WEEKLY, April 6, 2024

gold + BTC narratives, defending crypto skeptics

Hi everyone, I hope you’re all doing well! This week sure went by fast, maybe because it was a short one, but anyway, not complaining…

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of the articles from the week. If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links.

If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content. And there’s a free trial!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

Gold and BTC – the narrative relationship

Defending Goldman Sachs CIO’s crypto comments

Some of the topics discussed this week:

Short-term macro BTC drivers not looking good

Longer-term macro BTC drivers still strong

The reassuring resilience of the BTC spot ETFs

What market jitters say about BTC narratives

“Data dependency” and BTC support

Bracing for more employment confusion

Gold and BTC – the narrative relationship

After a few years of lurking in the wings, waiting for its cue to come on stage (and missing quite a few of them), gold is finally sneaking into the spotlight.

With a 1-month performance of 8.5% (vs 1.9% for the S&P 500, 3.0% for BTC), you could counter with the observation that it is stomping into the spotlight, but no, I’m going to stick with sneaking because I think its role has some way to play out yet.

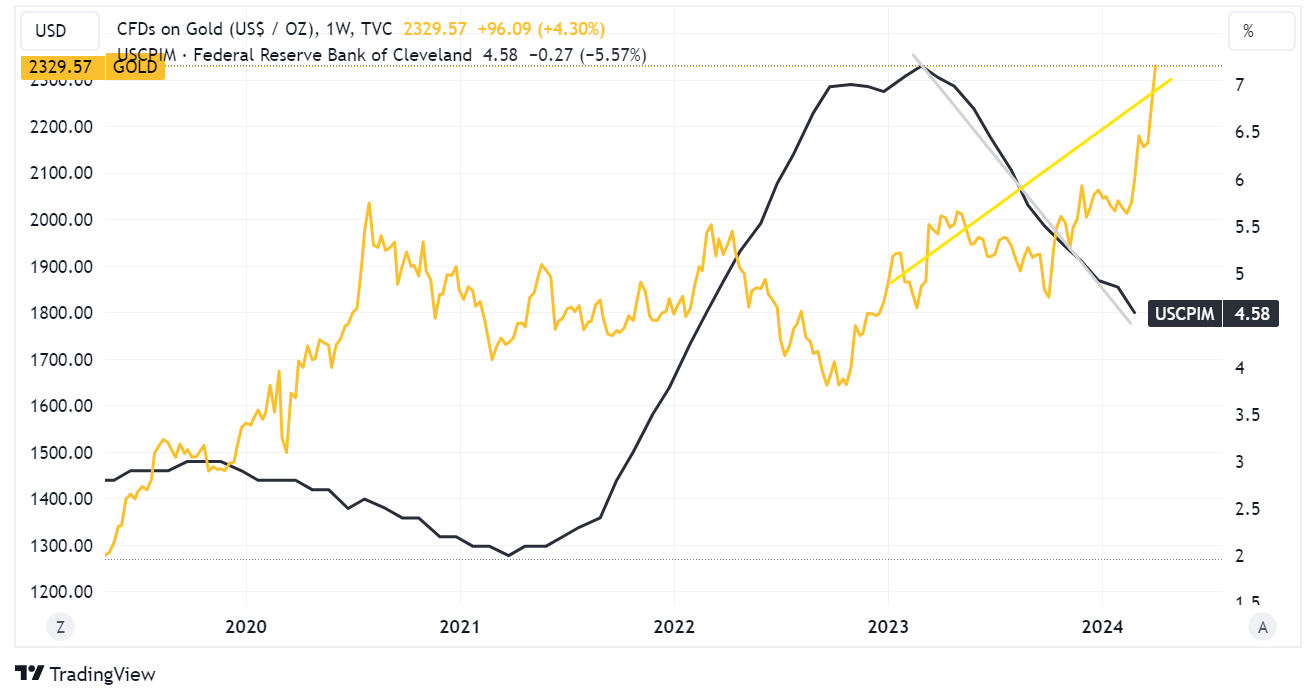

(chart via TradingView)

What kind of role are we talking about? For millenia, gold has been regarded as a robust and reliable “store of value” that can protect wealth in times of uncertainty and inflation.

