Wednesday, May 22, 2024

ETF suspense, China’s e-CNY, crypto donations, market evolution and more…

“The greatest danger for most of us is not that our aim is too high and we miss it, but that it is too low and we reach it." – Michelangelo ||

Hello everyone! Happy Bitcoin Pizza Day to those who celebrate! This day recognizes the significant contribution to crypto’s evolution from US-based engineer Laszlo Hanyecz, who 14 years ago showed that bitcoin could pay for goods. It was a clunky transaction involving various steps and a whole lotta trust, because back then there was virtually no infrastructure to support bitcoin payments. But it showed that bitcoin could have real-world use, which in 2010 was a big step forward. At the time, BTC was around $40.

If you find this newsletter useful, would you mind sharing it with your friends and colleagues? ❤

IN THIS NEWSLETTER:

And now we wait

Why isn’t the e-CNY more in the news?

Crypto donations

Blurring asset categories

Stablecoins in Colombia

If you’re not a subscriber to the premium daily, it would be so awesome if you’d consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

WHAT I’M WATCHING:

And now we wait

With the updated ETH spot ETF proposals filing in, we now wait for a sign from the SEC as to whether all this was a waste of time and excitement, or whether the agency moves on to approving the S-1s.

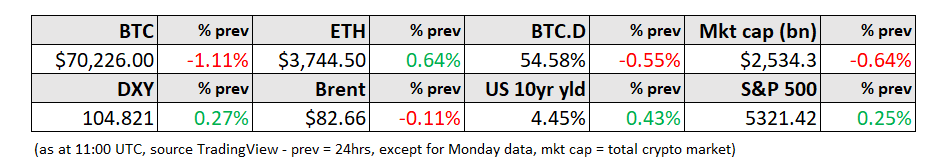

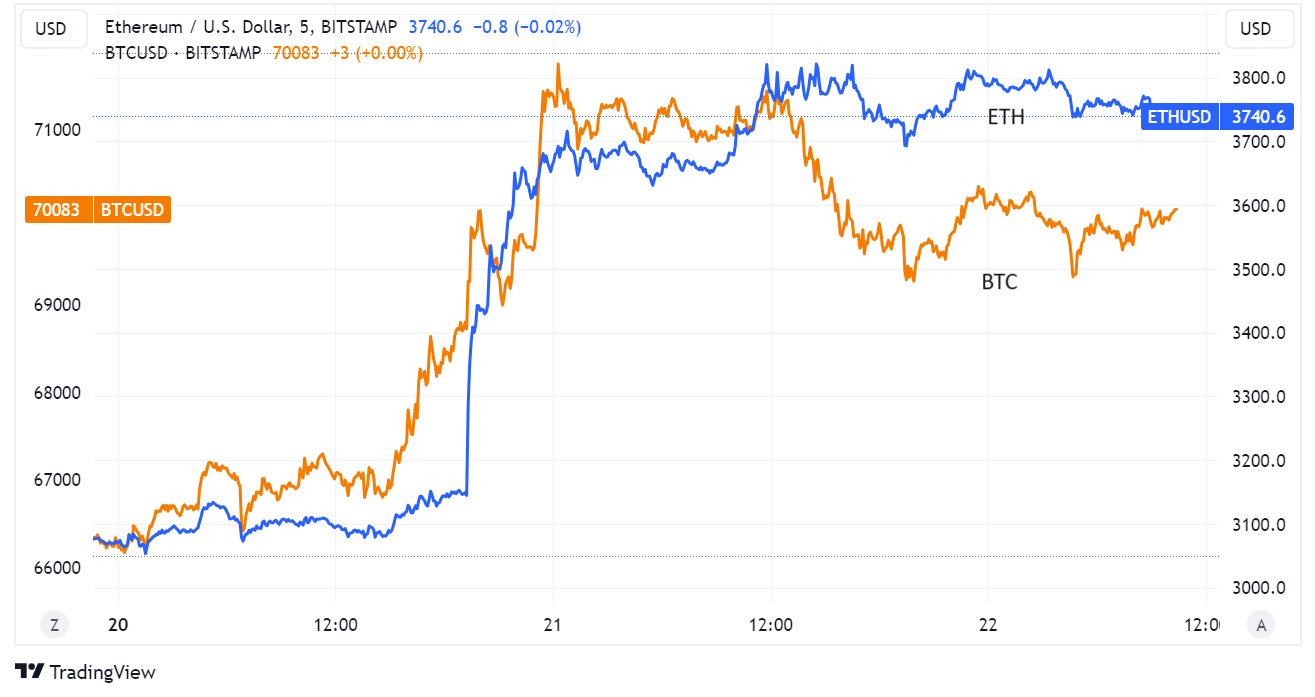

Crypto markets seem to have entered waiting mode, trading more or less flat after an astonishing jump over the past couple of days.

