WEEKLY, Jan 14, 2023

Hello everyone! So, this is a nice change – markets were weirdly flat there for a while, which is even worse than negative sentiment. Now we can feel a new mood in the air.

You’re reading the free weekly Crypto is Macro Now newsletter, where I look at markets and narrative shifts that shape how our industry interacts with the macro economy. The premium daily version of this newsletter dives deeper into market drivers and news that highlight the growing overlap between the crypto and macro ecosystems. I never give investment advice, nor will you see protocol reviews or app recommendations. You will get insight into how crypto is impacting the world we live in, and where this could lead. If you’re interested in keeping up with shifts in adoption, regulation and perception, I hope you’ll consider subscribing.

Some of the topics discussed this week:

Economic expectations bias

Crypto as a “levered” macro bet

Central bank mandates

What BTC transaction trends are telling us

Crypto bans + layoffs

MARKETS

Some economic cheer?

It feels incongruous to be even thinking about good economic news after the year we’ve all had, with a land war still raging in Europe, the pandemic not exactly over and the fed funds effective rate a good 4% higher than in January 2022.

But, this past week we saw University of Michigan consumer sentiment survey data show surprising improvement, EU industrial production come in much stronger than expected and US inflation deliver some pleasant surprises.

(via Investing.com)

On the inflation data, the biggest surprise for me was the continued slowdown in core inflation. At 5.7% year-on-year it is still high, however – but the annualized three-month moving average of inflation minus energy, food, shelter and used vehicles (a good measure to detect momentum) is now pretty much at the Fed’s goal of 2.0%.

(chart via The Overshoot)

What’s more, a key factor in official inflation expectations is wage growth. According to an index compiled by the Atlanta Fed, the three-month moving average of median hourly wage growth is also heading down.

(chart via the Atlanta Fed)