Yet it is pretty clear that, over the past few years, that role has not played out. Reported inflation rates are well down from a year ago (even if they seem to be a bit stuck now).

(chart via TradingView)

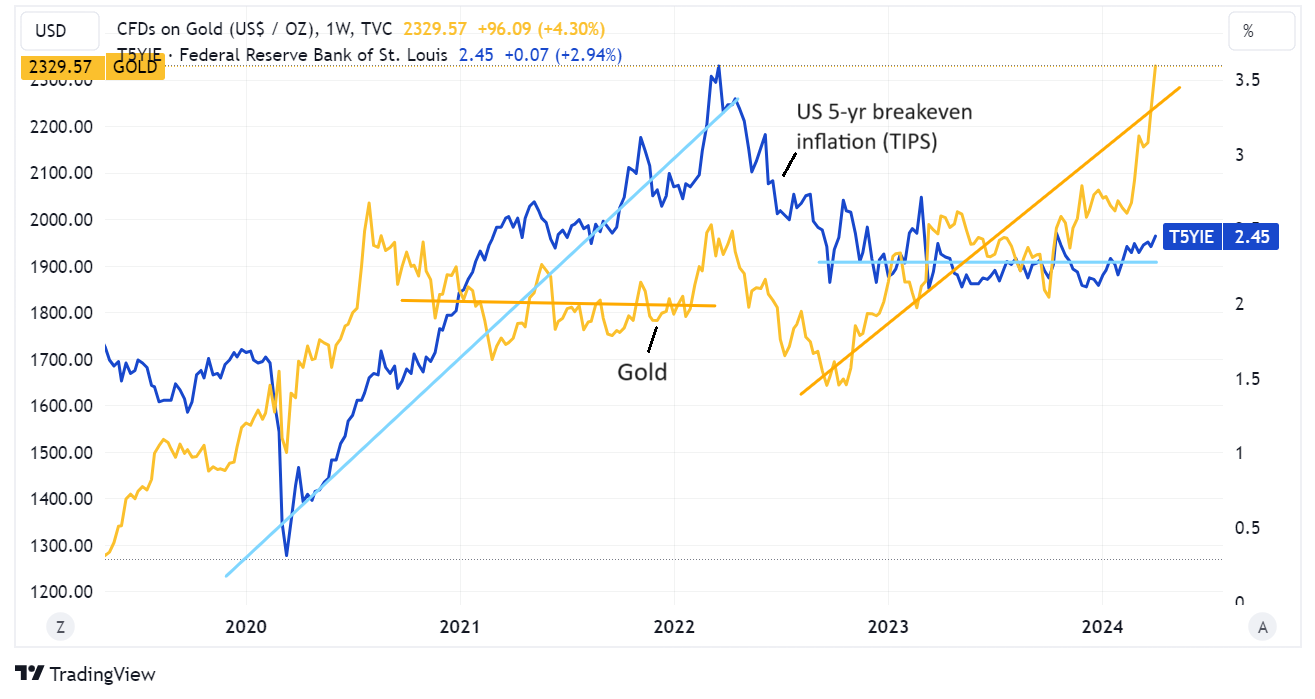

“Ah, but reported inflation is backward looking,” I hear you exclaim. “Gold responds to expected inflation!”. Nope, doesn’t look like that, either, going by the relationship between the gold price and the 5-year breakeven inflation rate implied in the pricing of inflation-indexed bonds.

(chart via TradingView)

Of course, TIPS yields just reflect the market’s consensus view on US inflation, which is obviously not replicated around the world. Here is where it starts to get really interesting, highlighting not only divergent inflation expectations but also non-economic reasons for buying gold.

