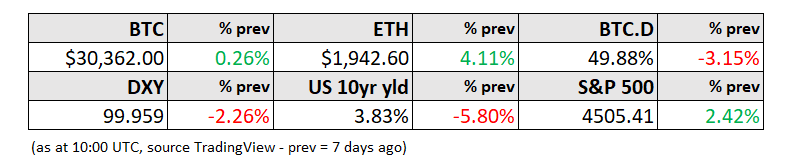

WEEKLY, July 15, 2023

The Ripple impact, correlations, corrections and tailwinds...

Hi everyone! I hope you manage to keep relatively cool this weekend – I’ve been reading about the “heat dome” currently baking the US, and it sounds downright sinister. Here in Europe, we’re grappling with a heat wave named after a three-headed dog, which for some reason gives off less oppressive vibes.

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, pick at established narratives and share listening recommendations. Nothing I say is investment advice!

The Saturday edition is usually a general overview of markets and crypto ecosystem developments that impact macro field. For premium subscribers, Monday-Friday I dive into narratives, developments and theses that sketch out how the two worlds are dancing around and working with each other. If you’re not a subscriber, I do hope you’ll consider becoming one to support my work – it’s only $8/month for now, with a free trial! 😊

Confusing clarity

This week turned out to be a significant yet confusing step forward in the long-awaited regulatory clarity that the US crypto community has been waiting for.

A verdict finally came down in the SEC vs Ripple case, delivering a result that vindicates the argument that tokens are not securities, while limiting distribution channels. Judge Annalisa Torres ruled that XRP that Ripple had distributed directly to the public via a third party platform were not unregistered securities, as the end buyer did not know who the seller was and thus had no direct expectation of profit from the seller. Distribution of XRP to employees was also not deemed a sale of unregistered securities, since there technically was no “sale”. The sale of XRP directly to institutional investors, however, was an unregistered securities offering, and as such broke the law.

This is a very big deal for the crypto industry. It sets a key (but not binding) precedent in future SEC actions, handicapping the regulator’s conviction that all crypto assets other than bitcoin are securities. It delivers a blow to the SEC’s case against Coinbase – if tokens sold in the secondary market are not securities, then Coinbase can’t be accused of selling unregistered securities.

It also turns on its head the assumption that retail investors deserve more protection than institutional investors – in this case, retail investors can purchase XRP on secondary platforms without the token having detailed disclosures, while institutional investors cannot acquire XRP directly from the issuer without it complying with the rules of a registered security.

More importantly, it highlights how clear guidance from Congress is needed. Contrary to what SEC Chair Gary Gensler has been saying, the rules are not clear, and the scope for interpretation is wide. Senators Lummis (R, Wyo) and Gillibrand (D, NY) presented an updated and expanded version of their crypto bill this week which, while unlikely to pass in the next session, could end up being a notable move toward a workable framework.

Another prong of the Ripple decision that adds to the complexity is the ruling that XRP distributed to employees are not registered securities. These were extended in lieu of “payment for services”, and these services were strangely not considered an investment in the project itself, even though the expectation conditions were almost identical to those set by the direct institutional sales.

The ruling does not cover all secondary sales, and the judge clarifies that much depends on token characteristics. But it does position the relationship with the issuer as a key factor. The agreement between an issuer and a purchaser can be an investment contract if there is an explicit understanding between them, but this doesn’t necessarily make the tokens securities in all subsequent transactions. The original Howey case (the standard for securities definitions) supports this – the agreement to earn profits from an orange grove was an investment contract, but the oranges are not securities.

A fascinating twist, one that highlights just how different crypto markets are, is that the security definition hinges on the transmission channel and the recipient, not the actual asset. Yet, unlike oranges, tokens can accrue benefits from the work of the issuing team. An orange is an orange, but a token can evolve. Equities, on the other hand, are declared securities in the original Acts, and so are securities no matter where and why they trade.

This is one of the most exciting aspects of crypto markets, in my opinion. The potential impact of crypto on traditional markets goes way beyond the efficiencies of tokenization – it is more the re-thinking of established principles, the recognition that technology can change the applicability of definitions, and the acceptance that flexibility is a key feature of resilience.

Not yet ready

The initial euphoria after the Ripple verdict didn’t last long. Yesterday evening, BTC turned south, dropping almost 4% in less than three hours.

(chart via TradingView)

This confirms that there is still resistance at $31,000. It almost feels like the market is not yet psychologically ready for that breakout, retreating each time it approaches to the “safer space” of the $30k-$31k band. Confidence builds, however, and despite the possibility that the SEC appeals the decision and draws out the uncertainty for longer, good news does seem to be picking up pace:

Things are not looking bad for Coinbase. This week, both sides had their first opportunity to be heard by the presiding judge, who asked pointed questions about SEC overreach, the conflict in allowing an “illegal” business to list, and the definition of staking services. The Ripple ruling is by no means binding on this case, but the decision that secondary platform sales do not constitute securities is a significant theoretical support, even if it ends up being overturned on appeal. It certainly weakens the SEC’s insistence that Coinbase knew it was breaking the law.

The CEO of BlackRock Larry Fink yet again used his considerable microphone to praise the potential of Bitcoin, stressing its differentiating value and international demand.

