WEEKLY, August 5, 2023

Hello everyone! You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, pick at established narratives and share listening recommendations. Nothing I say is investment advice!

The Saturday edition is usually a general overview of markets and crypto ecosystem developments that impact macro field. For premium subscribers, Monday-Friday I dive into narratives, developments and theses that sketch out how the two worlds are dancing around and working with each other. If you’re not a subscriber, I do hope you’ll consider becoming one to support my work – it’s only $8/month for now, with a free trial! 😊

Some of the topics discussed this week:

The politics of money

Bond yields sending signals

Crypto in Nigeria

Binance will be ok

Tether is making a lot of money

NFT utility continues to evolve

Coinbase vs the SEC

DeFi vulnerability hits the crypto market

The Worldcoin clampdown begins

Bitcoin and the ESG argument

… and much more.

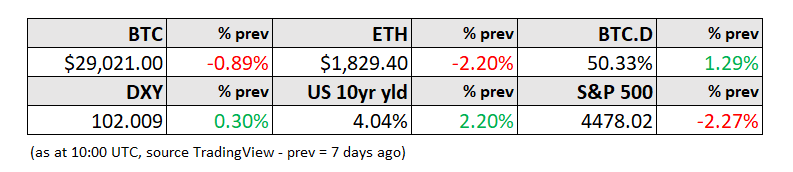

WHAT I’M WATCHING

Hello everyone! Today’s newsletter is going to be relatively short since it’s the middle of summer and I hope you’re all taking some time to regenerate – I have a feeling we’re going to need to be well rested come Q4, given the pressures that are building in both the crypto and macro markets.

Where’s the volatility?

While this week saw plenty of interesting activity in stocks and bonds driven by macro data, official announcements and some worrying sentiment shifts (more on this below), BTC was as flat as a pancake.

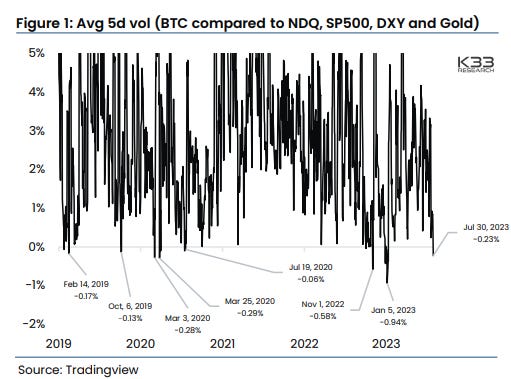

Ok, that’s a slight exaggeration, I’ve just eaten a pancake for breakfast (with apple, very nice) and it was flatter – but BTC is unusually stable at the moment. According to K33 Research, BTC’s 5-day volatility is now lower than that of Nasdaq, the S&P 500 and gold. In a recent report, the firm points out that levels of volatility this low has always in the past been a sign of incoming drama.

(chart via K33 Research)

Bloomberg reported yesterday that BTC has now had eight days without a >1% move. The last time this happened was in early January, just before the price started rallying from $16,000 to $24,000. Before that, the previous time was in October 2018, just before the price dropped from $6,000 down to $3,200.

(chart via Bloomberg)

And crypto market data firm Kaiko shared a chart earlier this week that shows that BTC and ETH 180-day historical volatility is at all-time lows. This is very weird.

(chart via Kaiko)

But there’s plenty going on

It’s especially strange given the amount of bullish news swirling around the crypto market, most of which has to do with ETFs.

The Bloomberg team have upped their probability that the BTC spot ETF will get approved to 65%, from 50% a few weeks ago and 1% a few months ago. Some of the reasons given include:

Gary Gensler downplaying his role at the SEC. In a recent Bloomberg interview, Gensler repeated a couple of times that he was “just one of five commissioners”. At the last BTC spot ETF denial in March, two of the five commissioners dissented – we could see that number move up to three this time around, which would be enough to overrule the Chairman.