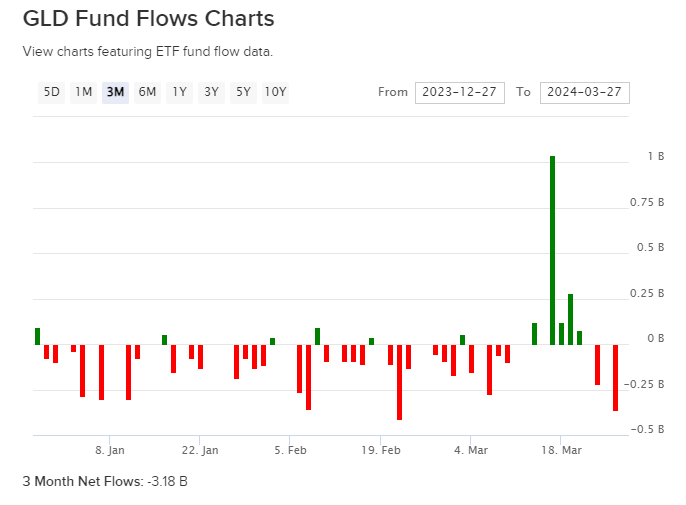

Judging by recent outflows from the leading GLD gold ETF, the US market is not too excited about the outlook for the shiny metal at the moment.

(chart via @BobEUnlimited)

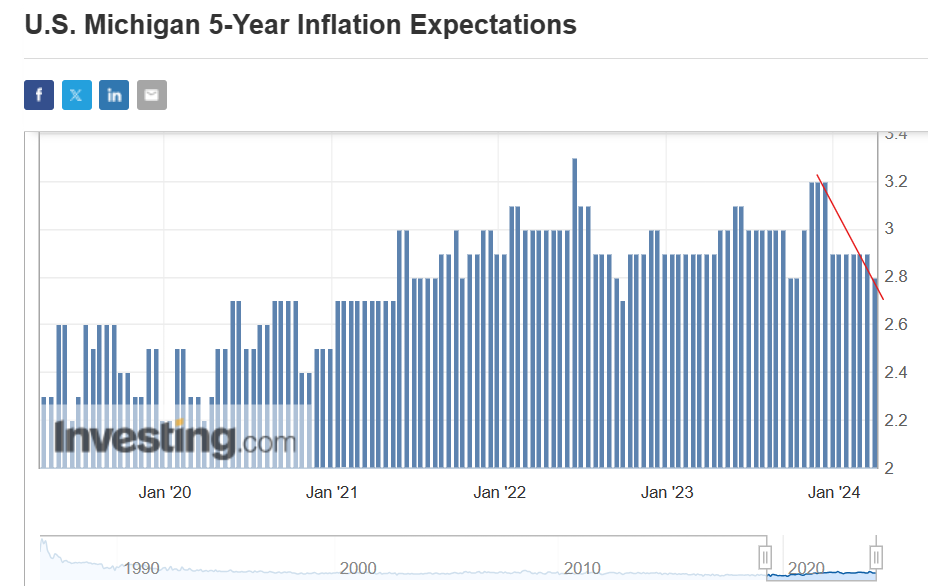

This is understandable when you take into account the consumer’s inflation outlook is dropping. Last week, we got the latest University of Michigan read on consumer expectations for inflation five years out, which came in below expectations (2.8% vs 2.9%), registering the first drop of the year.

(chart via Investing.com)

It’s also understandable when you compare the appeal of a “safe” hedge to the potential for any number of more leveraged and AI-sensitive tech stocks. Plus, there could be a cultural thing in play here – gold is what your parents invested in. It may be pretty, but it’s not really “cool”.

The US is the largest financial market in the world, with the largest gold ETFs – holdings are dropping, and yet the gold price continues to climb.

(chart via @BobEUnlimited)

Why? Because the demand is coming from elsewhere, and for a variety of reasons.

