WEEKLY, Jan 28, 2023

A look at macro and crypto market drivers, thoughts on antiquated vocabulary, plus some read and listen recommendations

Hi all! So, the first post-2022 month is almost over. While nowhere near the scale of November and December, it has seen its share of drama, and too many of our industry colleagues lost their jobs this month – but it also feels like a month of new beginnings, with emerging clarity as to bankruptcy proceedings, corporate restructurings and market fundamentals pointing to the bottom being behind us. You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, ask some philosophical questions and share listening recommendations. Nothing I say is investment advice!

For more detailed market updates and news commentary and narrative updates, I hope you’ll consider subscribing to the premium daily newsletter.

Some topics covered in the premium version this past week:

Bitcoin network growth

Ethereum’s weird options market lethargy

Crypto indices expansion

Blockchain greenwashing

MARKETS

Competing narratives

It is frustrating that we are still, after months of back-and-forth, in a tussle as to which narrative will dominate market sentiment on any given day. Growth is holding up better than expected, which means that earnings may not need to be downgraded quite as much as some feared. Or, growth is holding up better than expected, which means that the Fed could continue to raise rates without fear of tipping the economy into a recession. Things seemed simpler back in the bad-news-is-good-news days, just a few weeks ago, when signs of impending gloom were understood to mean an upcoming pivot from a suitably cowed Fed. Now the extreme gloom seems further away, yet we are still split as to whether we should be happy or disappointed.

This week saw a barrage of economic data that surprised to the upside:

US PMIs came in stronger than expected across the board, although Composite, Manufacturing and Services still show a contraction (although with a less pessimistic measure than a month ago).

EU PMIs also came in stronger than expected, with Composite and Services showing expansion for the first time since the middle of last year.

US GDP for Q4 grew by more than consensus forecasts (2.9% annualized vs 2.6% expected), although slower than Q3’s 3.2%.

The US housing market is showing signs of having bottomed, with new home sales rising for the third consecutive month in December, notably more than expected.

The US core PCE index, Fed Chair Jerome Powell’s preferred inflation gauge, decelerated further in December with a 4.4% year-on-year increase vs 4.7% in November. The headline figure came in at 5.0% year-on-year, below expectations and notably lower than November’s 5.5%, delivering the slowest climb since 2021.

Yet:

The US Leading Economic Index (LEI) from the Conference Board fell by more than expected in December (1.0% down month-on-month vs a 0.7% drop expected and a 1.1% decline in November), flashing recession signals. The index is now down 7.4% year-on-year, the steepest drop since the beginning of the pandemic.

The US Q4 GDP growth was driven largely by 1) personal consumption, which is showing signs of slowing; and 2) a build-up of private inventories, which confirms the slowing consumption (production exceeds demand).

So, what does all this mean for US rates expectations? A 25bp hike next week is now practically a certainty, but after that, what? During the course of the week, the CME-indicated probability of another 25bp in March jumped from just below 80% to almost 90%. Meanwhile, the probability of a pause at the following meeting in May climbed slightly from 55% to 57%. Expectations of a third 25bp hike in May also climbed to 35% from 33% - but, for now, the pause is winning.

(chart via CME FedWatch)

That would be huge, especially if inflation continues to show signs of moderating. There is, of course a risk that it could pick up again, especially if oil prices continue to increase as they have been doing for most of January so far.

(chart via TradingView)

This could continue. Prospects of higher demand from China now that COVID cases seem to have peaked as well as the declining dollar making commodities less expensive are pushing up oil demand expectations. US crude oil inventories data out this week showed a much lower increase than forecast, suggesting a pick-up in buying in coming weeks. What’s more, supply could face some constraints in the short-term. On February 5, the EU ban on Russian crude imports expands to include petroleum products, OPEC+ is not expected to increase supply at the upcoming meeting, strikes in France continue to hamper refinery shipments, and a significant Angola oilfield is going offline for maintenance.

