Hi everyone! This week reportedly had the highest average global temperature ever, so I hope you’re keeping refreshed as possible wherever you are. Stay safe! In Madrid, where I am, it hasn’t been so bad, but temperatures are expected to climb to record levels next week, accompanied by Saharan dust. Fun. 😰

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, pick at established narratives and share listening recommendations. Nothing I say is investment advice!

The Saturday edition is usually a general overview of markets and crypto ecosystem developments that impact macro field. For premium subscribers, Monday-Friday I dive into narratives, developments and theses that sketch out how the two worlds are dancing around and working with each other. If you’re not a subscriber, I do hope you’ll consider becoming one to support my work – it’s only $8/month for now, with a free trial! 😊

Programming note: I have to skip publication of the daily newsletter on Monday, apologies! Back in your inbox on Tuesday.

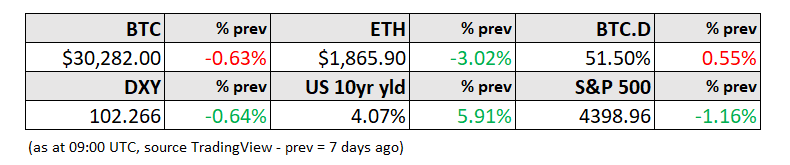

This is still bitcoin’s market

Since September of last year, bitcoin’s dominance (the percentage of total crypto market cap accounted for by bitcoin, measured by the BTC.D index) has risen from a local low of 39% to over 52% at the end of June.

(chart via TradingView)

It has had other climbs before – for instance, as the 2017 bubble unwound and high flyers such as ETH fell by a greater amount than the more “boring” BTC, or in 2019 as the tripling of the BTC price set the stage for the next bull run.

Generally, a meaningful change in bitcoin’s dominance has implied a major market shift is underway.

This can be positive, as BTC starts the momentum for the next swell of inflows – for most new crypto investors (retail or professional), BTC is the “gateway” asset, the one with the highest liquidity and the widest range of on-ramps.

Or, it can be negative, as the market turns and BTC drops by less than higher-risk smaller crypto assets.

The current dominance reset is clearly an example of the former. As in 2019, speculation around the likelihood of a spot ETF approval is yet again putting bitcoin in the mainstream headlines. Unlike 2019, investor understanding of the potential role of bitcoin in portfolios is much better informed, market infrastructure is more sophisticated, and regulation has gained in clarity in most jurisdictions.

BTC is not only the “gateway” into the crypto market for first-time investors – it is also arguably the most “macro” of non-stablecoin crypto assets. Its provable hard cap, global liquidity and multiple use cases, as well as its sensitivity to monetary liquidity, detachment from economic fundamentals and lack of yield, position it as a potential foil for uncertainty, turmoil and geopolitical resets. It’s not so much the potential hedge against inflation and currency debasement that makes it an appealing portfolio diversifier for many (although that, too) – it’s more that bitcoin is not vulnerable to short-term decision making. In an environment awash with short-termism, a long-term asset is likely to take on new sort of protagonism.

Macro on the move

What’s more, the macro landscape sure is giving plenty to chew on.

The short work week in the US delivered a confusing mix of employment data, one of the key macroeconomic variables that informs the Fed’s interest rate strategy.

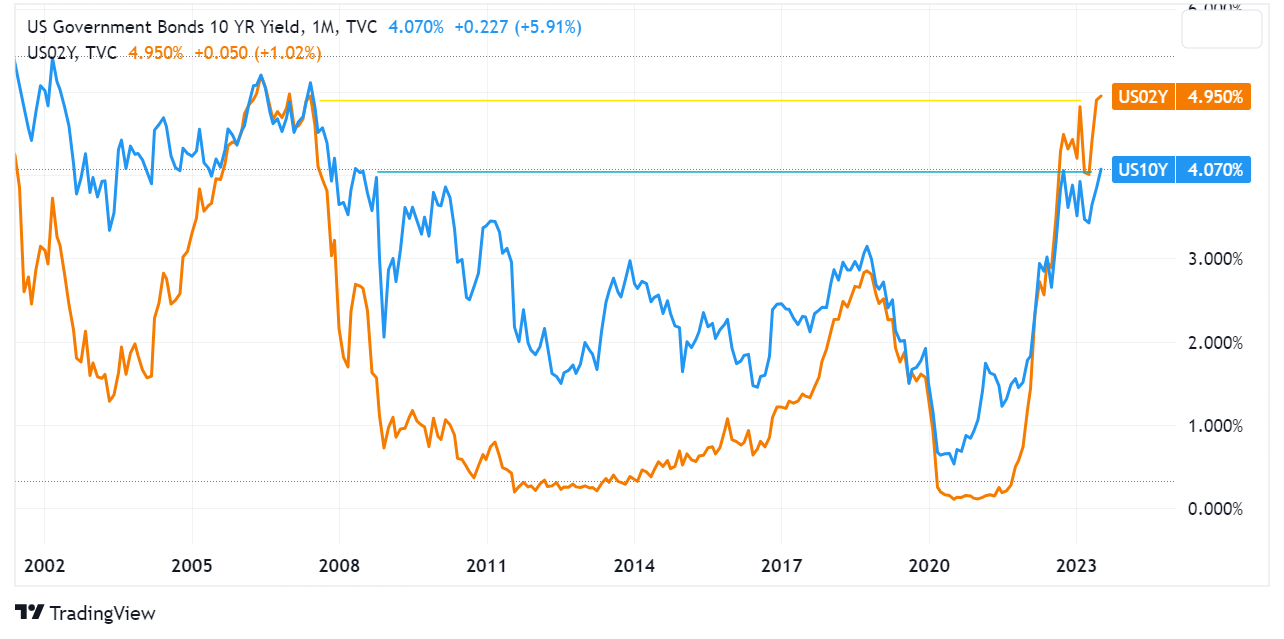

On Thursday, the ADP non-farm payroll read came in more than double consensus forecasts, showing an astonishing increase in employment for the month of June. The shock pushed US treasury yields above 4% across the curve – the last time this happened was briefly in March, as the banking crisis was getting under way, and also in 2007. We know what happened after that.

