Wednesday, Nov 15, 2023

inflation, irrational expectations, weird BTC reaction

“Technology does not drive change. It is our collective response to the options and opportunities presented by technology that drives change.” – Paul Saffo ||

Hello everyone, I hope you’re all doing ok!

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now, with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

IN THIS NEWSLETTER:

Why bitcoin reacted strangely

Inflation and irrational expectations

Bank lending

Logistics and politics

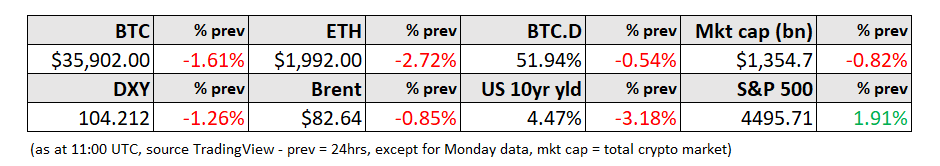

WHAT I’M WATCHING:

Why bitcoin reacted strangely

By now you’ll no doubt have seen the US October inflation figures – good news on all fronts, with a stronger-than-expected slowdown in both headline and core CPI increases. Even the so-called supercore measure, which also removes housing, rose at about a third of the pace in September month-on-month. Sticky services inflation seems to finally be cooling.

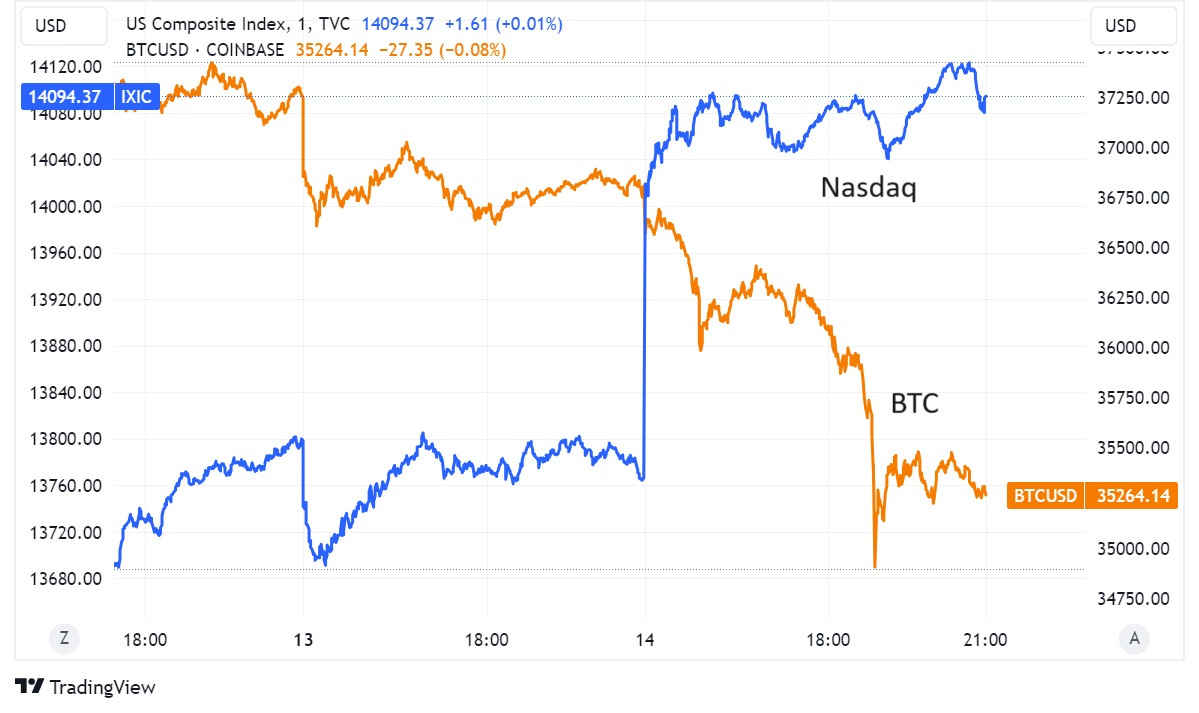

But, the reaction in the bitcoin market was kind of weird.

Risk assets celebrated, with the Nasdaq jumping 2.4% yesterday. BTC rose almost 1.5% on the news, but then dropped sharply, down to $36,000. It bounced, but then continued dropping. Bitcoin was not behaving like a risk asset that would benefit from higher liquidity.

(chart via TradingView)

Even gold jumped when the inflation data came out, and continued rising. Bitcoin was also not behaving like a hard asset that benefits from a weaker dollar.