WEEKLY, Jan 21, 2023

How we misunderstand "trust" and "values", what the US debt ceiling means for BTC, why the dollar is likely to keep heading down, and more...

Hello everyone! With the flow of big-picture thoughts from the snowy mountains of Davos to the bustle of courtroom drama as crypto contagion continues to play out, this week felt particularly picturesque. Colourful images don’t necessarily add much to progress, however, and I continue to believe that the flashy story lines say very little about where either the macro or crypto markets are heading. We can learn much more by reading the data, noting the funding, watching the experimentation and asking good questions.

You’re reading the free weekly Crypto is Macro Now newsletter, where I look at markets and narrative shifts that shape how our industry interacts with the macro economy. The premium daily version of this newsletter dives deeper into market drivers and news items that highlight the growing overlap – there’s also a daily quote, incongruous sketches and sometimes article/podcast/book/music links. I never give investment advice, nor will you see protocol reviews or app recommendations. You will get insight into how crypto is impacting the world we live in, and where this could lead. If you’re interested in keeping up with shifts in adoption, regulation and perception, I hope you’ll consider subscribing, or taking out a free trial.

Some of the topics discussed this week:

On-chain trails

Crypto optimism

Stock market nerves

Follow the developers

To all those observing the Lunar New Year, I wish you and your family health, happiness and prosperity.

Programming note: the premium daily email will not publish on Monday, Jan 23 – back to the usual schedule on Tuesday!

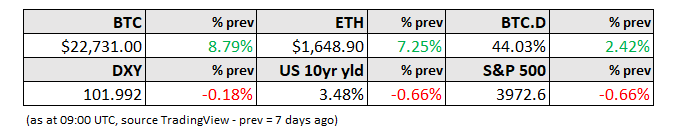

MARKETS

USD weakness

The dollar continued its downward trend this past week, and this is significant not only for the macro landscape but also for the BTC price.

The DXY index, my preferred dollar tracker (mainly for convenience), on Wednesday reached its lowest point since June of last year – it has since rebounded slightly, but is still more than 10% off its October highs. Given the strain a rising dollar placed on emerging market net importers with dollar debt as well as the hit to investment in these economies, this correction comes as a huge relief and is one of the main drivers of the walk-back of dire predictions of economic doom we were wallowing in last year.

(chart via TradingView)

What is behind the continued decline?

In part, it’s because many key commodity prices have been coming down. Oil is below its level on the eve of the Ukraine invasion. So is wheat. Natural gas is back to mid-2021 levels. This impacts the demand for dollars.

Also, the market is discounting peak US rates in 2023, with fed funds futures even pricing in a cut before year end. This impacts the expected return from holding dollars.

Recent economic data in the US and EU has stoked hopes of a soft landing which, combined with China’s reopening and the decline of the US dollar (virtuous circle, anyone?), is mitigating fears of a harsh global recession and the need of a “safe haven” currency.

Concerns are starting to circulate about the US federal debt ceiling which could cause treasury market volatility, further weakening the dollar’s “safe haven” support.

And cracks are appearing in the dollar’s role as the global reserve asset. Eight of the top 10 foreign investors in US treasuries reduced holdings in October. India is starting to trade with Russia in rupees and last year purchased Russian coal using yuan, and moves are afoot to boost the use of the “petroyuan” as China cements trade agreements with the Middle East.

Looking ahead, most of these trends are likely to continue and possibly even accelerate, suggesting continued declines in the DXY. Given the typically inverse relationship between the DXY and BTC, this is likely to be a support for the crypto market. Beyond the “denominator effect”, there’s the signal that the DXY sends as to expected interest rates.

Indeed, market anticipation of a rate hike pause and even a Fed pivot have been building, in spite of repeated Fed official comments to the contrary.

(chart via Bloomberg)

One overlooked aspect of what declining rates expectations does for assets such as crypto is the appeal of risk. With lower expected returns on “safe” assets such as US treasuries, investors move up the risk curve to find the return – and when nothing terrible happens, they get more confident and take on more risk. This is typically one of the main drivers of boom and bust cycles, and the recent one is no exception. Arguably, we have gone through a painful bust in crypto. Given what looks like a floor in crypto prices and the approaching peak in rates, is another boom getting started?

Debt ceiling and risk assets

One important twist in the rates narrative is the brewing crisis over the US debt ceiling. The US government has hit the limit on the amount it can borrow on a net basis until the debt ceiling is raised. Some accounting manoeuvres can be taken to keep paying holders of treasuries, such as running down the Treasury’s cash balances and delaying payments to certain government pension funds. But these can work only for a few months before they, too, are exhausted. Yellen has hinted that this could come as soon as early June. At some stage, Congress will need to raise the limit – if it doesn’t, it will end up having to default on its debt, which would be catastrophically bad for global markets.