The remaining question is: which narrative will dominate? Will declining inflation pressures encourage the Fed to ease up on hikes? Will the gap between current inflation and the target, plus the risk of a resurgence, plus the relative strength of the economy, give the Fed confidence and cause to hike further? Truthfully, I have no idea, but am inclined to lean more toward the former. It is noteworthy that the futures market is assigning a 3% probability to the official forecast of a 500-525bp range for the Fed funds rate. That is a very significant disconnect.

(chart via CME FedWatch)

BTC: The onramp

The BTC price passing through $23,000 this week, and staying there, did more than push bitcoin to price levels not seen since last August – it also seemed to herald the re-emergence of upward momentum after a long winter of drops and then what seemed like no movement at all. Of course, there could be more drops ahead. But, as I’ve been saying in the daily email often over the past few weeks, the fact that prices have not been dropping on the multiple blows of bad news shows that sellers at these levels are scarce.

What’s more, there are plenty of other signs that interest is picking up.

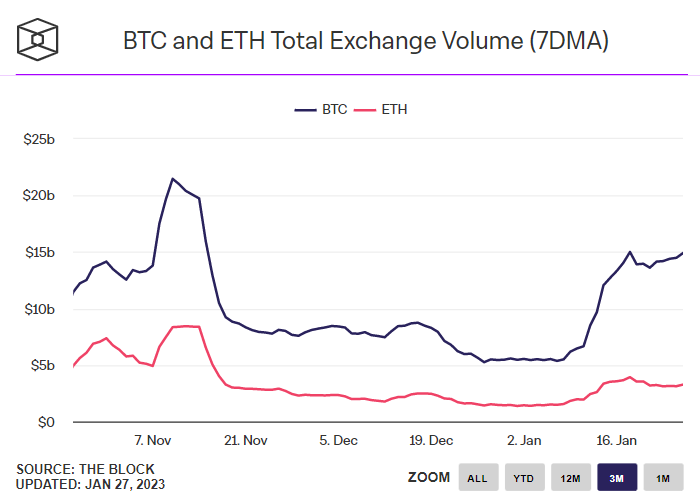

Spot volumes are recovering, especially in bitcoin.

(chart via The Block Data)

The market preference for bitcoin in this environment, also seen in the jump in the dominance index BTC.D, suggests that much of the uptick in activity is coming from macro investors for whom BTC is a gateway to the ecosystem. Were it to come largely from crypto-native hedge funds, we could expect BTC.D to decline as superior returns are sought in more volatile assets. However, more macro-focused investors seeking exposure to “crypto” more broadly would instead choose a representative asset with high liquidity and a lively and regulated derivatives market.

(chart via TradingView)

