Wednesday, Oct 9, 2024

Cambodia's Bakong project, tomorrow's inflation read

“I have never let my schooling interfere with my education.” – Mark Twain ||

Hi everyone! I hope you’re all doing well.

Today’s send is early since I have to be away from my desk at mid-day Spain time. Now, if only I could get it out at this time every day… I live in hope.

Below, I dive into Cambodia’s Bakong project, one of the few central bank digital currency projects that seems to be working – maybe because it isn’t a CBDC.

I also look at suggestions that tomorrow’s CPI data might disappoint markets eager for hints of large rate cuts ahead.

IN THIS NEWSLETTER:

Does inflation deserve a bit more attention?

When is a CBDC not a CBDC?

If you’re not a premium subscriber, I hope you’ll consider becoming one! It’s the price of a couple of New York coffees a month, and you get ~daily commentary on how macro moods are influencing crypto markets, and also on how crypto is impacting the macro economy.

WHAT I’M WATCHING:

Does inflation deserve a bit more attention?

Last week was jobs week, this week attention turns to inflation with tomorrow’s release of US CPI data for September. This may now be out of fashion as a metric to obsess over as inflation is no longer a key concern, but it is still relevant for its ability to potentially deliver some unpleasant surprises.

It’s not so much the direction of fed funds moves that matters for traders now, it’s the speed – and that depends on confidence as to inflation’s continued path towards 2.0%. Given the likely stickiness ahead, inflation is nudging its way back into our daily diet of conflicting economic narratives.

Last week’s employment data showed average hourly earnings growth unexpectedly accelerating to 4.0% year-on-year. Fed Chair Powell insisted in his recent post-FOMC press conference that wage growth was consistent with an overall deceleration, but the below chart shows that it is still running well ahead of the pre-pandemic average.

(chart via Bloomberg)

And any uptick in union unrest – we just might find that the recent dockworkers’ agreement is just a taster of more to come – could put more upward pressure on costs, as could mass deportation of immigrant workers. And resilient spending could continue to keep services employment relatively high. Put differently, wage growth may not decelerate as much as Powell hopes, unless the jobs market notably weakens.

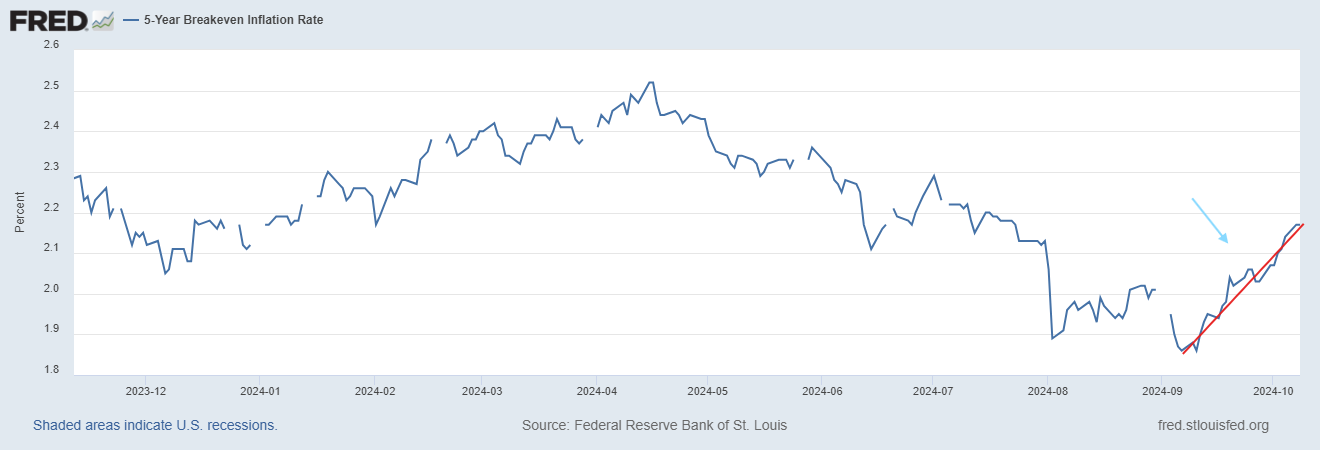

Inflation expectations reflected in the treasury market, going by the five-year breakeven rate (taken from inflation-indexed bonds), have been heading up since early September and are now back to where they were at the beginning of the year.

(chart via the St. Louis Fed)

The NFIB report out yesterday showed that more than a third of small business respondents reported higher prices for September, with only 13% reporting lower prices – both percentages were unchanged from August, which sounds sticky to me.

That said, the latest University of Michigan consumer survey showed that expectations of inflation one year out continue to come down. These tend to be sensitive to energy prices, however, and the latest measure was taken before the oil price started climbing along with an escalation of tension in the Middle East.