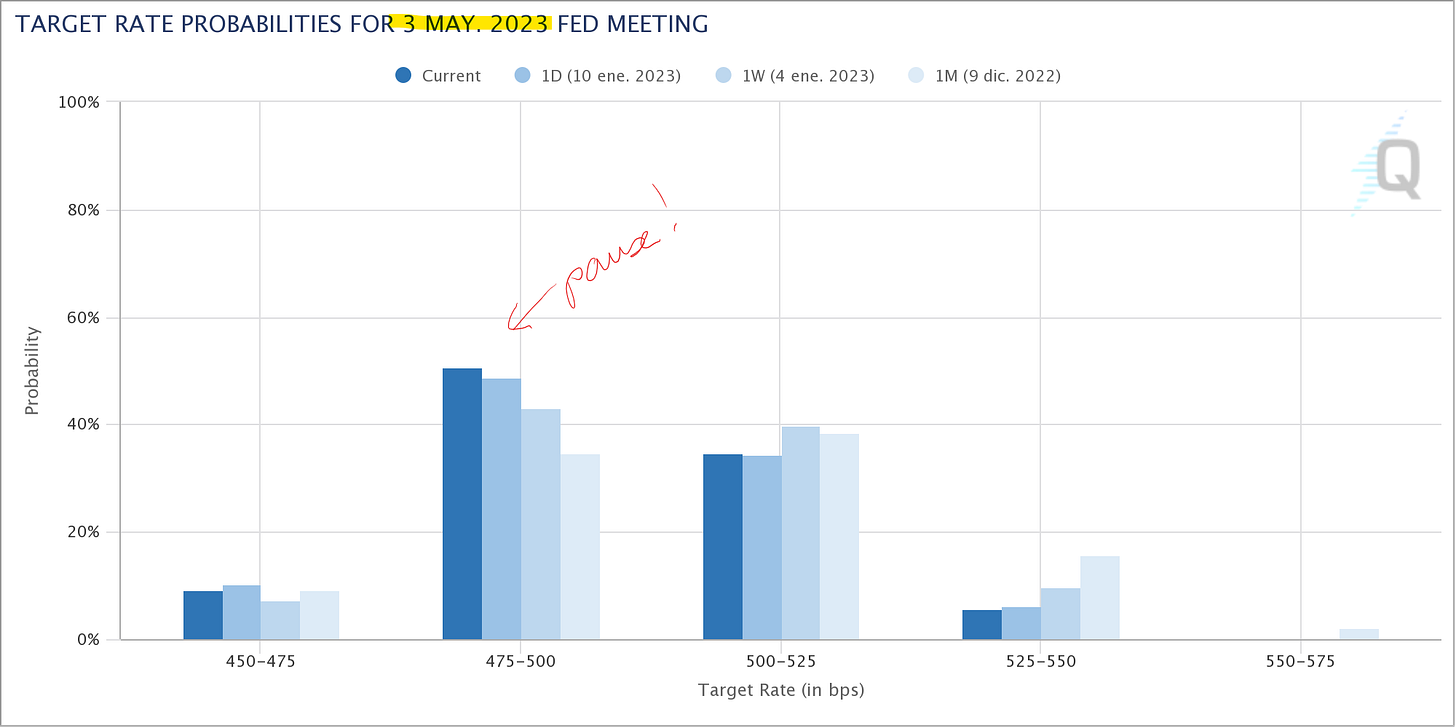

Fed officials are not going to be swayed by these results just yet – Powell has often stressed how they will focus on trends. However, these are so far heading in the right direction, and the Fed chair’s vow to be “data dependent” could push the committee to consider a pause in H1. CME futures pricing signals a 25bp hike in February, another in March and then a pause in May. The market and the Fed disagree on the direction after that, however, with fed funds futures markets signaling a cut before the end of the year while a total of zero fed officials expects the same.

(chart via the CME FedWatch, taken Jan 11)