The SEC’s tacit approval of Coinbase’s BTC exchange. On Monday, the Financial Times published a report on an interview with Coinbase co-founder and CEO Brian Armstrong in which he disclosed that the SEC had requested earlier this year that the exchange de-list all tokens except Bitcoin. Coinbase asked for some clarity on the request, the SEC declined to provide any, and when Coinbase did not comply, the regulator followed up with the June lawsuit. It can be inferred from the request that the SEC was fine with Coinbase offering BTC services, which suggests that the regulator is ok with the idea of a US-based spot BTC exchange.

SEC loss in front of same judges in Grayscale case. Last week, the SEC lost a non-crypto case in the DC Circuit Court, with the judges ruling that the SEC order was “arbitrary and capricious”. Two of the three ruling judges are also judges on the Grayscale case. While that is not necessarily indicative, the two cases do reportedly have some parallels.

Growing political pressure. Aside from BlackRock being a prominent donor to the Democratic party, we saw in the recent SEC testimony and crypto regulation hearings before Congress that dissatisfaction with the SEC’s crypto approach is spreading, even among Democrats.

And, this week we saw a flood of ETH futures ETF filings. I believe the latest count is 14, but there may have been one or two more late yesterday, it’s hard to keep up. Some of them are for mixed BTC and ETH futures, at least one is for an inverse ETH (replicating a short), and Bloomberg analysts put the odds of approval at 75%, the same odds they gave the BTC futures ETF proposals a couple of years ago.

It’s not the first time we’ve been here – we saw a similar rush back in May, but the applications were swiftly withdrawn, presumably after a “geddoutahere” call the US financial regulator.

This time just might be different. Just over a month ago, the SEC allowed the listing of BITX, which is a leveraged BTC futures fund that provides twice the daily performance of BTC. It could be hard to argue that an ETH futures ETF is riskier than that. Also, the company behind BITX – Volatility Shares (aptly named) – was the first off the bat to submit its ETH filing.

If the SEC allows these, that could be seen as a shift in the mood – approval doesn’t mean that ETH is or is not a security, but it would indicate that the SEC accepts that ETH is part of the market landscape, despite having asked Coinbase to delist it just a few months ago.

If the SEC decides to not allow them, it will have to explain its reasoning, which would of course be scrutinized and picked apart for biased decision-making, attracting even more political heat than it already faces. It could justify rejection on the basis of relative volumes, or maybe lack of regulatory clarity (which would be circular). But any of the aforementioned issuers could then sue the SEC in order to get a more impartial verdict, and possibly win. Either way, the dialogue is about to intensify.

