WEEKLY, Dec 10, 2022

Hello everyone! As the year careens toward a welcome close, pundits are sharpening their pencils for their end-of-year predictions, investors are shuffling allocations, traders are calculating tax losses, bosses are negotiating 2023 hiring budgets, employees are figuring out hiring plans and all of us, collectively, are reflecting on lessons learned and goals for 2023. Next year will end up being pivotal for the crypto industry overall, not just from a market reset but also from regulatory progress AND the growing realization that crypto IS about much more than speculation. There will be progress, there will be setbacks and there will be drama. I say bring it on.

You’re reading the free weekly Crypto is Macro Now – if you’d like daily insight into market trends and news that highlights the intersection of crypto and macro, I hope you’ll consider upgrading to the premium version.

Nothing I say is investment advice. If you find this newsletter useful, by all means share with friends and colleagues.

Programming note: The free weekly will publish as usual next Saturday, but will then go quiet on the 24th and 31st of December for the holiday celebrations, back on the 7th of January. The premium version will continue to publish throughout.

MARKETS

Much of the traditional market drama this week seemed concentrated around the oil price, which dropped to annual lows in spite of (or because of?) the G7/EU price cap set on crude exports from Russia. Xi Jinping’s visit to Saudi Arabia hints at greater geopolitical shifts ahead which could end up influencing the trajectory of energy costs, inflation and interest rates.

(chart via TradingView)

FTX drama continued but without any major changes other than Sam’s willingness to testify before Congress next week. BTC and ETH trading was largely rangebound with occasional spikes and drops, most of which seemed to be driven by liquidations. Leverage – as measured by the volume of spot trading relative to that of futures – seems to be increasing slightly, which suggests this sort of behavior will continue.

(chart via TradingView)

I go into more detail about market moves in the premium daily Crypto is Macro Now email – if you’d like more insight into what macro market moves mean for crypto prices, I hope you’ll consider subscribing.

Some of the topics covered:

Signs that the crypto dust is settling post-FTX

An intriguing new derivative that hints at the emergence of a benchmark interest rate

The significance of Xi’s visit to Saudi Arabia

Corporate experimentation with soulbound tokens

Confusing economic indicators

COLUMN

“Blockchain Not Crypto” – Here We Go Again?

Déjà vu. You know that feeling, when you momentarily are not sure of where you are in the timeline and you wonder what you’ve missed. We’re there now.

The “blockchain not bitcoin” chorus seems to be re-emerging, taking us back to the 2016-18 heyday of thematic and platform consortia convinced that the benefits of greater efficiency would overcome corporate competition. Bitcoin was an asset with no backing or clear utility, the implied argument seemed to go, whereas blockchain, well that was a technology.

This week, Goldman Sachs CEO David Solomon wrote an op-ed for the Wall Street Journal titled “Blockchain Is Much More Than Crypto”, in which he reminded us of the potentially far-reaching impact of tokenization and peer-to-peer payments and drilled down on the benefits of risk reduction and settlement speed. Last month, Citi published the results of a survey showing that 92% of participating institutions see value in tokenization while 88% are either exploring distributed ledger use cases or actively participating in blockchain projects. Over the past few days, the Red Cross talked about ongoing work on a blockchain-based aid distribution prototype, and Japanese banking conglomerate Sumitomo Mitsui Financial Group announced plans to work on soulbound tokens for digital identity.

What’s going on? Is this part of a post-FTX “reset”, a cathartic back-to-basics? Or is something else in play?

Both. Yes, we are likely to see more public discussion about distributed ledger efficiencies and less about crypto asset trading and investment. This is a natural reflex after the damage done by layered leverage, flimsy tokenomics and trading fraud, and some high-profile reminders that crypto is not just about greed are more than welcome.

It is also an acknowledgement that there is a constant battle for attention, and the “X not Y” model assumes that only one variable is worthy. “Blockchain not bitcoin” emerged in 2018 as an attempt by enterprise projects to capitalize on the market’s performance woes – the new version does the same but swaps in “crypto” to reflect the ecosystem’s spread.

So, a large part of this is a cyclical narrative shift. But there’s something else going on as well: this shift comes on top of a longer-term tale of technological evolution and shiny things.