A sentiment awakening

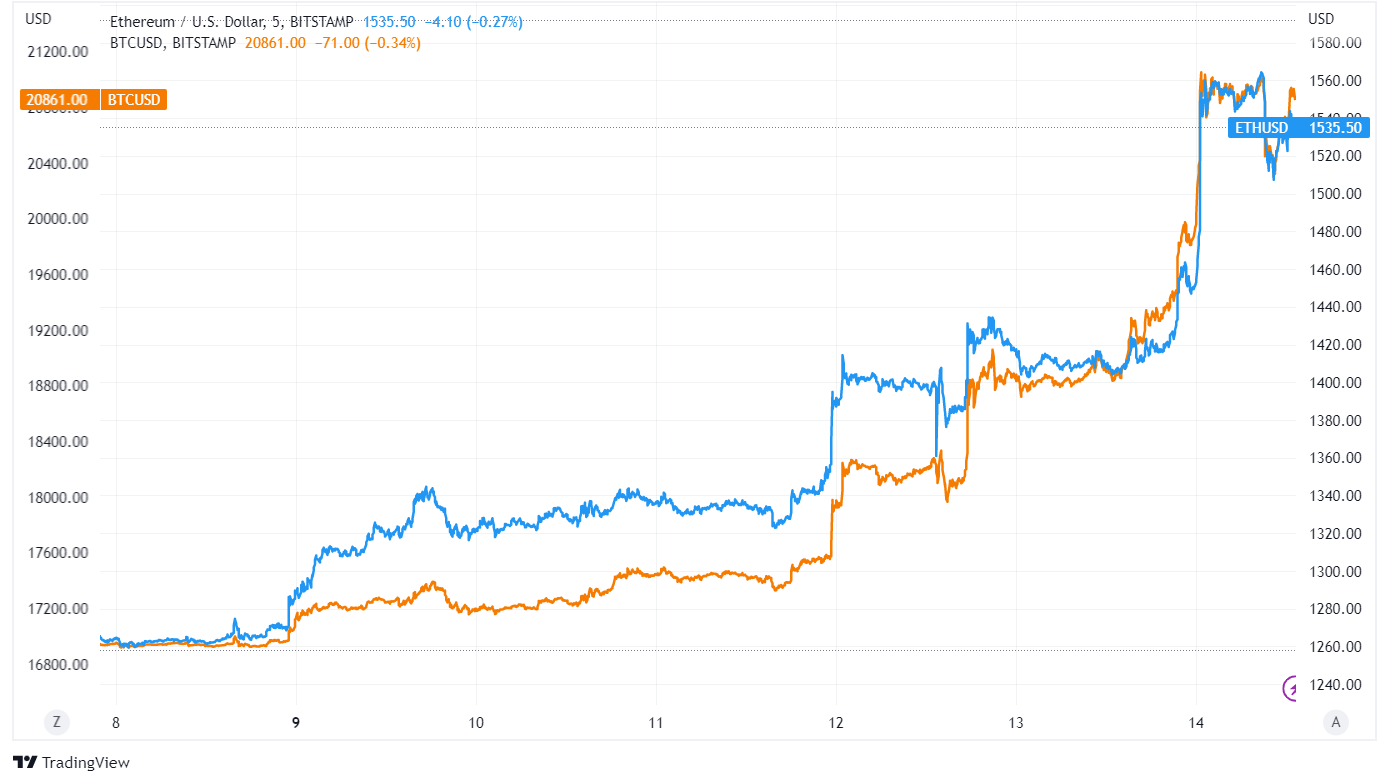

The crypto market seems to like this, understandably. BTC and ETH rose more than 20% on the week, respectively, easily outperforming the S&P’s pretty good 2.7%.

(chart via TradingView)

It’s not just the acceptance that peak inflation is behind us and that rates probably don’t have that much further to rise. It’s also that most sellers have been flushed out of the market. Signs of seller exhaustion include:

The absence of further drops on bad news

Low and flat trading volume

Recent record low realized and implied volatilities

More volume on drops than on spikes

A whopping 75% drawdown in the rear-view mirror

While much of the move over the past few hours can probably be attributed to a short squeeze (short liquidations late yesterday were the steepest in months), the trigger seems to have been an uptick in buying interest in a thin market. Spot and derivatives volumes had started improving, implied volatility was waking up, and liquidations at first were relatively muted.

Who then, is buying? It seems that large players are tentatively coming back into the market.

The open interest of BTC futures on the CME (the “institutional” derivatives exchange) in native units has almost recovered end-of-year levels.

(chart via Coinglass)

Looking at the trajectory of transfer volumes in BTC terms (blue line), we can see that most of the increase comes from larger orders which are pulling the mean up (orange line) while the median (mid-point of transfer volumes, green line) continues to drop.

(chart via glassnode)

And a glassnode index that tracks the size of on-chain transfers overlaid onto price shows that the bulk of recent moves have been from larger addresses (dark purple/red dots).

(chart via glassnode)

There is still a considerable uncertainty overhang, and next week could bring more contagion-related bad news. Plus, short squeezes generally unwind. But FOMO is likely to play a role in how the market evolves from here, and it has been quiet for long enough for many to wonder if it is time to start accumulating again. The market is still thin, so any move in either direction could be swift. Investors are probably now weighing the relative probabilities as to whether it will be up or down.

ETH withdrawals

Last week’s Ethereum developer call signaled strong progress toward the Shanghai upgrade, which will enable stakers on Ethereum’s Beacon chain to withdraw their tokens. Developers decided to leave all other adjustments to Ethereum aside in order to focus on enabling withdrawals, which should speed up the timeline. Staked ETH withdrawals are currently being tested, and developers aim to launch public testnets in February with a tentative mainnet launch for the upgrade in March.

There has been some concern that this will lead to a flood of sell pressure as stakers withdraw their holdings and send them to exchanges. In my opinion, this is unlikely for the following reasons:

Staking will be gated, with a maximum of approximately 43,000 ETH allowed to exit per day – at this rate, it would take around a year for all staked ETH to be disposed of.

Most sellers at these prices would do so at a loss. It’s probable that many would choose instead to wait until the market picks up – and a rising market does tend to influence investor decisions toward holding on a bit longer.

Liquid staking protocols such as Lido, Coinbase and Rocket Pool enable ETH holders to both benefit from staking yields and the opportunities presented by DeFi applications that accept the liquidity tokens.

In other words, there may be some staking participants that decide to rush for the door, but it is unlikely to be a meaningful percentage, and the flood will probably be more like a trickle. We could even see a net inflow of ETH to stake as users feel more comfortable with the staking flexibility.

