WEEKLY, Dec 3, 2022

Hello everyone! The city I live in is now festooned with sparkling lights, and things are starting to feel festive – a welcome foil to the prevailing dismay as key companies prepare for a long winter, and indignation as a certain crypto villain manipulates public sentiment on the platforms he is eagerly given. You’re reading the free weekly Crypto is Macro Now – if you’d like daily insight into market trends and news that highlights the intersection of crypto and macro, I hope you’ll consider upgrading to the premium version.

Nothing I say is investment advice. If you find this newsletter useful, by all means share with friends and colleagues.

MARKETS

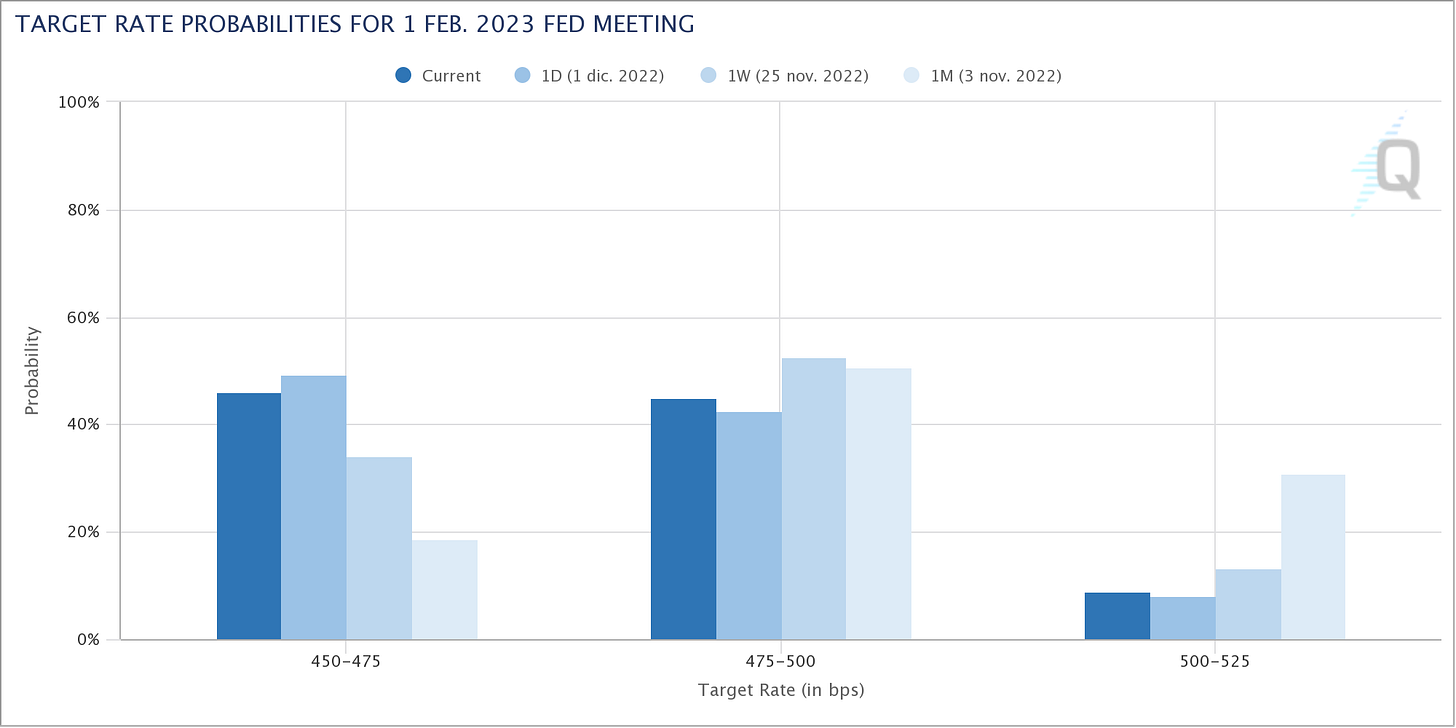

Traditional markets this week were driven by a relaxation of rates hike expectations, with Powell’s speech on Wednesday practically confirming 50bp for December. The message “higher for longer” seems to have been drowned out in the excitement, however, with the probability of another drop to 25bp in February moving past that for another 50bp for the first time.

(chart CME FedWatch)

In spite of continuing contagion concerns, crypto markets also showed some relief, with a couple of notable jumps delivering a refreshingly strong weekly performance.

(chart via TradingView)

(I’m keeping this section short today because I just know that Substack will scold me about the overall email length – for more detailed market and news insight on a daily basis, with a focus on data and narratives, I hope you’ll consider upgrading to a premium subscription, or take out a free trial).