(chart via TradingView)

Friday’s more official BLS employment survey, on the other hand, was more muted and delivered its first surprise to the downside in over a year. While still relatively strong, the six-month moving average of monthly employment increase is trending down:

(chart via Bloomberg)

This is too slow for the Fed’s comfort, however. What’s more, average hourly earnings increased by more than expected, at an annual rate of 4.35%, well above the 3-3.5% the Fed sees as consistent with its inflation goal. The Fed needs a weaker labour market.

So, another rate hike for this month is now pretty much a sure thing, with an almost 25% probability of another 25bp hike in September.

A key indicator to watch is the MOVE index, which measures US treasury market volatility. It should be low – US treasuries are supposedly the safest assets in the market. And indeed, it has been trending down recently. Thursday’s employment data surprise, however, changed that – the last time it rose by this much in a day was at the onset of the banking crisis in March.

(chart via TradingView)

The strength of the jobs market and the surprising resilience of stock indices are telling the Fed that they have more room to hike further. Since this is their key tool with which to achieve their main objective, it’s reasonable to expect them to use it.

Each hike, however, brings the financial system closer to serious problems. The yield mismatch that triggered March’s bank outflows has not gone away, and while the Fed has shown that it can step in and paper over crises, public confidence is not high – bank shares have not yet recovered from March’s low levels.

(chart via TradingView)

In sum, the strong jobs market gives the Fed leeway to keep on hiking until something breaks. When that happens, markets will be chaotic as the recent FOMO positioning is rapidly unwound. Crypto will get hit if shares drop sharply – but this year so far has shown that there is notable buying support at lower levels, especially given the crypto-specific narratives gaining strength.

Bitcoin wants to what?

One of those narratives is the BlackRock spot BTC ETF filing, which was swiftly followed by others from big legacy names. This week, excitement kicked up a notch when BlackRock CEO Larry Fink spoke about bitcoin on a live TV interview.

With all due respect to Larry Fink (he didn’t get to where he is by not being smart and by not working hard), his bitcoin take is worrying. It’s influential, sure, but it’s narrow and largely incorrect.

I didn’t hear his interview, so my reaction is based on media reports, which means there could be nuance that I’m missing. But here are some objections:

“We do believe that if we can create more tokenization of assets and securities – that’s what bitcoin is – it could revolutionize finance.” (CoinDesk)

What? Bitcoin is not about the tokenization of assets and securities. It would make a terrible security tokenization platform. And, no, Bitcoin is not about to “revolutionize” finance (that term is so often overused) – it represents an alternative to traditional finance, not its replacement. The world needs a viable alternative, to empower those denied access and to enable anyone, anywhere greater agency over their savings and interactions. If Bitcoin were one day to become the system, another alternative would be needed.

"What we're trying to do with crypto is make it more democratized and make it much cheaper for investors." (The Block)

By centralizing access? By accumulating a meaningful amount of outstanding BTC? By controlling users’ custody? Yes, I know that many investors would prefer a firm such as BlackRock to handle all the hassle of acquiring and storing bitcoin – but it’s not democratizing anything.

And he still maintains (Bloomberg) that bitcoin initially was used “heavily used for, let’s say, illicit activities”. Used, yes, but “heavily”? Much, much less so than fiat, which he has no problem with. Both research and practical experience show that bitcoin is a really terrible tool for “illicit activities”.

“I do believe the role of crypto is digitalizing gold, in many ways.” (Decrypt)

Here he seems to be conflating bitcoin and “crypto” – they are very much not the same thing at all. And even if we do him a favour and swap out the terms, I take issue with “the” role of bitcoin being that of digitalizing gold, which implies it doesn’t have any other roles. It can represent a digital form of gold, sure – but bitcoin goes further by actually having a hard cap (gold doesn’t) and a transparent, verifiable supply (gold doesn’t). Bitcoin has some functional flexibility (gold, not so much). Bitcoin is evolving (gold isn’t). Bitcoin can be seen as a digital version of gold, but it is much more than that.

"[Bitcoin] can represent an asset that people can play as an alternative." (CoinTelegraph)

This implies that he only sees Bitcoin as a speculative vehicle. True, he is in the asset management business, which explains his particular lens. But he fails to grasp that Bitcoin is more than that – for many, it is about number-go-up, and there’s nothing wrong with that. But for others, it is a lifeline, an alternative, a gateway to financial independence.

“Let’s be clear—Bitcoin is an international asset.” (Decrypt)

Ok, this one I agree with. Finally.

All that said, the publicity is good. It’s not quite as validating as when Paul Tudor Jones came out in favour of bitcoin back in 2020 – he sounded like he had done serious homework and had conviction. But Larry Fink is Larry Fink, and BlackRock’s BTC spot ETF filing has pushed the ecosystem closer than ever before to getting a listed vehicle approved for trading in the US. Let’s just take a second before we celebrate just how much he doesn’t understand what he’s promoting.

HAVE A GREAT WEEKEND!

A snapshot from history: This video of Nancy Sinatra’s appearance on the Ed Sullivan Show in 1966 is not just about the awesome song – it’s also for the outstanding outfits and the dance moves. Simpler times, but colourful.

Hello Noelle

Truth: the fact that Larry Fink finks that Bitcoin can replace gold is already a huge win ... we will take that !!!