WEEKLY, Feb 24, 2024

Nigeria's crypto ban, ETF vulnerabilities, Circle leaving Tron

Hi everyone! A fun fact: if you write today in the European numerical version, it’s 24022024, which I think is cool. I do love symmetry.

You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links.

If you’re not a premium subscriber, I hope you’ll consider becoming one! It would help me continue to explore the deepening intersection of the crypto and macro landscapes - given what’s going on in the world, it matters now, more than ever. With a premium subscription, you’ll get a daily update on relevant progress along with some market commentary and deep dives into trends, narratives, experiments, opportunities and obstacles. There are also charts, links to interesting podcast episodes and long reads, and a running commentary on some of the craziness out there. And an audio version of the newsletter! A bit clunky still, but I’m getting better at the recording.

Follow me on X at @noelleinmadrid where I share photos of gorgeous city I live in, charts, comments on headlines, and, you know, stuff depending on the mood.

Of course, nothing I say is investment advice!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

Women in Blockchain is working on understanding the crypto compensation landscape (and not just for women!) – would you help them out by filling in a brief survey? We know the ranges are wide, but more information could be useful.

In this newsletter:

The other side of the ETF coin

A stablecoin retreat

Nigeria’s crypto ban: the silver lining

Some of the topics discussed this week:

Ethereum’s next upgrade: What is Dencun?

What sanctions against a CBDC developer say about the US dollar

A Citi tokenization trial raises some interesting ideas

The post-ETF market infrastructure

About those retail flows: I’m not convinced

Do the ETFs make Bitcoin more vulnerable?

China gets back to work

Why Chinese geopolitical moves are worth watching

China: targeted, and disappointing, stimulus

Heading for an interest rate split?

What is leading about the Leading Indicator?

