Wednesday, Nov 16, 2022

“Success breeds a disregard of the possibility of failure.” – Hyman Minsky ||

Hi all! You’re reading the premium daily Crypto is Macro Now, where I look at markets and trends that highlight the growing overlap of the crypto and macro landscapes. I’ve been writing crypto-focused newsletters for over six years – now that I’m focusing on independent research, it felt natural to continue. Nothing I say is investment advice! Nevertheless, I hope you find this useful – if so, please consider sharing with friends and colleagues.

And if you arrived here from somewhere other than your inbox, please consider subscribing!

MARKETS

US stocks were strong yesterday on the back of the lower-than-expected October PPI increase. The consensus core estimate was 0.3% month-on-month – the actual figure came in at a cheerful 0.0%! Core year-on-year, expected at 7.2%, came in at 6.7% vs September’s downward revision of 7.1%, and headline year-on-year PPI delivered 8.0% vs 8.3% expected and 8.4% in September. All very good news.

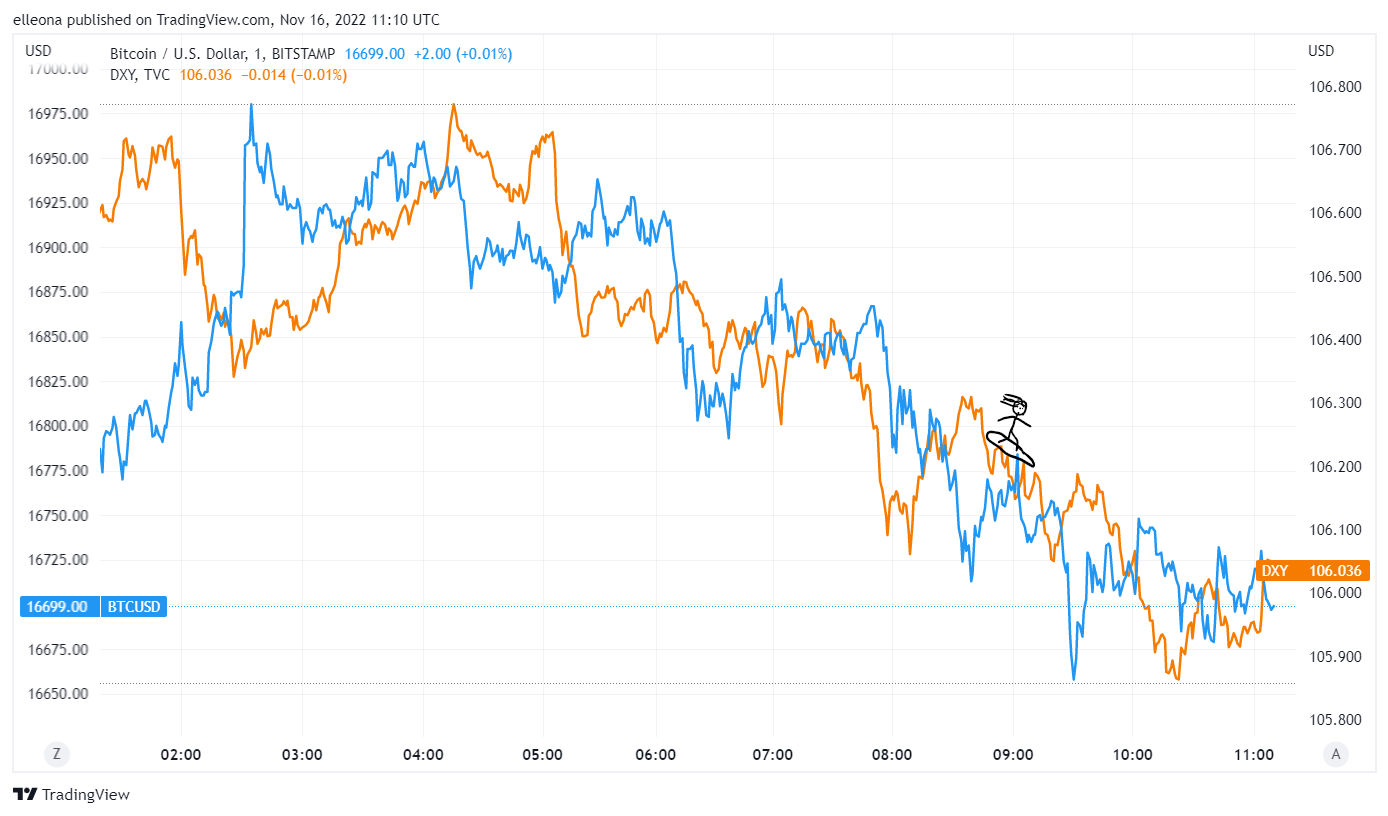

Yields dropped, with the US 10-year treasury now below 3.8%, back to early October levels. The DXY index also headed down, at one stage dropping below 106 for the first time since August. This was not enough to support crypto markets, however, which continue to be buffeted by bad news. BTC and ETH are down almost 1% and 2% over the past 24 hours, respectively (at time of writing).

