WEEKLY, July 20, 2024

Closer than we think? || Countdown time for ETH spot ETFs

Hello, everyone, I hope you’re all well!

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of the articles from the week.

If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get ~daily commentaries on the growing overlap between the crypto and macro landscapes, including market narratives, regulatory moves, tokenization trends, adoption news and more. And cool links to relevant podcasts and articles. And music. And my sincere gratitude!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

In this newsletter:

Closer than we think?

Countdown time for ETH spot ETFs

Bob Newhart

Some of the topics discussed this week:

Bitcoin and China’s Plenum

BTC’s narrative

Are crypto VCs necessary?

What happens to crypto if Biden drops out?

Tokenization roundup: a big European bank, ECB trials, tokenization on Bitcoin, “unusual” assets

Markets are turning

Hidden signs of inflation

The difference a second can make

and more…

Closer than we think?

I got a question from a follower this week on X that made me realize I was wrong about something: I had been conflating prediction markets with election polls, and the ~65% lead of Trump on crypto betting site Polymarket cemented a Republican landslide win in my mental roadmap.

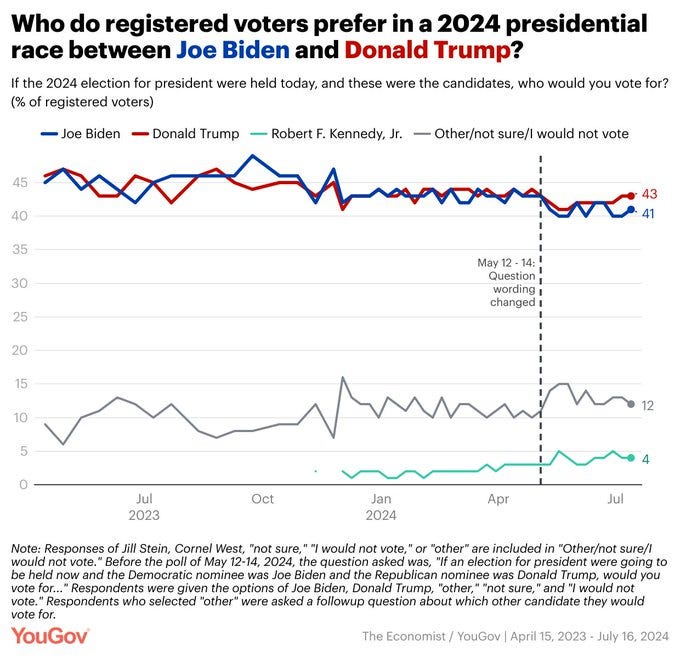

This person (thank you!) pointed out that the margin of error in polls meant it wasn’t a sure thing, and I almost responded with “there’s no margin of error” – only, there is. I looked up the latest YouGov results, and they’re pretty close. What’s more, according to the polling company’s website, 97% of the responses were collected after the assassination attempt on former president Trump.

(chart via @YouGovAmerica)

You’ve probably seen studies showing that prediction markets tend to be more accurate than polls, which is why I was focusing on those – they adjust real-time, they’re more anonymous (less social shame of telling someone what you actually think), and they tend to be based on binary choices (yes/no, win/lose) which clarifies thinking.

But here’s the thing: the questions are very different.

The prediction markets ask “who do you think will win?”.

The polls ask “who will you vote for?”.

That difference is huge as we all know sane, smart people who think Trump will win but are going to vote for Biden anyway. I personally know many who can’t stand what Biden and his cabal have done to the Democratic Party, but just can’t bring themselves to vote for the Republican Party.

So, I am now aware we need to be careful with our assumptions about the outcome. It could still be a landslide, especially if those who would vote Democrat no matter what just end up staying home on election day because why bother. Or, it could end up being close if Biden hands over to someone else. The tone of his defiance and of the people around him has changed over the past few days, especially since his COVID diagnosis.

(As an aside, the reports of his diagnosis were run with a video of the president getting on a plane – if that footage was actually from this week, where was his mask?)

So, how would markets react should the Democrats win?

There could be initial chaos, especially if the result ends up being contested and the validity of the election called into question (we’ve been there before). Markets don’t like chaos, so we could see sharp drops across the board as bond yields climb given the inflationary impact of conflict and tariffs as well as the risk premium, especially if the Fed floods the market again with monetary liquidity to calm things down. Gold would probably be the exception. Crypto would be hard hit given the yanking away of the priced-in hope of a regulatory thaw, and because in a panic anything liquid and/or with “risk” gets dumped.

As things settle down, however, there would probably be a strong recovery rally as the resulting liquidity injections do their usual thing to asset markets, and as allies breathe a sigh of relief that US support perhaps will not be withdrawn after all.

Of course, much depends on what’s going on at the time in China, Japan, Russia, Europe and elsewhere – “America first” sounds great but just does not apply to global markets, and a sharp shift in monetary policy in any large holder of US debt could end up having an outsized impact in macro outlooks.

