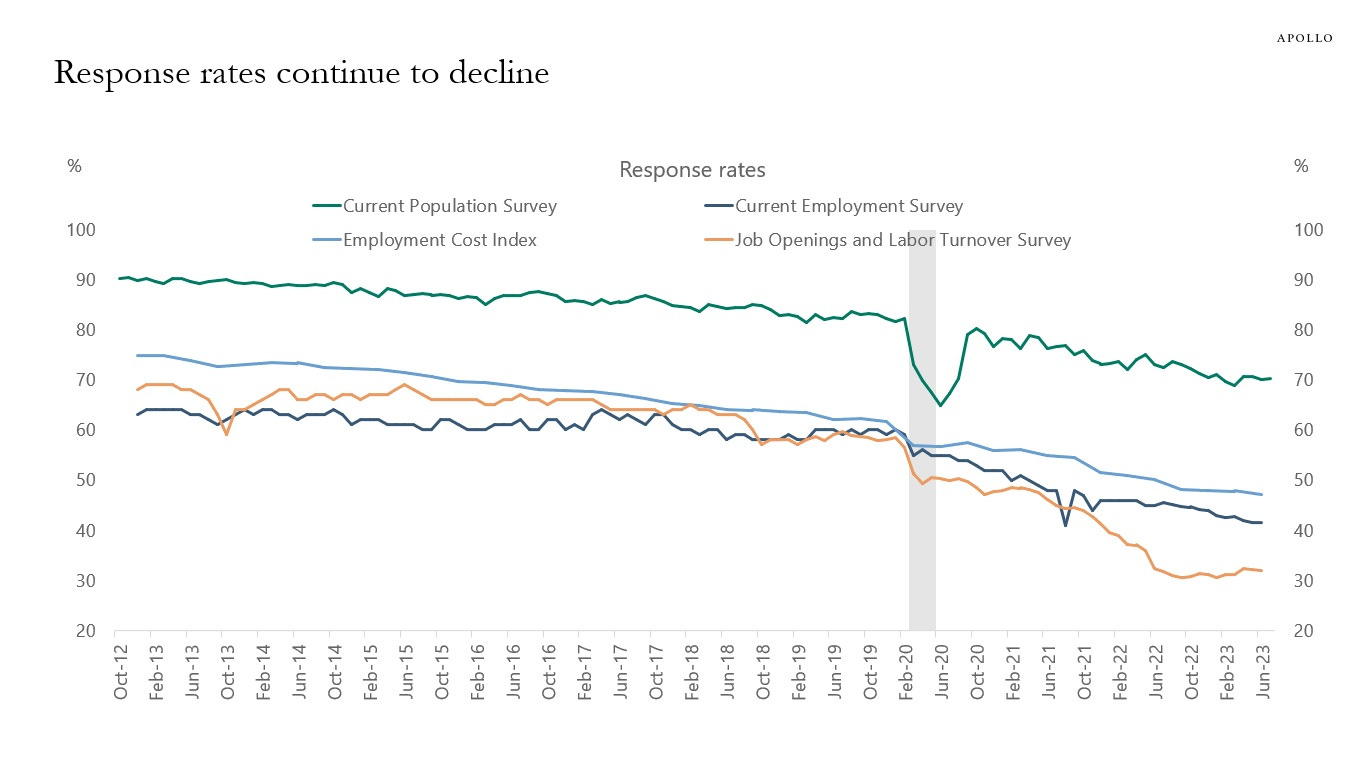

2) A very small percentage of these 21,000 businesses bother to respond. When the survey started, roughly 70% of enrolled participants answered. These days, that figure has dropped to around 30%. That’s worryingly low, easily the lowest response rate of all official employment-related surveys, and calls into question the usefulness of the JOLTS information.

(chart via Apollo Academy)

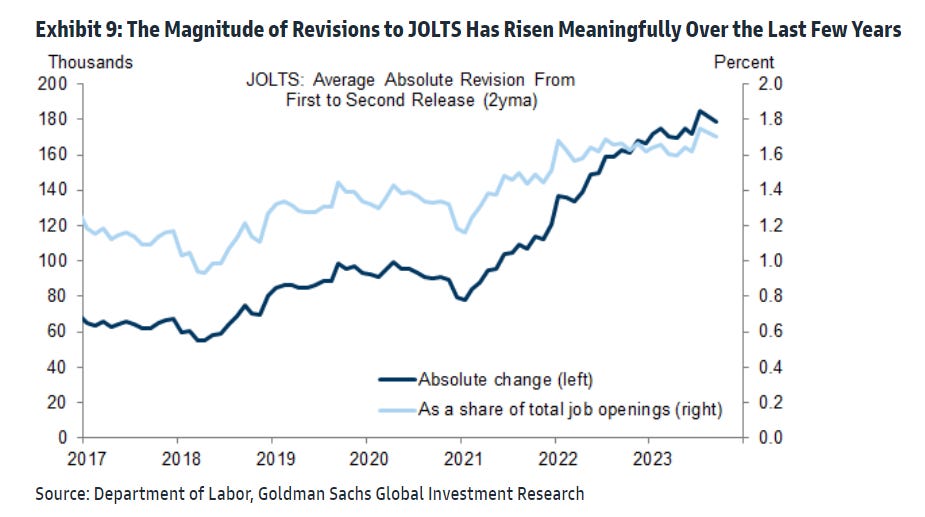

3) The low response rate contributes to low data reliability. Here’s a chart compiled by Goldman Sachs of revisions to initial JOLTS readings – the two-year moving average of monthly revisions is now around 180,000 in either direction:

(chart via Goldman Sachs)

4) When the survey started collecting data, back in 2000, it cost companies to post job ads. They would often be in the newspaper, trade publications or similar, and they would only be there until the post was filled.