COLUMN

Crypto Technology’s Impact Goes Beyond Crypto Technology

After the drama punctuated by doldrums (or is it the other way around?) of 2022, many of us glass-half-full types have been welcoming the opportunity to focus less on market moves and more on the impact that the continued development of crypto technology can have on the world. And it’s potentially a pretty big impact, nothing less than the spreading of economic opportunity and individual empowerment while re-wiring finance and culture, so it certainly deserves more attention. But when we talk about focusing on the technology, we generally mean ways to store and distribute information on networks with varying degrees of decentralization, which in turn will power new forms of engagement and economic activity. What is still largely overlooked is the potential that crypto technology has to support innovation in other areas of development. In short, the impact of what we are collectively working on will be felt well beyond blockchains, finance and culture.

The root of this influence lies in crypto markets. This may sound surprising given the devastating losses, bad actors, painful exploits and regulatory clampdowns defining the markets of recent months. It may also appear incongruous given the “institutionalization” of market experimentation, with banks and official organizations testing familiar forms of issuance with new types of settlement – hardly the technology boost I’m referring to. To pull on this thread a bit more, I need to take a step back in time.

Newcomers to the manic world of crypto markets may not be aware of their origin. The first peer-to-peer crypto trades were done on what were essentially online bulletin boards – low cost, easy to spin up, with a high degree of trust required. These evolved as demand grew, but early iterations were still rudimentary, uncoordinated and making it up as they went along. Then they started to get more sophisticated, especially as professional investors got interested, and today they are a complex amalgam of services, structures and best practices designed to support a considerable flow of funds throughout the system.

They are not nearly as complicated as traditional exchanges, however. In part it’s due to simplified settlement and storage. In part it’s because, while tendrils now extend into traditional finance, crypto platforms still operate largely in a niche area that regulators have yet to fence off with volumes of rules. What’s more, they are easier to spin up in a variety of configurations, such as centralized order book, decentralized liquidity pool or an as-yet-untested new structure. That relative flexibility, not enjoyed by traditional exchanges, is one of the crypto ecosystem’s superpowers.

It does introduce risks: the often-lamentable lack of transparency as to the good faith of platform operators, the absence of regulatory protection, hacks as well as code errors are just some that come to mind. But as familiarity grows, technological solutions improve, interfaces evolve and regulators start paying more attention, many of these can be mitigated. Innovation is about focusing on potential while implementing safeguards – and here is where the flexible structure of crypto markets comes in.

The relative ease with which blockchain-based protocols and applications can raise funds by creating tokens and distributing them to users and/or investors is by now well-known. “Initial coin offerings” (ICOs) drove the hype bubble of 2017, with harsh lessons learned in the subsequent shake-out. Since then, however, tokens have often worked in tandem with equity stakes to kickstart or boost economic activity on new layer-1s, decentralized applications and creative initiatives.

Blockchain-based fundraising for blockchain-based projects, we get that. What we are overlooking, though, is the potential crypto has to support fundraising and engagement for other, unrelated technologies, and what’s more, it can do so almost anywhere given crypto market structure flexibility.

Imagine this:

A regional bank in Luanda sets up a platform that tokenizes tranches of loans to startups aiming to bring digital efficiency to Angola’s ports, mitigating lender risk by adding liquidity and thus lowering the financing costs.

An incubator in Addis Ababa works with the Ethiopian Ministry for Innovation and Technology to develop an exchange for the trading of equity-like tokens issued by exiting startups with ideas ranging from vertical farms to satellite launch sites.

A venture fund in Accra works with the Ghanaian stock exchange to launch a crypto platform that facilitates token-based fundraising, ICO-style but with official oversight and sufficient disclosure, helping projects from telehealth to e-learning get off the ground and find a market.

Politicians across the developing world can be heard touting the importance of technology on economic growth, but few actually implement policies that move the funding needle. Raises outside the usual hubs tend to be small as pools of capital are less abundant than in the developed world and as the target demographic is often more limited in size given geographical as well as network restrictions. But this doesn’t need to always be the case. More liquid, transparent and innovative markets could kickstart regional development, especially if cross-border investment is allowed, possibly leading to tech initiatives that are global in scale.

