WEEKLY, June 10, 2023

Crypto drama, law suits, portfolio dumps, and more...

Hi everyone! What a week… I hope those of you in the northeast US can breathe again, and that all of you get to enjoy a beautiful weekend, wherever you are.

You’re reading the free weekly Crypto is Macro Now email, where I look at the intersection between the crypto and macro landscapes, pick at established narratives and share listening recommendations. Nothing I say is investment advice!

If you’re a premium subscriber, much of what I write about here you’ll have already seen in the daily emails, so feel free to skip. And if you’re NOT a premium subscriber, I hope you’ll consider becoming one to support my work and to get a frequent update on how crypto is influencing the macro landscape, and vice versa. You’ll get more in-depth and up-to-date market commentary, a daily big picture look at the broader trends influencing crypto adoption, links to interesting articles and podcasts, cute stick figures on charts (when time allows), sometimes a fun video, and always a shared enthusiasm for how the crypto industry is no longer a niche topic that appeals to a limited audience.

MARKETS

Whoa what happened

After a brief spike in volatility when the back-to-back SEC suits against Binance and Coinbase dropped, BTC had settled back into its now-familiar pattern of sideways trading on low volume. Until this morning, anyway.

(chart via TradingView)

I had written a few paragraphs earlier today on how remarkable BTC’s resilience was in the face of what looks at first to be very bad news for the market, which I was about to erase upon seeing the price movement this morning (note to self: it’s not worth getting up early to do price commentary). But, on reflection, the observations still hold.

Before we get to those, what could have caused the drop? At just after 4am UTC, BTC fell almost 2% in 10 minutes and would drift down another 1% over the next couple of hours. Smaller-cap tokens such as ADA, SOL and MATIC are down more than 20% over the past 24 hours.

(chart via TradingView)

Twitter started mumbling about a $2bn portfolio dump, and at around 7am UTC, a tweet from Scimitar Capital – a “crypto proprietary trading firm” according to its bio – confirmed that it was liquidating its crypto holdings.

This feels off, though. First, a $2 billion dump would probably drive altcoins down by more than 20%, given how thin the market is and how there are not going to be a lot of buyers in size at this stage in the narrative.

Second, most people I talk to have not heard of Scimitar Capital. Its Twitter account was created in March, and its first and only tweet so far was today – this is very unusual for a crypto fund.

Third, one of the founders of Scimitar Capital appears to be the Twitter account @thiccythot_ (according to an interview he gave last week), who has been active on Twitter since 2021. This morning he tweeted a “rumour” that Scimitar (his fund) was behind the dump, he then retweeted the Scimitar tweet saying that the fund appears to have confirmed the rumour (even though it’s his fund), and he shared a screenshot of a fake Financial Times article about the liquidation. The article looks real at first glance, but the text doesn’t make sense, and it turns out to be a word-for-word copy of the Financial Times’ Three Arrows Capital report from last year, with the fund name, liquidator and date switched. All very weird.

If Scimitar isn’t liquidating, then I have no idea what they’re up to with this very strange communication strategy. If it is, well, ditto. The disconnects suggest that there may be another cause for the drop – perhaps another fund or large holder is exiting, or perhaps it’s an attempt to drive prices down to cover shorts or close derivative positions. Early Saturday morning UTC time is not a good time to exit unless you want to really move the price.

Today’s move is not good news, and not just because of the lower prices. It reminds investors how thin the market currently is, and how prices could be manipulated. According to data from The Block, in May exchange volumes had their weakest month since October 2020.

(chart via The Block)

On the other hand, thin volumes and sharp drops present strong accumulation opportunities. The rapid levelling-off of price movements suggests that the damage is done and limited (always risky to say that, I know), and we could soon see a bounce, at least in some of the larger names less impacted by the regulatory uncertainty.

Not that fussed

Now, on to what I was going to say today, before this morning’s drama.

