Wednesday, Mar 22, 2023

ETH's surprising move, the *real* surprise likely from the FOMC today, some changes to this newsletter, and more...

“When it is obvious that the goals cannot be reached, don't adjust the goals, adjust the action steps.” – Confucius ||

Hi all! You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks for being a subscriber! Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider hitting the like button at the bottom, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day. 😊

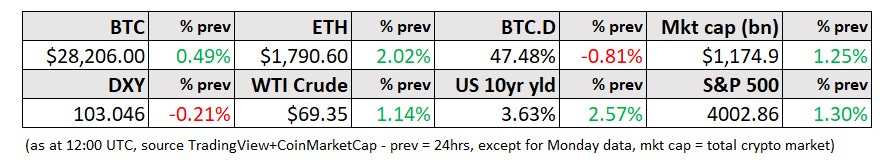

MARKET

Edge of our seat

You know, I do like a good cliff hanger. But I am really looking forward to getting past the “will he/won’t he” and focusing on the looming recession and geopolitical manoeuvring. CME futures are now pricing in an almost 90% probability of a 25bp hike, which means that anything other than that will trigger some wild market moves.

One factor suggesting that Powell could feel more confident now about a hike not breaking the system is that the KBW bank stock index has been relatively stable over the past few days. Some are interpreting this as greater reassurance that there won’t be ripple effects, but I disagree – the fact that the index is not going up could hint at a “wait and see” stance, with ripple effects already priced in after the brutal drop so far this month.

(chart via TradingView)

Keep reading with a 7-day free trial

Subscribe to Crypto is Macro Now to keep reading this post and get 7 days of free access to the full post archives.