WEEKLY, Jan 13, 2024

BTC and ETH moves after the ETF approval, crypto VC funding, martial arts + baking

Hi everyone! You’re reading the free weekly edition of Crypto is Macro Now, where I update and/or re-share a couple of things I wrote in more detail about during the week. If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links.

If you’re not a premium subscriber, I hope you’ll consider becoming one! It would help me continue to explore the deepening intersection of the crypto and macro landscapes - given what’s going on in the world, it matters now, more than ever. With a premium subscription, you’ll get a daily update on relevant progress along with some market commentary and deep dives into trends, narratives, experiments, opportunities and obstacles. There are also charts, links to interesting podcast episodes and long reads, and a running commentary on some of the craziness out there.

Follow me on X at @noelleinmadrid where I share photos of gorgeous city I live in, charts, comments on headlines, and, you know, stuff depending on the mood.

Of course, nothing I say is investment advice!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

Priced in for BTC?

ETH on the move

VC funding: What I’m keeping an eye on

Some of the topics discussed this week:

Bitcoin and Wall Street: More than one milestone was reached yesterday

BTC spot ETFs: A moving and momentous dissent

BTC’s big week? Maybe not

The significance of ETF fees

The confusing BTC spot ETF data

ETH next?

Nigeria’s stablecoin experiment

The deceptive US employment data

Inflation gets stubborn

The global stakes in Taiwan

Priced in for BTC?

Well, now we know that BTC spot ETF approval was pretty much short-term “priced in” – Wednesday’s official confirmation did not trigger a notable price jump.

Nor did it trigger a “sell the news” event. The market reaction at the time was surprisingly “meh”.

(chart via TradingView)

All of us crypto watchers, however, were popping corks and getting emotional – I mean, our little kid that we knew in nappies went and got a job at an investment bank at the tender age of 15. Who wouldn’t get emotional?