COLUMN

BTC Dominance is Behaving Weirdly, and That’s Sort of Good

In the current whirlwind of dismay and disappointment (or should I say shock and shame?), many in the bitcoin ecosystem are no doubt fondly remembering simpler times when BTC crashing was all we had to stress about. In 2011, BTC’s drawdown reached 93%, a market cap loss of $172 million. The 2014-15 crypto winter saw bitcoin market cap lose over 80%, wiping out $11.3 billion of value. Sigh, those were the days.

Obviously, I’m not serious – they were no doubt shockingly painful for anyone in the industry back then. The Mt. Gox implosion at one stage felt existential – sure, the bitcoin blockchain would continue to exist after the largest exchange turned out to be engaged in fraud, but would anyone care? The fallout, however, was limited to a relatively small circle of libertarians, cryptographic experimenters and the techno-curious. It was barely covered in the mainstream press. This turned out to be a blessing, as the bruised could get to work rebuilding, out of the glare of mainstream attention.

The contrast with today’s market could not be more stark, as the world has been flooded with a torrent of headlines covering every possible angle of the FTX implosion. Wednesday’s Andrew Sorkin/Sam Bankman-Fried interview at the New York Times’ DealBook Summit was viewed by probably hundreds of thousands, if not millions. The extent of the fallout is as yet unknown, there is serious talk about how it might impact traditional finance, and skeptics feel they should be involved in shaping what the reconstruction might look like. The damage has hit thousands of assets, costing almost $160 billion in market cap.

Back in 2011-2015, bitcoin was the whole market. Now, that is far from the case. This is unreservedly good – the range of technological spin-offs and evolving use cases has probably surprised even the most optimistic of the early adopters. And the rapid spread of interest and adoption has grown the value of the entire market. It has also, through diversification, reduced overall market risk.

This last assertion may sound out of place, given the implosion the industry has just witnessed. But it has been an industry implosion much more than a market implosion. The market still works. Crypto assets (with a couple of notable exceptions) are still doing what they do. Bitcoin still produces secure blocks, Ethereum still pays staking rewards, DeFi tokens continue to incentivize platform participation, value is still transferred on-chain. The market infrastructure has changed; the market itself, not so much.

We can see this in a key metric that serves as an indicator of sentiment, and that I subliminally introduced in the previous paragraphs: bitcoin dominance. This is simply the percentage of total crypto market cap accounted for by BTC, and is tracked through the BTC.D index. Up until the emergence of Ethereum in 2015, it was around 99% (a few smaller tokens had emerged, none of which gained significant traction). Ethereum’s early success triggered a Cambrian explosion of innovation, new tokens emerged at an astonishing pace, and the ICO frenzy of 2017 pushed bitcoin’s dominance down to 37%. The drop coincided with a 470% increase in the overall crypto market cap in the space of approximately three months.

(chart via TradingView)

This introduces a salient feature of bitcoin’s dominance: its role as a sentiment gauge. In times of high speculation, such as in late 2017, BTC.D drops. BTC is the least volatile of the non-stablecoin crypto assets, and when traders and short-term investors are feeling confident, they tend to prefer the high-risk/high-reward offered by some of the smaller tokens.

The 2018 crash and the ensuing bear market reversed that trend. The speculative assets fell by much more than the relatively “stable” bitcoin, and its dominance climbed, reaching over 70% in August 2019. Then the market got confident again, new layer-1s attracted attention, and BTC.D headed down, reaching 58% a year later. We then saw an unusual phenomenon – a speculative market in which bitcoin was a star performer. In August 2020, MicroStrategy announced its first major BTC purchase, in the following weeks, several other firms, funds and millionaires revealed BTC holdings. The institutions had arrived.

(chart via TradingView)

In early 2021, BTC corrected from its highs just as institutional and celebrity interest in other tokens started to take off, with a flurry of new funds, new listings and new services. BTC.D dropped as lower-cap tokens took the spotlight, outshining BTC’s performance even as it reached its all-time high of $69,000 on November 10. The following chart shows how the normally high 60d correlation between BTC and other tokens dropped sharply during this period.

(chart via Coin Metrics)

We’re getting to the weird part: BTC.D spiked during this year’s May/June market drama along with a rotation into the relatively “safe” crypto asset, although the metric remained below 50%. It then understandably declined as the dust settled. But it hasn’t really moved since, even though there has been plenty of cause for fear.

(chart via TradingView)

Over the month of November, as the FTX contagion rippled through the system, crypto’s market cap lost 15%. And yet BTC.D oscillated between 40.0% and 40.9%. It can’t possibly be telling us that sentiment is flat.

Has BTC.D lost its role as a sentiment gauge? That would imply that BTC has lost its role as the “safe” crypto asset. Or could there be something else going on?

