WEEKLY, Apr 15, 2023

ETH outperformance, what moves BTC's price, what the mood was a year ago, and more...

CRYPTO MARKET PRICING: Join myself and a team of experts from data and analytics provider Coin Metrics in a free webinar to discuss crypto markets, pricing challenges, valuation factors, why regulators are paying attention, and much more, on Thursday, April 20 at 10:30am ET. Sign up here!

Hello everyone! This past week was a short one for many of us, but even so, it absolutely FLEW by. Strange how time compresses when things are on the move.

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, poke at established narratives and share listening recommendations. Since many of you are new here (welcome!), I’ll introduce myself again. I’m Noelle, and I’ve been writing crypto-focused newsletters for almost seven years, first for CoinDesk and more recently as Head of Market Insights for Genesis Trading. After I left Genesis in September of last year to focus on independent research, it felt only natural to continue. Nothing I say is investment advice!

In the weekly, I generally comment briefly on the markets, include a longer piece about a topic I’ve been thinking about, look back to where we were a year ago, and also offer some totally unrelated links and recommendations. If you’re interested in daily market and news commentary, with charts and some fun links, do consider subscribing to the premium daily newsletter, it’s only $8/month. Or take out a free trial! 😊

MARKETS

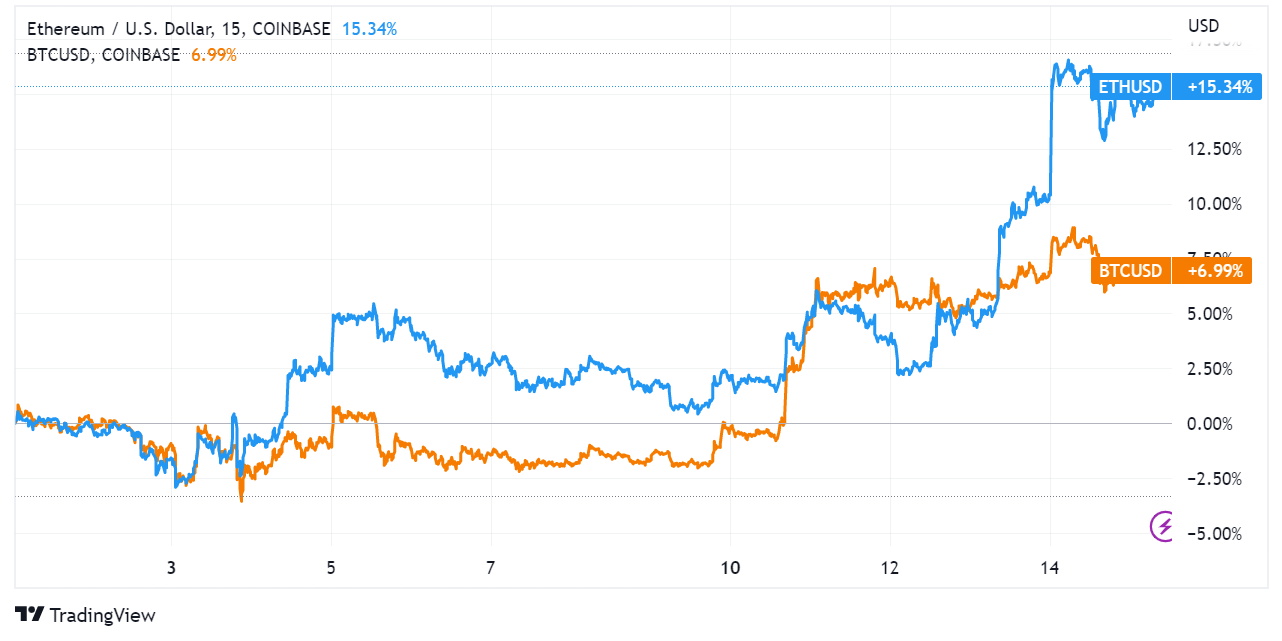

The tables have turned. After a strong outperformance year-to-date, over the past week, ETH revved into action and grabbed market attention from its older sibling.

