WEEKLY, Feb 4, 2023

Market whiplash, maybe the Fed was right, BTC signals, information asymmetry, and some unrelated links because why not...

Hello everyone! Welcome to the shortest month of the year. Not that any of the other months are going to feel long, the pace at which things are moving… Things are heating up, and I hope you’re getting ready for what will likely turn out to be a particularly interesting few months. You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, pick at established narratives and share listening recommendations. Nothing I say is investment advice!

Since many of you are new here (welcome!), I’ll introduce myself again: I’m Noelle, and I’ve been writing investor-focused crypto newsletters for over six years now, first for CoinDesk and more recently as Head of Research at Genesis Trading. Now that I’m focusing on an independent research project (the topic is in the newsletter name), it felt only natural to continue.

For more detailed market updates and news commentary and narrative updates, I hope you’ll consider subscribing to the premium daily newsletter to support my work. Or take out a free trial. Or convince a friend to do so. Any would be appreciated. 😊

Some of the topics covered in the premium version this past week:

Signals from crypto volumes and fund flows

Bitcoin volatility

What’s going on with gold?

Crypto industry downsizing

Why “tech plays” should re-label

MARKETS

Markets vs the Fed

This was a dramatic week in terms of economic data.

First, the FOMC meeting on Wednesday did not deliver the expected stern talking-to regarding excessive market optimism that a rate cut was coming this year. Market conditions had been easing for some weeks: lower treasury yields, a lower dollar, a lower oil price and strong employment data all either make financing less expensive and/or put more money in consumers’ pockets. In the post-meeting press conference, Fed Chair Powell was asked whether he was worried about the market easing signals. He could have said yes, but instead waffled.

The market took this as vindication, and ripped higher. Stocks and crypto assets jumped, while yields and the dollar fell. Traders sent a clear message to the Fed that they weren’t buying it, that rate cuts were clearly coming before the end of the year, which was obviously good news. This didn’t make sense. Those of you who subscribe to the premium daily email will know that I’ve raised this issue before. From Thursday’s edition:

“If the market is right and recession indicators get louder with unemployment suddenly shooting up (the staccato of layoff announcements does seem to be getting more intense), then that would not be good news for stocks – downward earnings revisions do not seem fully priced in. If the market is wrong and the Fed does not feel compelled to give up its inflation fight, then there is the mother of all expectations adjustments ahead.”

Then came Friday’s data. US non-farm payrolls for January blew expectations of a 185k increase out of the water, coming in at a gain of 401k jobs, the most since July 2022. The US unemployment rate dropped to 3.4%, its lowest point since May 1969, below December’s 3.5% and consensus estimates of 3.6%. The possibility of a soft landing ratcheted up, underscoring that the Fed will not need to lower rates this year (and would be ill-advised to do so, because inflation could come back). Yields soared, as did the DXY, while BTC and stocks dropped.

Then something weird happened: BTC, which normally moves inversely to the DXY index, recovered without a corresponding correction in the DXY. A decoupling?

(chart via TradingView)

Friday’s drama continued: the US ISM non-manufacturing PMI for January came in very strong, at 55.2 vs 49.2 in December, much higher than the consensus estimate of 50.4. Yields and the DXY went into a tizzy (a technical term from my childhood), jumping some more. Then another weird thing happened: the DXY corrected, unwinding its second leg up, but yields didn’t. The 10-year sort of gently drifted down, while the DXY unwound its unwinding. Confused yet? The currency market sure is.

BTC seems to have had a mini-identity crisis during the macro drama. At first, the decoupling looked set to continue. But then it appeared to come to its macro senses and fell as the DXY got its second wind and continued to climb.

(chart via TradingView)

Meanwhile, rates expectations have shifted. The probability of another 25bp hike in May has doubled from 30% to 60% at time of writing (Friday night). That is significant.