The last wave of blockchain hype may not seem to have produced much value. Pilots and proofs of concept involving lettuce, plastics, even (alarmingly) nuclear weapons seemed to deliver no practical utility. Groups working on blockchain use cases for trade finance, healthcare, telecoms, insurance and more have either gone quiet or been wound down.

And we have seen some recent high-profile distributed ledger failures. Just over a week ago, IBM and Maersk announced the closure of their blockchain-based supply chain joint venture TradeLens. Last month, the Australian Stock Exchange (ASX) cancelled its much-hyped blockchain project after years of delays and cost over-runs. This summer blockchain-based trade finance initiative we.trade, backed by IBM and 12 major European banks, went into liquidation and B3i – a blockchain insurance venture backed by more than 20 insurers and reinsurers – ceased operation.

So, the “please, not again” discomfort at the renewed protagonism of “blockchain” potential is understandable and even healthy (inflated expectations of any sort should be kept in check) – but not necessarily correct.

Both hype and failure are a natural part of a new technology’s evolution. Remember the dot com bubble? That wasn’t just about crazy stock valuations – it was as much about the promise of rapid societal change, with business models rewiring their engagement models and with individuals flourishing in their new-found creative independence. In the early days of any radical innovation, manifesto and prophecy often get confused, and experimentation is the only way to test the bounds of reality. Failure is an integral feature of experimentation.

You’re probably wondering where the successes are, and that’s fair because they don’t get much attention. They’re hidden in the persistence of some projects that could have given up ages ago, in new use cases under trial, and in a changing participant profile. Distributed ledger work has been ongoing all along, but given the rapid growth of crypto markets, the “flashiness” of some participants and the gripping drama of the year so far, it has been largely overlooked. Things that move fast get more attention. Enterprise experimentation does not move fast.

Some examples: A few years ago, we got excited when a commercial banks successfully issued blockchain-based assets in pilot tests. This week a state-owned bank did the same but for real, at least one government is almost there, while other governments and banks are testing the process with some intriguing innovations. We also have trials where the main participants are central banks. That is definitely progress.

Large traditional asset managers such as KKR, Apollo and Hamilton Lane are issuing blockchain-based tokens representing funds. Not as a proof-of-concept – for real. Just this week we learned that Vanguard Australia is using a distributed ledger for back-office settlement, Starbucks (one of the largest unregulated “banks” in the world) has launched an NFT experience in beta for its Rewards users, and Goldman Sachs as well as Germany’s music rights management society have carried out separate distributed ledger tests. Recent initiatives seem to have learned from the failures to date: start small, iterate up the ladder, and never overlook human incentives.

As the dust settles on the FTX fallout, and as the crypto ecosystem takes stock of the damage and starts to heal, we can expect more prominence for enterprise blockchain milestones. This doesn’t at all mean that crypto is losing its sparkle or that asset innovation is done. This week we saw the emergence of an intriguing new derivative that lets traders bet on the Ethereum staking yield, potentially coalescing market acceptance of a benchmark interest rate. We are also still seeing glimmers of institutional interest in crypto assets as investment. None of that will disappear.

But a time in the sun for the less glamorous side of blockchain evolution will be good for the industry as a whole. We could well still see some ideas that strike us as fanciful, because people are people and creativity should never cease to surprise – who knows, some might even stick. But we can certainly expect more solid experimentation at senior levels. As David Solomon pointed out in his Wall Street Journal piece, traditional market structure is an area ripe for improvement. The intensifying work on wholesale CBDCs suggests that cross-border payments is another.

Perhaps even more important: we have to push back on the “X not Y” mentality. The crypto ecosystem is certainly big enough by now for any number of approaches, and this industry grew on the back on permissionless innovation – it’s incongruous to see crypto enthusiasts argue that only one approach is worth any time or attention. For those that care about blockchain utility, there’s plenty to get excited about. For those that think there’s greater societal value in trading and saving, markets will continue to evolve and some prices will eventually recover. Many of us may be frustrated by the amount of pixels given to what we personally see as useless ideas – but we should think about what our industry would look like were one reduced group to have the power to decide what is “valid” and what isn’t.

Meanwhile, the narrative shift will act as a refreshing reminder that this industry is about much more than profits and portfolio allocations, and that the potential goes way beyond sentiment recovery, regulatory clarity and deeper understanding. “Blockchain AND crypto” – there’s plenty of room for both.

