WEEKLY, Feb 18, 2023

BTC's price floor, SEC moves shed light on security definitions, liquidity is back, and more...

Hi everyone! This has been a wild week, with dramatic market moves and regulatory actions changing the landscape. Below I dive into some of the shifts, and pick at the often-contentious issue of what bitcoin IS and how that impacts its value.

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, poke at established narratives and share listening recommendations. Nothing I say is investment advice!

For more detailed market updates and news commentary and narrative updates, I hope you’ll consider subscribing to the premium daily newsletter to support my work. It’s $8/month for now, and it would make my day.😊

MARKETS

A sentiment shift

This week felt like something profound had shifted in overall crypto sentiment. That does not mean that it’s up-only from here, all rallies have corrections, and there is still (yes, still) potential bad news ahead that could spook traders. Also, the connection between crypto and macro markets has not been broken, and there are clouds gathering over the latter. But this week a different narrative elbowed its way into the spotlight: a focus on liquidity.

Not crypto liquidity – macro liquidity. And crypto asset performance is currently being led by bitcoin, probably the most liquidity-sensitive play available in the market today.

Looser conditions

Let’s review the status of market liquidity: this is not just about rates, although they do matter. It also depends on many other factors that have been conspiring to loosen conditions since late last year. These include (but are not limited to):

Lower volatility. This impacts collateral requirements, with lower volatility releasing more liquidity into the market.

Higher asset prices. These also impact collateral requirements, with rising prices releasing locked-up capital.

Lower dollar, which impacts global liquidity by giving issuers of dollar debt more room to breathe.

Lower oil price, which essentially puts more money back into everyone’s pockets.

International rates. China – a formidable source of global liquidity (and one especially relevant to crypto markets given the volume dominance of Asia-based exchanges) – is likely to ease further in Q2.

The drawdown of the Treasury General Account, which has been going on for most of the past nine months and is likely to continue as the Treasury uses its funds parked at the Fed to cover essential expenses in the absence of an agreement to raise the debt ceiling.

The Chicago Fed National Financial Conditions Index shows that financial conditions now are as loose as they were a year ago, before the rate hiking cycle had begun.

(chart via the St. Louis Fed)

Liquidity play

Now on to why BTC is not only a liquidity play, it is arguably the most sensitive liquidity play in the market:

For BTC and other crypto assets, it’s not about rates – they don’t directly impact BTC, whereas the same cannot be said of other assets. With stocks, for example, rates impact earnings through operating and financing costs, and current valuations through the discount factor applied to future cash flows. BTC has no operating or financing costs, and no cash flows to discount. Rates only impact BTC in terms of liquidity withdrawal and release.

What’s more, BTC is easy to hop in and out of, 24 hours a day and 365 days of the year, unlike other high-risk/high-return assets such as venture equity and other traditional assets such as stocks and bonds. In times of liquidity shifts, this is key.

Compared to other liquidity-sensitive assets, BTC has arguably suffered more than others, with a >70% drawdown from its November 2021 high. How much lower could it go? BTC has demonstrated signs of a strong support floor for some time – in spite of this week’s and last week’s bad news for the crypto markets, BTC did not drop notably, and even given the percussion of contagion disasters over the past few months, has held up well. This is no doubt a factor in many investors’ timing decisions. (More on this below.)

Also, unlike other assets such as stocks and bonds, BTC doesn’t HAVE to be in any macro portfolios – the lack of weighting requirements put it at the front of the queue to be dumped when liquidity is being withdrawn.

We saw this at the top of the last cycle: BTC started falling fast much sooner than stocks or bonds, as investors adjusted for the coming liquidity crunch. Now that liquidity seems to be easing, we are seeing investors position to take advantage of the new paradigm.

And this positioning triggers more positioning. While there could be a correction from here, we know from experience that 1) mainstream investors tend to move as a pack, and FOMO is one of the key drivers of the crypto market, and 2) BTC price action is a very strong marketing tool for the asset (unfortunately).

A macro move

For now, this move feels largely macro-oriented, going by the role of BTC in the market move – BTC tends to outperform when macro investors are taking positions in what they see as the “proxy” crypto asset, with the highest liquidity, lowest non-stablecoin volatility, the liveliest derivatives market and the broadest range of onramps. Bitcoin dominance (BTC.D) jumped…

(chart via TradingView)

We saw the same thing happen back in January, when macro investors started getting involved in the crypto markets again. Then other assets caught up while BTC took a breath. We could see the same rotation happen again as return-seekers move out on the risk curve in the hopes of market-beating returns.

The SEC gets busy

The past week saw two major moves by the SEC against crypto actors that shed light on its thinking around the definition of “security” when it comes to crypto assets.