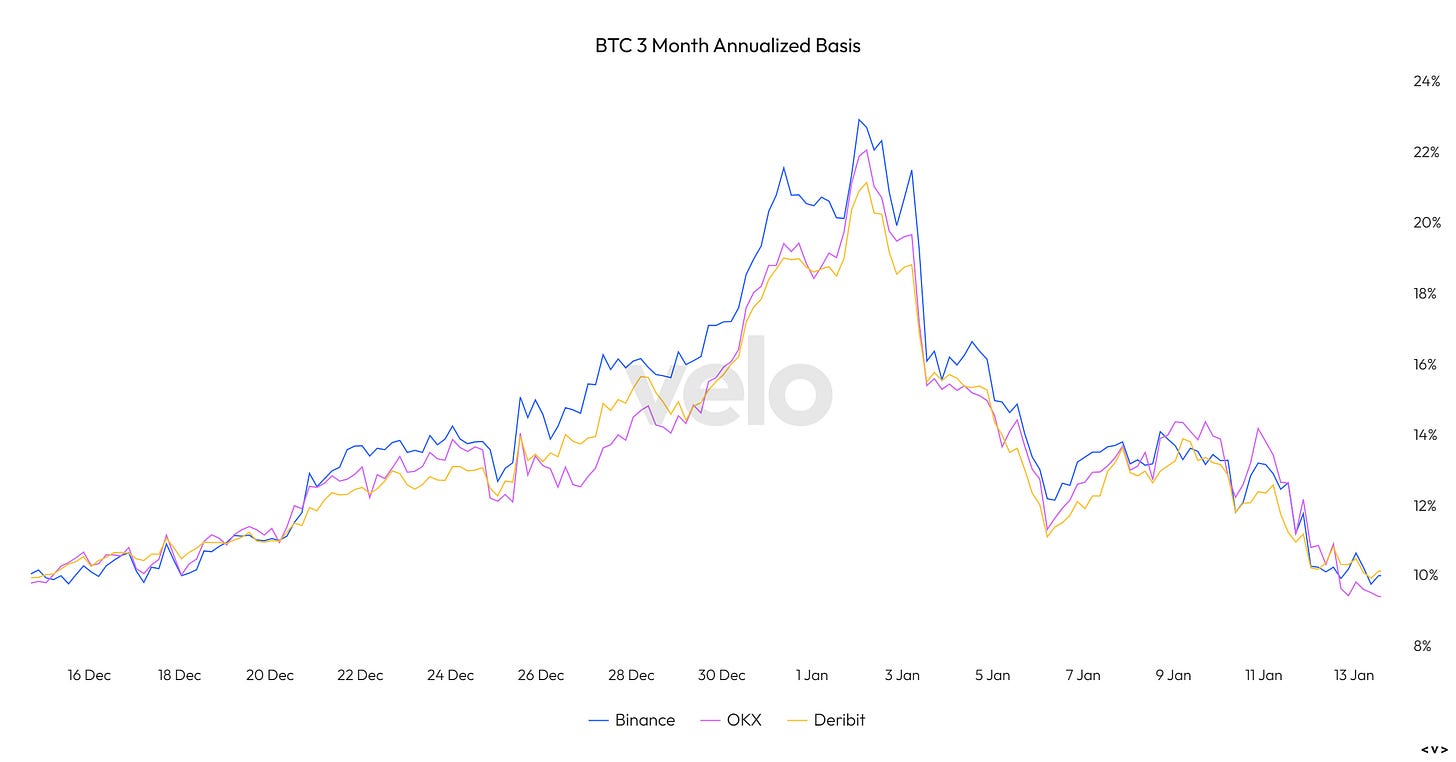

And the lack of sharp price moves on the day is good news as it suggests the market is far from “frothy”. Derivatives data confirms this. BTC futures basis (the annualized difference between spot and the 3m futures price) is back down to more “normal” levels.

(chart via velodata)

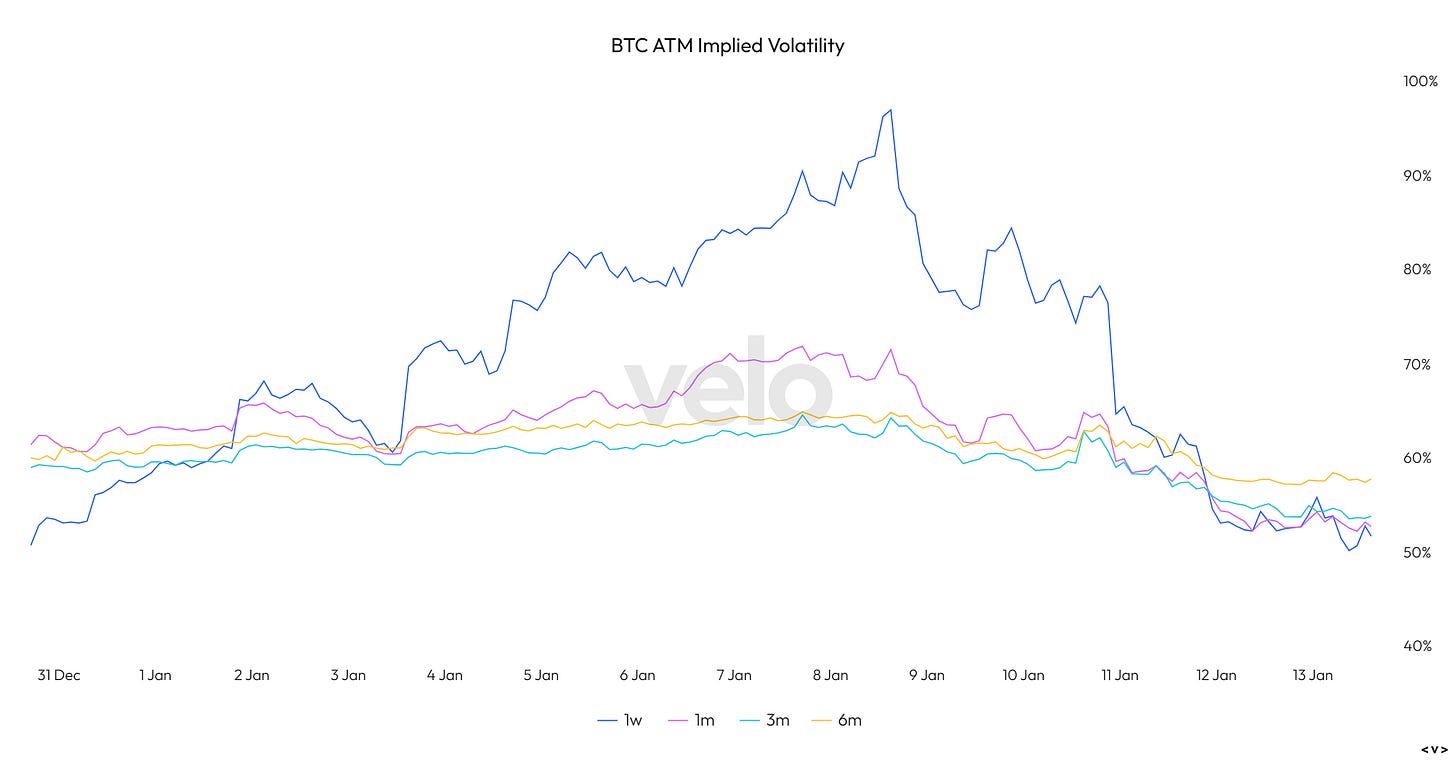

And BTC short-term ATM implied volatility (taken from options pricing) has calmed down:

(chart via velodata)

