WEEKLY, Apr 29, 2023

What the macro environment says about bitcoin and other crypto assets

Hello everyone! I hope you had a good week, and that those of you at Consensus get some time to recover! You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, poke at established narratives and share listening recommendations. Nothing I say is investment advice!

In the weekly, I briefly comment on the markets, include a longer piece about a topic I’ve been thinking about, and also offer some totally unrelated links and recommendations. If you’re interested in more detailed daily market and news commentary, do consider subscribing to the premium daily newsletter, it’s only $8/month. Or take out a free trial! 😊

Programming notice! A multi-tiered one, as well.

It’s a public holiday in most of the world on Monday, May 1, so the daily version will be taking a break, back in your inboxes on Tuesday.

Also, this is the last weekly Crypto is Macro Now until May 20 – I have to have surgery next Friday, May 5, and have been told I will need at least a week to recuperate. The daily email will publish as usual Tuesday-Thursday of next week, but will then pause until Tuesday, May 16. For daily subscribers, I will be pausing subscriptions for the week of May 8, so your subscription period will be extended.

MARKETS

Both BTC and ETH eked out decent gains this week as the market as a whole hovers in wait-and-see mode.

(chart via TradingView)

Yet again, BTC outpaced ETH, pushing the BTC/ETH ratio back up to early April levels and suggesting that macro drivers are still predominant (more on this below).

(chart via TradingView)

Next week brings not only the FOMC meeting and the expected 25bp hike, but also some key economic data, most notably ISM business activity indicators and official employment statistics, so we could see some significant swings as the debate around whether or not a recession is fast approaching gathers more support. After Thursday’s reveal of notably lower US GDP growth for Q1, down to 1.1% from 2.6% in Q4, economists surveyed by Bloomberg are expecting an apathetic 0.2% US GDP increase in Q2. Between 0.2% and negative is a very short step, and a big question for markets in coming days will be just how much slowdown is already discounted in stock prices and bond yields.

COLUMN

Crypto’s Macro Drivers – It’s Not Just About Bitcoin

Barring an uncharacteristically shock move from the US Federal Reserve (not known for its rash decisions), next week we will see another 25bp hike in the federal funds rate. The raise itself is not that significant – background noise, if you will, we’re all used to this by now. What is noteworthy about this one is that there is a strong likelihood it will be the last. This is a very big deal for the whole crypto market, not just for bitcoin.

Below, I dive into why I think next week’s will be the last US rate hike, why this is good news for bitcoin, and why the tailwind extends to other crypto assets as well.

This past week, we saw preliminary US GDP come in at 1.1% quarter-on-quarter growth, much lower than the expected 2.0%, and lower still than Q4’s downward revision of 2.6%. The bulk of the disappointment was due to weak inventory build, with defence and consumer spending accounting for most of what little growth there was. Adjusted for inflation, consumer spending jumped 3.7% in Q1, much higher than the previous quarter’s 1.0% increase. Bear in mind that this increase is after one of the steepest rate hike campaigns ever.

This is unfortunately reflected in inflation data. The Fed’s preferred inflation index of Personal Consumption Expenditure (PCE) ex-food and energy (known as core PCE) for Q1 increased by 4.9%, more than the consensus estimate of 4.7% and than Q4’s 4.4%. The more granular core PCE reading for March, released on Friday, did not show a startling increase but nor did it decline, coming in at a steady 0.3%, or 4.6% on a year-on-year basis. Again, frustrating resilience after almost five percentage points of interest rate hikes in 12 months.

So, since higher interest rates do not seem to be working, does that mean that the Fed will need to raise them even more? Not necessarily. As the Fed has often reminded us, the data moves with long and variable lags, with no guidance as to what “long” means. There are signs that the acceleration in core prices seen in Q1 is trailing off. In addition to the March figure, we have the Cleveland Fed’s Inflation Nowcast which models April core PCE steady at just over 4.6%. This could encourage the Fed to choose to wait and see if more impact starts to show up, which it is likely to.

For now, this likelihood is not obvious. On Friday, we saw the Employment Cost Index for Q1 come in at a slight increase of 1.2% quarter-on-quarter. This is the Fed’s preferred employment cost gauge, as it takes benefits as well as wages into account and is therefore not distorted by employment shifts among occupations or industries. The uptick was only 0.1 percentage points, but that it was there at all is concerning, and the year-on-year increase was 4.8%, well above the target inflation rate of 2%.