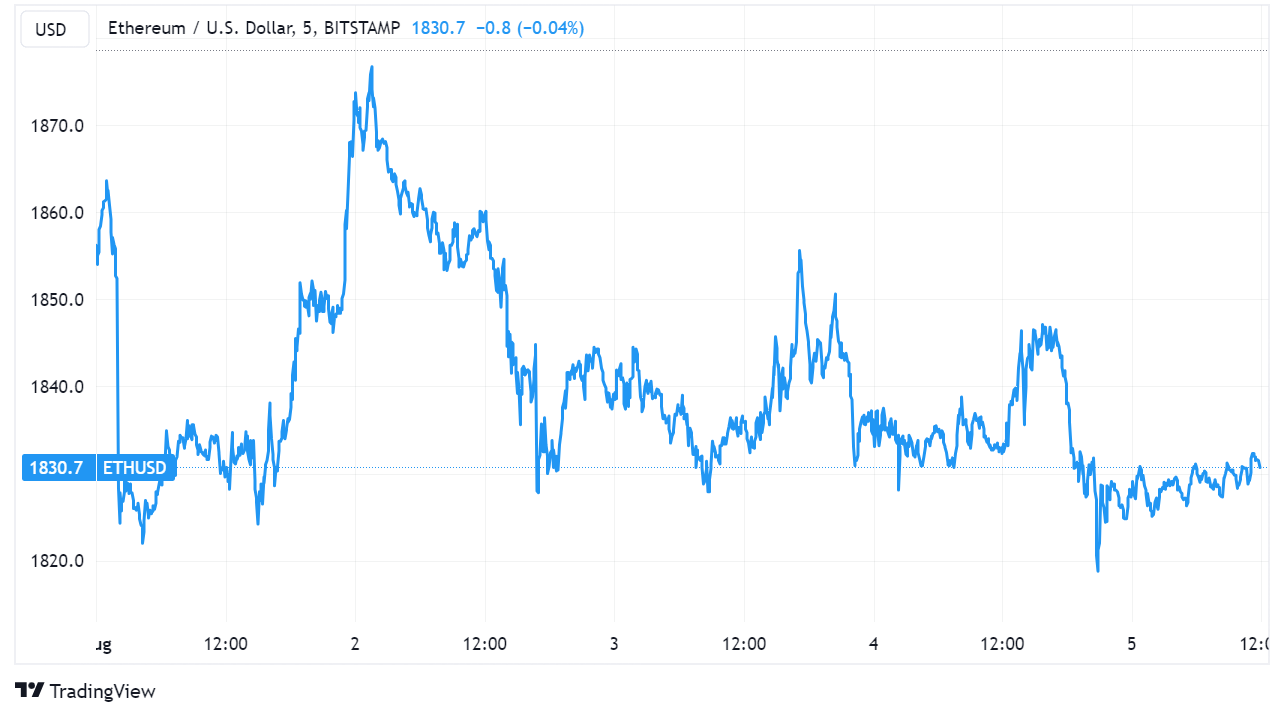

And yet ETH the asset has not responded to what would most likely be a considerable uptick in investor interest. It yet again underperformed BTC over the week, in part due to this week’s Curve hack.

(chart via TradingView)

On Sunday night, approximately $60 million worth of tokens were stolen from several pools on Curve Finance in a “reentrancy attack”. This triggered an outflow from many DeFi platforms, and could dampen investor confidence for some time to come as the exploit was enabled by a code vulnerability and was only stopped by the intervention of a white hat hacker.

What’s more, it emerged that the Curve founder owned almost half of all outstanding tokens at the time of the hack, had deposited the bulk of them as collateral for loans, and avoided liquidation only by selling chunks of his holdings to some wealthy crypto friends. These are not exactly the kind of conditions that make macro investors or institutional participants feel comfortable.

While Ethereum was not directly implicated, lower DeFi activity is likely to dampen ETH transactions, which in turn dampens demand for ETH as well as the fee burning that has been keeping net new supply just under 0.

Macro mood

All this is happening against a macro market that turned negative this week, despite a strong employment report and other signs that the US economy is doing better than many expected this far in to the rate hikes.

This week, we saw two large investment houses – Bank of America and JP Morgan – pivot on their recession forecasts. Meanwhile, signs are pointing to a blowoff rush into equities: an equity positioning measure maintained by Deutsche Bank reached its highest point since early 2022, and stock option data suggests that demand for protective hedges is low. What’s more, the earnings yield of the Russell 1000 stock index is now lower than the yield on investment grade bonds – this is very rare, as equity yields are supposed to be higher than bond yields to compensate for the extra risk. The last time they were this distorted in relative terms was in 2008 – read into that what you will.

(chart via Bloomberg)

Yet both stocks and bonds had a bad week (I went into more detail on the gyrations of the US bond market in yesterday’s premium daily). It could be that investors are finally getting jittery and realizing that strong economic data means that the Fed will keep rates higher for longer. Yesterday’s jobs data seems to have had enough of a softening tone to raise expectations of a pause at the next few FOMC meetings – but this feels more like wishful thinking tinting the lens than actual good news on the inflation outlook. Wages rose faster than expected, the unemployment rate dropped, and non-farm payrolls for July came in under expectations but still above the figure for June.

Meanwhile, the oil price is climbing, an index of food prices is climbing, and counting on inflation continuing to come down feels precipitate. Yet prices seem to be factoring in nothing but good news.

Given this backdrop, we should probably appreciate the relative lack of activity in BTC and ETH – for now, anyway, it could be what gives them their outperformance.

HAVE A GREAT WEEKEND!

This week I want to share with you one of my favourite music videos that coincidentally reminds me of the current state of political discourse, pretty much everywhere. Nobody Speak, by DJ Shadow with Run the Jewels: great song, excellent acting, and where did the little pig come from?