WEEKLY, Feb 25, 2023

The rise of the east, rates adjustments, crypto corrections, and more...

Hi everyone! The shortest month of the year sure did live up to its name – next week we enter the final month of the first quarter of 2023. I don’t know about you, but I feel like I haven’t yet caught my breath from January.

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, poke at established narratives and share listening recommendations. Nothing I say is investment advice!

For more detailed market updates and news commentary and narrative updates, I hope you’ll consider subscribing to the premium daily newsletter. Or take out a free trial! 😊

MARKETS

Conspicuous consumption

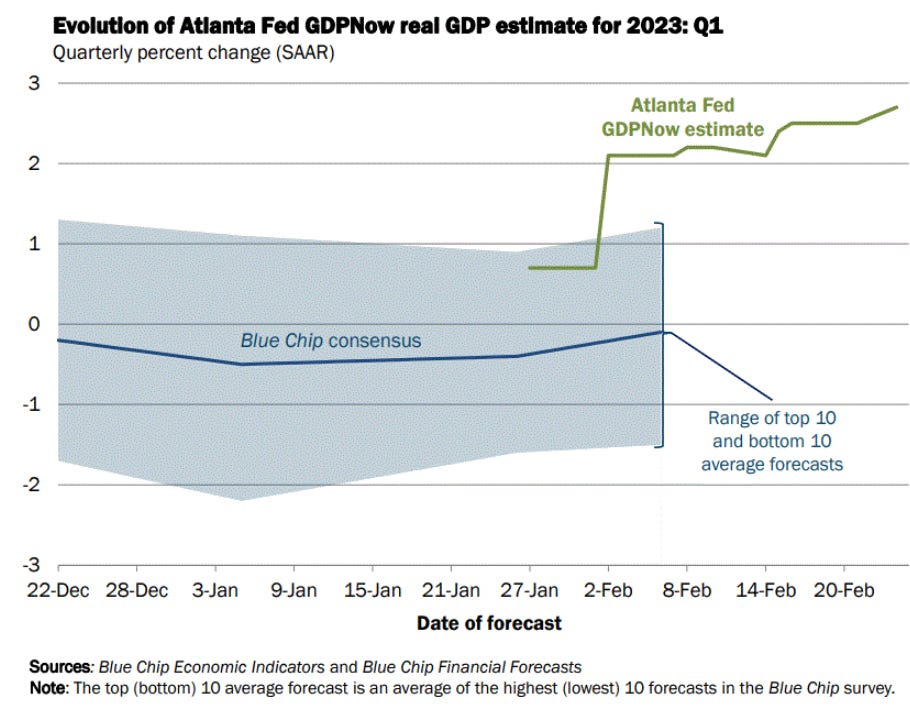

Consumers are just not willing to take a break. This is good for the economy, for sure – US Q4 GDP came in relatively strong with this week’s revision only slightly down to 2.7% from the previously reported 2.9%. The Atlanta Fed GDPNow model is predicting the same level of growth for Q1 2023, in spite of notably higher interest rates.

(chart via the Atlanta Fed)

But the strength of consumption is triggering inflation concerns. Personal spending for January came in notably higher than expected (1.8% month-on-month vs the 1.3% consensus forecast), and much higher than December’s contraction of 0.1%. The Core PCE index for Q4 was revised up, from 3.9% to 4.3%. And the year-on-year figure for January came in on Friday at 4.7%, ahead of December’s 4.6% and way ahead of consensus expectations of 4.3%. Pressure is not abating.

Pressure is also building in production figures: PMI composite indices announced this past week not only came in well ahead of expectations in the US, UK, Germany and France, they also moved into expansionary territory for the first time in months. In the EU as a whole, the composite PMI index moved even deeper into expansionary territory, recording the highest level since June 2022.

This is starting to show up in inflation expectations: the University of Michigan inflation expectations survey for February pointed to 4.1% for 12 months out, while 5-year breakevens reached a 4-month high of 2.6% earlier this week. Getting core PCE down to 2% from here will be very, very hard.

Rates expectations continue to adjust to reflect this shifting sentiment, with the probability of a 50bp hike in March now up to almost 30% from virtually 0% a month ago, and a 65% probability that the year-end rate will be even higher than the official forecast (which is likely to be significantly revised up at the next FOMC meeting).

(chart via CME FedWatch)

In my opinion, a 50bp hike is much less likely than the market is signaling, for the following reasons:

1) It would signal panic, something Powell has been careful to not do so far.

2) The consumer strength numbers are not yet well understood, and could be due to seasonal adjustments – as Andreas Steno Larsen has pointed out, these are unusually large, with some reaching all-time highs, which suggests there is more to this story. Apparently weather is playing a big role, and as we all know, weather is fickle.

BTC adjusts

Given the sharp increase in the DXY dollar index over the week (largely in response to rising treasury yields and higher rates expectations), as well as BTC’s recent strong performance, it’s not surprising that the market saw some correction this week.

(chart via TradingView)

Zooming out a bit, however, highlights the changing market drivers. The DXY has now retraced all of its January losses and is back where it was at the beginning of the year. BTC has lost some of its recent gains, but is still almost 40% up year-to-date.