This is not a new phenomenon – there seems to be a debt ceiling-related showdown every year. But this year feels especially prickly given the contentious positioning that has already started, and the problematic nomination of House Speaker McCarthy which resulted in the appointment of several Republican hardliners to the Rules and Appropriations Committees and his promise to use the debt negotiations to secure spending cuts.

The market is more worried about the debt ceiling negotiations than usual: US 5-year credit default swaps have spiked back to levels last seen in 2012, the tail end of a debt ceiling crisis that led to a downgrade in US debt by the S&P ratings agency (it has not yet been restored – the US currently has the same rating as Austria, New Zealand and Finland, and its debt is technically not the safest asset in the world, in spite of market perception).

(chart via Investing.com, taken on Jan 17)

Is another downgrade on the table? It’s certainly a possibility, this year more than others given the febrile nature of US politics after the mid-terms and the increasingly remote likelihood of a swift agreement.

Here is where it gets especially interesting for markets, especially for “risk assets”.

Failure to reach a swift agreement on raising the debt ceiling would obviously curtail the Treasury’s ability to issue more bonds. This decreases supply; assuming demand remains constant, the price should increase and yields drop, complicating the Fed’s monetary tightening strategy.

In theory, this yield drop could be offset by a risk premium increase, given the greater chance of a US debt default or downgrade. Only in theory, however – after the S&P downgrade in 2011, the US 10-year yield actually continued to decline since US treasuries were still the world’s “safe haven” asset, even while the US was a driver of market risk. Go figure.

(chart via TradingView)

It’s possible that any agreement will include some concessions on government spending, although this could be political poison for the Democrats. Any reduction there could end up helping to bring inflation down further, which would be especially useful given the likely difficulty of getting the acceptable rate down from, say, 4% to 2%. It’s always the “last mile” that’s the hardest.

A contentious battle regarding the solvency of the United States of America could send investors scurrying to find alternative safe havens. The gold price has been rising recently amid a spike in central bank buying, which itself could attract more participants back into the market. Of course, bitcoin does not have the same “safe haven” allure, but is seen by many as a digital alternative to gold in that it is not subject to variable monetary policy.

(chart via TradingView)

BTC and ETH sentiment pickup

The price jump in BTC and ETH that I wrote about last weekend has managed to hold, against a backdrop of growing unease around stock market valuations given the likely impact of an economic slowdown. So far this year, BTC and ETH have notably outperformed the S&P 500 and also the TLT long treasury index.

(chart via TradingView)

BTC’s implied volatility has corrected some since last weekend’s jump, but is still significantly higher than the lows of early January, hovering around pre-FTX implosion levels. According to The Block Data, the BTC funding rate on Binance, which is the rate that holders of long perpetual futures positions pay those who have short positions and is a signal as to market optimism, is now higher on a 7-day moving average than at any point since at least August (which is as far back as their data goes), signalling an uptick in bullish sentiment.

What’s more, BTC options open interest is increasing in both USD and native asset terms, with an optimistic bias – the put/call ratio of BTC’s open interest has declined over the past month given traders’ preference for long positions via calls.

There is definitely a different sentiment in the air as well as in the data.

COLUMN

Code vs values: The crypto twist on “trust”

We hear the term “trustless” thrown around a lot in crypto, and many are confused by its implications. It is a vague term with several potential meanings, depending on the context. “Directionless” means “without direction”, so “trustless” must mean “without trust”, right? Surely an absence of trust is bad?

It turns out that “trustless” is yet another term that the crypto ecosystem has appropriated and imbued with an altered definition, to refer to the lack of the need for trust. In traditional finance, we trust our banks to make our payments and safeguard our deposits and we trust our brokers to execute our buy/sell requests. In crypto, in theory, we don’t need to trust any third parties. We can transact directly peer-to-peer, leaving the code to handle the balance adjustments and verify on-chain that all is in order. This is not an absence of trust – it is an environment in which trust is not needed.

In theory, anyway. Peeling away layers, we still have to trust the blockchain as well as the interface we use, we even have to trust the miners and/or validators maintaining the network. And in buying our crypto assets from a centralized exchange or storing it with a centralized custodian, we are trusting middlemen to handle our funds fairly (unfortunately not always the case, as we have seen). If we use a decentralized app, we trust that the code has no bugs (also not always the case). Like the air we breathe, our lives are fuelled by trust, even in “trustless” systems. Our society doesn’t work without it and nor will it, no matter how decentralized we get. Trust is why contracts work, empires fall and people seek community.

It is also why the annual Edelman Trust Barometer, published every January, makes such compelling reading. Since 2000, it has been documenting the decline of trust in our society by canvassing 32,000 people across 28 countries, to gauge attitudes toward the institutions that shape the framework of our lives.

