WEEKLY, Apr 22, 2023

Crypto and politics have a new relationship

Hello everyone! I hope you had a good week! You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, poke at established narratives and share listening recommendations. Nothing I say is investment advice!

In the weekly, I briefly comment on the markets, include a longer piece about a topic I’ve been thinking about, look back to where we were a year ago, and also offer some totally unrelated links and recommendations. If you’re interested in daily market and news commentary, with charts and some fun links, do consider subscribing to the premium daily newsletter, it’s only $8/month. Or take out a free trial! 😊

I’ve decided to stop doing the “A Year Ago” section as I realized we were coming up to an anniversary in crypto markets few want to remember or are able to forget. And then several other dark days followed that one over the next few months. I still feel it’s important to keep perspective of how far we’ve come, but there are many other ways we can do that. Instead, I’m bringing back the listening/reading links that some of you had said you missed.

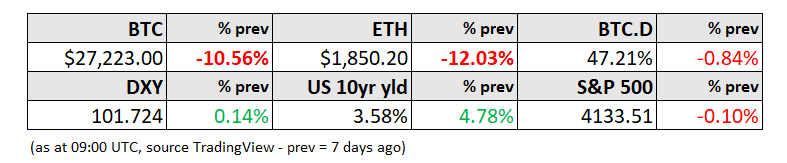

MARKETS

The ominous drumbeat of economic data reflecting an activity slowdown is getting louder: this past week we saw the US housing market is showing signs of softening, with house prices finally starting to come down, a notable drop in mortgage financing, and resales resuming their slide. Recurring US unemployment benefit claims jumped to the highest level since November 2021. With long-awaited moves in two of the most resilient economic indicators, and the Conference Board’s Leading Economic Index dropping to its lowest month-on-month level since mid-2020, you’d think the stock market would be finally bracing for a recession, right?

(chart via Investing.com)

Nope – it’s showing some weakness, but zooming out is in a relatively stable holding pattern. What is it waiting for?

(chart via TradingView)

It’s not the upcoming FOMC rates decision, since consensus is strongly signalling a 25bp hike. It could be the tone of the remarks, which the market might hope would drop hints of upcoming rate cuts – this outcome is unlikely, since the chorus of comments by Fed officials over the past few days is almost uniform in its “we’re not done yet” messaging.

It could be stronger economic catalysts: next week we get a preliminary reading on Q1 US GDP, which is expected to slow slightly to 2.0% quarter-on-quarter, from 2.6% in Q4 – unless we get a strong negative surprise, this could still be spun as a “soft landing”. We also will find out by how much the core PCE index (the Fed’s preferred inflation indicator) grew – consensus forecasts point to not much change at all, which will add fuel to suspicions that we might have not one but two more rate hikes ahead. Expectations of rate cuts have been markedly pushed back over the past week, although CME futures are still pricing in two cuts by year-end.

(chart via CME FedWatch)

In the absence of encouraging signs on the monetary liquidity front, BTC continued to drift down over the week after its sharp drop on Monday, dragging other large-cap crypto assets with it.

(chart via TradingView)

A notable feature of this market is the lack of volatility – BTC 30-day realized volatility is back to early-March lows, and even implied volatility, a forward-looking measure derived from options pricing, has been heading down.

(chart via TradingView)

This signals a lack of conviction as to the direction of the next move, even though some sentiment indicators – such as the ratio of long vs short futures positions on Binance (the largest BTC futures exchange in terms of open interest) – are pointing to a build-up of optimism.

(chart via The Block Data)

Given the relatively thin volumes (which have been gently recovering after touching a multi-year low earlier this month), this build-up could trigger sharp moves at any time.

(chart via The Block Data)

Derivatives positioning suggests that this is likely to be to the upside, but the macro environment is particularly uncertain now, and BTC – while being an “insurance” asset that should outperform when other asset groups are suffering – is still heavily impacted by the overall macro mood, which will largely be driven by monetary liquidity expectations.

For more detailed market and ecosystem commentary, with charts and occasional stick figures, do subscribe to the daily email - or take out a free trial!

COLUMN

Why the politics of crypto is different this time

This week’s appearance by SEC Chair Gary Gensler before the House Financial Services Committee was his first in over a year, and his first since the current Congress took over. The political shift rapidly became glaringly obvious as the overall tone was markedly hostile, with the agency’s approach to digital assets a key point of contention.

As with most congressional hearings, the event was largely about making political points and grandstanding for the cameras. But it felt significant in that it revealed the scale of Republican dissatisfaction with Mr. Gensler’s administration, suggested several points that are likely to become campaign platforms, and publicly weakened the SEC chair’s credibility which in turn could prompt some modifications to the agency’s approach.

Normally the public doesn’t care too much about financial regulation. The rhetoric witnessed this past week, however, suggests that politicians could start to make sure they do. No longer is it just about financial disclosures and settlement rules: it is rapidly becoming about individual freedom and US pride.

The full video makes for compelling although occasionally frustrating viewing. Here are some of the key highlights:

Ahead of the hearing, around 30 elected representatives signed a letter “blasting” (their word) Mr. Gensler for misrepresenting the digital asset platform registration process. This is something the crypto community has been complaining about for some time, but the tone of the message and the public offices of the signatories signal a notable escalation.

This became even more apparent as the hearing kicked off with Chairman of the House Financial Services Committee Rep. Patrick McHenry (R-NC) coming out swinging. Mr. McHenry highlighted, among other things, the inconsistency with which Mr. Gensler throws out crypto enforcement actions, asks for extra budget and yet refuses to give clarity as to the application of securities laws to digital assets and their service providers.