(chart via TradingView)

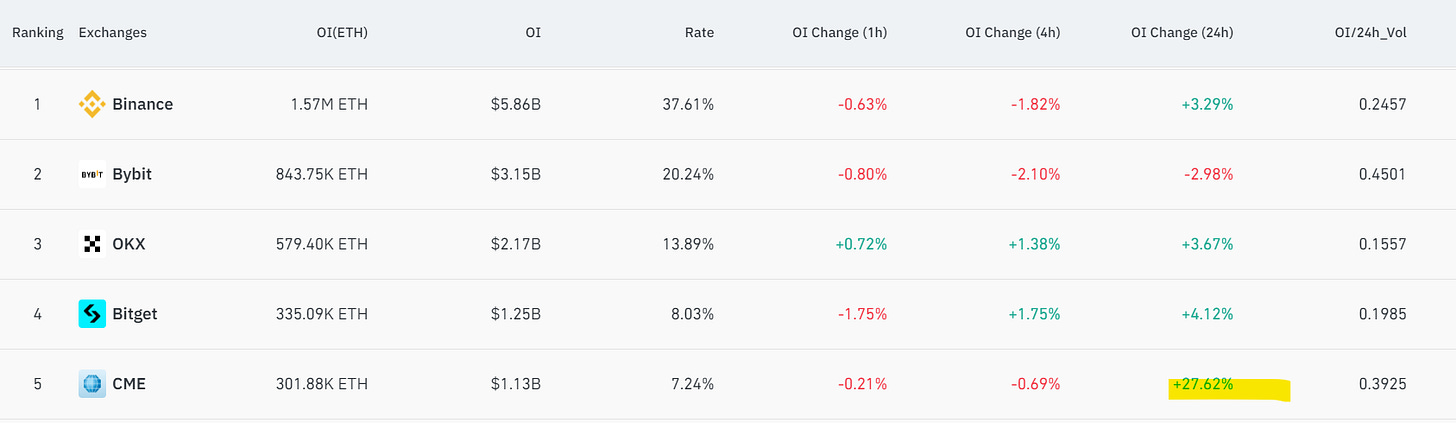

Meanwhile, derivatives markets are signalling a strong uptick in ETH positioning, with open interest on ETH futures reaching an all-time high.

(chart via coinglass)

In contrast, BTC futures open interest has been climbing, but has not yet surpassed the highs reached in March, even though its price is much closer to its all-time high than is that of ETH.

(chart via coinglass)

Here’s an interesting twist: the CME is the largest BTC derivatives platform in the market, in terms of open interest. But it ranks only fifth in ETH derivatives. US institutional investors are maybe just not really into the ETH narrative?

(chart via coinglass)

The previous day the CME ranked sixth, though, so US institutional interest in ETH is jumping. But the relatively low participation from the same institutions that will probably be expected to pour into the ETH spot ETF upon launch, suggests that the initial inflows could be disappointing.

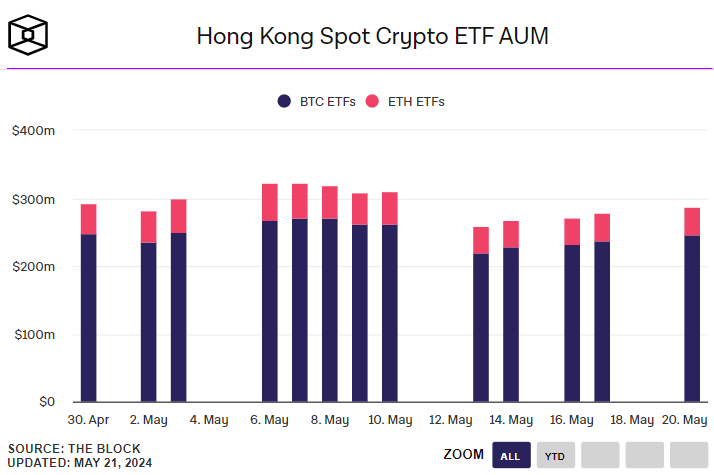

Another way to gauge potential demand is via other ETFs.

In Hong Kong, ETH accounts for less than 15% of total spot crypto ETF AUM.

(chart via The Block Data)

In the US, the difference in interest is even starker: the AUM of the leading ETH futures ETF (EETH) is around 4% that of the leading BTC futures ETF (BITO).

So, when/if the ETH spot ETFs eventually launch, we should brace ourselves for a disappointing reception. This is even before taking into account that the ETH spot ETF will be a bad product. Yes, it will be a convenient way to get ETH exposure, but investors will be forgoing staking yield, since the SEC has vetoed reward distribution.

Nevertheless, there will be some demand from institutions that can only hold assets listed on regulated exchanges, and from others that want exposure but also the convenience of traditional custody. And there should be some mainstream interest from those that want some diversification in their crypto holdings. For these investors, forgoing the roughly 4% staking yield will be akin to paying a 4% fee, and they may think it’s worth it.

But, stepping back, the potential inflows aren’t the big deal here.

It’s the official confirmation that ETH is not a security. SEC Chair Gensler may continue to hem and haw on the topic, but the rule the current batch of ETFs are filed under is not appropriate for security-based ETFs. So, if these are allowed to list, that’s a hefty concession which would remove a key headwind for the Ethereum ecosystem.

In sum, the ETH spot ETFs are not a good product, and will probably disappoint in terms of inflows. But their listing would still be very good news for the industry as a whole.