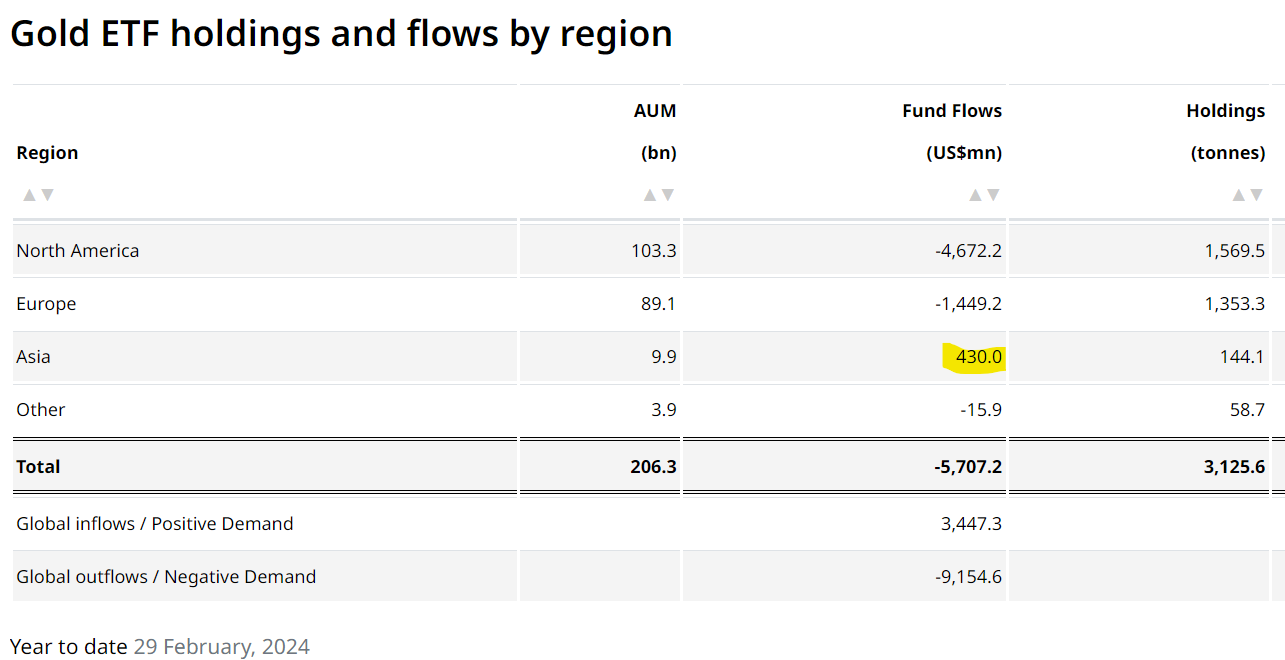

The table below helps frame where the flows are coming from: it’s not North America, and it’s not Europe. Asia is the only region with net inflows into gold ETFs in the first two months of 2024. This only measures funds flowing into the few gold ETFs listed in the region – the market infrastructure for gold vehicles is nowhere near as developed as in other areas, largely because retail gold traditionally has been bought directly from jewellers and bullion dealers.

(table via the World Gold Council)

So, net, Asian investors seem to be more optimistic about the outlook for gold. What about that other large gold buyer segment: central banks?

(Stay with me, this is coming around to crypto in a moment…)

