Wednesday, Sept 6, 2023

BTC and oil, stablecoins vs banks, crypto lending and liquidity, banks and tokenization

“Most people spend more time and energy going around problems than in trying to solve them.” – Henry Ford ||

Hello everyone! You’re reading the premium daily version of Crypto is Macro Now. In this newsletter, I give some depth on factors I’m keeping an eye on that highlight the growing overlap between the crypto and macro landscapes – my focus is on how crypto is affecting the global economy, and vice versa. There is often a market discussion as well. Nothing I say is investment advice!

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now (I will be raising prices in the autumn), with a free trial – the price of two cups of coffee in NY!

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? It’ll make me happy, and I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER

BTC and the oil price

How stablecoins will take business from banks

Could crypto lending be on the verge of a revival?

How banks launching tokenized security services can support crypto assets

WHAT I’M WATCHING

BTC and the oil price

After a brief flash of excitement after Grayscale won its case against the SEC, BTC ennui seems to be back, and we can largely blame the oil price.

(chart via TradingView)

Yesterday, Saudi Arabia and Russia agreed to prolong their unilateral oil production cuts by another three months, startling a market that had been discounting an extension of one month. In response, the Brent Crude and West Texas Intermediate benchmarks both reached their highest levels so far this year, exacerbating concerns that inflation could stage a come-back.

(chart via TradingView)

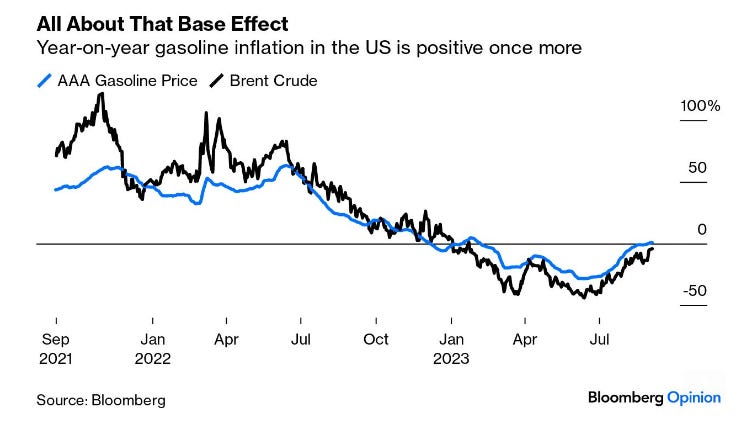

Gasoline prices are now higher than they were a year ago, for the first time since January when US headline inflation was at 6.4%.

(chart via Bloomberg)

While energy prices are not included in the core inflation measures that central banks prefer to look at, they do impact the price of just about everything. The price of oil dictates the price of common inputs such as plastics, fertilizer and other chemicals, and transportation costs have to be factored into both goods and services pricing. And gasoline prices influence consumer expectations – if consumers start to expect inflation to go up, they could bring purchases forward, which could move prices up and thus confirm their expectations. Even Fed Chair Powell has stressed how important consumer expectations are.