The FOMC minutes and what they didn’t say

Thursday’s moon landing is a big deal

The other side of the ETF coin

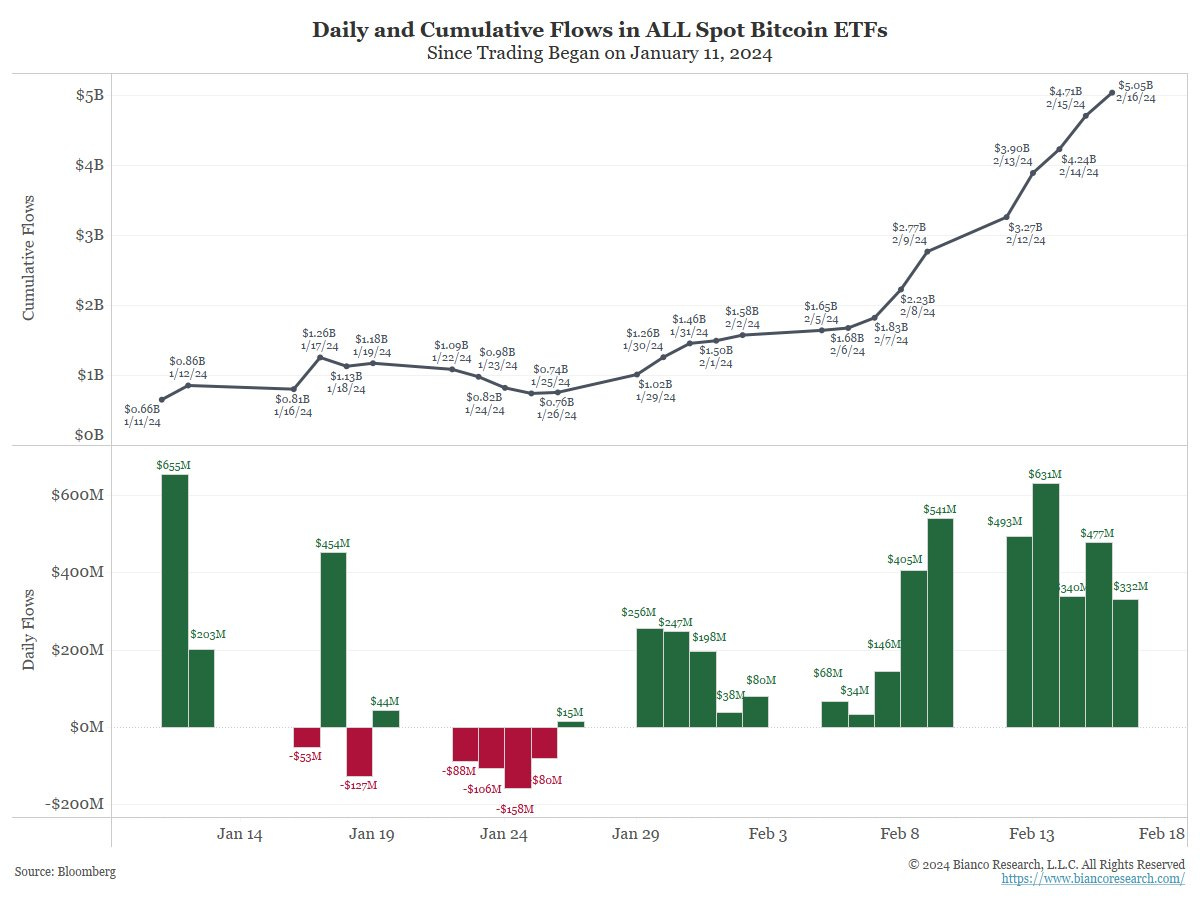

Jim Bianco had a strong thread on X last weekend reminding the crypto market that it should be careful what it wishes for. He points out that a significant chunk of the inflows into BTC spot ETFs could be from “degens”, which is a way of saying “hot money”. These are funds that will exit when they think the market is near the top, or – even more worrying – as it is dropping. The reason this is worrying is that BTC tends to move fast both near the top and on the way down, especially if leverage has built up. Add to this momentum the sheer weight of the ETF funds, and the moves could be even more alarming, possibly pushing “tradfi” investors out of the market permanently.

Personally, I’m not too worried about “tradfi” investors leaving the market permanently. Some will, sure, but that happens in every cycle. Assuming the registered advisors or others responsible for wealth management have done a reasonable job of crypto learning and education, BTC will only be a small part of any portfolio, and investors will be aware that it is not an “up only” asset.

Individuals who have gone “all in”, well, tragically they will lose a lot of money relative to their net worth when the market turns, and this is never good but it is how risk works.

No, what worries me more is that BTC is a 24/7 market, but ETFs aren’t. Imagine the bitcoin price starts to head down with force on a Friday night. ETF holders are stuck in their positions until Monday morning, by which time a significant chunk of their BTC value could have been wiped out. They will probably then all rush for the door at the same time, tipping the BTC price into something that looks like freefall, and adding significant strain to the market structure, especially since redemptions have to be cash-only.

(chart via @BiancoResearch)

That’s the part that worries me about the BTC spot ETFs. They have the potential to turn an “orderly” market into a disorderly one, which would damage trust much more than would a drop in price.

Nevertheless, I do still firmly believe they are a net positive for the crypto market, from the education, validation and additional liquidity they bring.

But thinking about whether the BTC spot ETFs are good or bad for crypto overall is actually an irrelevant exercise. They were always inevitable, given 1) evidence of building demand for BTC, 2) markets’ constant search for novelty, and 3) the lack of any reasonable rules to prevent them.

Rather than declare ourselves in the “pro” or “against” camp, we should examine both the upsides and the downsides, so that we can be better prepared for each. We also need to think of hidden risks, especially given the market axiom that “every action triggers a reaction that you didn’t expect, either right away or eventually”. Ok, I just made that axiom up, but I think it holds. Feel free to use it if helpful!

A stablecoin retreat

Circle is discontinuing support for Tron-based USDC, following a risk assessment of the network.

This may seem like big news, but it’s actually trivial, not a surprise, and probably a smart move.

The big question left hanging is, of course, did Circle uncover anything new about Tron that we should know? The network’s creator Justin Sun is a colourful character who has struggled to shed his, um, controversial image while making splashy promises, getting cushy diplomatic posts, sometimes denying verifiable facts and more recently promising to bring smart contracts to Bitcoin. In March of last year, the SEC brought a suit against him on charges of market manipulation among other things – I confess I’m not sure where that’s at right now. And last November, Reuters reported that Tron was the preferred network for Hamas and Hezbollah. Not exactly the seal of approval a network would hope for, I’m guessing.

A major problem with Justin Sun’s network would be bad news for the ecosystem, since the largest fiat-backed stablecoin, USDT, has more tokens issued on Tron than on any other blockchain, according to data from The Block.

(chart The Block Data)

The main reason for this is that Tron is cheap, which is what users in developing economies care about. In sub-Saharan Africa, for instance, USDT on Tron is the preferred crypto asset for trading and for savings (I don’t have a link to verify, but I have been told this by several people who would know).

But Tron is not a significant part of the USDC universe. It’s not even in the top five of supported blockchains (in the chart below, it appears to be lumped into “5 Others”, the blue line), so ceasing service will not make much of a dent in its overall supply or volumes.

(chart The Block Data)

Plus, Circle has been publicly distancing itself from Tron for some time, so this move is not a surprise. Back in November, the entity sent a letter to US Senators Sherrod Brown and Elizabeth Warren insisting that all accounts held by Justin Sun and his affiliated projects had been terminated nine months earlier.