Mr. McHenry pointedly asked Mr. Gensler several times if ether was a security, and each time Mr. Gensler attempted to trot out the standard Howey definition without answering the question.

Mr. McHenry also attempted to get Mr. Gensler to acknowledge that the rules are not clear; Mr. Gensler continued to insist that they were plenty clear (that sound you hear is lawyers guffawing), but that he couldn’t say anything about any specific asset.

Mr. Gensler endured a fierce takedown by House Majority Whip Tom Emmer (R-MN) who highlighted the SEC’s inconsistency in both its reach (Mr. Gensler has often said that the rules cover the industry adequately; he has also said that he needs additional congressional authority to be able to cover the industry) and its approach (all firms need to do is register, but there is no applicable registration process).

Rep. Warren Davidson (R-OH) pointed out that Mr. Gensler’s SEC approved the pre-IPO documents of Coinbase, which described in detail its staking procedures and other operations, allowing retail investors to purchase shares. Two years later, the SEC sent a Wells notice to the company, implying concerns about the legality of some unspecified listed digital assets, the staking service, the crypto wallet and other areas of the business.

After reciting a litany of failures, Mr. Davidson introduced a bill to remove Mr. Gensler from office.

To be fair, the hearing wasn’t all about perceived SEC failures and shortcomings. Some committee members praised Mr. Gensler for his bold approach in reforming securities clearing and for “standing up to crypto bro billionaires” (did he, though?). And many of the Republican critiques were not about the agency’s crypto approach but about its move into policing the environmental impact of listed companies and other initiatives that would add to the compliance burden of smaller businesses.

The political nature of the questions was quite clear, however, with Republicans against and Democrats supportive of the current SEC leadership. Mr. Davidson’s bill proposing the firing of Mr. Gensler is unlikely to progress, but it loudly trumpets that the battle is getting more intense. It’s a curious battle to pick, given the broad range of hot issues likely to dominate the rapidly approaching 2024 election campaign. In any political competition, the opposition finds a weakness and attempts to escalate it to the public consciousness in order to score points and shift perception of the incumbents. That digital assets are a key protagonist of the current positioning is a strong message for the Republicans to send.

What’s more, they’re not pulling their punches. This isn’t just about financial oversight or administrative inefficiency. Nor is it just about the functioning of capital markets. Most voters don’t care too much about that. Some of the statements made clear that this was about much bigger issues.

One is patriotism. Mr. Emmer was not the only one to remind Mr. Gensler that his actions are encouraging US businesses to change jurisdiction, but he went as far as accusing the SEC chair of “pushing American firms into the hands of the CCP”, referring to the Chinese Communist Party. Some hot buttons are being pushed there, especially since Mr.bGensler did not have a memorable rebuttal to any of the allegations.

Another is individual freedom. Mr. Emmer and others brought up the politicization of capital formation, but the mic drop belongs to Mr. Davidson with the following quote that we are likely to hear again:

“You can’t just exclude retail investors from markets and claim it’s for their own good.”

There is still quite a while between now and the U.S. election, and a lot can happen in the interim. It’s unclear to what extent the current administration will dig in and back Mr. Gensler in his digital asset approach – a recent report on the crypto ecosystem from the White House Council of Economic Advisers was not exactly encouraging, and the administration may be loath to give the Republicans what could look like a win. Or, it could be that Mr. Gensler’s bosses decide that this is not a hill to die on, especially as the noise of high-profile suits involving the SEC gets louder and especially if the SEC starts losing.

Either way, digital assets are likely to increasingly form part of the political discourse. This will broaden awareness as observers choose their sides, either sticking to party lines or perhaps switching sides as the ideological divide widens.

A bigger takeaway, though, is that the digital asset ecosystem is moving from market niche to political platform. This week, crypto entrepreneur Ryan Selkis announced the launch of a $100 million multi-entity pro-crypto political campaign, and the industry has many influential protagonists who will either join or form similar initiatives.

Uncertainty is never comfortable, but we can take a moment to appreciate the attention, even if it’s not the type of attention the industry had hoped for. You know what they say: the only thing worse than people saying bad things about you is people not talking about you at all. While I’m not sure I believe that, it does shed light on the importance of where the ecosystem is on this journey.

To see it take up so much of politicians’ time, whatever the stance, is a sign that the industry has a seat at an ever-bigger table. Politics changes, and regulators come and go. Meanwhile, crypto keeps on building.

SOME GOOD LINKS

An eye-opening discussion on the Odd Lots podcast about how globalization has not helped all regions, and how its unwinding could distort growth figures.

In this Macro Voices podcast episode, David Rosenberg adds to the voices calling for a stock market drop as the recession gets under way.

Hayek would have liked Bitcoin, not as a universal ledger but as monetary competition.

A refreshing rebuttal from FT Alphaville to the hopeful claims that the dollar’s hegemony is waning – it may be declining slightly, but it is far from in danger.

Have a good weekend!

Last weekend I watched RRR – a Tamil film dubbed in Hindi on Netflix, apparently the most expensive film ever to emerge from India. It’s long, I had to break it up into two sessions, but holy cow it was worth it. Pure spectacle. Outrageous but gorgeous, with astonishing fight scenes as well as the most jaw-dropping dance numbers I’ve ever seen – a strong recommend if you like your cinema somewhat over-the-top, with awful, evil villains and deep, noble, physically fit (to say the least) heroes.