(For more detailed market analysis on a daily basis, I hope you’ll consider subscribing to the premium Crypto is Macro Now.)

CeFi to DeFi

One of the main news items from the week has to be the reveal of Base, a layer-2 blockchain built by Coinbase developers. While another layer-2 blockchain may sound like more technical noise wrapped in PR hype, it’s actually a very big deal, and although I am not a developer or even a frequent DeFi user, I think this is exciting on many fronts.

1) This makes Coinbase the first listed company to launch a blockchain. Equity analysts will be scrambling to understand zk-rollups, bridges and more, which should deepen Wall Street interest in and familiarity with the on-chain world. Who knows where that could lead.

2) Coinbase doesn’t need a blockchain – it already is one of the largest crypto platforms in the world. But its own chain sets the base for a new direction of development, perhaps giving birth to new types of transactions, app connections, etc. For instance, imagine extending the existing Coinbase wallet to Base, wrapping tokens from other ecosystems and having some of these unlock NFT functionality while creating new identity systems and supporting the emergence of new communities.

Plus, creating a new chain ecosystem that forms part of the larger Ethereum ecosystem – Base was built using open-source tools from the Optimism stack – is a way to more deeply embed Coinbase in the blockchain community. It is also a chance for Coinbase to influence how decentralized applications evolve, by contributing code as well as users. Coinbase will become the second official core developer team in the Optimism ecosystem.

3) The chain will offer open-source tools for external developers to create applications for the Coinbase community. These could include cross-chain applications or hookups with other platforms, and would in theory put a broader range of use cases in front of Coinbase users than if applications were limited to those created by Coinbase teams.

4) Why would external developers work on Base? According to the Q4 earnings report released earlier this week, Coinbase has 110 million verified users. In other words, a huge community with plenty of upside – only a tiny subset of Coinbase users have ever transacted on-chain.

5) There are no plans to issue a token. Whether a token is necessary to incentivize adoption has been the subject of much controversy, and the jury is still out. Base will give the market a chance to observe the build-out of value based on utility rather than reward.

6) Base will start out relatively centralized, with a centralized sequencer and a handful of validators, but the intention is to move toward a totally decentralized network some time in 2024.

7) The testnet is live now, and the mainnet is expected to follow within a few months. Initial users yesterday found several glitches, which were of course aired on Twitter. Rather than disappointing, I find that hopeful: it shows the level of scrutiny this launch will be under, as well as the value of getting a sizeable and critical community to test and test and test.

8) Bigger picture, Coinbase has been instrumental in onboarding millions into crypto markets. It has a relatively trusted brand, and could therefore also become a gateway to the on-chain economy for more mainstream users.

9) The most significant big-picture impact in my opinion, however, is this: Base gives us a glimpse of how centralized crypto service providers can become decentralized. In other words, how CeFi can move to DeFi. This is relevant not only for other centralized crypto services, but also possibly for centralized finance more broadly.

COLUMN

Crypto Market Drivers From the East

As political experts focus on the diplomatic dance amid building tensions between the United States and China (punctuated by some balloon-shaped comic relief that might end up being not so funny after all), a more benign battle is brewing in the halls of financial regulators. While local for now, nothing stays local for long in global markets, and the potential ramifications go well beyond crypto markets, potentially shaping economic influence which, in this changing landscape, is more geostrategically important than ever.

Earlier this week, Hong Kong’s Securities and Futures Commission (SFC) published the proposed text of its upcoming crypto regulation, slated to go into effect on June 1, and opened it up for public comment. Its scope includes the licensing of crypto asset service platforms, which were originally only going to be allowed to service accredited investors. The SFC is now seeking input on whether or not retail investors should also be allowed to participate, and what types of protections should be in place. Also open for discussion is the range of “approved” assets, which in principle would only include a limited selection of the most liquid tokens.

So far, this seems like yet another example of a jurisdiction way ahead of the United States in terms of regulatory clarity and willingness to engage with the public on the topic. Yet, lifting the lid a little, it is so much more. It is also an example of the East-West strategy divide, the power of retail and the importance of watching the flows.

Not that long ago, Hong Kong was not exactly welcoming to crypto businesses, but nor was it overtly antagonistic. It seemed to regard them as largely inconsequential, in contrast to China’s building antagonism. In 2020, Hong Kong announced plans to introduce a new licensing regime to directly regulate all crypto platforms and to limit their reach to accredited investors. This recent move seems to not only clarify those promises but also to broaden the scope and take into account what the regulators see as growing retail interest.

Yet it's about more than licensing. Hong Kong has also budgeted HK$50 million (~$6.4 million) for crypto asset development, including education efforts for individuals and businesses. And Hong Kong's financial secretary Paul Chan announced the launch of a task force, composed of policy and industry representatives, to explore crypto asset integration. This feels much broader and longer-term than just crypto service provider oversight.

