Wednesday, Nov 8, 2023

CORRECTION, got the date wrong in the previous send!!

“There is surely nothing quite so useless as doing with great efficiency what should not be done at all.” – Peter Drucker ||

Hello everyone! You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now, with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

And later today I’m on a CoinDesk Twitter Spaces to talk about crypto markets – we kick off at 11am ET, so come and join us!

Programming note: this newsletter will take off Friday, Veterans’ Day in the US.

IN THIS NEWSLETTER:

More BTC signals from derivatives and inflows

Top-level stablecoin politics

Bankruptcies

Aliens

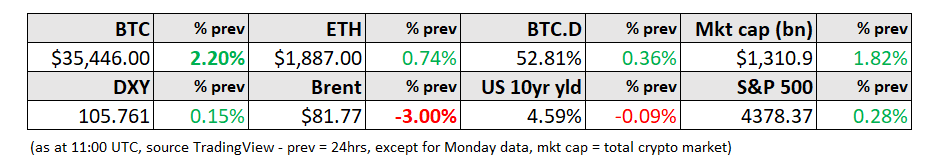

WHAT I’M WATCHING:

More BTC signals from derivatives and inflows

So much for the “gentle, organic upward slope” for bitcoin I wrote about on Monday.

(chart via TradingView)

Actually, looking up close, yesterday’s move was relatively sharp, but if you zoom out you can see that the organic slope vibe still holds for now.

(chart via TradingView)

Meanwhile, the futures market continues to spin off intriguing signals. I’ve written before about the USD open interest on the “institutional” derivatives platform CME reaching record levels. It’s also worth looking at the BTC basis, which reflects the premium implicit in futures pricing and can be taken as a gauge of sentiment – a positive basis means traders are feeling optimistic that the price will rise. Last week, the CME BTC and ETH basis reached levels not seen in a very long time.

(chart via K33 Research)

Zooming out a bit, we can see that the BTC annualized daily basis on Binance is at its highest since the excitement surge of June, when BlackRock filed its spot BTC ETF proposal.