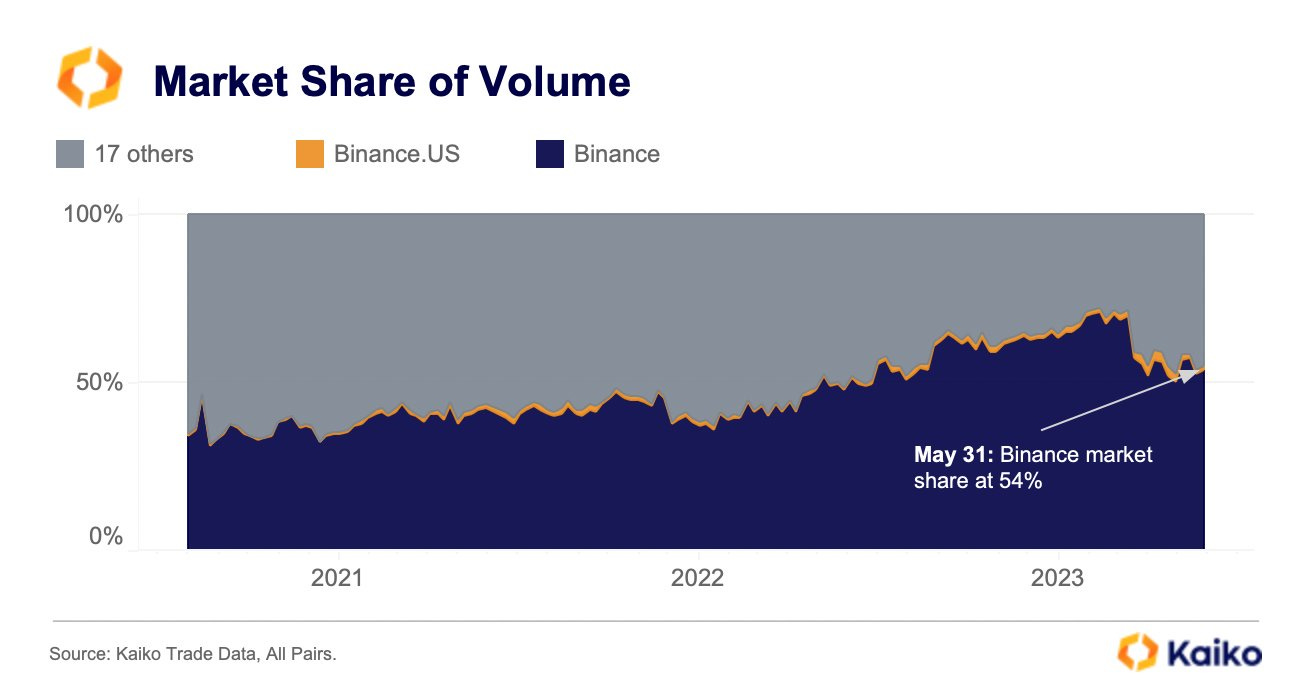

I was going to point out that it was quite surprising that BTC and ETH didn’t fall further on Monday’s news that the SEC was suing Binance, Binance.US and their founder CZ. Binance is the largest crypto exchange in the market, ranked by trading volume (although evidence presented in the suit has cast doubts as to how inflated that volume may be).

(chart via Kaiko Research)

The business does have significant problems. In March, the CFTC sued Binance on allegations the company knowingly offered unregistered crypto derivatives products in the US. It has been accused by senators on both sides of the aisle of being a “hotbed of illegal financial activity”. It has been shown to have lax accounting controls and has acknowledged flaws in stablecoin backing. And, more importantly, the SEC charges are really serious. This is “regulation by enforcement” in the determination of which crypto assets are securities; but the allegations of misuse of customer funds and intentional avoidance of US law (with texts from Binance executives to back this up) are not to be underestimated.

This triggered some concern that this might be curtains for Binance, which would indeed be very, very bad news for the global crypto market, up there with the FTX implosion (minus the emotional shock). But this is unlikely.

Binance will probably end up retreating from the US market. This was pretty much on the cards anyway – last month it pulled out of Canada, citing regulatory tensions, so it was pretty obvious that the US was next. This should not impact its operations elsewhere. For many emerging markets around the world, Binance is the preferred venue. It is licensed in seven European countries, and has active operations across Asia, with a licensed Japan entity supposedly launching later this year.

We could also see a change of leadership. CZ himself has some tough legal battles ahead, and could decide to step down. Last week, we heard that he had promoted Richard Teng to Head of Regional Markets, an expansion of his previous role leading Asia, Europe, Middle East and North Africa (to which he had been promoted just a month ago). He brings serious regulatory chops to the table, having served in official roles in Singapore and Abu Dhabi. In what would be one of the most rapid ascensions ever, he could be Binance’s next CEO.

After an initial drop, the BTC price bounced along within a relatively tight range during Asian and European trading hours, showing that, outside of the US, investors don’t really care much about the SEC suit.

(chart via TradingView)

Then came the Coinbase news.

Silver linings

On Tuesday, news dropped of the SEC’s suit against Coinbase. I am perplexed as to why the SEC decided to go for both at the same time, possibly diluting rather than amplifying the PR impact, and stretching SEC resources probably more than it currently expects.

Anyway, the two suits are very different. While the Binance suit contains allegations of fraud, the Coinbase suit is entirely based on interpretation of US securities laws.

The market reacted with relief and a BTC price bounce.

(chart via TradingView)

This chart says “ok, Binance.US is probably toast and the resulting loss of liquidity isn’t great”. It also says “that’s all you got against Coinbase? bring it on!”.

The Coinbase suit is not a sure win for the SEC, far from it. The suit accuses Coinbase of knowingly breaking the law, which will be hard to prove given the team’s public efforts to engage in dialogue with the SEC. And it’s likely that a court will find that securities law is less clear than Gensler seems to think it is. It’s also possible that a court may bristle at what looks like overreach, and potential violations of due process. For instance, a big chunk of the suit is taken up with detailed explanations as to why certain assets are securities, in the eyes of the SEC. With this, the SEC is indirectly accusing the issuers of breaking the law, but the issuers have not been given a chance to defend themselves.