(chart via TradingView)

The FT published an article yesterday on potential cracks in the US Treasury market, pointing out that the market is at its worst depth (which reflects the ability of a trader to buy or sell without moving prices) since March 2020, even though the overall size is much larger.

(chart via FT)

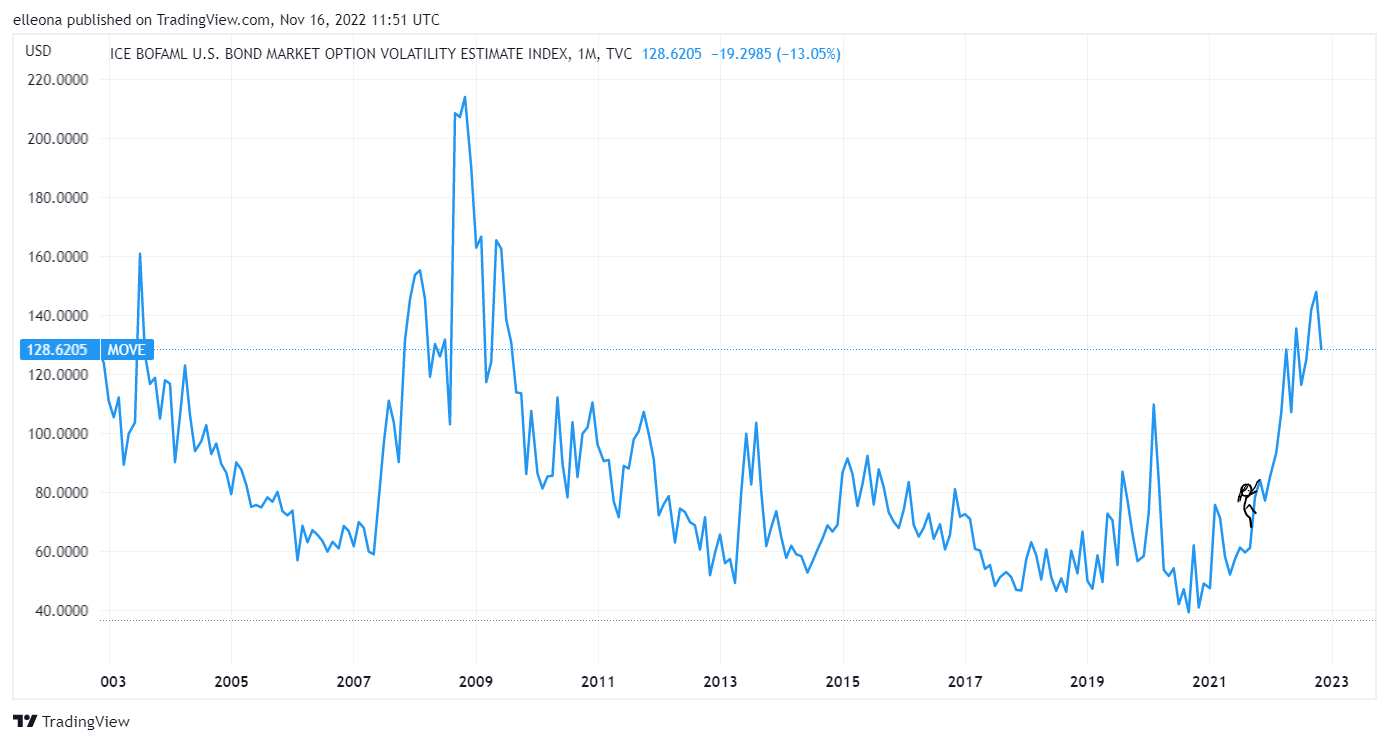

In October, the MOVE index, which measures implied volatility in the US Treasury market, reached its highest point since 2009 – it has since dropped back to mid-August levels, but still indicates notable strain on market liquidity.

(chart via TradingView)

Several proposals under consideration – such as buybacks of older, less liquid issuances, greater use of central clearing, lower bank capital ratio requirements, broadening the definition of “dealers” and enhancing trading transparency – as well as various emergency liquidity mechanisms could solve both short-term and longer-term problems.