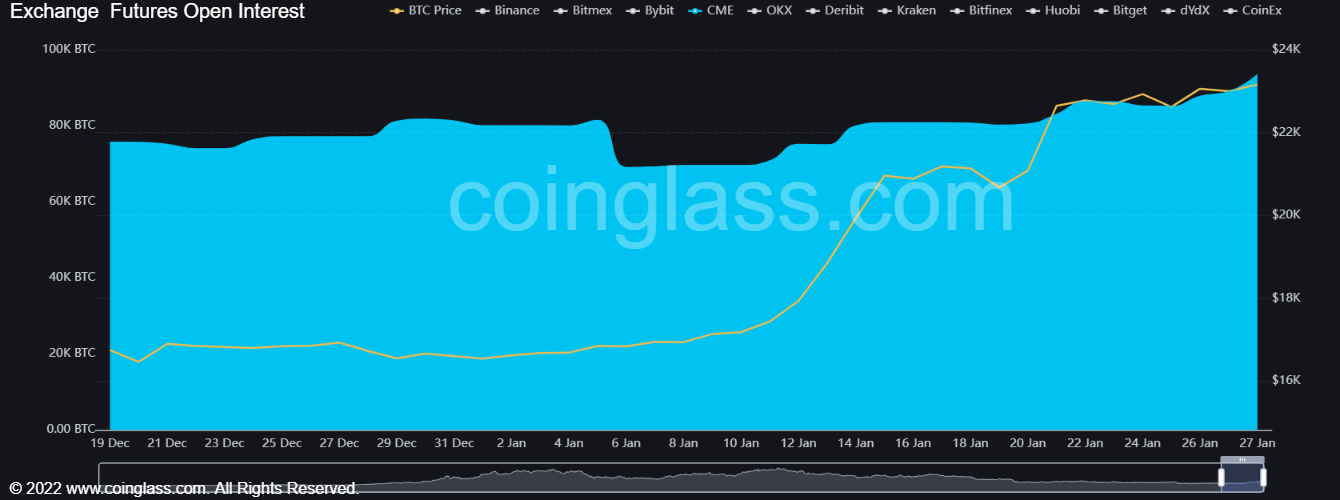

Speaking of derivatives markets, most institutional investors, especially those based in the US, would choose the CME for its crypto derivatives exposure, since it is one of the few officially regulated venues and since most already have accounts there. The BTC futures open interest on the CME has recovered to levels last seen in late November in BTC terms (a more useful measure given the recent price increase), whereas on Binance it is still notably below.

(chart via Coinglass)

This growth has pushed the CME into second place in terms of BTC futures OI – normally it hovers between fourth and sixth. The last time I remember seeing this was

(chart via glassnode)

In sum, there are clear signs of a reawakening of institutional interest in BTC more than in other crypto assets, adding further support to the conclusion that the bottom is behind us.

COLUMN

A Crypto What? – Why Vocabulary Matters

New concepts are complicated enough to talk about without having to struggle with vocabulary. It’s not so much the need to occasionally use arcane terms; it’s also that long-established words can be inadequate and better ones are not yet in circulation. One painful example is a word I need to use several times a day, knowing it is inaccurate.

I’m not talking about the word “crypto”, although I certainly could – it used to refer to cryptography, which is not necessarily blockchain-related. I’m referring to a description of what we are actually doing here.

Those of us that frequently talk about crypto invariably fall back on using the collective term “industry” to include any project building on a blockchain, issuing an asset or helping assets move from one owner to another. But is “industry” correct? I looked up various definitions, and this is what I found.

Investopedia: a group of companies that are related based on their primary business activities.

Collins: all the people and activities involved in making a particular product or providing a particular service.

Vocabulary.com: a group of manufacturers or businesses that produce a particular kind of goods or services.

You get the drift. The most common definitions imply that an industry has a common purpose and is composed of businesses engaged in a similar activity.

Skimming through the main crypto news sites this morning, there are articles about crypto exchanges, NFT platforms, decentralized lenders, game developers, new blockchains, custody services, data storage, asset managers and more. What is the common business activity here?

We could argue that it’s the promotion of blockchain technology. But should the classification of an industry focus on its technology, or its activity? Take the healthcare industry, for example – its common thread is the well-being of people, using whatever technologies it can. Or the insurance industry, whose common purpose is to provide insurance to any kind of entity. An industry united by the desire to promote a new technology rather than satisfy needs doesn’t sound very, well, industrious.

To put it another way, is the tech the “big deal”, or is what it can do more important? Those building will probably argue that the tech is a pretty big deal, and they’re right – but the tech is not going to make much of an impact on the world without use cases. And isolating the technology in its own industry grouping could hamper its impact by creating distance between it and the activities it wants to disrupt.

To be fair, this definition confusion started with the tech industry. This started out grouping companies such as IBM, Oracle and Microsoft that build computers and/or software, and has since expanded to include robotics research, headset manufacturing, payments, video conferencing and mattress retailers.

Extrapolating the pattern, this sounds like a maturity issue. “Tech industry” was fine when the building of the tech was more a focus than its uses, because those were still nascent. But categorization was needed, a mindset was formed, and other companies wanted the “cool” label. The crypto industry is in a similar situation: in the early days, the cryptography and blockchain construction was the priority. Now, however, the focus is also on use cases which complicates the categorization – but habits have been set and labels happily adopted.

