WEEKLY - Hong Kong, stablecoins and more

plus: assorted links, and a weekend recommendation

Hello everyone, I hope you’re all doing well! As always, summer is going by way too fast, no matter how much I try to “slow down” and enjoy the sunset. Maybe I’m not doing it right…

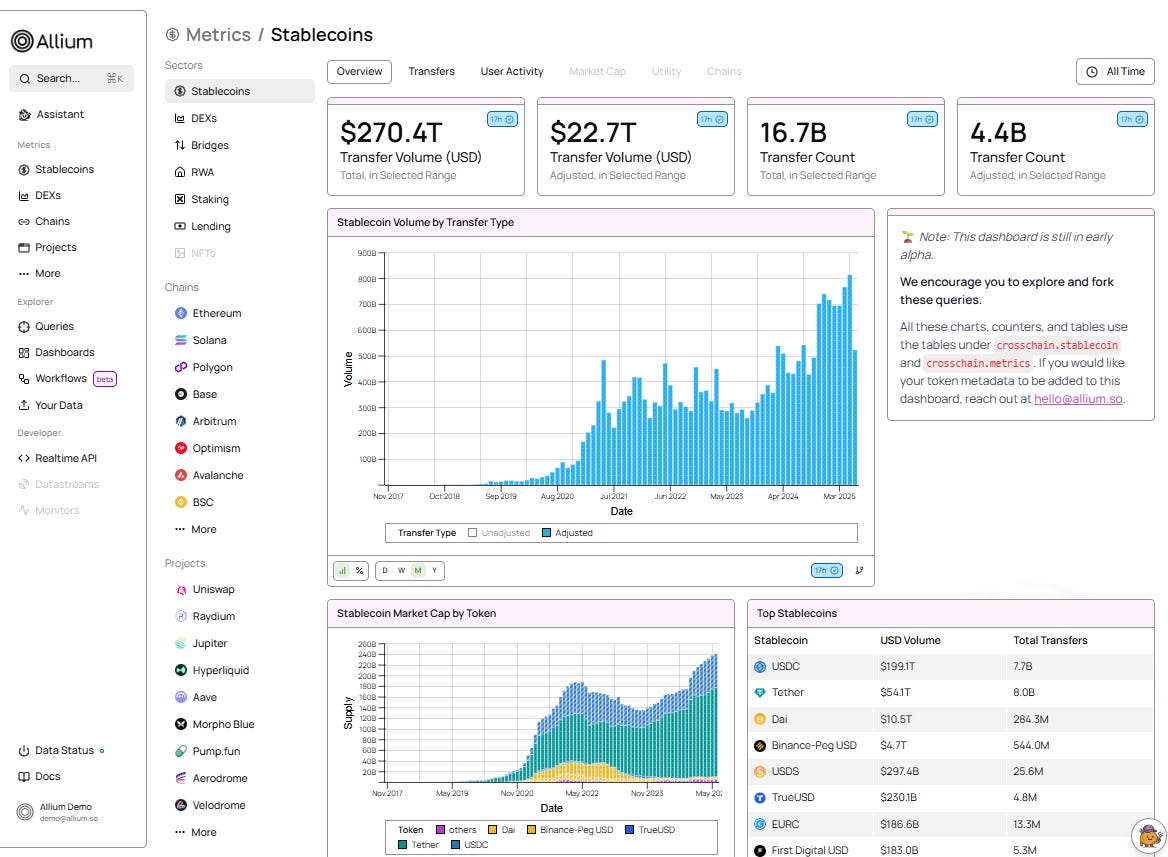

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

You’re reading the free weekly Crypto is Macro Now, where I reshare/update a couple of posts from the past few days, offer some interesting links I came across in my weekly reading, and include something from outside the crypto/macro sphere that is currently inspiring me (it’s a fascinating world out there).

In this newsletter:

Hong Kong’s stablecoin geopolitics

Assorted links: time perception, book banning, privacy, evolving ideologies and more

An epic film recommendation

Some of the topics discussed in this week’s premium dailies:

Coming up: trade data, Fedspeak, jobs outlook, Japan’s plenary

NFPs: the drama and the overreaction

Market reactions

Hong Kong’s stablecoin geopolitics

Macro-Crypto Bits: market narratives, factory output and more

Permissioned stablecoins: why?

Macro-Crypto Bits: Japan, stagflation, IPOs, markets, staking

Why the tariff chaos matters for crypto

Switzerland: decentralization brings stability but at a cost

Developer liability: why it matters

Hong Kong’s stablecoin geopolitics

On Friday, global stablecoins took a step forward. I’m not talking about developments in the US, although there’s plenty of progress there. Rather, I’m looking at the other side of the Pacific, where Hong Kong has joined the small set of jurisdictions with active stablecoin frameworks.