But there are signs that the employment market is cooling. Thursday’s US continuing jobless claims held on to the increase seen at the beginning of April, with the most recent four readings up more than 6% from the preceding four. The wave of layoffs depressing our headlines suggest this figure is likely to keep heading up.

(chart via Investing.com)

Furthermore, one thing that jumps out when looking at charts of the unemployment rate over time is that, when it starts to move up, it does so suddenly and quickly. The tightening credit outlook will further constrain economic growth as companies struggle to refinance, leading to even more layoffs, and the impact on demand will exacerbate the painful momentum.

(chart via the St. Louis Fed)

Aware of these trends, I believe it is likely that the Fed will pause rate hikes at the June FOMC meeting and then hold steady for some time as higher rates start to do their damage. We shouldn’t forget that reported economic data is backward-looking. The US Conference Board’s Leading Economic Index dropped by 1.2% in March, more than double February’s decline. This downward trend should continue as the consequences of tighter bank credit roll through the economy, punctuated by damage done to balance sheets from falling collateral values. Dark clouds are gathering.

What this means for bitcoin

If the Fed does pause in June, this would be good for bitcoin as it implies an easing of financial conditions.

While the rates themselves may not change, expectations of cuts on the rapidly approaching horizon should be enough to move the liquidity needle – with the exception of the 1960s, an extended pause after a series of hikes has always been followed by cuts. What’s more, financial conditions are not just defined by the rate of fed funds: they are also influenced by bank profits and policies, the oil price, the level of the dollar, fiscal policy and the credit outlook around the world, among other factors.

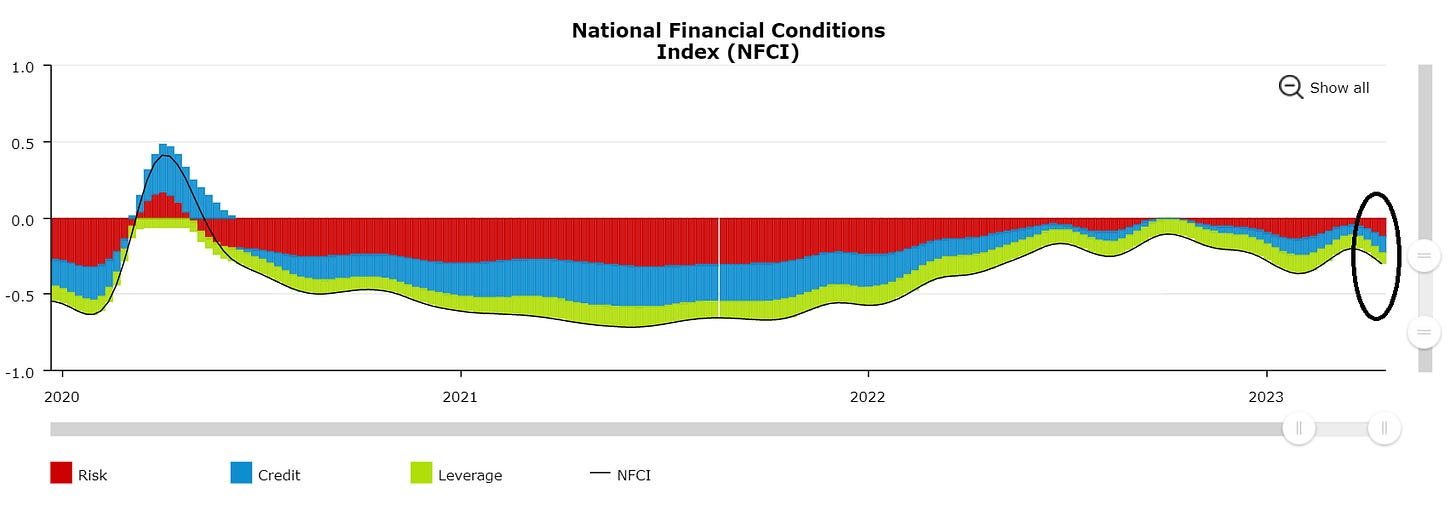

Indeed, while the Chicago Fed National Financial Conditions Index – which looks at US capital markets as well as shadow banking – shows a tighter environment than a couple of years ago, it is heading down, which means more market liquidity.