Obviously, digital ledger platforms are not essential for this type of fundraising. Startups have been closing rounds, banks have been lending and grants have been funneled without them so far. But the transparency and immutability of public blockchains could give additional assurances to lenders, investors and startups, eventually encouraging more interest from a greater range of participants. And they are easier to spin up than traditional exchanges, lowering time- and cost-to-market.

Now, I’m not a trading systems engineer or a blockchain developer, so there are parts of this framework I’ll probably get wrong, but the rails on which the assets move already exist, and on-ramps are not as hard to design now as they were a few years ago. Platforms have emerged that essentially offer a plug-and-play back end for exchanges, and the ecosystem has evolved to allow a degree of modularity in constructing the necessary stack of services – wallets, custody, KYC, staking, tax accounting and more. The complicated part, I imagine, would be connections to banks or payment services, but the growing use of stablecoins can provide a stopgap while the market adjusts.

What of the regulators? Obviously, they’re going to want to have some say as to user protection, fund flows, foreign influence, etc. And anything new means risk, which regulators don’t like. But improved funding channels for local technologies that could boost employment, tax revenues and regional status while offering transparency as to asset distribution shouldn’t be too tough a sell, especially as governments change and/or are increasingly influenced by younger voters eager for the opportunity to work on progress. There could also be pressure from local institutions eager for a broader variety of assets with which to construct portfolios, as well as excitement from retail investors less risk-averse than the norm in more developed financial systems with more stable currencies and more readily available savings vehicles.

This is possibly naïve, because change is hard. But change is happening anyway, not just in local demographics, economic priorities and political sentiment. We are witnessing the reshaping of spheres of dependence, at a time when new tools of independence are gaining in resilience and reach. Fundraising and engagement farming examples set in areas with sophisticated financial systems will no doubt be noticed in regions searching for a new status. They will also be encouraged by bright minds outside the typical hubs who are pushing for progress on projects that could end up contributing to human development. Crypto’s market flexibility is about much more than the ease with which tokens can be spun up, purchased and transferred – it is about facilitating economic activity in all areas. In sum, it is a superpower with a potential impact that goes well beyond its initial remit.

Good reads

Podcast: Empire – I’ve listened to many, oh so many, 2023 predictions episodes, and can say that this was the one I found most interesting so far – with Brevan Howard’s Colleen Sullivan and Peter Johnson.

Podcast: Odd Lots – this was a personable and informative debate on economic signals and roadblocks, with Neil Dutta, chief economist at Renaissance Macro Research, and Bloomberg columnist Conor Sen.

Mario Gabriele’s take on tech and crypto trends to watch out for in 2023 is a good read.

A visit to the Virunga wildlife park in eastern Congo (DRC), which largely funds itself through hydro-powered bitcoin mining. Plus, great reporting and an astonishing story.

Have a good weekend!

I subscribe to a ton of newsletters. Soooooo many. I don’t get to read them all every day, although I do try to at least give them a skim and then spend more time on the ones that are relevant to what I’m thinking about at the time.

Most, unsurprisingly, are crypto- or markets-related. But I do have a few cherished subscriptions that have nothing to do with these subjects. I value them for the breadth and the break they offer, and they’re all fun and uplifting reads. These ones I do not skim, and I learn something every time.

The Marginalian – Maria Popova is one of the most learned, thoughtful and prolific writers I have come across – her holistic approach to art and the search for meaning manages to be moving, eye-opening and grounding without feeling at all preachy or pedantic. An oasis of calm in the torrent of news we live in, and a refreshing reminder of how beautiful and complex life is. (Not paywalled, but Maria sure deserves a donation.)

Foreign Exchanges – an eloquent yet condensed and personable round-up of what’s going on in the world with virtually no focus on economics or markets. There is, however, a fair amount of who’s fighting with who, who is not voting for who, and which leader is visiting which country. Plus, some cool history tidbits here and there. (I pay for this one, well worth it, in my opinion.)

Flow State – this delivers, early in the morning, a music recommendation for the day. It focuses on music to accompany the kind of work that requires focus, and I’ve discovered many new jazz favourites here.

After School – fun updates on Gen Z culture that serves as an eye-opening reminder about how radically culture can change in just a generation – and I say that with fascination and admiration.