(chart via TradingView)

This shift started after the Wednesday’s successful implementation of the Ethereum network’s Shapella upgrade which enabled withdrawals of staked ETH, and was powered by a drop in the DXY dollar index in response to changing monetary liquidity expectations as well as relief that the network upgrade did not produce a “sell the news” event.

(chart via TradingView)

Heading into the upgrade, opinions were divided as to whether the ability to withdraw ETH would trigger a flood of selling, or would be a non-event as ETH stakers tend to be long-term holders who would probably not be eager to sell at current prices. It turned out to be the latter – although there has been a strong stream of withdrawals, this has dwindled to an almost negligible rate, while new deposits continue to enter staking contracts.

(chart via Nansen)

Longer-term, we are likely to see greater demand for ETH staking as the illiquidity risk factor (not being able to withdraw staked ETH) has now been removed. This is good for the network as it in theory better distributes network governance, which should – all else being equal – further enhance overall value. Meanwhile, Ethereum developers are now turning their attention to the next upgrade.

Next week, in the daily emails, I’ll dive into what the recent regulatory rumblings around DeFi could mean for the value of ETH, why Treasury yields are relevant, as well as the evolution of ETH transactions and the impact on overall supply.

COLUMN

Bitcoin’s “Store of Value” Narrative Is Real but Not a Price Mover

Markets are noisy, chaotic things that us human beings instinctively try to imbue with order and reason. This generally involves searching for explanations as to why prices are trending up or down or what triggered a sharp move. Often there is an obvious explanation – an earnings surprise or an unexpected corporate action. Sometimes the cause is not so easy to see – flows of funds, an evolving user base, steady product development, etc. With bitcoin, it’s even harder to discern what is driving sentiment shifts at any given time since it doesn’t have earnings, there are no corporate actions, regulation isn’t the threat it is for some other crypto assets, and the narratives are multiple and varied. There isn’t even universal agreement as to what bitcoin is, let alone what drives its price.

But our search for reason amid chaos encourages us to latch on to something that makes sense, and if it is a narrative that justifies our interest while highlighting a timely concept, then so much the better.

One phrase we’re hearing a lot of these days is “store of value”. It tends to mean different things to different people, but in general, it refers to an asset that holds its value relative to a broad basket of other assets over a long stretch of time.

In spite of its short-term price volatility and sharp bear markets, bitcoin is a store of value since it is the only asset traded on liquid exchanges today with a programmatic and verifiable hard cap. With other “hard assets” (those with limited supply) such as gold, diamonds or real estate, we don’t know what the supply cap is, nor do we know how much is currently in existence. Plus, with other “hard assets”, the price influences the potential supply. For instance, if gold were to surge to $20,000/oz, new extraction methods would become viable, boosting the theoretical cap. Bitcoin is the only asset traded on liquid exchanges for which the price has no influence whatsoever on the supply. It is the hardest of hard assets.

What’s more, the supply of its most common denominator – USD – has been increasing over the decades, and more recently at an astonishing pace. We are likely about to embark on another wave of monetary easing, involving lower interest rates and the incentivization of credit to overcome declining economic growth and consumption. An increase in the supply of USD above what economic growth can absorb will – all other things being equal – decrease its value relative to other assets, and following basic maths, if the value of the denominator drops, that of the ratio increases. Bitcoin is a store of value and a hedge against currency debasement.

Finally, bitcoin the asset lives on a decentralized network (confusingly also called Bitcoin) which lends this store of value an almost unique degree of seizure resistance. It can be argued that other hard assets can be held “off the grid” (gold can be kept under the kitchen floorboards, and maybe no-one knows about the cabin in the woods), but they are complicated to transport and can be seized. Bitcoin ownership does not reside on centralized ledgers unless it is at the holder’s request, an option many choose for convenience. Even so, the asset’s inherent seizure resistance and mobility further enhance its store of value qualities.

Given the ballooning economic uncertainty, it makes sense that investors are looking to strengthen their portfolios with stores of value, and it makes sense that many are starting to pay more attention to this novel asset. This growing interest, we’re told, is one of the main factors behind bitcoin’s more than 80% price increase since the beginning of the year.

Only, technically, it’s not.

Stores of value are generally of interest to longer-term investors. Bitcoin’s price is set by short-term traders.