This year, the main theme is growing polarization, with respondents in the US, Argentina, Spain and others overwhelmingly checking the “extremely divided and no solution in sight” box. One of the principal drivers of this shift is the declining trust in government (seen as “unethical and incompetent”) and media (seen as “biased and misleading”).

“Business” comes across as the only trusted pillar of our society. This year’s report highlights the growing expectations the public has of CEOs. A resounding 89% of respondents expect them to take more of a stand on the treatment of employees, 82% on climate change, 80% on discrimination.

Rather than offer relief that at least one key group of institutions is still trusted, this raises many concerns. What is the purpose of business, to make profits for investors or to advocate for certain values? How political should business become, and to what extent could this hurt its growth potential?

This shift in expectations resurfaces something I touched on earlier. We can’t suppress the need for trust in our lives, and when it is damaged in one area, we look for compensation in another. But expecting businesses to step into the role of societal governance and dissemination of “truth” could end up distorting markets.

Which brings us to crypto: an easy assumption is that crypto runs on cold code rather than warm people and therefore delivers a “purer” market experience. This may be the case (no corporate decisions impacting earnings potential, leaving investors to focus on design choices), but code – especially in crypto – does embody values. Satoshi didn’t create Bitcoin to fill a void in the world’s trust map. He (or she or they, I’ll use “he” for convenience) created Bitcoin to fill a void in his trust map, expecting that other like-minded individuals would find it interesting. Bitcoin has no leaders to shape it into what its market wants, nor a marketing department to help identify what that is. Bitcoin didn’t go looking for users – its ecosystem spontaneously emerged among people who value what its code can do, and has grown as more and more people question established market and money orthodoxies.

An often-misunderstood premise of Bitcoin and similar crypto networks is that they’re code written to perform a function which makes them a tool, and tools have many uses, good and bad. Bitcoin, for example, may have been created with certain values in mind, but that doesn’t stop it from being used by those that don’t share those values.

This matters for investor expectations. Investing in crypto is akin to investing in tools, which makes crypto much more like a commodity market driven by supply and demand than a securities market driven by corporate strategy and soft goals. Yet, unlike commodities, crypto assets also embody certain characteristics that put them in the path of the “values investing” crowd, which the Edelman study showed is even larger than most of us realized. No-one has ever accused copper of having values.

It also matters in terms of regulatory assessment, surfacing a heated debate with which many in crypto are all too familiar: Should you regulate a tool, or only its uses? Knives can make food easier to eat and they can kill, yet no politician is advocating for the regulation of knife sales. However, Bitcoin (to choose an obvious example) was born with embedded anti-regulation sentiment. That warrants some concern on the part of those who see their influence waning.

All this highlights just how new crypto concepts still are, and how we have barely scratched the surface in terms of their impact on the way we see concepts such as markets, regulation and trust. It’s about so much more than understanding algorithms, data structures, securities law or economic incentives.

Reining in the gusts of philosophy, however, it’s worth questioning our trust in a report about trust, especially when a PR firm that caters to corporations tells us that corporations are more trusted than other areas of our societal framework. Whether the report’s conclusion is biased or not, probing neatly packaged narratives is a healthy exercise.

Perhaps this is the ultimate utility of the crypto ecosystem. While it continues to test use cases and expand into new market segments, it has given us more than a means to route around selective barriers and a window into a new economic hierarchy. It has also given us a lens through which to question established conventions.

As the Edelman report suggests, “values” and “trust” are important – it just may turn out, however, that we don’t understand them as well as we thought, and that the new tools in the philosophical box will nudge us to think about what they mean for us as individuals and communities. This could, in turn, lead to a deeper awareness of just how these fundamental concepts can shape the next generation of markets and transactions, and what that means for our connections with each other.

GOOD READS/LISTENS

Arthur Hayes talks about BTC and USD liquidity – the pivot is not here just yet, and CPI is meaningless.

Podcast: a Macro Musings interview with former Bank of England official Paul Tucker that offers hood insight into the outlook for the dollar as the world’s reserve currency.

Podcast: one of the most enjoyable Bankless interviews I’ve heard recently, with economist Tyler Cowen presenting a rational and concise macro argument for crypto.

Podcast: this What Bitcoin Did interview with the founder of Gridless, which is building micro-grids in rural Africa financed by bitcoin mining, just resonated – significant on so many levels.

Have a good weekend!

This YouTube series is a bit dated but totally charming, and it took me a while to realize that it wasn’t a parody. Dave Fishwick, a self-made minivan millionaire from Burnley in the north of England, wanted to help his town by opening a bank, one that would believe in people and give back to the community. Needless to say, it was much harder than he expected. It’s a refreshing reminder that there are people like Dave all over the world with noble ambition and bottomless drive who strive to figure out ways to do what they think is right. More power to them.