(chart via CME FedWatch)

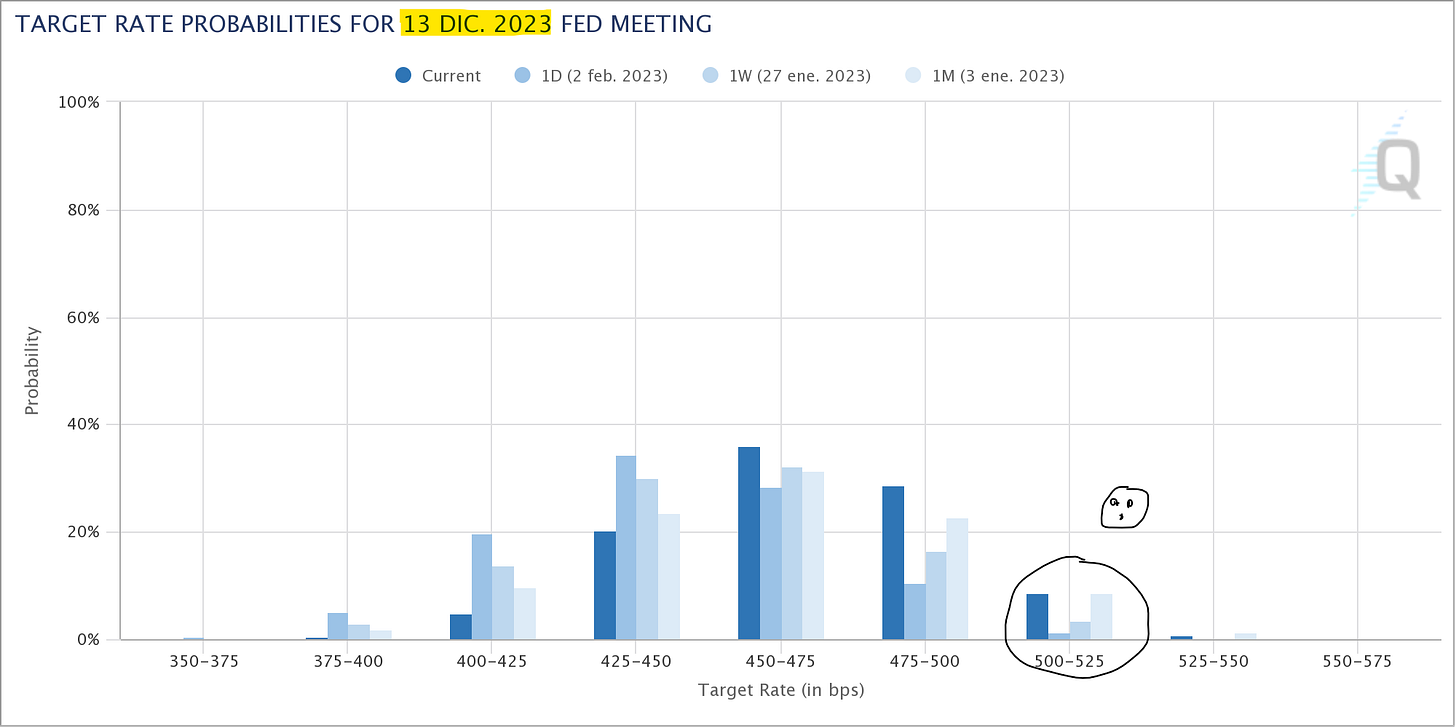

And the market’s conviction that the Fed’s consensus forecast of end-2023 rates of 5.00-5.25% has increased from virtually 0% (a strong we-don’t-believe-you signal, right?) to almost 9%. It’s not yet close to a meaningful number, but the increase itself is meaningful.

(chart via CME FedWatch)

What does this mean for crypto assets going forward? It feels like the narrative is changing. The economic schism is becoming clearer: you can’t have rate cuts unless there is a whopping recession which is unlikely to be good for stocks, so careful what you wish for. And if there is to be a soft landing, which is looking more likely, the Fed would be nuts to lower rates until it is certain inflation is not coming back. That will take a while.