Last Sunday night, the Wall Street Journal broke the story that the SEC had issued a Wells notice to crypto asset service provider Paxos for violating investor protection laws and for issuing unregistered securities in the form of the Binance stablecoin BUSD.

The initial reaction from many was that there was no grounds to declare a stablecoin a security since there is no expectation of profit. But while that is an important prong of the Howey test, it is not a deal-breaker, and the Howey test is not the only securities definition that matters.

We saw further evidence of this on Thursday, with the news that the SEC was suing Terraform Labs, the company behind the TerraUSD stablecoin, and its co-founder Do Kwon, for misleading investors and issuing unregistered securities. There are some hefty fraud and market manipulation allegations in there as well. This particular action sheds a lot of light on the SEC’s security definition thinking:

It alleges the algorithmic stablecoin UST was a security.

UST apparently represented “rights to subscribe” to a security (LUNA) – this checks the boxes of the “enumerated security” test, a different approach to using the better-known Howey test.

Also, UST was closely tied to Anchor, which was marketed as a profitable investment.

It alleges that wrapped tokens (blockchain-based assets wrapped in the code of another blockchain to enable interoperability) are securities. A Terra-based example was wLUNA.

The SEC also used the “enumerated security” test for this one, and determined that wLUNA was a receipt for a security, and therefore a security.

It alleges that mAssets are securities-based swaps. mAssets are blockchain-based assets created to mirror the price performance of real-world assets.

The SEC went even further on mAssets, accusing them of violating the ’34 Exchange Act by not trading exclusively on registered securities exchanges or ATSs.

Terra’s sponsorship of a baseball team was mentioned as evidence the whole ecosystem was “for profit”. Several of Do’s cringe hypemaster tweets were quoted to the same end.

The big deal here is that, looking through these arguments to others the SEC is probably preparing, pretty much any crypto asset could be accused of being an unregistered security. This feels like a strategic laying out of a tentative regulatory roadmap while going after the lowest of the low-hanging fruit – Do Kwon is not exactly a popular figure, and probably not in a position to fight this. His current whereabouts are unknown, and he presumably would have to testify were he to want this to go to trial, which – given the Red Notice – would mean instant arrest.

This going through without a fight would set a strong precedent that could hurt many other assets – and algorithmic stablecoins that in theory use a programmatic peg could be in trouble. We can appreciate the clarity – but dark clouds are brewing for crypto experimentation, which has, even in worst-case scenarios, had very little spill-over into traditional markets. I continue to maintain that disclosure rules rather than blanket bans (which the current registration rules effectively impose) would protect investors while giving them more choice and crediting them with enough intelligence to assess risks, without killing responsible innovation.

COLUMN

Bitcoin’s multiple use cases give it price support

As surely as the earth spins on its axis, spring emerges after winter. This applies to markets as well, and few markets have suffered as brutal a winter as that for crypto assets. It’s not just the collapse of prices that hurt, it’s also the implosion of key components of market infrastructure, starting with the Terra ecosystem and ending with… well, that’s still to be determined.

The two threads of doom – a weakening macro environment and structural fragility – fed upon each other, with price drops unmasking faulty disclosures, risk practices and incentive constructs, which led to further price drops and further unmasking. Until they didn’t anymore. That’s the part I want to focus on here: why prices stopped falling.

In early November, as the shock of the FTX revelations tore through the ecosystem, BTC suffered what would be its last leg down, dropping to around $16k. The bad news did not stop coming: the bankruptcy, the magnitude of the fraud, the spread of the damage, the suspension of withdrawals and subsequent bankruptcy of the industry’s “blue chip” lender, concerns about bitcoin’s largest fund… the hits kept coming. But BTC did not fall further, when – just going by the bleakness of the narrative – in theory it should have. What happened?

It has to do with bitcoin’s multiple use cases. Many insist that the asset is only about speculation: there’s no fundamental value, price is driven by narrative and nobody uses it. This blinkered assumption even tends to come from experienced market watchers, which is an encouraging lesson for the rest of us (as in, no-one understands everything, no matter how much of a household name they may be).

Those of us who have been paying attention know they are wrong: bitcoin is not just for speculation. It is a speculative asset, sure. Trading volume picked up from local lows at the beginning of the year, and although still relatively low, is a consequential $13 billion daily on reputable exchanges, according to data from The Block. While we don’t know who is behind these trades, on-chain data tells us that the vast majority of BTC moved on any given day was last moved in the previous 24 hours (the light yellow-dark yellow area in the chart below). In other words, most of on-chain activity is short-term churn. While some of this could be payments, we can probably assume that at least most of that is, for now, the result of speculative moves.