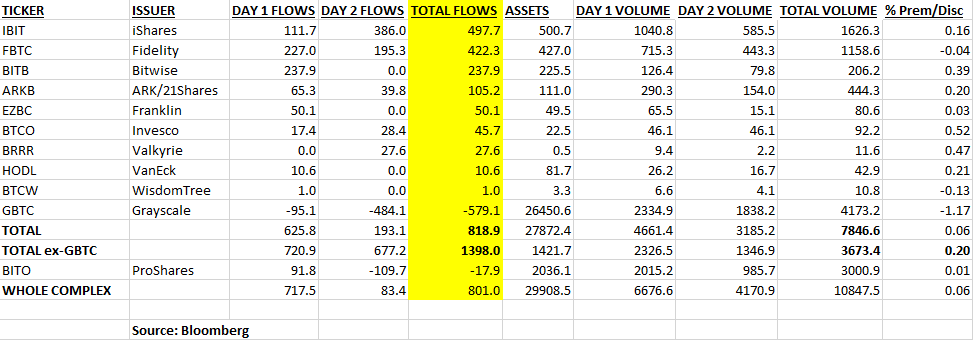

With the numbers in for the first couple of days of trading, Bloomberg analyst Eric Balchunas has calculated that the amount of net new inflow was around $0.8 billion, which is pretty impressive. This includes the $0.6 billion outflows from GBTC. BlackRock’s IBIT is currently the AUM leader with $500 million, followed by Fidelity’s FBTC at $427 million. Total volume for first two days of trading was a whopping $7.8 billion.

(chart by Eric Balchunas)

Given the $800 million of new inflow, is it weird that the price didn’t go up? No, because there was always a possibility of “sell the news” pressure from speculators who were front-running approval. BTC buying from the ETFs meant the selling pressure wasn’t that notable at first. Plus, it’s very unlikely that all the outflows from GBTC went back into BTC, either spot or via the ETFs – many speculators had been buying GBTC in recent months to speculate on the price-NAV gap closing, they are likely to just take profits. Yesterday’s price slump was likely a result of the GBTC redemptions being sold.

So, now what? The new funds are likely to continue to see strong inflows over the next week, as money on the sidelines is funnelled in, and as the marketing machines get going. This could be offset short-term from more outflows as speculative positions are unwound. We could also see some crypto portfolio rotation from BTC into ETH, which is the next object of ETF speculation.

ETH on the move

ETH easily outperformed BTC this week.

(chart via TradingView)

Zooming out, you can see what a sharp BTC/ETH ratio retracement this is:

(chart via TradingView)

There will be much to unpack in coming days about the narrative shift from BTC ETF speculation to ETH ETF speculation, especially as it starts to incorporate the commodity vs technology debate. Watch this space.

VC funding: What I’m keeping an eye on

This chart from Galaxy Research shows that, despite the pick-up in crypto market interest (seen in both prices and volumes) in Q4, VC funding has not yet recovered. Not only that, it reached its lowest point in three years.

(chart via @glxyresearch)

It will rebound. Many crypto businesses went quiet on the funding trail over the past year, either because they knew VCs were reluctant or because they didn’t want to do down rounds (or both). Now that the market is gearing up for an expansion of investor and user interest, smart VCs (and there are many) will start to see the opportunity again, and smart venture investors (again, there are many) will increasingly want to capitalize on not only crypto ecosystem growth but also developing synergies between crypto and other innovation areas.

The potential is somewhat capped in this cycle as 1) there is not as much easy money sloshing around as when interest rates were almost at 0, and 2) a lot of the “hot” money will chase the trendy AI opportunities. But, there is plenty of room and potential for strong VC investment growth in the crypto ecosystem. And along with that will come more hiring, more connections, more user exploration and a deeper and broader crypto industry.

This time around, I expect to see more investment in crypto growth outside the US – not just because other areas (EU and Japan to name just two) have regulatory frameworks in place, but also because crypto utility in some emerging markets is becoming more obvious. A growing number of countries are drawing up “blockchain strategies”, with government agencies moving beyond exploring to actually using distributed ledger applications.

For now, I’m keeping an eye on the crypto startup ecosystems in sub-Saharan Africa as well as Latin America. And I’m particularly excited to watch the deepening connections between crypto-as-investment and crypto-as-a-financial-rail: This year, we’re likely to see these two narratives move from competing to complementing each other.

HAVE A GREAT WEEKEND!

This week, rather than music, I have a series recommendation for you. I’m about halfway through The Brothers Sun on Netflix. It features Michelle Yeoh in a very Michelle Yeoh-like role, and as if that alone weren’t enough, the very first scene manages to weave together martial arts and baking, two of my favourite screen themes. I’m generally not a fan of dark humour, but the first few episodes had me chuckling out loud and recoiling in equal parts. Throw in a great soundtrack, creative camerawork and a tight script, and you get an utterly original recipe for what is essentially a story about family.