That’s not to say that the store of value narrative has not been a key driver of bitcoin investment since the early days. In bull markets and bear, those with a long-term thesis have been steady accumulators – metrics that track the movement of bitcoin on-chain show that almost 30% of bitcoin in circulation has not moved in over five years, and even during the painful drawdown of last year, this percentage continued up and to the right (true, some of these bitcoin could be permanently lost, but the bulk of it most likely corresponds to store of value investors). Almost 40% has not moved in over three years, over 50% has not moved in over two. You get the picture.

But this steady accumulation has been quiet and consistent, and has not accounted for bitcoin’s wild price swings. Those are driven by speculation on this and other narratives.

In any public market, the latest trade is what determines the price. In liquid markets, there are trades every nanosecond, and they are usually at prices close to the last one but changing preferences will move this up or down. These are usually from traders and market makers hoping to profit from short-term moves, which are influenced by narratives and news.

For bitcoin, while we don’t have access to the churn in exchange volumes since these happen off-chain, we do know the average age of on-chain movements. These are much less used by traders than are off-chain transactions, but we can assume that they are at least representative of the makeup of exchange volumes. The below chart from glassnode shows that, on any given day, at least half of bitcoin transferred between addresses had last been moved within the previous 24 hours (the light yellow and darker yellow bands). Even on-chain, the bitcoin market is high-turnover, and short-term traders dominate.

(chart via glassnode)

So, in the case of bitcoin, the trader-led expectation of growing interest in the store of value narrative is probably behind more of the recent price move than is actual interest. Investors may increasingly see bitcoin as a store of value, and growing demand in the face of a fixed supply will obviously push the price up. But the bulk of price moves are from traders betting on this demand rather than actually forming part of it.

This highlights the key role narratives play in crypto markets, more so than in other markets with a steadier flow of fundamental data.

It also exaggerates price movements on the way up, and on the way down. Unlike fundamental value drivers, narratives are inflated and deflated by sentiment, which is influenced by an incomprehensible range of factors. It even ends up influencing itself.

What generally happens in bitcoin cycles is that the prevailing narrative starts out being about one thing (eg. store of value) and ends up being about another (price). Whatever you may believe is the main story line driving current interest – store of value happens to be the one I’m hearing most about these days, but there’s also monetary liquidity, the need for banking “insurance”, and more – the attention invariably pivots to price movements, which themselves end up becoming the story.

We need to keep an eye out for this, since we’ve all seen how that type of narrative can push the price up (which is good) but rapidly remove support when winds change. When “price” becomes the story, we need to be aware that sentiment is becoming flimsier, since traders are no longer betting on what longer-term investors will do, they are betting on what other traders will do. The underlying potential growth may not have changed and accumulation by those with an eye on the bigger picture will continue regardless. But sentiment and price tend to be driven by short-term market participants who are influenced by much more than a good story – this matters for market momentum, and serves as a warning against becoming too wedded to any particular narrative when it comes to trying to make sense of market moves.

A YEAR AGO

Around about this time last year, crypto markets were well down from their January levels but were still feeling a bit frothy. The Dallas Cowboys had just signed a sponsorship deal with Blockchain.com, Ava Labs was reported to be raising $350 million at a more than $5 billion valuation, and at least three new funds (two from Fabric Ventures and one from White Star Capital) were reported to be close to completing raises of over $100 million each.

Meanwhile, over in the always-insane NFT segment, the Bored Ape Yacht Club franchise announced a deal with Coinbase to produce a trilogy of movies starring the ugly simians, the NBA filed for four NFT trademarks, “Crypto Beaver” NFTs formed part of a political campaign and Las Vegas’ MGM Grand started experimenting with NFT ticketing.

In macro markets, US inflation had just topped 8% for the first time in decades, the US 10-year yield had not surpassed 3%, and fed funds were still at a paltry 0.25-0.50%. The pain was just getting started.

HAVE A GOOD WEEKEND!

Spring means flowers. I guess that also means allergies, and if this affects you, I’m truly sorry. But I do love flowers. Earlier this week, The Atlantic shared some photos of the extraordinary blooms across California, the result of an unusually wet winter, and the sheer scale is a reminder of how surprising and breath-taking nature can be.

(photo by George Rose, via The Atlantic)