(chart via glassnode)

However, this accounts for less than half of the bitcoin in circulation. Most BTC held in addresses does not move much. Over 67% has not moved in over one year, almost 50% has not moved in over two years, when so far this year most of that cohort could have sold at a profit. Even being conservative and removing all coins dormant for more than 10 years, since they could be considered “lost”, over half of outstanding BTC has been stationary for over a year.

(chart via glassnode)

While any of these holdings could be sold at any time, and many probably will be should the BTC price continue to rise, these address owners are not pure speculators. For them, BTC is a long-term investment, a store-of-value, a hedge – whatever you want to call it, for them bitcoin does have utility beyond short-term speculation.

(A caveat against using address-based analysis: with the recent mass exit from exchange custody, given concerns about market structure, reading address tea leaves is harder than ever. For instance, the number of non-zero addresses is shooting up – but this doesn’t necessarily mean an uptick in activity, it could just be people moving coins off-exchange. In other words, these are not necessarily new users, they are just moving coins around. Or, they could be new users, we just don’t know. However, when looking at BTC that hasn’t moved in a while, we can be relatively confident about what we are seeing – you can’t disguise a lack of movement. If anything, the HODLer positions are probably understated – many investors may have held their BTC on exchanges up until the market drama. They are long-term holders, but on-chain they appear short-term.)

Back to the thread… Bitcoin is a speculative asset, and a long-term investment. For some, it is a payment tool, judging from the growth on the Lightning Network. Bitcoin is all of those at once, and perhaps in the future it will also be an NFT platform, who knows. This multi-faceted use case lends support. Back when its price was at the local floor, accumulation was scooping up the sell pressure from miners and exiting speculators. That provided some price support, and goes a long way toward explaining why, even amid further terrible news, the price didn’t fall further.