It’s possible that BTC has not outperformed other crypto assets because, rather than rotate into relative safety, investors have largely left the market. BTC spot volumes have dropped to local lows after the panic spike earlier this month. But they are still above levels at the beginning of the year, while those for ETH are notably lower. This feels like an exit but not a massive one.

(chart via The Block Data)

It's more likely that we are witnessing the consolidation of the crypto market’s speculative nature.

This may sound alarming as many of us now instinctively recoil at the thought of more speculation, after the damage done to portfolios and reputation by shady actors over the past year. We also flinch just imagining how regulators are sharpening their knives to excise heightened risk from the market. All this is reasonable, as is the relief felt by builders and creators that the industry can focus on the constructive aspects of crypto potential now that risky froth has been washed out.

Only, it hasn’t. We’re seeing this not only in the flat BTC.D but also in the performance of some smaller tokens. Over the past month, one of the worst for crypto in recent memory, litecoin (LTC) is up over 25%, OKEx’s token OKB is up more than 36%, the Binance ecosystem wallet’s token (TWT) is up over 110%, DeFi exchange GMX’s token is up over 33%. The past week has produced scores of 10+% jumps amongst medium-cap tokens such as dogecoin, AAVE, Uniswap and others.

If the FTX implosion has not removed speculation, and nor has macro uncertainty plus the broad withdrawal of liquidity from crypto and traditional markets, then what will? Nothing. Speculation is here to stay.

As much as some of us may wish it away, speculation is a feature of free markets. It is also a feature of sophisticated ones, and we want crypto markets to be both. Speculators may be all about buying an asset and selling at a higher price (or selling an asset and buying lower if they’re shorting) rather than actually contributing to a project’s growth. But that is a key feature of markets – the freedom to buy and sell at prices we deem fair. Without the ability to express different opinions, markets become predictable and altogether uninteresting.

They also become less useful – speculators may contribute to volatility, but they also enhance price discovery by reflecting opinions weighted by capital, closing arbitrage gaps and providing exit liquidity.

Speculation is not harmless: it can destabilize markets, especially if done with high leverage, but in most cases the issue is more with the facilitating platforms than with the trading behavior. Many critics point to the price distortions as evidence of speculative damage, conflating aggressive trading with market manipulation. In the confusing aftermath of the FTX implosion, even industry insiders are assuming that speculation rather than a violation of trust was at fault. And for many of us who are in this industry because of its potential to improve financial freedom and integrity, the desperate rush for returns feels, well, uncomfortably superficial.

Speculation-bashing may align with many core crypto values, and it does have a certain cathartic utility, but it is pointless. The strange behaviour of BTC.D during the recent turmoil tells us that the market composition has changed. Bitcoin is still the anchor asset, by a wide margin, but the volatility of its protagonism is weakening. This is a sign of a maturing asset class. That this should become apparent during one of the industry’s darkest times is cause for hope.

KEEP AN EYE ON

(A handful of the main themes from the week, explored in more detail in the daily emails.)

Evolving market infrastructure. To outside observers, it may seem as if crypto market infrastructure is frozen like a deer in the headlights (with centralized exchange Kraken announcing 30% layoffs this week, and crypto trading firm Auros missing a DeFi loan repayment), but this is far from the case. We may be still anxiously awaiting further news of contagion, with some key players keeping a low profile – but the industry is far from paralyzed. Over the past week, we saw several signs of continued investment in infrastructure along with new services and products.

Fidelity – one of the world’s largest asset managers – launched its retail crypto service, offering commission-free trading of bitcoin and ether.

TP ICAP, the world’s largest interdealer-broker, registered as a digital asset provider with the UK’s Financial Conduct Authority in order to offer a trading platform in partnership with Fidelity Digital Assets.

Crypto platforms Nexo and Gemini have obtained licenses to operate in Italy.

Switzerland-based crypto bank Seba opened an office in Hong Kong.

Telegram announced plans to build a decentralized exchange and non-custodial wallet system.

Blockchain protocol Komodo launched AtomicDEX Web, a combination of a browser-based multichain wallet, a cross-chain bridge and a decentralized exchange.

Market maker Keyrock announced the completion of a $72 million Series B round.

Regulation on the move. This week, US senator Sherrod Brown (D-OH), the chairman of the Senate Banking Committee, sent a letter to Treasury Secretary Janet Yellen, for the first time officially suggesting they work together to devise comprehensive rules to govern the crypto industry. Senator Brown’s crypto skepticism and reluctance to engage has long been seen as a major barrier on the road to regulatory clarity for crypto market participants. This change in tone comes at a time when regulators around the world are sounding the alarm about the lack of comprehensive crypto regulation. It also hints at an acceleration in progress, which many in the industry fear but even more would welcome, as uncertainty as to what the rules are is a greater impediment to progress than well-defined speed bumps would be.