Another shift that might ease the strain on the Treasury market is lower yields as they tend to dampen demand, and it does look like yields are pulling back in line with what looks like relief on the inflation front (in spite of the UK’s 41-year high of 11.1% released this morning, notably higher than the expected 10.7%). The US Federal Reserve, the ECB and the Bank of England have all hinted that they are entering a period of slower tightening.

But the Fed is not going to want notably lower yields just yet as a bond and stock market rally will get the “wealth effect” going again and inflation could come roaring back. So, should a rally materialize, we can expect a flurry of hawkish speeches with stern words. Yields may drift lower from recent highs, but are unlikely to materially correct at this stage. And the Treasury market woes may have eased, but they are not over.

We can, however, all be relieved that a material escalation in the war in Europe is off the table, at least for today.

--

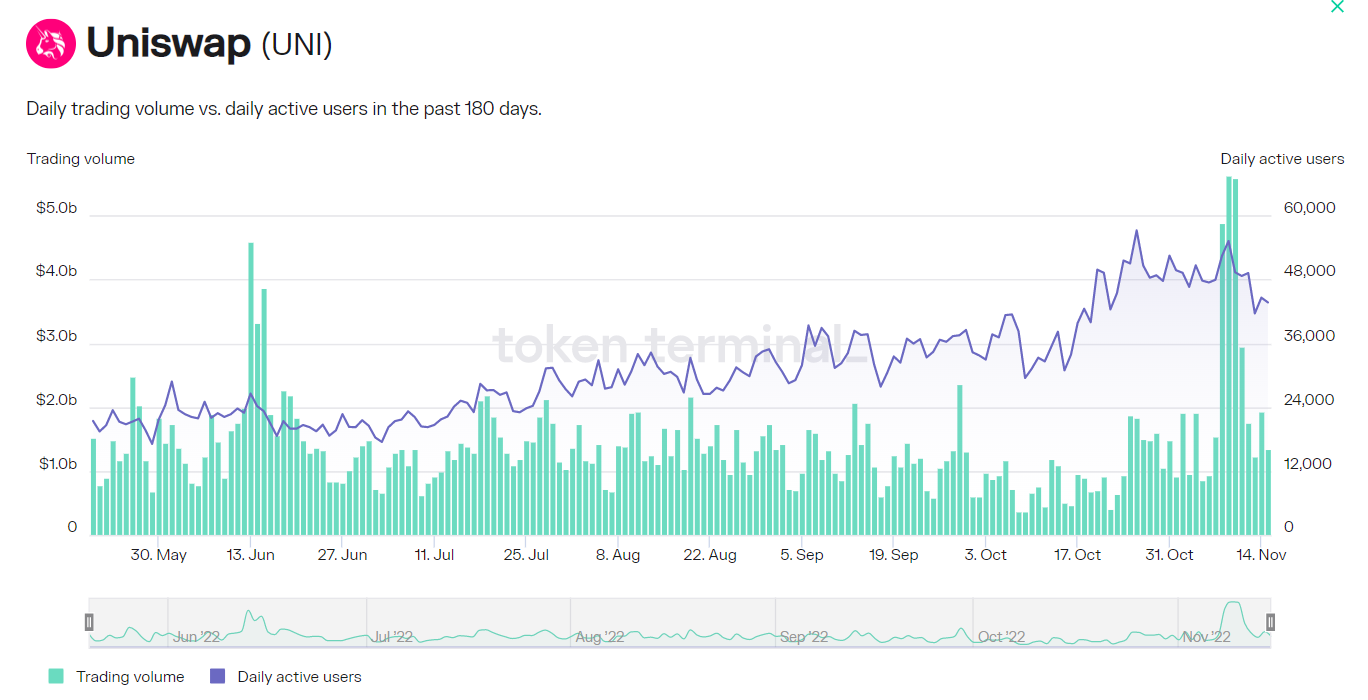

One consequence of the blow to market confidence is the growth in trading volumes on decentralized exchanges (DEXes). Taking Uniswap as an example (the largest DEX in terms of market cap), annualized trading volume is up 85% over the past 30 days, and the number of daily active users on a 30-day average is up almost 40%. The price of UNI, however, is down approximately 5% over the same period (according to data from Messari).