(chart via the Chicago Fed)

This matters for bitcoin since it is one of the most sensitive assets to changes in overall liquidity. You no doubt often hear that “risk assets” benefit from looser monetary conditions. Well, bitcoin is the ultimate “risk asset” asset in that respect:

It is long duration, which means that its implied value is entirely derived from its eventual price (ie. no dividends or coupon payments)

It has no earnings or credit rating vulnerability

It is untethered to the real economy except through the impact of liquidity flows

We can expect BTC to continue to act as a liquidity barometer, as it did in January and again in March, once the Fed’s interest rate policy settles down into wait-and-see mode. And liquidity is likely to head up once peak rates are in and as the looming recession becomes increasingly obvious.

What this means for other crypto assets

While bitcoin is the most “macro” of all crypto assets, the macro environment influences other crypto assets in two ways:

Bitcoin is still the anchor asset for the crypto market, with an increasing dominance (% of total market cap) and a high correlation with other tokens. In other words, what happens in bitcoin affects sentiment throughout the market cap table.

(chart of 60d Pearson correlations between BTC and other crypto assets, via Coin Metrics)

It does so through increased attention to the entire ecosystem, which encourages new businesses as well as their funding. A rising BTC price justifies investment in market infrastructure and crypto asset services, which in turn supports access to and liquidity of other assets. Where BTC goes, the market tends to follow.

What’s more, once funds are comfortable with an allocation to BTC, many will look for even higher return opportunities, which means heading out on the risk curve. This tends to be encouraged by easing financial conditions, with potential gains more than compensating the cost of leverage.

There’s also the special case of ETH, which is more directly impacted by macro yields. Currently, staking on the Ethereum network earns approximately 5% in rewards, not taking into account any price appreciation. This is less attractive to macro investors when US government bonds offer similar yields with no risk but, as these come down, the equation changes. What’s more, ETH’s relatively stable yield comes with the potential of upside. Now that staking is flexible after the recent Shapella upgrade, macro investors are more likely to consider ETH in relation to other steady-income opportunities, especially if it is seen as a window into greater ecosystem participation.

An inflection point

While the macro economic outlook and probable path of monetary policy is at one of its most uncertain moments in recent history, a step back to look at the entire investment landscape can reveal pockets of opportunity as well as highlight narratives that did not exist the last time the global economy found itself in a similar position. For the first time, we have assets that do not depend on traditional economy considerations for their operation, and that embody a range of emerging use cases that in turn lend resilience to investment theses.

All economic cycles have certain patterns that tend to repeat – that’s one of the reasons they’re called “cycles”. Crypto markets have cycles, too, only these in the past have been driven mainly by crypto-specific factors. Not any more – now the crypto market has multiple drivers, making the narratives more complex while opening up the market to new investing cohorts. This should not only continue to close the gap between the crypto and macro landscapes; it should also shine even more attention on crypto assets’ unique characteristics.

GOOD READS/LISTENS

On the this Odd Lots episode, Tracy and Joe talk to Paul McNamara, investment director at GAM, about how realistic the de-dollarization talk really is (spoiler: not very).

I’ve recommended podcast interviews with David Rosenberg before, and there’s a good reason for that – this interview on On the Margin is no exception.

This account by Nathan Crooks of The Block gives a glimpse of how crypto adoption is likely to be slow, even when there are obvious advantages. Nothing wrong with slow – change does take time.

The latest Hidden Forces episode with Jacob Seigel is a compelling listen on the difference between disinformation and propaganda, what the spread of social media platforms means for trust in governments, and a whole lot more.

Have a good weekend!

Sad to hear of Harry Belafonte’s passing. ☹I grew up listening to his music – my mother would sometimes put it on while she was preparing dinner, and we would all belt out the words to the Day-O song while prancing around the table. My favourite has to be his “Malaika” duet with Miriam Makeba. “Jamaica Farewell” is one of the ultimate crooning songs. His “Thula, Thula” makes me weep. And you can’t help but chuckle watching him count coconuts with the most renowned coconut counter of all.