Wednesday, Nov 9, 2022

“Nothing travels faster than the speed of light, with the possible exception of bad news, which obeys its own special laws.” – Douglas Adams ||

Hi all – wow, what a week so far. I hope you’re all taking care of yourselves. You’re reading the premium Crypto is Macro Now newsletter, in which I look at the trends shaping the intersection of the crypto and macro landscapes. Yesterday’s news and market moves were – unlike those of May and June – largely divorced from macro markets, but the impact on crypto market infrastructure could influence a range of factors that will shape our industry’s role on the larger macro stage, perhaps positively, perhaps negatively, most likely a mixture of both. I briefly touch on some of these factors below – more to come as more information emerges and we can collectively spend more time thinking about this.

If you find these emails useful, please consider sharing with colleagues and friends.

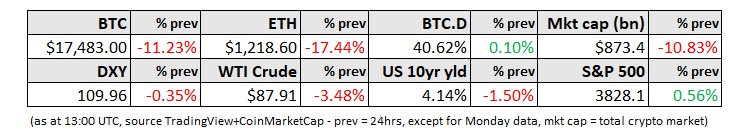

MARKETS

With drama piling on top of drama, the contours of the crypto landscape changed yesterday. By now you’ve no doubt heard that FTX CEO Sam Bankman-Fried reached out to Binance CEO CZ to ask for help with a liquidity crisis. Yesterday I sketched out the shape of the public Binance/FTX tension and shared some data regarding exchange withdrawals. But I confess I didn’t expect this twist to the tale. FTX was the “savior” of struggling crypto lenders Blockfi and Voyager. To see it need saving itself is worrying.

Since details are scant, it is more interesting to focus on what we don’t yet know:

How this happened

Whether Binance will see the deal through (the signed LOI is non-binding)

What global regulators will have to say about the deal, if anything – Binance is the largest exchange in terms of volume, FTX the fourth largest, and there may be anti-trust concerns (unlikely, in my opinion)

Why this bailout is needed, especially since Sam had tweeted just the day before that FTX has a “long history of safeguarding client assets”

Whether another buyer could enter the picture

What this means for Alameda, and how trading counterparties might be affected

What happened to FTX’s supposedly impressive war chest, which at one stage had Sam in the reported position of considering buying Robinhood and even Goldman Sachs

Whether lawsuits from investors will be forthcoming – earlier this year, FTX completed a $400 million round at a valuation of $32 billion, with funding coming from Paradigm, Temasek, Multicoin Capital and SoftBank among others.

FTX.US is not included in the deal as it is “not owned by FTX” according to the company’s website, but it is unclear just how separate the division is

How this will impact FTX Ventures or any of its 54 portfolio companies (which include >$200 million investments in Circle, Yuga Labs, Near Protocol, Aptos and others).

Details will no doubt continue to emerge as the week progresses and it’s unlikely we’ll get the full story for some time yet. You would think that after the debacles of May and June, we would be inured to surprise – but from what I can tell, almost no-one saw this coming. Meanwhile, we are all still reeling from the shock, and reactions seem to be swinging from anger to sadness to frustration to disappointment.

As you know, I’m a glass-half-full person, so I have to sketch out the upside here:

Maybe this is the push toward full capitulation the market needed.

Users will start to demand more transparency regarding exchange reserves – yesterday, seven exchanges (including Binance) issued statements committing to facilitating verification of asset reserves.

Lessons learned will strengthen risk management practices for all platforms that accept customer deposits.

The resilience of DeFi platforms amidst such market turmoil could reinforce their value in the eyes of regulators

We will see greater focus on the ability of machine learning algorithms to track risk, which tends to build up in overlooked areas causing blowouts that sideswipe even the most expert of experts. Humans are not good at keeping things simple, nor are we good at simultaneously tracking multiple threads and thinking several moves ahead. We need – and will develop – ways to better manage this.

This is a blow to crypto market infrastructure, but not necessarily to the value inherent in the assets themselves – longer-term investors will see good accumulation opportunities here.

That said, this is short-term bad news for the ecosystem:

There are most likely more price drops ahead – earlier this morning there was over 18 million SOL in the unstaking queue, most of which could hit the market within the next few days (unstaking requests usually take 2-3 days to process).

We will see more unwinding of collateralized positions which will withdraw even more liquidity from the market, keeping prices low for a while.

We could also see further platform collapses as the extent of the contagion from the loss of collateral value becomes clear.

VC investment will most likely freeze for a bit and then be slow for quite a while.

Institutional investors will re-think investment plans.

The expectation of a regulatory reaction will add to the uncertainty.

Industry consolidation is part of any bear market, but the combination of the largest and fourth largest crypto exchanges by volume produces a disconcerting degree of concentration in an industry that has decentralization as a driving ethos.

Sentiment among even crypto old-timers is shaken, much more than with the collapses of May and June. This could have an unfortunate impact on the confidence of entrepreneurs and builders, slowing down expansion plans.

The week’s events are also likely to dampen enthusiasm for talent considering a move into our space, which will hinder its momentum and adoption potential.

And if all that wasn’t enough, the midterm elections are not going the way most expected, CPI for October is out tomorrow, and a hurricane is literally about to hit Florida.

However, this is as good a time as any to remember that bad times are bad but we get through them. The crypto industry will survive this, even if even worse news has yet to emerge. Value is still value, the technology still has the potential to improve access and opportunity for all, and the loss of short-term market confidence won’t change its eventual impact.

--

In one of the most volatile trading days of the year (which is saying something), the price of BTC swung over 17% in the space of three hours, from a high of $20,660 after the FTX “bailout” was announced to a low of $17,120 as investors realized just how tentative things still were. ETH followed a similar pattern, and implied volatility (as measured by Deribit’s DVOL index) for both leapt up to levels not seen since late September.

(chart via The Block Data)

The BTC long/short ratio on Binance, which had been settling into optimistic territory, shot back above one signaling a sharp swing toward negative positioning.

(chart via The Block Data)

BTC’s dominance, which usually rises when fear rattles the market, behaved as expected yesterday but is coming off sharply this morning as investors that had focused on the “blue chip” crypto asset exit the market and as collateralized positions are unwound.

(chart via TradingView)

For a deep dive into what on-chain data says about BTC selling, I recommend the glassnode thread I link to below.

--

Also:

Some good threads:

Relevant on-chain analytics:

Lucas Nuzzi with an intriguing theory on how the FTX hole happened

A Brian Armstrong twitter thread

Jeremy Allaire thread on why US regulators need to step up their time frame

And not a thread but an excellent write-up by Arcane’s Vetle Lunde