Wednesday, Mar 29, 2023

Why are BTC spot volumes dropping? What does the “ETH is a security” debate say about US regulation? What is a "safe asset" anyway?

“There are things known, and there are things unknown, and in between are the doors of perception.” – Aldous Huxley ||

Hello everyone! Today’s email gets a bit more theoretical than usual, but I sat down this morning to start to type and it sort of went off on its own path. You know how it goes, right?

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider hitting the ❤️ button at the bottom, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day. 😊

Programming note: 🌺 Easter is rapidly approaching and it’s a big deal where I live, so this newsletter will be taking off Friday, April 7, through to Monday, April 10, including the weekend edition. 🌺

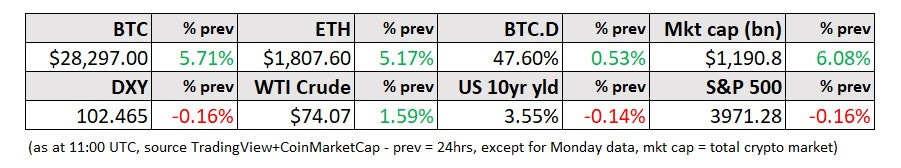

MARKETS

“Safe” expectations

Yesterday I wrote about the dollar and bitcoin as a safe assets, and so today I want to extend the theme and look at other “safe” assets and what safety even means. It may seem like this is becoming a recurring topic, but it is a key element in my larger thesis that investing has changed radically over the past 10 years, and pockets of our current market structure and services have not yet noticed.

Take banks. Banks are safe places to deposit your money, and Fed Vice Chair for Supervision Michael Barr said in testimony before Congress earlier this week that the US banking system is “strong and resilient” and that depositor money is safe. Depositors aren’t so sure, with small banks losing $109 billion in deposits in the week leading up to March 15, the fastest bank drain in history. With banking now almost totally digital, what’s to stop a few rumours from draining a bank’s balance sheet in a question of minutes? (When the digital platforms work, that is.) We need banks to be safe, but without controversial and expensive blanket government insurance, they’re not.

Take US treasuries, supposedly the safest assets in the market. Volatility is high, however, and we have witnessed distortions caused by thin trading books. Over the past year, with the fastest hiking period since the 1980s, interest rate risk has been higher than ever. Bond values have plummeted, putting strain on balance sheets of banks, pension funds, insurance funds, hedge funds, sovereign funds… you get the picture. Not so safe.