Meanwhile, crypto fundamentals and technical continue to improve. Spot volumes are up:

(chart via The Block Data)

Derivatives signals are pointing to a build-up of bullish interest:

(chart via The Block Data)

And network activity continues to grow:

(chart via glassnode)

The debate has shifted from whether the bottom is behind us or ahead, to just how long will we bounce along at low levels before a wave of new investors pushes prices up again. We’ve been here before. It’s an exciting phase of the cycle.

COLUMN

Grapes in a basket of lemons: What the information symmetry of bitcoin means for markets

You’ve probably heard the story of the market for “lemons” – not the fruit, I’m talking about low-quality consumer durables. In his seminal paper, economist George Akerlof showed that information asymmetry as to which second-hand cars are good and which are “lemons” (with sellers knowing more than the buyers) ended up lowering the price and driving out the good cars, because owners of these would not sell at an unfairly low price. This in theory should push the price down even further and eventually kill the market.

The thesis has received a lot of pushback over the years, especially from people who correctly point out that the market for second-hand cars is far from dead, but it does raise an important thought experiment: what does the person I’m buying from know that I don’t know?

Akerlof’s co-Nobel prize winner Michael Spence extended this to the job market, introducing the theory of signaling and the over-reliance on credentials. Many have looked at how this impacts the stock and bond markets, and information asymmetry is one of the main preoccupations of the SEC. Asset issuers almost always know more than their target market, and when trading, sellers have different motivations (and presumably different sets of information) than buyers.

Not so with bitcoin and similar crypto assets.

With bitcoin, there is no management meeting behind closed doors to make decisions that will affect future revenue. With bitcoin, nothing gets altered without everyone knowing about it right away, and no code changes get through unless there is widespread consensus.

In this sense, bitcoin is a commodity. Wheat is wheat, gold is gold, we all know what they are and accept that their properties will not change any time soon. With bitcoin, as with wheat and gold, you know exactly what you are getting.

This matters for regulation. The SEC is right in thinking that some crypto assets should be treated like securities (such as tokens linked to projects heavily dependent on a small leadership team that hopes to extract profit from its efforts). But bitcoin has no leadership team – some may argue that the core developers are leaders, but they serve the community and do not maintain the network. What’s more, rules around financial disclosures are designed to level investors’ access to relevant information – it’s hard to imagine a more open book than decentralized blockchain networks.

Information symmetry also matters a lot for market structure. Take lending, for example. In traditional finance, borrowers have a more detailed idea of what they plan to do with the solicited funds, and this may be different than what they tell the lender, who compensates for this lack of transparency by requiring a ton of paperwork and/or applying maths to credit profiles. Even when collateral is required, there is uncertainty: is that house, yacht or painting really worth its stated valuation? The compensation for this risk shows up in the interest rate to be applied.

With crypto lending, beyond counterparty risk (painfully relevant these days), there is no information asymmetry. Open-source code can be confirmed, rightful ownership of digital bearer assets is relatively simple to ascertain, and their market value is easy to determine 24 hours a day, seven days a week, every day of the year.

Crypto collateral can be more volatile than the more traditional kind (although, these days, not necessarily). But this can be compensated for by high loan-to-value ratios. And the relative ease with which this collateral can be transferred, even programmatically via smart contract escrow should certain conditions be triggered, removes another layer of uncertainty as well as hassle.

This is a huge point. Lending based on high-quality crypto collateral has the potential to be safer, more efficient and more open than that based on traditional assets, largely because of information symmetry. What went wrong last year was lapses in risk and collateral management, often due to a lack of experience and/or oversight. We can hope that lessons have been learned and standards raised. Regulation can play a part as well, by requiring crypto lenders to publish loan-to-value and collateral handling policies.

Stepping back, we can start to glimpse how market infrastructure could evolve were it able to focus more on liquidity and service, and less on compliance requirements designed to compensate for unequal information access. As well as enabling regulators to dedicate more freed-up resources to go after intentional crime, assets with embedded full disclosure could end up lowering transaction costs and enhancing capital efficiency for savers and builders.