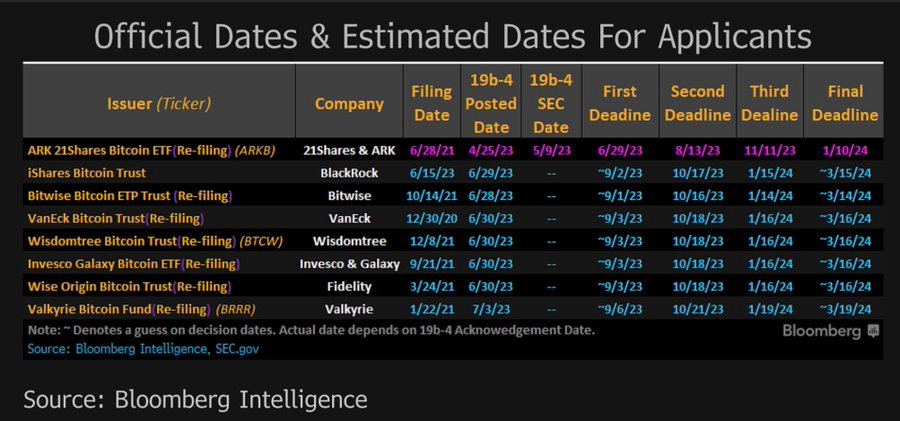

The SEC has now acknowledged most of the current spot BTC ETF filings, starting the countdown clock to a decision.

(via @EricBalchunas)

Congressman Ritchie Torres (D, NY) has requested an investigation into the SEC’s approach to digital assets, accusing the SEC of preferring to rule by enforcement rather than by guidelines – and this from a fellow Democrat.

Long-term BTC holders (defined by glassnode as those that hold for at least 155 days) are still accumulating.

(chart via glassnode)

US-based investors are starting to accumulate again. Over the past year, Asian investors have been steadily accumulating, while US-based investors have been reducing holdings. This turned, however, when BlackRock filed for a spot BTC ETF.

(chart via glassnode)

Bitcoin’s hash rate – an indication of the computing power invested in processing network blocks – reached an all-time high earlier this week (on a 7-day moving average), suggesting growing confidence in the outlook despite the upcoming halving of rewards.

(chart via glassnode)

And BTC’s correlation with stocks seems to have reached local lows, which many take as a support for portfolio diversification or even rotation.

This last one warrants a bit more thought, however.

Is bitcoin “uncorrelated” again?

Correlations are a convenient narrative device that many use to justify price movements and to extrapolate relative performance going forward, with often confusing results.

Yet they are usually misunderstood. For one, correlations are a backward-looking metric, taking average relative performance that can extend over time frames as short as 10 days or as long as a year. Different time frames give different results, and observers tend to choose one that suits their mental models.

Also, “uncorrelated” doesn’t mean what many think it does. It does not imply that price series move inversely to each other. It means that there’s no clear relationship. “Negatively correlated” implies different directions, but this is not necessarily causal. In other words, one series moving in one direction does not necessarily cause the other to move in the opposite one.

And the result can be distorted by the underlying volatility of the two series. Research has shown that high volatility can lead to high correlations, and vice versa. Over the past few months, volatility for both BTC and the S&P 500 has been unusually low.

That said, it’s undeniable that the correlation between BTC and the S&P 500 has dropped from the highs of last year, and in the case of the 30-day correlation, is now negative.

(30-day correlation between BTC and the S&P 500, chart via Coin Metrics)

The 60-day correlation is hovering around zero. The 90-day correlation is the lowest it’s been since mid-2021. You get the picture.

But this does not mean that the two measures are unrelated. It means that they have not been moving much in sync of late, but it does not mean that they won’t start to do so tomorrow, or next month, or anytime narratives once again converge.

The main driver of the drop in BTC-S&P correlations is the dispersion of narratives. Equity markets are currently dominated by large-cap tech plays that are enjoying gusts of AI hype. They are also supported by growing conviction in a soft landing, some positive surprises in earnings reports, and fear of missing out on any rally.

BTC, on the other hand, is seeing signs of a nascent re-awakening of institutional interest, a reminder that use cases are still evolving, evidence of strong support at lower levels, and the inevitable halving approaching in less than a year (which reduces sell pressure). There’s also the growing legal clarity in jurisdictions other than the US, the deepening sophistication of crypto markets in high-inflation countries, and building expectations of a spot BTC ETF in the US in the near future. These are all specific to crypto markets.

The macro narrative for BTC has not gone away, however. It is still a liquidity-sensitive asset, as are long-duration stocks, and both could start to move in tandem when signs become clearer either that liquidity is tightening or that easing is back.

In other words, correlations are currently low, but that does not mean that BTC and equities are no longer connected. It does mean that BTC narratives are marching to a different drummer than equity narratives, for now. Whether or not this continues very much depends on what happens to overall macro sentiment.

HAVE A GREAT WEEKEND!

Your vote is needed. Comedy Pet Photos wants to know which image makes your entire being smile the most, for their annual photography award. The polls are open until August 6th, and the winner will be announced on August 11th.

This is my favourite – encapsulates my mood yesterday:

(photo by Kenichi Morinaga, via My Modern Met)