(chart via TokenTerminal)

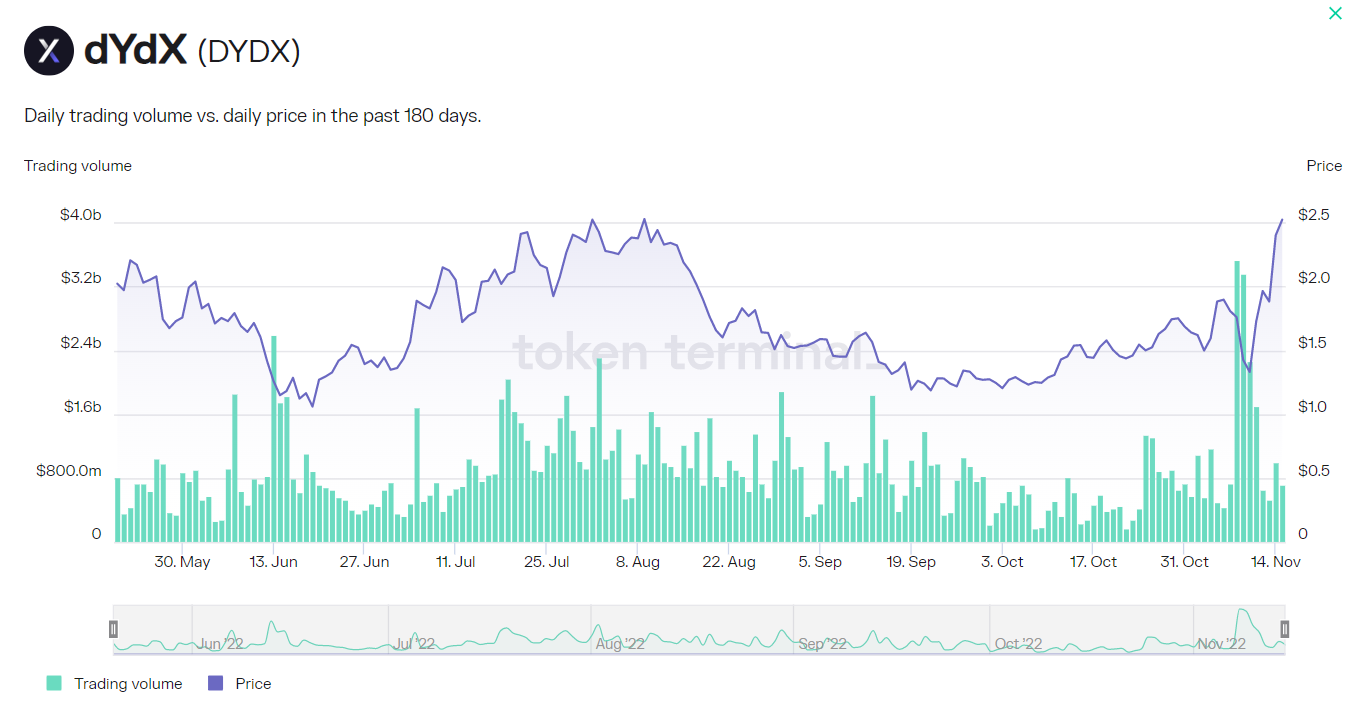

On the other hand, decentralized trading, lending and derivatives platform dYdX has seen an almost 60% jump in annualized trading volume over the past 30 days, while the price of its token is up a similar amount. There are probably other factors in play here (such as the regulatory landscape or even token-specific features, I need to do some more digging), but it’s worth keeping an eye on.

(chart via TokenTerminal)

NEWS

Nope. New York Department of Financial Service’s superintendent Adrienne Harris is urging Congress to adopt the New York BitLicense model for crypto regulation, which would be disastrous for the industry – overly restrictive, cumbersome and expensive, it would upend the ethos on which crypto markets were built, and push most activity offshore, just as the introduction of the BitLicense pushed many service providers out of the state. For that reason, it’s unlikely that Congress will follow her advice (one can hope), but this is representative of what could be an increase in regulatory turf wars given the heightened attention on the crypto market post-FTX.

As expected, the fallout from the FTX collapse continues…

Blockfi is preparing a potential bankruptcy filing, according to a report in the Wall Street Journal.

Nigeria-based venture collective Nestcoin has disclosed funds trapped on FTX which has necessitated layoffs and salary reductions at the company.

Crypto lending platform Salt has halted withdrawals and deposits, citing the FTX impact, and online investing platform BnkToTheFuture is backing out of a planned acquisition of the company.

DeFi Solana-based prime broker Oxygen has said that 95% of its ecosystem tokens are trapped in FTX.

FTX Digital Markets, the Bahamas-based subsidiary of FTX, filed for Chapter 15 bankruptcy – a protection process open to foreign debtors – in the Southern District Court of New York.