I am by no means suggesting that networks such as bitcoin are the solution to all the information asymmetry problems out there. I do believe, however, that the transparency, decentralization and open-source nature of some distributed systems can change how certain market-based activities are carried out, by removing layers and adding new types of simplicity.

These new systems could also end up influencing economic theory by showing that not all markets need to involve intangible expectations, and that the pricing of these expectations does not always need to rely on thick veils of trust. At a time when the “market economy” is increasingly becoming the “information economy”, transparency and verifiability are taking on ever more important roles in defining the habits of transaction.

Obviously, these are sweeping statements, and the crypto market does have its share of lemons. Some projects are run by small teams who can change token characteristics, some blockchains are not decentralized, some assets are not reliably backed and some tokens are based on untested incentives. But established networks such as bitcoin offer an alternative way of thinking about the “credible disclosure” problem, with limited technology and human risk.

So, to give high-information, high-quality assets their place in the market slang fruit basket, I thought about the opposite of a lemon. Many economists use “peach”, but they bruise easily, wrinkle quickly and I don’t much like them. I’m going to go with “grapes”. They are sweet while lemons are sour, open to the air while lemons are wrapped in protection, and firmly anchored to the vine while lemons are pretty easy to pluck. Bitcoin is a bunch of grapes.

To be honest, I don’t really see this catching on since the concept of “lemons” never made it over into the digital age anyway. But markets today are hindered by information asymmetry, ironically in an age that generates and collects more information than we know what to do with. For the first time, we now have a technology that reliably embeds simple asset information in the asset itself. The subset of assets for which this simplicity is sufficient is small for now – but its impact is already being felt in market services being built today. And its evolution could end up shaping the structure and expectations of the market services of tomorrow.

GOOD READS/LISTENS

This turned out to be an unexpectedly engaging podcast series from the Bloomberg team, covering the history of ETFs. It’s definitely nerdy, but it’s also a parable about how hard it is to get new products launched. Once they catch on, however…

A paper by researchers at Washington University in St. Louis, published last month, suggests that the pandemic stimulus checks in the US significantly boosted interest in crypto, correlating the timing of distribution with a spike in Google searches, wallet creation and trading volume. This seems to support the mainstream view that crypto markets are a casino and the stimulus checks were “house money”. At least it boosted familiarity, there’s that.

I love street art, which some might call graffiti. This FT profile of 10-foot was an insightful take on the genre. “Part of the strangeness of graffiti is that, while its writers are regularly thrown in jail, the same subculture they’ve risked their lives to preserve is being used to promote expensive trainers, boutique cafés and ‘street art’ tours… This line between commercial acceptability and criminal liability often turns court cases into chin-stroking seminars on the nature of the art object.”

I’m not sure what to think of this article from The Cut about modern etiquette. Whether or not you think “modern” applies to you (I certainly don’t, too old for that), it’s an amusing read. And I agreed with a whole lot more than I expected.

HAVE A GOOD WEEKEND!

I want to share with you some female alternative musicians I’ve been listening to on loop over the past month. Since “alternative” means different things to different people, I’ll clarify: these are three women whose music is hard to categorize, but perhaps falls more or less near “international folk”, or maybe “fusion world music”.

In no particular order, they are:

Lhasa de Sela was a Canadian-American singer/writer who was raised in Mexico and the US and divided her adult life between Canada and France. She tragically died way too young of breast cancer in 2010, but before then, well, someone should make a movie of her life. I’m not sure I’d watch it, though, because I don’t like sad movies. Nevertheless, her music is compelling, very hard to label, and a strong emotional legacy.

Ana Alcaide is equally fascinating. She heard someone play the nyckelharpa when she was on a trip to Stockholm while pursuing a degree in biology, taught herself to play the instrument back home in Toledo (Spain) because of course why not, and has since become a leading expert on ancient music traditions.

Marjan Farsad just can’t stop creating. She was born in Iran, but currently works as an animation and graphic designer in New York. She’s a phenomenal musician, singer and songwriter. She also makes animated films. This video shows the sublime combination of those two talents.