This brings us to why categorization matters more than most realize. Industry labels are important because of investment specialization and indices. Just as good venture funds can help projects find synergies with others in different markets, good crypto investors can also lift entire groups through connections and collective learning. And just like the market is overrun with tech ETFs which contain a curious amalgam of business activities, so we will soon have crypto ETFs (based on listed shares but eventually also tokens) that span a range of industries.

We’ll know our category is maturing, though, when the labels blur and possibly even fade away – when we care more about what a project does than how it works. When we see blockchain-based payments companies make it into financial services ETFs. When tokenized shares of Facebook and NVIDIA power a metaverse ETF alongside native tokens such as MANA and SAND.

Labels matter a lot for regulation, too. Law makers seem to understand that they can’t regulate “technology”, but they can make sure that technology companies don’t abuse data and don’t get too big. Yet we see many call for regulation of “crypto” as if it was one activity, without understanding that it is already too sprawling to be regulated comprehensively.

But there is a glimmer of linguistic hope on the horizon. The fact that we even have a “crypto industry” – that it isn’t just lumped into the “tech industry” bucket – is confirmation that what we are working on is truly innovative and unique, as well as a sign that, finally, the tech label is evolving. The same will eventually happen to our area.

And just as technology evolves, maybe vocabulary should also. Maybe it’s time to retire the word “industry”, at least in its application to tech and crypto. It does, after all, conjure up images of manufacturing in physical locations.

So, what then? “Sector” is too broad – it’s currently best applied to economic segments, such as “services sector” or “public sector”. Personally, I prefer “ecosystem” – it sounds more community-driven, less technology-specific and more flexible as to ultimate goals. It feels more encompassing, collaborative and welcoming, even for those who don’t work in blockchain-related projects. “Industry” will no doubt still creep into my writing with frequency as some habits are hard to suppress (and as my inner thesaurus will rebel against repeating “ecosystem” too much). But I’m going to give it a try – after all, the crypto ecosystem deserves better than having to make do with antiquated terminology.

GOOD READS/LISTENS

In this adaptation of their powerful (and longer) newsletter post, N. S. Lyons (not his/her real name) picks apart the Washington DC ideology of purpose, and shines a light on how members of the “establishment” are driven by an adopted story without questioning who that story benefits or whether it makes sense in the arc of history. I found myself thinking of the crypto ecosystem while reading this, and wondering if many of its participants are also blindly parroting a narrative without thinking about consequences and second-order (and third- and fourth-order) effects.

A somewhat distressing and yet enjoyable article from the always charming and insightful Irina Slav (seriously, subscribe to her newsletter for unique and often sardonic insights into global energy trends) – on how we are supposed to start eating insects. I grew up in Zambia, where dried insects were sold by weight in our local market. Still, I think I’ll pass, thank you.

Pippa Malgrem warns us that our fridge is spying on us.

The Economist looks at the struggles of Goldman Sachs to adapt to the changing times. Are its missteps merely examples of legacy finance’s obsolescence? Or are they down to the entitled culture of big money in a gated, opaque world? My takeaway was of an industry ripe for disruption, just like GS disrupted in its day. And the header image – with the legend Goldman Sags – deserves special mention.

Podcast: Preston Pysh talks to Lyn Alden and Alyse Killeen about bitcoin’s evolving technology and use cases, covering the electrification of rural areas, stablecoins on bitcoin, decentralized community custody and more…

Have a good weekend!

This week I have a book recommendation for you: Daniel Yergin’s The New Map. It was published in 2020, and I’m kicking myself for not reading it sooner. Like all of Yergin’s work, it’s extremely well-written, with the additional draw of being oh-so-relevant to the current shifts in today’s geopolitics. He starts with the history of the US shale industry, walks you through the evolving balance of energy production and what that means for political influence, passes through new sources of power (literal and figurative) and ends with an epilogue that brings you up to date with the push to Net Zero and the contradictions that entails. An eye-opening read.