Much to think about here, and we should think about it – on reflection, celebrating an easy Republican win feels premature. Prediction markets are not the same as election polls, not when politics has become so polarized and so emotional.

Countdown time for ETH spot ETFs

We finally have the fee information for the ETH spot ETFs, which look on track to start trading on Tuesday.

Surprisingly, Grayscale is holding its 2.5% fee for its $ETHE fund, while others are starting with a fee waiver or a <0.25% cost. Given the flood of outflow from the GBTC bitcoin trust when it converted to an ETF, this is a surprising strategy.

The asset manager has been given the green light to list its new mini ETH ETF ($ETH) along with all the others, with a fee waiver for the first $2 billion or the first 6 months (whichever comes sooner), 0.15% thereafter. This new fund will be seeded with 10% of ETH from $ETHE – this essentially means that 10% of any $ETHE holding gets automatically converted (tax-free) into the lower-cost $ETH fund, which will slightly lower the overall fee for $ETHE holders. But not by much – if my math is correct, the average fee will be around 2.27% (after the waiver). And it’s worth noting that the new fund will start off with almost $1 billion in AUM, because of the 10% seed from $ETHE.

So, we will probably see strong outflows from $ETHE because even with the attempt to average down the cost, the difference is huge. The new fund $ETH should do well as it is now offering the lowest fee of the batch (although we could see more revisions as other issuers bring theirs down).

Here's the comparative fee table from Bloomberg analyst James Seyffart:

(table via @JSeyff)

Now, on to ETH’s strange price reaction. You would think that as launch day approaches, we’d see some speculative run-up – but no.

(chart via TradingView)

Indeed, BTC has been slightly outperforming over the past few days, as can be seen in the BTC/ETH ratio.

(chart via TradingView)

Sure, markets are very different than when the BTC spot ETFs launched – but, if anything, the tailwinds are even stronger now. What’s more, the approval of the ETH spot ETFs was much more of a surprise than was that for BTC spot ETFs, so you’d think there’d have been more of a reaction since it was less “priced in”.

Between BlackRock’s filing of its BTC spot ETF proposal (which is when ETF speculation for BTC truly kicked off) on June 15, 2023, and the launch date on January 11, 2024, the price of BTC increased by a whopping 85%.

Between the first signs ETH spot ETFs might get approved (May 20) and today, ETH is up 13%.

(chart via TradingView)

Again, markets have changed a lot since June of last year, but still, that’s a stark difference.

Why ETH ETF?

I’ve written before about how I think the ETH spot ETFs are a bad product in that they don’t distribute staking rewards. Investors can earn ~3.5% more by buying ETH and staking, even via third party platforms.

But that doesn’t mean there will be no demand for the ETH spot ETFs. For one, the regulatory status of staking is unclear for now, as the SEC is sticking to its stance that a staking contract could be a security. So, many investors may prefer to stay away from that additional yield, just in case.

Also, many may prefer the ease of buying an ETH spot ETF via the usual channels – it is a lot simpler than opening a crypto account, buying ETH on an exchange, and then sorting out the staking contract. The loss of staking yield could be seen as a “convenience fee”.

Plus, staked ETH can be a lot less liquid than spot ETH, as requests to unstake get put into the exit queue. For now, this is not an issue as the time to wait for an exit is around one minute, according to validatorqueue.com. But in times of considerable market churn, this could climb, just when holders are in a rush to exit.

And, there are funds that can only hold assets listed on regulated exchanges, which limits their crypto options to the spot ETFs.

So, there is likely to be some demand for the ETH spot ETFs – nothing like with the BTC spot ETFs, but not zero, and it doesn’t feel like this is priced in.

Price reflexivity

There’s another factor to consider: the more activity on the Ethereum blockchain (such as, ETF issuers buying or transferring ETH), the lower the new supply of ETH, adding a further price support.

ETH paid in transaction fees is “burnt”, or permanently eliminated. And if enough transaction fees are paid, the burnt amount can more than offset the new supply created as rewards for validators. For this reason, there have been periods in recent months with a net negative new ETH supply.

(chart via The Block)

So, any activity burst because of the ETF launch could have a positive and recursive effect on the ETH price.

Another factor is the lack of constant miner selling. BTC introduces a steady stream of new supply into the market every day, and given the hit to miner profitability after the network halving which reduced the reward for processing blocks, many miners have been selling what they earn. While BTC sell pressure from miners is variable (it depends on the price and on the overall health of miners), ETH does not have the same type of sell pressure to contend with.

All this highlights how the impact of the ETF is probably not yet priced in. A relevant question is: why not?

It could be because of overall uncertainty, which should soon dissipate as the macro and the election outlooks become clearer – then again, they could become even more confusing. A sobering thought, I know.

HAVE A GREAT WEEKEND!

Old-school comedian Bob Newhart passed away this week. I remember first seeing him with my parents when I was very little, they were huge fans – and then he just got better as we all got older. Somewhere I have an old vinyl of his. I loved his role in “In & Out”, with Kevin Kline and Tom Selleck. I could go on…

Here are a couple of examples of his hilarious talent, which will be missed.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.