Wednesday, March 13, 2024

CPI stuck, US deficit ballooning, record net inflows for BTC spot ETFs, Dencun

“Progress is a comparative of which we have not settled the superlative.” – G. K. Chesterton ||

Hi all! I hope you’re all doing well! Today’s format is a bit different – shorter points, as I want to get this out before 9:30amET (the US losing an hour before Europe is NOT convenient, just sayin’ - really want to publish even earlier). No audio, sorry!

A programming note: I won’t be publishing tomorrow – I have to go to hospital for a biopsy (yes, a bit nervous, send good vibes please!). Back on Friday.

IN THIS NEWSLETTER:

CPI disappointment

Record BTC ETF inflows

US budget deficit continues to balloon

Swedish hypocrisy

Dencun goes live

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually! but not today!) access to an audio read of the content. And there’s a free trial!

WHAT I’M WATCHING:

CPI disappointment

Yesterday’s US CPI numbers ended up highlighting a series of uncomfortable trends that frustrate both those expecting imminent rate cuts and those preparing for another hike.

Headline CPI month-on-month growth accelerated slightly to 0.4%, in line with expectations but not good news nevertheless. Core CPI held steady at 0.4% month-on-month, disappointing consensus forecasts of 0.3%.

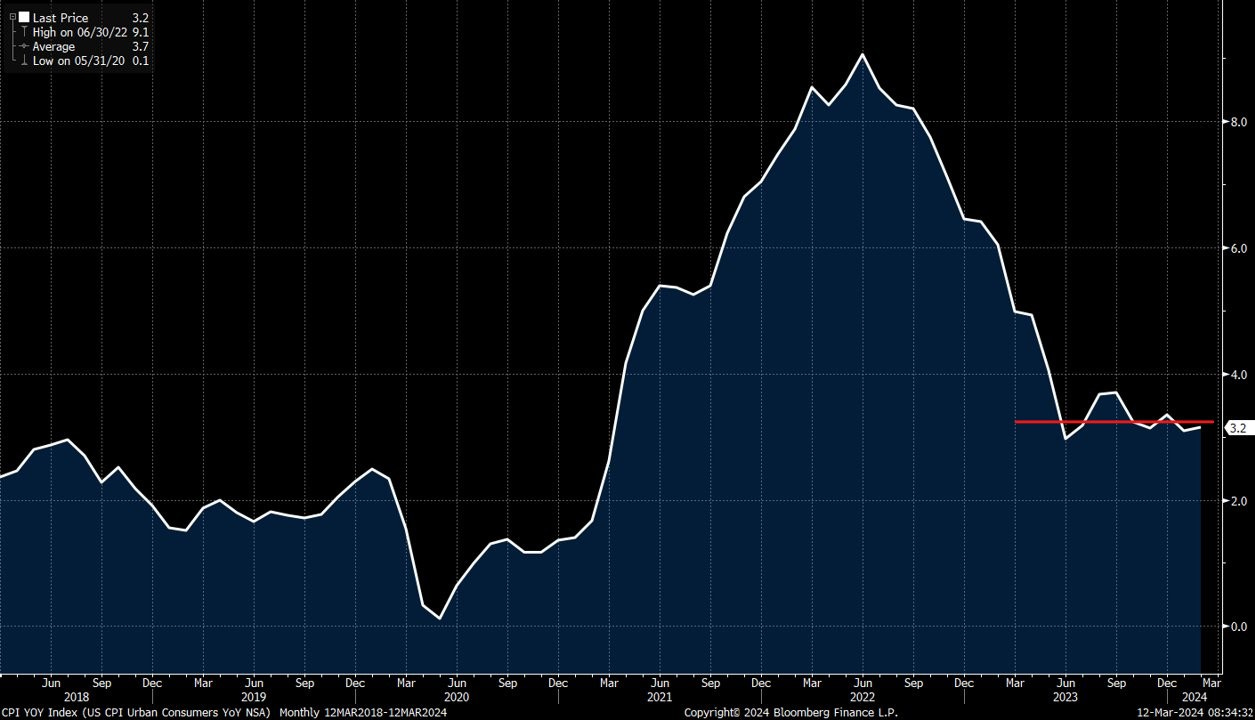

Year-on-year, headline CPI unexpectedly accelerated to 3.2%. Core CPI growth slowed slightly, to 3.8%, but still came in higher than the average forecast. Over the past three months, the annualized increase of core CPI is 4.2%, the highest level since June.

(chart via @EpsilonTheory, I added the line to show that CPI is stuck)

The data reinforces the Fed’s insistence on caution, but is neither worrying enough nor encouraging enough to materially shift rates expectations in either direction.

(chart via Bloomberg)

Shelter and energy accounted for the bulk of the increase, which is especially worrying – those are two categories that don’t have easy substitutes, and the more they eat up of monthly paychecks, the less disposable income to support other areas of the economy.

Also worrying is the increase in goods prices (excluding food and energy), which increased for the first time since last May.

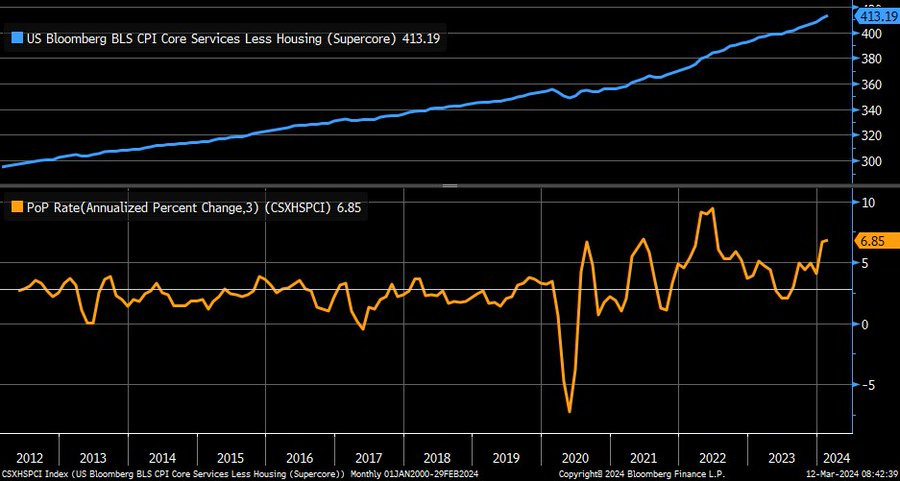

And “supercore” inflation, which strips out food, energy and housing (areas less susceptible to monetary policy), increased at a three-month annualized rate of 6.9%, the highest in almost two years. Yikes.

(chart via @LizAnnSonders)

The lack of good news here combined with a weak 10-year treasury auction to push the US 10-year yield up, with the climb continuing this morning. The alarming trajectory of the US deficit, per yesterday’s Treasury report (more on this below), hasn’t helped bond market confidence.