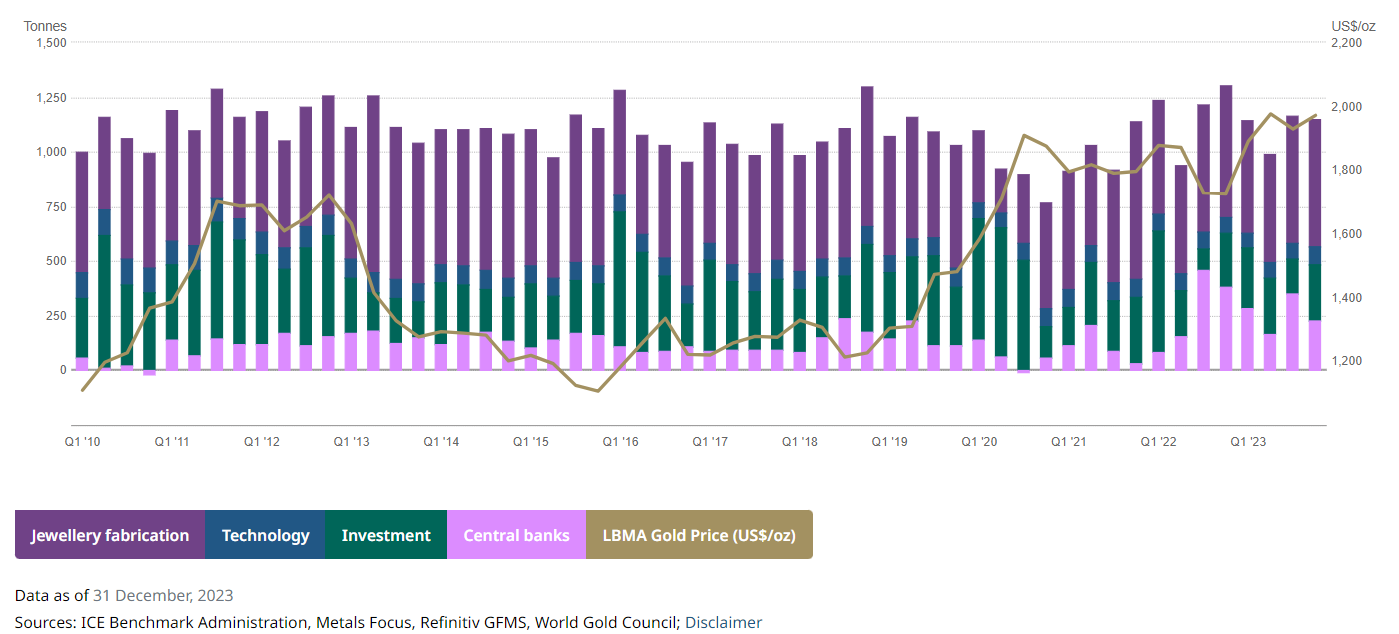

Over the past 10 years, the net purchases of gold from central banks has increased – check out the pink bars in the chart below.

(chart via the World Gold Council)

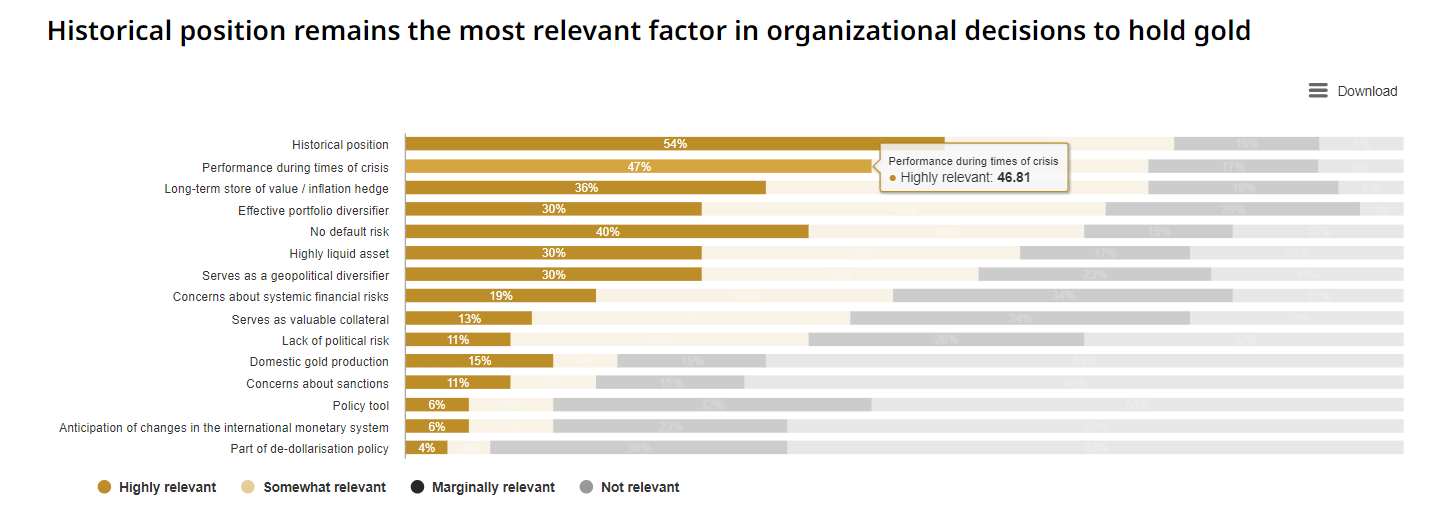

It would be easy to conclude, especially for bitcoin enthusiasts, that this was a sign of a growing interest in reducing savings in and use of the US dollar. The recent weaponization of the world’s reserve currency has certainly encouraged investigation of ways to transact cross-border without touching the dollar system. But, intriguingly, the data suggests otherwise: a survey carried out by the World Gold Council in 2023, in which central banks were asked about their motivations for buying gold, showed that tradition, diversification, and a hedge against “crisis risk” are the main reasons. “De-dollarization” is way at the bottom.