There are also some issues that strike at the heart of crypto market structure: for instance, Coinbase’s self-hosted wallet is accused of being an unregistered broker. This is precedent-setting, and could be hard to win since it ignores the basic premise of self-hosted wallets, that the user and not the wallet issuer is in control. The fight against individual agency and independence is usually a tough one since it touches on liberties and invariably ends up in the political realm.

Other factors stacking up against the SEC’s case:

Gensler has in the recent past publicly said that the SEC does not have the authority to regulate crypto. He has since contradicted this, but it does speak to a potential wedge to lean on.

In 2020, the SEC approved Coinbase’s business for listing on Nasdaq – in other words, the agency allowed retail investors to buy shares in a company that was, in its own words, breaking the law.

Even in the worst-case scenario, the regulatory clarity that market participants have been asking for is finally incoming.

None of this means that Coinbase will emerge unscathed. It could end up having to (or pre-emptively deciding to) close down staking in the US, especially after several states are now accusing Coinbase of violating state securities laws with the program. In the first quarter of this year, staking accounted for less than 10% of Coinbase revenue, and not all of that would disappear since staking is also available in other countries that are not showing signs of following the US lead.

There will probably also be some hefty fines involved. Times are tough for crypto exchanges right now, but at the end of Q1, Coinbase had $5 billion in cash and could probably raise more debt, especially since its bonds are now yielding 10 percentage points above Treasuries.

And meanwhile, investors could leave the platform and/or stay away from the crypto market altogether. That would not be great for Coinbase earnings, nor would it be good for crypto prices. Volumes have been painfully low for the quarter so far, signalling a lack of institutional and retail interest, with little on the short-term horizon to turn that around.

So, in sum, these back-to-back actions by the SEC are not good news for the market in the short term. There will probably be a further hit to liquidity as market makers and traders back away from Binance.US, and uncertainty around the Coinbase case could dampen volumes and dissuade market participation.

But they are good news longer-term. The Binance suit will go a long way toward clearing up a murky corner of the market, and the Coinbase suit will finally deliver at least some of the regulatory clarity service providers and institutional investors have been clamouring for.

The waiting game

Until this morning, the silver lining was supported by the range-bound trading since Wednesday’s recovery. It is still supported by what looks like a tentative recovery since today’s leg down.

(chart via TradingView)

You would think, with such a sharp regulatory sword hanging over two of the market’s largest exchanges, that the price would still be heading lower. After all, it does look like the SEC is trying to “close down” the crypto market, and while crypto could of course continue unimpeded elsewhere, the US does have the largest financial market in the world and a very large potential investor base. The crypto market would be much thinner without it.

So, why isn’t BTC heading lower?

1) In part, it’s because there are not that many motivated sellers at the moment. With traditional markets still relatively buoyant, there is no rush to raise cash.

Also, the low volumes and volatility over the past few months suggest that accumulation has been steady – not the behaviour of exit-quick speculators. On-chain data shows that the amount of BTC held in addresses without moving for at least a year is at an all-time high of 68%, and this figure is probably understated given the custody shuffling by long-term holders in recent months.

(chart via glassnode)

The amount of BTC held without moving for over three years is at a record 40% (again, probably understated), when these holders could easily sell at today’s prices to lock in a handsome profit. Crypto data firm glassnode calculates that 7.5% of circulating supply is probably lost and unspendable, but even so, longer-term holders dominate the BTC investor base.

(chart via glassnode)

Obviously, this doesn’t mean that BTC can’t go lower – it certainly can, especially if the stock market starts to sell off, and we could see some crypto fund liquidations in coming weeks unless things pick up. There are no obvious catalysts ahead to trigger strong institutional inflows.

If China eases monetary policy next week, that could see an Asia-based move into risk assets, including crypto. But in the US, investors are playing a waiting game. Accumulation will continue, but probably not with sufficient volume to ensure sharp moves up just yet. This will eventually come, and just as moves down can be sharp on low volume, so can moves up, triggering a FOMO scramble – there will be more upside pressure when the market turns than there will be downward pressure in the meantime. No-one knows when that turn will come, however, and a lot can happen in the meantime.

Have a great weekend!

Today I want to share with you an artist I’ve been listening to a lot this week: Geoffrey Oryema. Born in Uganda, the son of a cabinet minister in Idi Amin’s government, he was smuggled out of the country after his father’s murder and took up residence in Paris. He has worked with many greats, such as Peter Gabriel, Sting and Tracy Chapman, but my favourite of his albums is his first: Exile.

Soulful and chill, it rings with a timeless sadness and acceptance that sounds both haunting and hopeful. If you ever get the chance to listen to this on a balcony while looking at the moon, I challenge you to not get a lump in your throat.