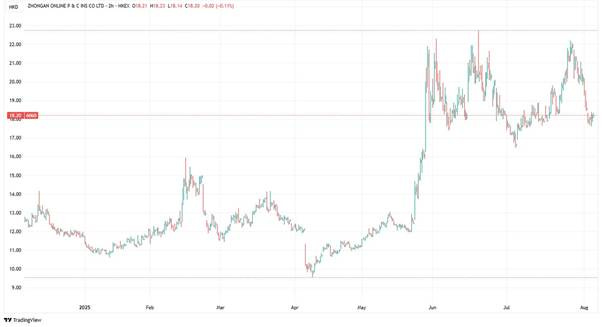

A month ago, I wrote about South Korea’s stablecoin frenzy, with share prices of contingent listed businesses soaring amid probably misplaced expectations of usage windfalls. Hong Kong has seen similar levels of froth, prompting two official warnings about bubbles over the past month from Hong Kong Monetary Authority (HKMA) CEO Eddie Yue Wai-man. For instance, ZhongAn Online P&C Insurance surged 80% over the past three months due to a subsidiary’s 8.7% stake in HKMA sandbox participant RD Technologies. LianLian DigiTech, RD’s partner, was also up 80% in the same period.

(ZhongAn Online P&C Insurance stock price on HKEX, chart via TradingView)

Last week, Yue tried to walk back expectations, explaining that there will be very few stablecoin licences granted and probably only to those who have participated in the sandbox. That’s a small subset of three: 1) a consortium including Standard Chartered, blockchain property rights innovator/investor Animoca Brands, and HK Telecom; 2) Jingdong Coinlink (a subsidiary of China’s ecommerce giant) and 3) as mentioned above, Hong Kong-based stablecoin issuer RD Innotech. And the first licenses probably won’t come until early next year.

Hong Kong does have history of going slowly with crypto-related authorizations. Its crypto asset framework went into effect in June 2023, and more than two years later, only 11 licenses have been issued, although as of earlier this month, it was reportedly processing nine more.

Yet there’s more at stake with this new license category in terms of geopolitics: mainland China is getting increasingly interested in stablecoins backed by the offshore yuan.

In June, Peoples Bank of China Governor Pan Gongsheng mentioned stablecoins and smart contracts in a speech at a finance forum in Shanghai, acknowledging the challenges to financial regulation but also recognizing their potential to improve cross-border payments. Reading between the lines, he essentially confirmed that stablecoins were being studied in Beijing.

The following week, a party media publication called for the development of yuan-backed stablecoins “sooner rather than later”.

Also in June, Hong Kong’s Secretary for Financial Services suggested in an interview that stablecoins could facilitate fund transfers within China’s global infrastructure “Belt and Road” strategy, which involves loans and infrastructure investments in developing economies.

In early July, the Shanghai branch of the official overseer of state-owned assets urged organizations to explore the potential role of stablecoins in trade.

And, speaking to a financial news outlet, a central bank adviser singled out Hong Kong as a more likely jurisdiction for the issuance of yuan-backed stablecoins than the mainland, due to capital controls.

Mainland businesses are starting to look into this.

In June, the founder of Chinese e-commerce giant JD.com spoke about the company’s multicurrency stablecoin strategy and how it could reduce cross-border transaction costs by 90%. Its Hong Kong subsidiary Jingdong Coinlink is one of the three participants in Hong Kong’s stablecoin sandbox, and is likely to be one of the first to get an official issuance license for tokens linked to the Hong Kong dollar and possibly also the US dollar. The entity has already registered the trademarks for Jcoin and Joycoin.

Ant Digital Technologies, a subsidiary of mainland tech giant Ant Group, has also declared an intention to apply for a stablecoin license even though it is not part of the Hong Kong sandbox.

In early July, North King Information Technology, a Beijing-based fintech services provider that built billing systems for China’s digital yuan, has announced a strategic partnership with Hong Kong-based GoFintech Quantum Innovation to develop stablecoin and tokenization infrastructure.

A couple of weeks ago, ChinaAMC (HK) – the Hong Kong arm of one of China’s largest asset managers – launched the first yuan-denominated tokenized money market fund. In a briefing, the international subsidiary’s CEO said that this was part of the parent’s stablecoin strategy, offering an interest-bearing complement to yuan-backed payment tokens.

And last week, stablecoin developer RD Technologies announced a US$40 million raise led by the ZA Group, controlled by China’s ZhongAn Insurance and parent of Hong Kong’s first and largest digital bank.

So, stablecoin interest is heating up, and Hong Kong will most likely soon be joined by other Asian nations in passing regulation to control risk and reassure institutions.

But the early interest carries even more weight given the region’s role as a global trading hub.

Building on its location, history and relative financial independence, Hong Kong is generally seen as a gateway for foreign capital into China. It is the world’s largest renminbi (RMB) hub outside of China, with massive cross-border flows. It is also the second largest trading partner for the Association of Southeast Asian Nations (ASEAN), behind mainland China.

The 2025 Global Financial Centres Index (GFCI), which ranks global financial centres taking into account a long list of factors including market liquidity, economic output, political stability, innovation and human capital, has Hong Kong in third place overall, behind New York and London but ahead of Singapore. In both finance and investment management, Hong Kong ranks #1.