(chart via the World Gold Council)

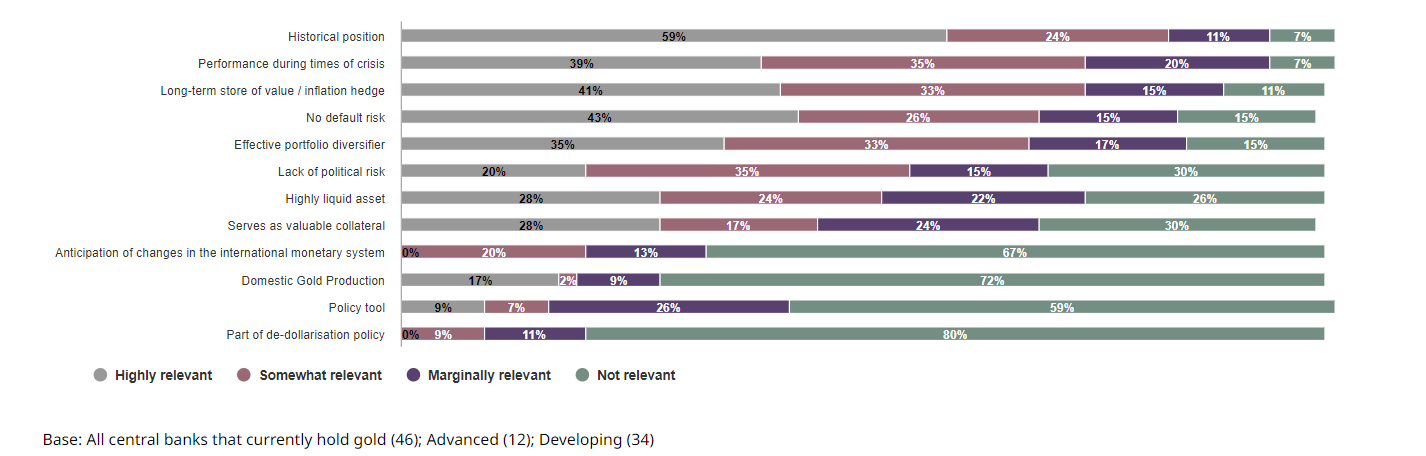

These reasons are believable and meaningful. They suggest that central banks are increasingly worried about geopolitical and other risks, which is not surprising. When you compare the 2023 central bank motivation survey to the results from the previous year, you see that the only gold-buying reason with an increased response was “performance during times of crisis” – all others declined or remained static.

(chart via the World Gold Council)

Did I say “crisis”? Let’s take a look at the main buyers. In Q4 2023, they were, in descending order: Turkey, China and Poland – each with arguably quite a bit to worry about. For the month of January, central banks bought more than double December’s net amount. The main purchasers? Again Turkey and China, with the addition of India.

This is relevant for the outlook for BTC.

Going back to the gold price and why central banks might be buying: gold is a reasonable hedge for the “risk” that certain central banks seem increasingly worried about. And, coincidentally, the countries whose central banks are adding to their gold pile happen to be countries with a strong tradition in retail gold purchases.

It’s conceivable that retail investors, especially younger ones, may prefer the convenience of gold’s digital counterpart. Compared to gold, BTC has a harder supply cap, is easier to verify and transfer, and is more portable in societies that are not confident in their centralized financial system. What’s more, BTC could appeal to a generation distrustful of anything that is part of the establishment and the older generation.

For now, the market cap of BTC is tiny compared to that of gold, and will most likely remain so for years to come. But younger savers don’t worry too much about that – there’s less “habit” and “established trust” to overcome.

