Hi everyone! I hope you’re all doing well!

You’re reading the free weekly version of Crypto is Macro Now, where I reshare/update a couple of the articles from the week.

If you’re a premium subscriber, you’ve probably already read them, so feel free to scroll all the way down for some non-crypto links. If you’re not a premium subscriber, I do hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links. And there’s a free trial!

Feel free to share this with friends and family, and if you like this newsletter, do please hit the ❤ button at the bottom.

Some personal/professional news!

I’ve joined forces with two other tradfi/crypto veterans to form Triple Crown Digital, a digital asset advisory that helps founders, startups and step-ups with their go-to-market, liquidity and messaging strategies. Many of you may already know my partners Bea O’Carroll and Christine Sandler, two of the most accomplished, motivated, empathetic and trustworthy people in our industry – it’s an honour to call them colleagues and friends. If you’d like to find out more, feel free to reach out via our website or to any of us on LinkedIn.

Of course I plan to continue with this newsletter! So far, our work at Triple Crown Digital is deepening my insight into actual application building and market integration, and I’m excited about sharing some of that with you. And you can thank Christine and Bea for this newsletter getting published by 8:30amET every day 😋 – long-time readers will remember that it used to sometimes (cough, often) be quite a bit later.

In this newsletter:

Bitcoin as a technology play

Observations from the tradfi trenches

Coinbase smart wallets: a new type of identity?

Some of the topics discussed this week:

Tokenizing violins – why?

Cross-border retail CBDC complications

Early days, big steps: cross-border trade and settlement - mBridge, Rialto and Agorá

ETH ETFs and ETH supply

Democracy at work

A CPI windfall

Economic jitters

The message from India

Conflicting jobs data – does it matter?

If only things didn’t need to be shipped

… and more!

Bitcoin as a technology play

As if the narratives supporting bitcoin’s price movements weren’t complicated enough (is it a macro asset? is it a store of value?), another one is emerging as a meaningful force: Bitcoin as an emerging technology.

Of course, we all know that Bitcoin is a technology, a radically innovative one at that. But it’s assumed to be boring, inert, unchangeable. After all, one of its security characteristics is that Bitcoin doesn’t change.

Only, that’s not really true. The underlying code may be thoroughly baked by now, well-tested, resilient and much scrutinized. But the application of that code is evolving.

This is especially intriguing since we, collectively, are bad at seeing what new technologies will be used for. We didn’t get the potential of the internet in its early days. The same with GPS, the phonograph, and many other inventions. It would be naïve to think that we clearly see what Bitcoin will become.

You may remember the spurt of network activity earlier this year as a new type of transaction became popular. “Ordinals” assign a unique identifier to each satoshi (the smallest recognized unit of a bitcoin, with 1 BTC comprising 100 million satoshis), opening up the network’s use cases to include NFTs, provenance and other functions requiring the removal of fungibility.

According to CryptoSlam.io, Bitcoin is now the second largest NFT blockchain with seven-day trading volume really close to that on Ethereum.

(table via CryptoSlam.io)

Then, with the halving, came Runes, a protocol that enables smart contracts and token issuance on the Bitcoin network.

The below chart shows the impact on Bitcoin transaction fees from the initial interest in each new application.

(chart via The Block Data)

While user interest may be softening, venture capital interest does not seem to be. Last month, The Block reported that there were roughly 90 bitcoin-related venture deals so far this year, more than in any other single year in Bitcoin’s history. And skimming headlines, it’s not hard to see that conviction in Bitcoin’s technological evolution is climbing.

Just some of the deals that caught my eye from the past month alone:

Bitcoin staking project Babylon (which offers BTC as a staking asset for proof-of-stake chains) raised $70 million in a round led by Paradigm.

Bitcoin development startup Botanix Labs raised $8.5 million from Polychain Capital and others to build a Bitcoin-native DeFi ecosystem and layer-2 with Ethereum Virtual Machine compatibility.

Bitcoin lending protocol Zest raised $3.5 million from Tim Draper and others.

And Bitcoin-native application platform Arch raised $7 million led by Multicoin Capital, known for its focus on the Ethereum ecosystem. According to Arch’s CEO, quoted in Bloomberg, around 20 developer teams are building Bitcoin-based defi apps.

These projects don’t plan to change Bitcoin’s code – that would require network consensus, notoriously difficult to achieve (as it should be). All hope to add new functionality to the network’s security. And all aim to broaden the number of users, increasing demand for BTC. This will be good for the network, beyond any direct BTC price effects.

Greater BTC activity in coming years should boost fees, necessary for the health of the network as miner rewards get slashed in halving events every four years. Users will have potential respite from high fees for small transactions with the continued development of Bitcoin layer-2s.

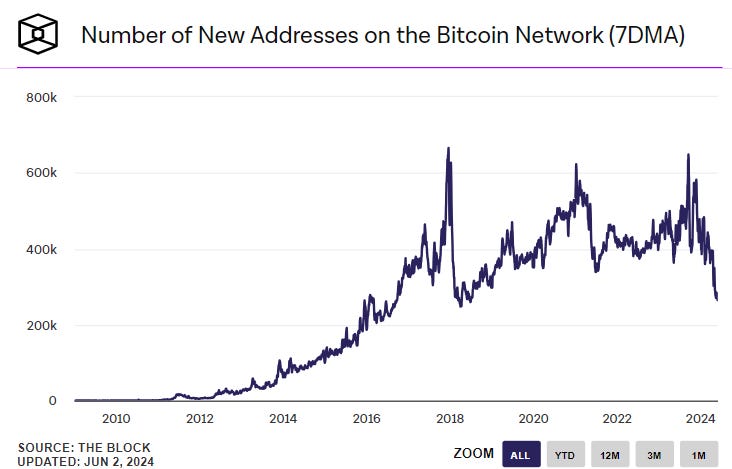

And a greater diversity among users will boost network growth. Recently, this has slowed, as measured by the daily number of new addresses, with May adding the lowest number of new addresses since 2018.