RIP enterprise blockchain? Not long after the Australian Stock Exchange abandoned its horrendously expensive and cumbersome distributed ledger transition, this week we saw another high-profile enterprise blockchain death: TradeLens, a joint venture between Maersk (now officially AP Moller-Maersk) and IBM which was created to streamline the sclerotic process of international trade. This is sad because global trade sure could use some help, and anything that reduces paperwork, fraud and waste should in theory be a good idea. According to an official statement, the issue was the inability to get broad cooperation, which made the standalone business a loss-maker, and it seems like the owners don’t see that changing any time soon. This highlights a key, basic and hard-to-overcome problem of industry distributed ledgers: humans with differing priorities. Frustratingly, there does not seem to be an obvious way around that in an increasingly fragmented world, and I personally don’t want to live in a world where machines make the decisions. I’m going to continue to naively hold out hope for enterprise blockchains, though, because the alternative is too depressing.

CBDCs and markets. I don’t usually talk about central bank digital currencies (CBDCs) here, since the discussion is still so speculative and I personally get tired of the flow of “we’re doing cool things!” announcements without real-world results. But the volume of moves on the CBDC front just over the past few days has been notable, and so I feel I can avoid the topic no longer. What is especially intriguing about the recent spate of announcements is the cross-industry approach which brings together central banks, commercial banks and markets – with this approach, the concept is starting to feel less like a theoretical exercise and more like the basis for a market structure shift. Some examples just from the past few days:

The central banks of France and Luxembourg settled the issuance of a €100 million blockchain-based bond issued by the European Investment Bank with a version of a CBDC, in a trial that also involved Goldman Sachs, Santander and Société Générale.

The DTCC, responsible for clearing and settling the majority of US market trades, shared its findings from a pilot carried out with the Digital Dollar Project, Accenture, Bank of America, Citi, Nomura, Northern Trust, State Street, Virtu Financial and Wells Fargo. The initiative explored the settlement of tokenized securities, and concluded that a CBDC could speed up and reduce the cost of post-trade services while enhancing their transparency.

The National Bank of Ukraine is working with representatives of banks, other financial institutions and digital asset markets to design a CBDC that would facilitate the exchange and issuance of virtual assets as well as cross-border transactions and retail payments.

The Reserve Bank of India has started testing its retail CBDC in four cities with plans to expand to nine others. This is with the participation of four leading national banks, with another four slated to enter the next phase of the trial, and also involves select groups of customers and merchants.

A YEAR AGO

(This section looks back at what was going on this time last year, so we can see how far we’ve come and how far we haven’t.)

This time last year, new investment funds were popping up on almost a daily basis, including large ones from Hivemind Capital Partners ($1.5 billion), South Korea-based investment firm Hashed ($200 million), Maven 11 Capital ($120 million) and Play Ventures ($75 million). Galaxy Digital announced a $500 million convertible bond raise in order to boost its asset management business and launch a new fund.

Bitcoin miners were also raising aggressively: Terawulf raised $200 million in debt and equity, and Griid announced plans to go public via a $3.3 billion SPAC deal (which has yet to close and is looking increasingly unlikely).

And crypto platforms were on an acquisition and service expansion spree, with Coinbase announcing the acquisition of crypto custody technology firm Unbound Security, Crypto.com buying two US-based derivatives platforms (Nadex and Small Exchange), and Blockchain.com acquiring Latin American crypto investment platform SeSocio, and opened an NFT marketplace.

GOOD READS/LISTENS

You’re probably as sick as I am of FTX takes, but I’m including a few links on the topic anyway because this is a historical moment:

David Z. Morris’ take on SBF’s self-incrimination tour.

An excellent Matt Levine read, with some background on some building Tether risk as a bonus.

This episode on Laura Shin’s Unchained podcast, with two well-known VCs, has some original things to say.

An informative interview on Blockworks’ Forward Guidance podcast that teases out the similarities between MF Global and FTX.

Have a good weekend!

This past week the trial of Markus Braun, former CEO of the now defunct payments company Wirecard, kicked off with a five-hour-long reading of the charges against him. The timing is both uncanny and relevant: many have compared FTX to Madoff’s fund, MF Global, Enron and Lehman Brothers. Totally overlooked are its potential similarities to Wirecard, which spectacularly collapsed in 2019 after years of work by a handful of FT journalists uncovered deep fraud in their accounts in spite of significant interference from German authorities.

A few days ago, I watched the Netflix documentary made about the case – it was ok, a bit boring in parts (the trailer below is astonishingly tedious). The book, however, is much more compelling, and a good read. As well as a blow-by-blow account of how the fraud was uncovered, it contains insight into what it’s like to be an investigative journalist, the workings of the FT, the seamier side of short selling, and intriguing evidence that the whole thing may have been a Russia-backed front for information gathering and destabilization.