True, the young these days have a worse savings outlook than the previous generation. But that could make it all the more important they look to not just wealth preservation, but also capital appreciation.

Over the past month, gold has easily beaten BTC – but here is where BTC’s relative volatility could be an advantage. Over the next 10 years, which is likely to have the higher appreciation?

Defending Goldman Sachs CIO’s crypto comments

I wasn’t going to dive into the recent crypto comments from Goldman Sachs Wealth Management’s chief investment officer Sharmin Mossavar-Rahmani, because I’ve done some tradfi criticism pushback recently and I didn’t want regular readers to think I’m getting repetitive. But a few of you asked, so here we are.

However, to make this one slightly different, I’m going to try to defend her statements. To be clear, I deeply disagree with most of them – but I also believe that better understanding opposing views makes us stronger advocates for crypto’s potential. Plus, it brings down the irritation level, which is good for overall well-being. And it’s a fun mental exercise.

Let’s start with the bigger picture and some background. First, Ms. Mossavar-Rahmani has an impressive investment background, which includes over 31 years at Goldman Sachs – that can’t have been easy, and deserves respect. Second, she does not represent all of Goldman Sachs. She is the head of the Asset & Wealth Management Division, which is distinct from Sales & Trading and Investment Banking, both of which are involved in the crypto ecosystem. Third, some crypto media outlets are shrieking that Goldman Sachs is now “under pressure” or “facing heat” because of Ms. Mossavar-Rahmani’s comments – I very much doubt that Goldman Sachs cares about crypto outrage, and its wealth management clients can find crypto exposure elsewhere if they want it.

Yet since her voice does carry weight among investment managers, especially those looking for an excuse to not bother learning about crypto assets, her statements in a Wall Street Journal interview do deserve some discussion.

In order of appearance:

1) “We do not think it is an investment asset class.”

As I stressed above, by “we” she does not mean Goldman Sachs, just the Asset & Management Division.

An easy reaction here is to scoff at her limited understanding of digital assets, because obviously they are an “investment asset class” in that they trade on active markets and people invest in them. But it turns out that the official definition of the word can vary. ChatGPT’s definition coincides with many others I looked up:

“a group of financial instruments that have similar financial characteristics, are subject to the same laws and regulations, and are typically traded in the same financial markets.”

It could be that Ms. Mossavar-Rahmani was referring to the lack of regulatory standards around crypto assets, at least in the US. If that second prong is indeed part of Goldman Sachs’ definition, then crypto assets do not fit. For now, anyway.

Also, “similar financial characteristics” is a bit of a stretch. Stablecoins are very different from BTC which in turn is very different from AVAX, BONK, and a long list of others.

We should bear in mind that she could be speaking about the category characteristics and not about whether crypto is investable.

2) “If you cannot assign a value, then how can you be bullish or bearish?”

This one is easy to take strong exception to, because we all know that you don’t have to have specific values in mind to believe something will go up or down. We also all know that you cannot accurately value crypto assets, for too many reasons to go into here, but there are no shortage of bulls and bears. So, obviously and provably false, right?

Hmm. For now, let’s try and put ourselves in Ms. Mossavar-Rahmani’s shoes. She runs an investment advisor division, one that is subject to considerable scrutiny and bureaucracy. She didn’t survive over 31 years at a particularly cutthroat organization by taking hard-to-explain risks with other people’s money. Old-school investment advisors need to be able to justify decisions to their clients, they need to “show their work” in case an investment goes badly. If her team can’t assign a model-based value to BTC, then buy/sell recommendations are more difficult to explain.

Most of us don’t have Goldman Sachs-level constraints – for me, for example, “up” is good enough, and I have a ballpark number at which I might take some profits, based on “feelz”. Other investment advisors I’ve spoken to have come up with target levels, but they’re not based on any validated method.

I will allow myself the observation that Goldman Sachs has many very smart investment analysts who surely can come up with a justifiable model – other big-name firms have done so, and even if there is little agreement, what matters is the reasoning. Leaving that task aside because there is no “official” model feels lazy, and I think we have a right to expect more from a firm that has styled itself as a pillar of Wall Street.