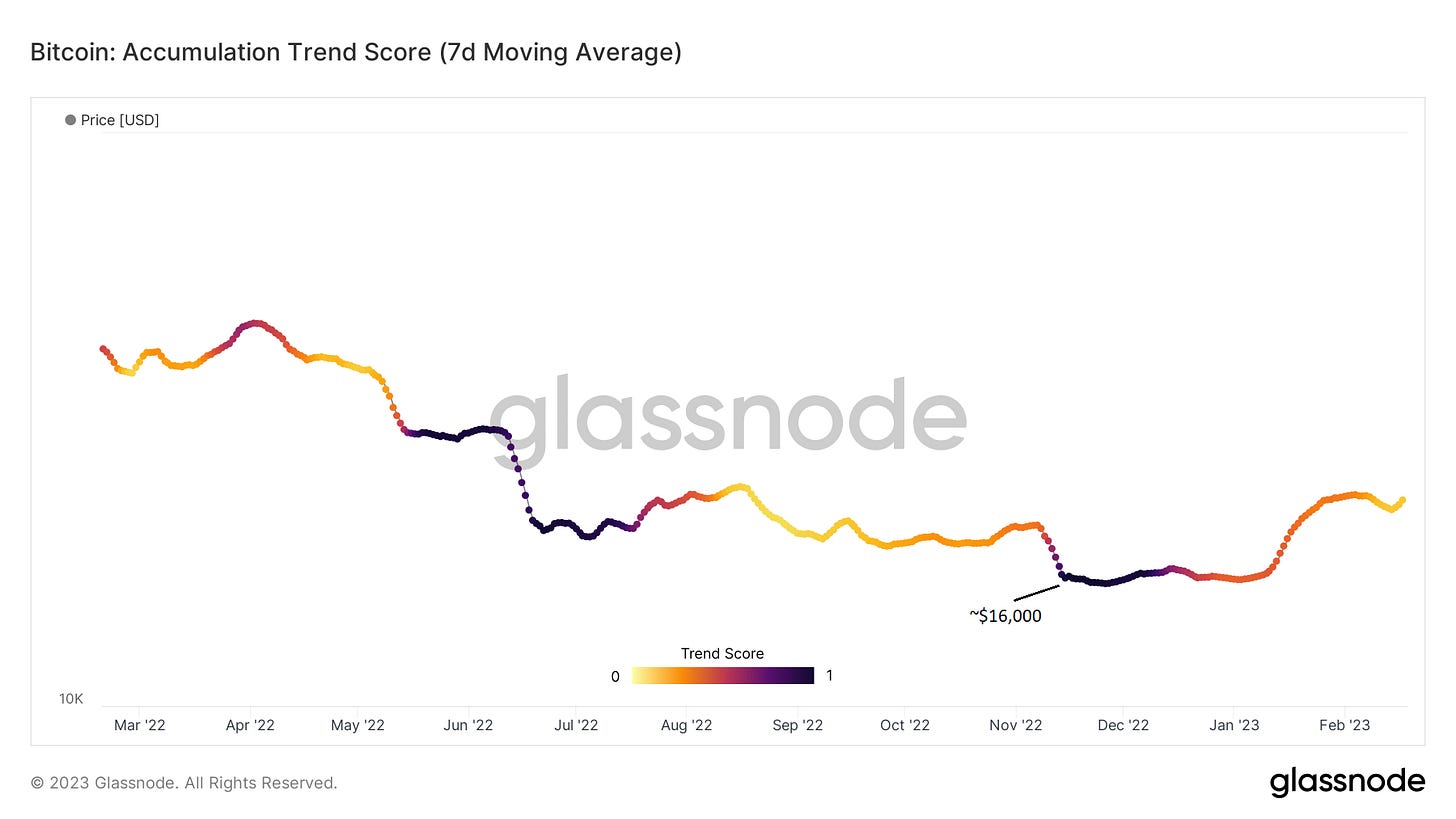

The below chart from glassnode colour-codes accumulation according to address size. Purple represents large holders accumulating, yellow shows that smaller participants are becoming more active. Back in November, after BTC dropped to $16k, large holders were buying the dip. Some of this could have been for speculation – but back then, sentiment was as bleak as I’ve ever seen it, volatility moves suggested that traders were stampeding for the exits, and speculators generally found more attractive risk profiles elsewhere.

(chart via glassnode)

This multi-use case not only provides a strong floor support, it also explains why even experienced traditional market watchers don’t “get it”. Can you think of any other asset that has multiple use cases? Gold and real estate come to mind – art, perhaps. But these have millennia of understanding behind them, and they are rarely confused with speculative assets since their prices are not volatile. Nor are these assets particularly liquid (with the exception of gold, although it could be argued that physical bars are only liquid at certain times of the day and certain days of the week if they are held at a centralized depository, which introduces new vulnerabilities). It is not easy to conceive of a liquid, always-on asset that represents different things to different people. This further underlines just how “unusual” bitcoin is – it’s speculative and volatile, it is also treated by many as a long-term investment, and history has shown that this lends the asset floor support while giving it ample upside.

Another reason why many seasoned investment veterans don’t “get it” is what they read in the media. Sharp price moves, uncovered fraud, exploits and examples of hype make for dramatic headlines, which get clicks and keep media business models afloat. It’s easy to see how those without the time or interest to dig deeper would take that as the whole story, especially when they are used to feeling “smart”.

But bitcoin’s theoretical and demonstrated price floor is a key feature of the asset’s asymmetrical risk – at these levels, the potential upside far surpasses the potential downside, especially now that we know the floor is not $0. Truly smart investors go beyond the headlines, even when it means going outside of comfortable frameworks.

What’s more, bitcoin’s use cases are still evolving. This will not only impact the debate around “intrinsic value”, it will also add more layers to the price floor. More traditional assets, even those also poised to benefit from the return of liquidity, don’t have this evolution embedded in the asset itself.

This implicit price floor goes a long way toward explaining why BTC has rallied so strongly this week. The price floor evolution also positions the asset as an intriguing longer-term bet. The narrative is yet again shifting.

GOOD READS/LISTENS

In the latest episode of Against the Rules, Michael Lewis talks to cybersecurity reporter Andy Greenberg about tracking bad guys on the blockchain. Fascinating, and important given the constant refrain of “bitcoin is for criminals” from certain misinformed politicians.

The Wall Street Journal published a deep dive into the small handful of people that maintain Bitcoin’s code – this article generated some controversy, with publicity-shy developers (fairly) alleging it would attract unwanted attention. Then again, it highlights how hard and how important the job is, and will hopefully breed a new layer of respect for the network, its governance system and the brilliant coders that keep it going.

This excellent episode from Forward Guidance with Michael Howell from CrossBorder Capital dives into the market liquidity shift, in much more detail and clarity than I could ever muster!

An interesting twist by Bloomberg’s Marcus Ashworth on the CBDCs good/bad debate that dives into whether central banks should be getting involved at all. Mission creep, perhaps?

Have a good weekend!

So, like many of you I imagine (‘tis the season?), I’ve been battling an awful cold for the past week, which has involved floods of hot apple juice, ginger tea and signing off early to snuggle up with my iPad. I went through the entire Season 2 of Slow Horses (on AppleTV), and thought it was even better than the first. A complex spy drama set in London with no glitz or gadgetry, just a strong script and a gripping plot. A high-level recommend for fans of Le Carré.