In part, it’s about laying some groundwork for the economic growth of the region. Hong Kong’s economy depends largely on financial services and tourism from the mainland, both of which were hit hard by the strict pandemic lockdowns. It recently reported its fourth consecutive quarterly GDP contraction, and the region’s leader John Lee has vowed to prioritize attracting foreign talent. Most crypto firms based in Hong Kong left as China’s 2021 crypto trading and mining ban cast a cloud of operational uncertainty. Now, several have announced they will be applying to return.

It's also about more than just Hong Kong and its 7 million residents. Hong Kong is obviously closely affiliated with China. The two jurisdictions operate under the constitutional principle of “one country, two systems”, which separates Hong Kong’s economic administration from that of its much larger parent. But events leading up to and during the recent protests made clear to the world that China held the reins, and that nothing happened in Hong Kong without China’s approval. Here’s where it gets particularly interesting: China seems to approve of Hong Kong’s crypto moves.

Earlier this week, Bloomberg reported that Chinese officials had been seen at Hong Kong crypto events. They were not there under cover. And in January, Huang Yiping, a former member of the monetary policy committee of China’s central bank, said in a public speech that the country should reconsider its crypto ban. He was not speaking on behalf of the central bank, but it is extremely unlikely his speech would have become public without official approval. None of this necessarily means that mainland China will be opening up to crypto markets any time soon – but it could be that China is watching Hong Kong’s moves with a view to relaxing its stance and eventually supporting the integration of global crypto assets into its economy.

This matters in part because of size. There are no small numbers in China, and the sheer scale of the potential participant pool could dwarf virtually any market. The country reportedly has 212 million retail investors – for comparison, the entire population of the United States is approximately 330 million. Many of these investors have withdrawn from the stock market given the economic uncertainty during the dark lockdown period, but with the improving outlook, some of the build-up of pandemic savings could be looking for high returns.

What’s more, Chinese retail investors tend to be less risk-averse than their US counterparts. In general, they prefer momentum-chasing to steady yields, which in part explains their enthusiasm for crypto markets a few years ago and why the potential risk of a wipe-out grew to the stage where the government felt the need to close off access. It did not manage to completely stamp out crypto activity, however – 8% of FTX’s creditors are mainland-based, according to the filings, and China-based miners currently account for approximately 20% of global hash rate, according to a recent Cambridge study.

Also, China is one of the few regions of the world actively easing money supply. Last week, the central bank ramped up liquidity injections while keeping the monetary policy rate steady, but analysts expect the committee to continue to cut rates in Q2. The amount of new loans extended by Chinese banks more than tripled between December and January. Most of us don’t have to cast our memories too far back to remember what monetary easing can do for risk assets.

It also matters in part because of geopolitics. It is no secret that China would like to see a weakening of the dollar’s international role without actually hurting the dollar, and it seems to understand that the role of US capital markets is a key factor in global trade. For a few years now, financial regulators have been working to encourage more activity on Chinese markets, such as opening them up more to foreign investors, enabling more hedging, streamlining onshore listing requirements, and boosting trade settled in yuan.

Allowing the opening of crypto markets could, of course, encourage more flows out of yuan, which the Chinese authorities would understandably prefer to avoid. But if crypto assets and the innovation they bring are going to be key to the development of the financial markets of tomorrow, then China would obviously want some influence. Furthermore, China is probably watching with interest the building antagonism toward crypto from Washington DC. If the US sees crypto markets as a threat, it could be a threat worth exploring.

This is representative of the typical strategic approaches of the two economic superpowers. I once heard someone compare the relative philosophies to board games popular in each region. In the US, they play chess, where you win by killing your opponent’s leader. In China, they prefer Go, where you win by conquering and holding on to territory. It could be that Chinese leaders see crypto assets as a territory play, with global financial markets as the playing field. Rather than an enemy to be weakened, crypto markets could be a strategic pillar of a new world order, or at the very least an opportunity to attract global capital, talent and prestige.

So far this year, analysts have been focusing on macro factors as the main driver of crypto market performance, with evolving use cases and technical speculation also a feature of the recovery. It could be that a more significant driver is slowly building on the global strategy stage – specifically, in the geopolitical rivers of the east.

SOME GOOD LISTENS

A fascinating Hidden Forces interview by Dimitri Kofinas with Sir Paul Tucker on shifting geopolitics and the likely impact on the global economy.

This episode from Laura Shin’s Unchained podcast with Rebecca Rettig and Paul Grewal delivers both high-level and detail-specific insight on the recent regulatory moves.

In the latest On the Margin episode, Mike Ippolito interviews StoneX’s Vincent Deluard about the big-picture evolution of inflation and what that says about where the economy could be heading.

A compelling Odd Lots chat with a former CIA official on the Ukraine War, Russian sentiment, the potential outlook and the climbing cost.

Have a good weekend!

Nature photography is possibly even more arresting than other categories not just for the immensity and granularity of the subjects; it could also be because we seem to instinctively understand the awe-inspiring combination of technique, perseverance and luck that goes into unforgettable shots.

Last week, National Geographic published the winner of its Picture of the Year competition, and the nine runners-up – all submissions are jaw-dropping, and an uplifting antidote to the daily grind of markets, headlines and trying to make sense of it all.

(photo by National Geographic Picture of the Year winner Karthik Subramaniam)