KEEP AN EYE ON

(A handful of the main themes from the week, explored in more detail in the daily emails.)

The signal in layoffs. After Kraken’s 30% layoffs last week, we now have Dubai-based Bybit, one of the industry’s largest crypto derivatives exchanges, implementing a 30% staff reduction, on top of the significant layoffs they already did in June. Australian crypto exchange Swyftx announced cuts of around 35%. Singapore-based trading firm Amber Group is reportedly downsizing by 40%. Such drastic moves coming after a radical drop in overall exchange volumes over the past 12 months suggests that these key platforms expect the bear market to continue for some time.

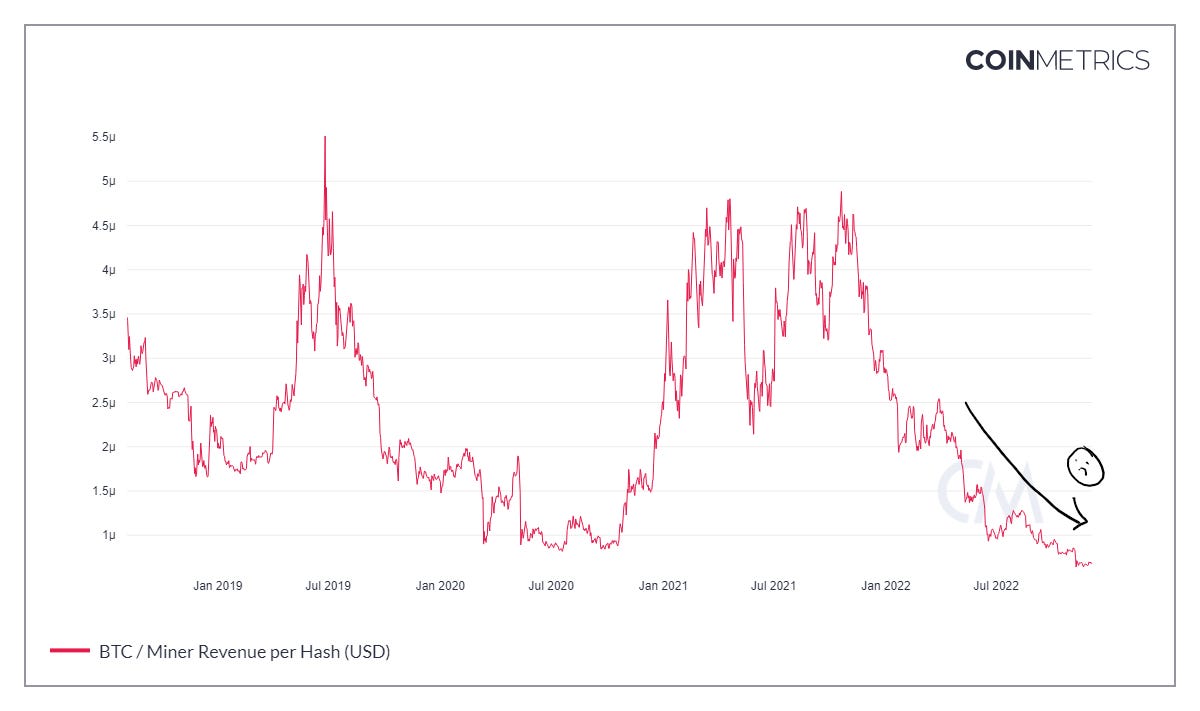

Difficulty drop. In an algorithmic rebalancing designed to keep the time between processed blocks at approximately 10 minutes, bitcoin mining “difficulty” dropped this week by over 7%, the steepest drop in over a year. This is in response to the declining hash rate as struggling miners left the network and should help remaining miners by making it less costly to process a block and receive the BTC reward. There is still considerable risk, however, as miner revenue per hash is at all-time lows, much lower than the 2018-19 bear market and even lower than the 2020 slump.