That they felt they had to do so shows what a smart move this is. Circle wants to become the leading regulated US dollar stablecoin issuer, and to get there, it has to polish its armour until it absolutely shines because the crypto opponents in positions of power will look for reasons to channel stablecoin activity into tiny silos of scrutiny operated by regulated banks.

In stepping back from Tron, Circle doesn’t lose much, and gains a reputation for doing whatever it needs to in order to comply with the rules.

Nigeria’s crypto ban: the silver lining

First, how does a government block access to websites? Usually, it’s through telecom operators, which can be asked to blacklist specific IP addresses. In the case of Nigeria, the Nigerian Communications Commission (NCC) ordered telecom companies to restrict consumer access to the websites of Binance, Coinbase, Kraken and many other crypto exchanges, including local operations.

Second, do these restrictions work? Sort of, but not really – they’re more an added friction which could deter many, but those who want to buy crypto assets will find a way. VPNs can get around IP restrictions. Websites can change IP addresses. And, according to Binance, only “some” of its Nigerian users have experienced issues accessing the site, with access to its app as yet unimpeded. CoinDesk reported yesterday that Coinbase has confirmed its website is still accessible in the country. And Nigerian users on X today report they can still access popular crypto sites. IP blocking is a game of whack-a-mole, hard to enforce and hard to maintain.

What’s more, peer-to-peer (P2P) platforms are particularly popular in Nigeria – according to blockchain forensics firm Chainalysis, Nigeria ranks first in global P2P exchange trade volume. While the IPs of well-known P2P platforms can be blocked, there are many smaller ones that have not registered and that could in theory dodge an IP freeze. On X earlier today, Ray Youssef – CEO of P2P platform Noones – showed users how to activate private browsing, which seems to grant previously denied access. And Telegram reportedly hosts some impromptu message boards that result in trades.

Third, and even more important, is why would the government do this? Here is where it gets particularly interesting.

Apparently, crypto exchanges are to blame for the devaluation of the naira.

The official reason given for the move against IPs is, according to the local Premium Times, the “continuous manipulation of the forex market”, and the decision was taken “following reports that currency speculators and money launderers were using [crypto platforms] to execute criminal activities”.

Also, presidential advisor Bayo Onanuga in a tweet on Wednesday accused Binance of “blatantly setting exchange rate for Nigeria, hijacking CBN [Central Bank of Nigeria] role”. Binance, meanwhile, published a notice highlighting its efforts to comply with the authorities, which did not go down well with many users.

If the official statements from government representatives sound like desperation, well, there’s ample reason for that: the naira has been one of the worst performers in the world against the dollar over the past year, and analysts don’t see much relief in sight.

(chart via TradingView)

Obviously, the 76% increase in Nigeria’s broad money supply over the past year is probably more responsible for the crash of the currency than are cryptocurrency purchases. But the government has over the past few weeks tried a host of increasingly desperate measures, which do not seem to be working. It looks like it’s time for a new scapegoat.

This could set a worrying precedent: blaming access to crypto assets for capital flight. As currency turmoil spreads, we could see more governments try to clamp down on crypto exchange access in order to slow any exit. It could even feed crypto opponents in developed countries a new tool with which to tarnish the entire industry, especially if (as Nigeria is attempting to do) “currency speculation” becomes associated with “money laundering”.

However, this blame could well backfire by calling more attention to the utility of crypto assets in wealth preservation.

Since this storm erupted earlier this week, local web searches for bitcoin haven’t moved much, but those for Binance spiked, according to Google Trends.

(chart via Google Trends)

And anyone pulling up the BTC price in naira terms would see an asset that has appreciated almost 650% over the past year and 125% over the past month.

(chart via TradingView)

It’s not just that shouting “don’t look at this!” of course makes everyone look. It’s also that the government is imbuing crypto assets with a currency manipulation power they don’t really have, and in the process enhancing their appeal. This is particularly relevant in a society in which only 25% say they trust their government, according to Gallup.

In sum, this looks like yet another regulatory battle the crypto ecosystem will have to fight, certainly in Nigeria but most likely soon in other regions as well. But it’s one it will win, because it is very hard to ban crypto transactions, especially when the attempt to do so highlights their relevance.

HAVE A GOOD WEEKEND!

I recently watched the Netflix documentary “The Greatest Night in Pop”, and I confess I was surprised. Nothing much happens – this is true for many documentaries, I guess – but I was left feeling emotionally drained and uplifted at the same time. I’d happily watch it again, not for the song itself but for the pull of teamwork and the power of purpose in almost every frame.

It did leave me wondering whether something similar could be possible today. I fear probably not. It’s not just that the music business is so different now (although it certainly is); it’s also the colossal challenge these days of reaching agreement on what even constitutes a worthwhile cause.