Wednesday, Nov 30, 2022

“It is amazing how fast people learn when they are not insulated from the consequences of their decisions.” — Thomas Sowell ||

Hi everyone! It’s finally here. The end of November. Only one month to go before we can put 2022 behind us. I’m never one to wish time away (it goes by waaaay too fast as it is!), but I am looking forward to the psychological reset that a New Year sometimes brings. 2023 will usher in a lot of market changes, and I am in the camp that the worst is behind us (excuse me while I find some wood to knock on).

You’re reading the premium version of Crypto is Macro Now, where I look at the evolving intersection of the crypto and macro landscapes. I hope you find this useful – if so, feel free to share with friends and colleagues.

If you arrived here from somewhere other than your inbox, or if someone shared this with you, I hope you’ll consider subscribing to support this effort (or take out a free trial!).

MARKETS

Rates less certain

Today we get the happy confluence of a public speech by Fed chair Jerome Powell, and the release of the preliminary US Q3 data. Consensus estimates point to 2.7% growth, a slight increase from last quarter’s 2.6%, and the Atlanta Fed’s GDPNow model (which was much closer to the actual Q2 figures than the consensus) suggests Q4 growth of 4.3%. This will be updated tomorrow and so could change, but so far, it doesn’t look like the US is in a recession.

(chart via the Atlanta Fed)

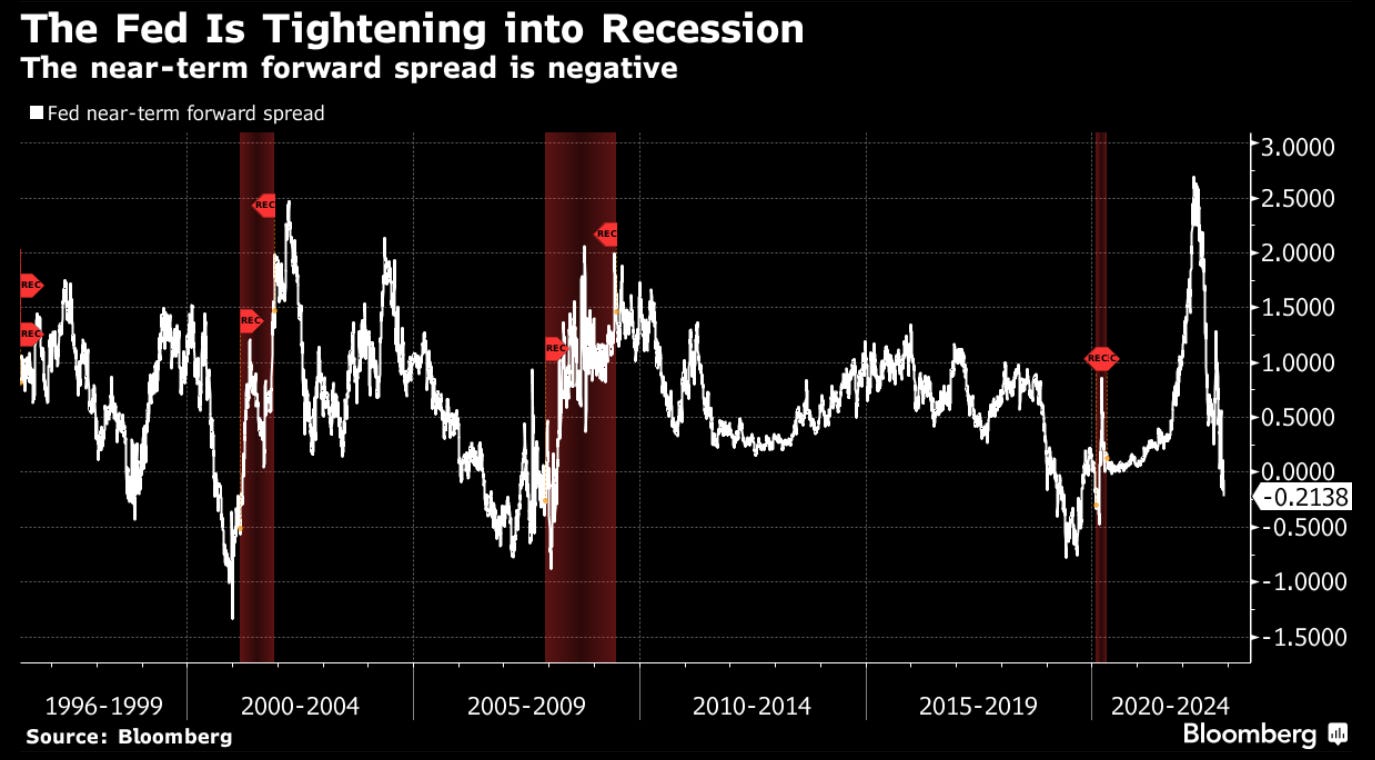

Yield curves are signalling furiously, however. Yesterday we looked at the 10y3m inversion, at its steepest since 1999. Today Bloomberg helpfully shared a chart of the 18m3m spread (I can’t find that on TradingView) – this is the indicator Powell himself said he’d be keeping an eye on for signs of trouble. Back when he said that, the spread was triumphantly positive – now it, too, is negative.

