Wednesday, May 29, 2024

market ennui, stablecoin use in cross-border trade, some weaknesses in FIT21

“Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.” – Sun Tzu ||

Hi everyone! I hope you’re doing well!

In today’s email, I look at why the markets aren’t more festive given the good news recently. I also talk about a report that even non-sanctioned Russian businesses are settling cross-border trade in stablecoins. And I finally dive into the details of FIT21 – there are some glaring gaps and weaknesses.

If you find this newsletter useful, would you mind sharing it with your friends and colleagues? ❤

IN THIS NEWSLETTER:

Macro malaise

Stablecoins for cross-border trade

Should we be excited about FIT 21?

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

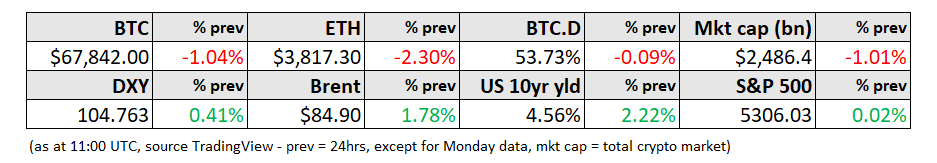

WHAT I’M WATCHING:

Macro malaise

Crypto markets have much to celebrate. Political hostility in Washington DC is getting meaningful pushback. The second largest cryptocurrency by market cap will soon have a US-listed ETF. And the BTC spot ETF is still, months after launch, seeing significant inflows.

Yet price movements do not feel festive. After the ETH ETF-fueled jump last week, BTC has largely drifted lower.

(chart via TradingView)

Part of this could be due to expected Mt. Gox disbursements, as the failed exchange finally, 10 years later, will at some stage get around to distributing recovered BTC, BCH and cash. Yesterday, the trustees moved ~140,000 BTC in preparation for transfer to claimant addresses, which signals that repayments could start soon – although they also put out a statement asking claimants to “wait a while” as the trustee is “proceeding with the preparation”. It’s not clear what “a while” means; the latest deadline is October of this year, but distribution could in theory start at any time. Or it could be months away.

The concern is that those receiving recovered BTC will sell, creating some price pressure.

In my opinion, this is unlikely. For one, the market has been worried about the Mt. Gox distributions for years now. I’ve lost count of the number of times deadlines have been pushed back. Also, the distribution is unlikely to be all at once, and recipients are largely long-time bitcoin enthusiasts and early adopters. It’s not a given they’ll all want to sell. Some will, for sure – but by now that’s largely already baked into the price.

A more compelling reason for BTC’s ennui is yet again the macro environment. US rate cut expectations continue to be pushed back in the light of economic data and Fed official comments, and the US 10-year yield is back up to levels not seen since the beginning of the month.

(chart via TradingView)

Yesterday we got the latest US consumer sentiment data from The Conference Board: the confidence index broke a three-month downturn, delivering an unexpected jump to 102, up from an upwardly revised 97.5 in April – the consensus forecast was for a slight decline to 96.