(table via GFCI)

What’s more, Hong Kong’s economy is more influenced than most by cross-border transfers. In 2024, its exports reached 182% of its GDP, while the global average is just under 45%.

So, where better to harness the cross-border efficiency of onchain payments?

Also, Hong Kong has always been a multi-currency hub. While the US stablecoin initiative will be focused on dollars, that of India is focused on rupees, etc., the Hong Kong regulation allows for the issuance of stablecoins backed by any fiat currency, as long as the reserves are 1:1. To start with, licensed parties will most likely work on Hong Kong dollar assets, perhaps also tokens backed by US dollars. But, with mainland China’s collaboration, we will eventually see renminbi/yuan stablecoins.

Won’t these compete with the digital yuan? Yes, they will, but the PRC will probably be ok with that. The main objective of the digital yuan is two-fold: 1) carefully internationalize the yuan, and 2) reduce reliance on US-controlled payment systems. Yuan-backed stablecoins can help further both goals, especially since many offshore trading counterparties may be more comfortable trusting a private issuer than the Chinese government.

This could become especially important as Hong Kong flexes its muscles in asset tokenization. The region already has a lead in digital bonds, with the government issuing a HK$800 million (~US$100 million) digital green bond in early 2023 as well as the world’s first multicurrency digital bond and one of its largest issuances to date (US$756 million) in February 2024. In May, Guotai Junan International – the Hong Kong group of China’s largest securities brokerage, state-backed Guotai Haitong – announced plans to issue tokenized securities, mainly digital bonds and structured products. And in June, the Hong Kong government released its second policy statement on digital assets, outlining plans to broaden the range of eligible assets.

Reading between the lines, it's not just Hong Kong interested in cultivating more flexible and liquid asset markets. China has been careful about opening up its capital markets, but last year’s economic agenda-setting Third Plenum had as a key component accelerating capital markets modernization. With Hong Kong generally seen as a “testbed” for Chinese financial reforms, we can be certain the mainland authorities are watching with interest.

✨SUBSCRIBE✨

If you’re not a Premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

ASSORTED LINKS

(A selection of reads I came across this week that I think are worth sharing, not always about crypto or macro. I try to choose links without a paywall, but when I feel it’s worth making an exception, I specify.)

Gurwinder Bhogal writes about what social media app design has to do with casino floor plans and right angles. Going deeper, his piece is really about how one of the more sinister aspects of social media is the manipulation of our perception of time, which eventually makes disorientation the default state. And it’s a reminder of what we lose when we fret that time is flying by. (How Social Media Shortens Your Life, The Prism)

Ted Gioia writes about the motivational harm done by music lessons, which typically take the fun out of one of life’s universal joys: creating melodies and rhythm. But his points can be extrapolated to education, generally. Learning is exhilarating. Lessons aren’t. Doing things is exciting. Homework isn’t. We all know this, and yet the format of schooling hasn’t changed much over the centuries – why? (Why Do Children Hate Music Lessons?, The Honest Broker)

Astute comments from Angelica Oung on the fluctuating weight of soft vs hard power in the geopolitical shifts over the past 50 years, and what that means for Russia, China, India and the US. (How Europe Fell into the Soft Power Trap, Taipology)

Book banning in the US is, unfortunately, more common than most realize. (America’s barmy battle to ban bawdy books, The Economist – paywall, but gift link)

Jemima Kelly writes with wit and pace about the UK’s self-styled “far right”, “alt right”, “dissident right” and “new right” scene – an enjoyable read that will leave you more confused than ever about ideological labels, which feels fitting for these times. (Sunday at the garden party for Curtis Yarvin and the new, new right – Financial Times, hefty paywall but a gift link that can only be used three times, stingy I know)

SEC Commissioner Hester Peirce delivered one of the most powerful explanations I have ever heard of why disintermediation matters for privacy. She cites a Supreme Court ruling that “a person has no legitimate expectation of privacy in information he voluntarily turns over to third parties”, even when we have no choice but to do so (eg. making non-cash payments, or even phone calls). And she points to the Bank Secrecy Act as an inefficient “sledgehammer” approach to stopping financial crime, deputizing private agencies and penalizing entities for not flagging absolutely everything. (Peanut Butter & Watermelon: Financial Privacy in the Digital Age, Hester Peirce)

Feel free to share this with friends and colleagues, and if you like this newsletter, do please hit the ❤ button at the bottom – I’m told it feeds the almighty algorithm.

HAVE A GREAT WEEKEND!

(in this section, I share stuff that has NOTHING to do with macro or crypto, ‘cos it’s the weekend and life is interesting)

I know I’ve made this recommendation before, but it was over two years ago, many of you are new here (hi!), and anyway it’s worth repeating. Yesterday, I re-watched the Tamil film “RRR”, easily one of the most cinematographically stunning movies I have ever seen. Plus, heroic heroes, obvious evil, uplifting love interests and a refreshing suspension of the limits of physical strength combine to deliver an epically good story.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI instead of search engines for research, but never for actual writing.