(chart via Bloomberg)

Also out today is the quarterly US GDP price index growth, expected to drop from 9% in Q2 to 4.1% quarter-on-quarter. We also get quarterly US PCE index data, but given the lag, tomorrow’s release of the PCE price index for October will be more relevant.

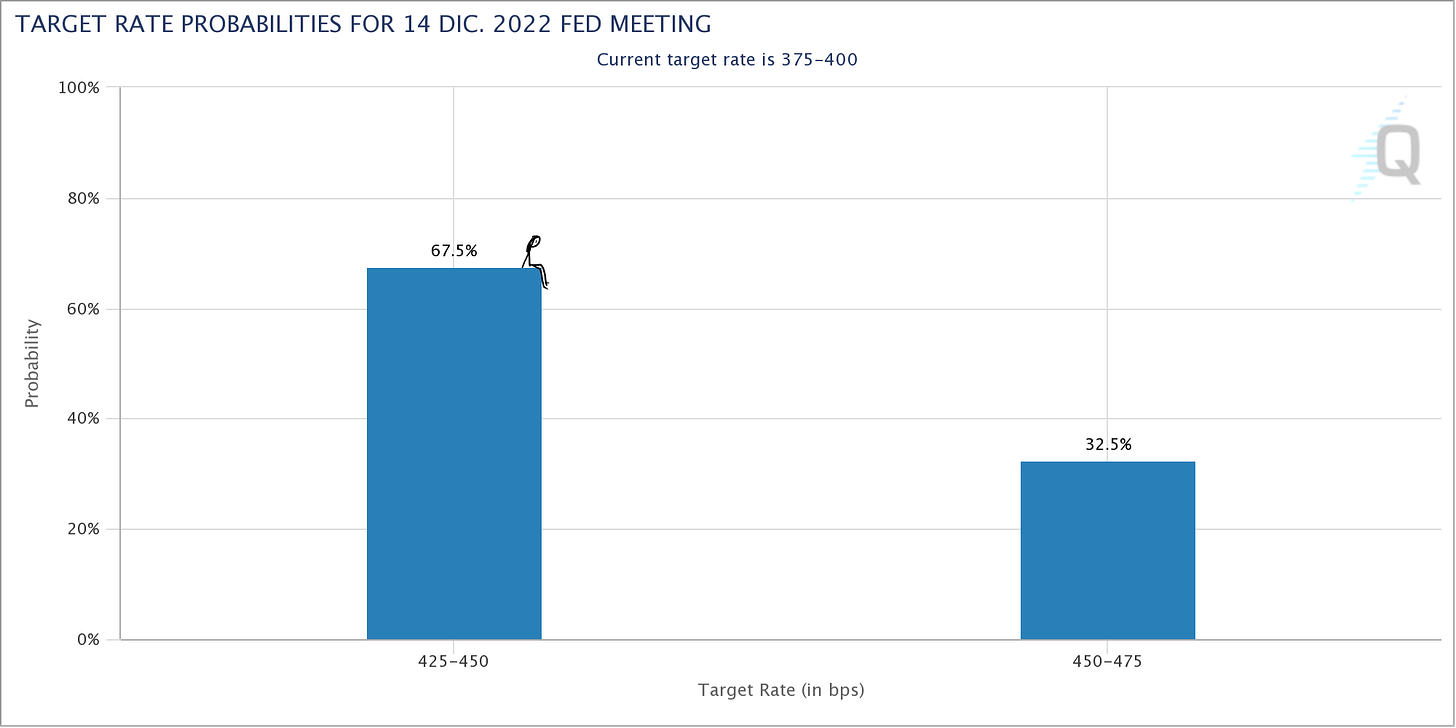

In spite of what is increasingly looking like a widespread slowdown in inflationary pressures (with so far only France and the UK bucking the trend of lower increases across Europe), confidence in a slowing of rate hikes seems to be waning, with CME futures suggesting a 67% probability of 50bp in December, down from 85% two weeks ago.

(chart via CME FedWatch)

In spite of this, the DXY index continued its drift lower and looks set to deliver its worst month since 2010. In theory, this should be good for BTC given their negative correlation. But crypto still has a lot of headwinds to battle – as these settle down, we could see macro-driven momentum build up.

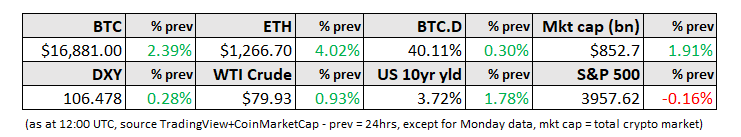

Crypto relief

Maybe it’s starting? Yesterday BTC and ETH rallied 2% and 4% respectively (over past 24 hours, at time of writing). This doesn’t yet feel “fundamental”, however, as almost all of that jump occurred in a 10-minute window just after 0:00UTC. In the case of BTC (but not ETH) this was accompanied by a notable spike in volume. Short liquidations were high, but not as much as you would expect from such an abrupt move, so it seems as if this was largely spot-driven.