But, Ms. Mossavar-Rahmani’s job is to play it safe. In that context, her comment is not out of line.

3) “[Crypto] creates absolutely no value in any shape or form.”

Ok, this one is really hard to defend. Crypto assets offer a wide range of services and use cases, which have value. Even if we narrow the discussion to BTC, it clearly has value for those struggling with currency depreciation or limited financial access.

But it turns out that “value” is a misunderstood word, even among investment professionals. Most of us assume that the concept has to do with utility, appreciation, satisfaction, belonging, and a host of other touchy-feely benefits. Art has “value”, so do flowers and friendships.

But maybe, Ms. Mossavar-Rahmani was referring to the “assigned value” we looked at in the previous section. Maybe she meant that if there is no established model spitting out a number, there is no value.

Nope, I give up, this one is indefensible and demonstrates a lack of understanding which I can only attribute to laziness since no-one is doubting her intelligence – “absolutely” no value?? “In any shape or form”??? Sigh. I tried.

4) “[Crypto bulls] all proclaim democratization of finance, yet the main decisions end up being driven by a few controlling people.”

In this one, actually, she’s kinda largely right. I would definitely suggest adding a qualifier – “some of the main decisions end up being”, or “the main decisions on some networks can end up being” – but on the whole, I agree that “decentralization” is an often misused word.

Then again, “decentralization” is not a binary condition. There are varying degrees. And many networks are gradually working towards greater decentralization, as they promised.

Now we come to what is possibly the most revealing quote from the interview:

5) “At least you can hold onto physical gold and store it; you can’t do that with crypto… And anyway, we don’t encourage people to own gold.”

Goldman Sachs has a long history of not recommending gold, and one theory is that it is because the investment banking division can’t make money issuing gold, whereas they do make a lot of money helping firms issue stocks and bonds. I’m not sure I buy that, but it is extraordinary to see a large investment manager ignore such a significant asset.

Perhaps it’s because gold also does not spin off any concrete “value”? Gold doesn’t have any cash flow or dividends. And if it doesn’t have any concrete value, how can advisors be bearish or bullish, right? And does gold actually “create” value, does it make anything, does it spin off a yield? No.

I think this statement reveals much about the others. It highlights Ms. Mossavar-Rahmani’s definition of “value”, as something that needs to be created. It could be that, for her, value requires a concrete output.

It also highlights her limited understanding of how crypto assets work. Many do have concrete output. And pretty much all are possible to hold and store.

I’m tempted to point out that this comment also suggests a limited view on gold investment, since few institutional or high-net-worth gold investors actually hold their own bars.

But stepping back, the point of this exercise was to show that not all crypto critics are wrong about everything, and it’s useful to understand exactly where the barriers to acceptance lie. It’s also useful to acknowledge that conflicting views make a market, and that they don’t actually matter that much in the longer term.

Even more important, it’s satisfying to think of all the people that we personally know who also rejected crypto concepts at first. Smart, educated people steeped in financial lore, who eventually decided to put in the work to better understand what we see – and they all eventually changed their mind. Maybe Ms. Mossavar-Rahmani will change her mind one day, too, maybe not, it doesn’t matter. But if our once-skeptical friends can approach our viewpoint with an open mind, then we should try to approach our critics with the same. At the very least, it will help us better understand just where we need to focus our explaining efforts.

HAVE A GREAT WEEKEND!

It’s cherry blossom season! Absolutely one of my favourites of the year, along with the first autumn leaves. So beautiful. I’m about to dash out to go and see some of Madrid’s trees, so I’ll leave you today with some photos from Reuters of blossoms around the world.

(photo by Issei Kato for Reuters)

(photo by Bonnie Cash)

(photo by Maja Smiejkowska)

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.

**Interested in promoting a webinar, report, event or service to the Crypto is Macro Now community? Drop me an email at noelle@cryptoismacro.com and I’ll send you more information.**

Noelle, the quality of your writing and analysis is exceptional. I’m glad I found you and subscribed. This coming from a highly educated financial investor, who did the work on bitcoin over six months, and became a believer last fall. Just as you said.