(chart via Coin Metrics)

An ETH unlock? One development likely to influence Ethereum sentiment in coming months is the expected timing of the unlock of staked ETH. For now, stakers on the Beacon Chain cannot remove their ETH, they are locked in earning staking rewards until the protocol undergoes its next upgrade. A few weeks ago, it appeared as if that would be pushed back, possibly to 2024, to roll all major upcoming changes into one upgrade rather than several. This did not go down well among many in the community, especially as the original timeline was to have the unlock a few months after the Merge. Yesterday, however, Ethereum developers decided to separate the changes, with the unlock back on track for sooner rather than later. The target date is now March 2023, after which ETH stakers will be able to remove their tokens from the staking contracts. Some speculate that this could depress the price of ETH as it could unleash a wave of selling. Others insist that the additional flexibility makes ETH a more attractive asset to hold, and a drop in overall amount staked will improve the yield for those that choose to do so.

Conference signaling. The beginning of the week saw the kickoff of the Africa Bitcoin Conference in Accra, Ghana. This is not the first crypto conference on the continent, but it is the first under that banner and the most high-profile to date, with sponsors such as the Human Rights Foundation, Btrust, Strike, Tether and others. The focus is on bringing together entrepreneurs, developers, policy makers and investors to explore the utility and accessibility of bitcoin in the region, and highlights the growing role of Africa on the global crypto stage. It also marks a departure from the common perception that crypto’s main use case for African youth is for speculation – while that may be the case today, events like this serve as a reminder that there is much more going on behind the scenes.

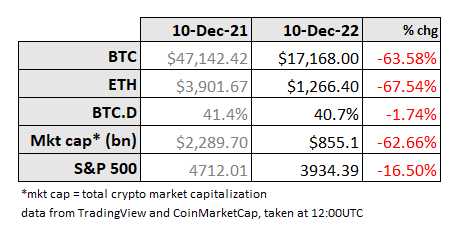

A YEAR AGO

(This section looks back at what was going on this time last year, so we can see how far we’ve come and how far we haven’t.)

Although the BTC all-time-high was already in the rear view mirror this time last year, we didn’t yet know that, and the flood of new products and services onto the market was still strong.

Visa unveiled a new crypto advisory unit, Ritholtz Wealth Management and WisdomTree launched a new crypto index, Brazil’s BTG Pactual launched a mixed fixed income and ETH fund, and Dan Tapiero’s 10T filed with the SEC to create a third digital assets fund with $500 million in capital.

Gaming was still a hot vertical, with Binance and Animoca Brands setting up a $200 million fund to invest in startups in that sector (although according to a report this week, few investments have been closed). Ubisoft, one of the world’s largest gaming studios, started testing in-game NFTs but promptly backtracked in the face of strong public resistance. It turns out that die-hard gamers resent the idea of additional commercial incentives being inserted into cherished scenarios.

And WhatsApp released a trial integration of the Novi (previously Diem previously Libra) wallet. We all know that didn’t work out, but it does plant the question of what a blockchain integration for WhatsApp would look like…

GOOD READS/LISTENS

The CoinDesk Most Influential 2022 is out. There will be parts you love and parts you totally hate, but the list is always an engaging snapshot of what CoinDesk staff think encapsulates the flavour of the market over a stretch of time.

This article by Niall Ferguson may be largely about the recent protests in China (with some original insight) but contains an interesting passage about the nature of crowd protests everywhere and how digital technologies have influenced the power of the group.

Michael Casey has an eye-opening perspective on how ChatGPT could influence the development of web3 applications.

With his usual sharp eye and wit, Arthur Hayes dissects recent market moves from an infrastructure point of view and pretty much calls the market bottom.

The latest episode of the Council of Foreign Relations’ Why It Matters podcast talks about the different approaches to internet access and governance in the US, Europe and China – eye-opening for all those who assume the internet has no boundaries.

The MacroVoices podcast has another Luke Gromen session on the Fed – these always bring fresh clarity.

Have a good weekend!

I don’t have much on my bucket list, but one thing that has remained there for years is seeing the Northern Lights. I’ve never even been to Iceland (I know that’s not the only place to see them, but it feels relevant somehow.) So you can imagine how mesmerized I was by these images, from Capture the Atlas’ Northern Lights Photographer of the Year competition. That there is even a competition for this is kind of amazing, and I sure wouldn’t want to be responsible for choosing the winner. But I am very grateful it exists.

(by Asier López Castro, via Capture the Atlas)

(by Marybeth Kiczenski, via Capture the Atlas)

(by Giulio Cobianchi, via Capture the Atlas)