(chart via The Block Data)

Some of this could be attributed to the launch of ETFs, with retail investors preferring convenient centralized onramps to having to set up their own BTC wallet. But should new types of BTC applications become popular, the consolidation trend is likely to reverse.

This could trigger the power of network effects, with each additional user multiplying the number of potential connections as well as the aggregate value of the network.

Tech investors get this: early investment in a network that ends up getting traction can generate significant wealth. Only, that kind of opportunity is generally limited to venture capitalists and other accredited investors – in other words, those who are already wealthy. With Bitcoin (and other crypto assets), anyone in the world can participate in its network growth.

What’s more, they can do this while holding a dilution-proof store of value. Or, if so inclined, benefit from the tailwind of macro liquidity easing.

The range of choice of Bitcoin narratives is confusing, and could put off many investors who just want an early stage tech investment, or digital gold, or a macro risk-on asset – not all three at the same time.

But those who recognize that we don’t yet know what Bitcoin’s main narrative will be 10 years from now will appreciate the flexibility.

Observations from the tradfi trenches

Earlier this week I spent a couple of days in Warsaw hanging out with capital markets institutions at the annual conference of the post-trade association The Network Forum. I was on a panel with Ben Duve from the European Central Bank, Jennie Baisch from Swift, Peter Hubli from the Zurich Cantonal Bank (head of CBDC settlement trial Project Helvetia), moderated by Martin Lawrence of The ValueExchange.

The topic was, of course, CBDCs and tokenization, and one of the main themes was how “things” have changed over the past few years. Some argued that they haven’t really changed much: we are still far from actual adoption of tokenized assets, there are some live issuances but they’re sporadic and small, and the large institutions are sniffing around but have yet to dive into tokenization with enthusiasm. I counter-argued that the main positive change was the waning of enthusiasm coupled with an increase in conviction. Let me explain.

I’ve lost count of the number of conferences I’ve been to over the years in which entrepreneurs breathlessly proclaimed that “everything will be tokenized!”. The assumption was that the advantages of speed, fractionalization and transparency would attract issuers and buyers in such overwhelming numbers that regulators and traditional market infrastructure would have no choice but to get on board and adapt.

This assumption always showed a lack of understanding of how finance works. The conferences would be crowded with builders excited about “revolutionizing” markets, and with banks interested in new revenue streams; but there was usually no-one from the buy-side or the regulatory world. Sell-side and infrastructure aren’t going to invest significant economic or social capital in building or issuing without concrete signs of demand, and buy-side institutions aren’t going to provide the demand in size without regulatory clarity.

That dynamic has changed: there are signs of institutional demand, and there is movement on the institutional infrastructure build. Central banks around the world are experimenting with different forms of tokenized money, a key component of a regulated blockchain-based market (focusing on wholesale transactions, not the same as retail!). Commercial banks are participating, as are global institutions and large money managers. The “suits” are definitely at the table.

But the hype has died down. Those who like shiny new things have moved to the AI sector. Those who want to “revolutionize” are touting the productivity gains of large language models. Those who want to raise lots of money are using different buzzwords.

Those who care about improving capital market efficiency and access have stayed, because they believe blockchain technology can help markets evolve and they want to figure out how. Those who have stayed are not just interested in the quick profits and the innovation glory – they want to make a difference.

Personally, I much prefer this mood. It’s less buzzy and less hip but just as interesting, perhaps even more so as now it is getting real. Now, we have new types of “money” entering the market, from systemic institutions (such as the stablecoin work from SocGen, Nomura, JPMorgan and others). BlackRock has tokenized a money market fund. Franklin Templeton allows payment for their tokenized fund in stablecoins. The BIS is coordinating a long list of trials to test how tokenized money and securities can interact. I could go on, because the list of interesting projects and experimentation is long.

What’s more, institutions pushing blockchain trials now have to justify the benefits. No longer are digital asset teams getting large budgets just so a bank or market infrastructure provider can appear “innovative”. Now, they need a potentially viable use case.

Startups are feeling similar constraints. The “easy money” has pivoted to AI, making it harder for digital asset projects to raise. That’s how it should be, though – ideas deserve pushback and debate before attracting funding, which suggests that the success rate for those that do secure rounds will be higher.

Other observations from the event:

“Technology” is still thrown around as a misunderstood buzzword, usually in the context of “banks have to use technology to stay relevant” which makes me wonder what people think banks have been using all along.

Current trials are more about design questions and legal contracts than about the underlying technology. No more proof-of-concepts, now we’re on to full trials with a network of participants.

We’re a long, long way from widespread adoption on tokenized securities.

Money market funds are the “low-hanging fruit”. Tokenized bonds will come next, tokenized equities some time after that. Regulators and issuers want to walk before they can run.

Absolutely no-one talked about tokenized commodities.

Blockchain trials now require a solid business use case – the “why” is more important than the “how”.

Some questioned whether the colossal cost of changing the way market infrastructure operates was worth it.

In my panel’s question session, an audience member suggested that we were painting a bleak picture of the digital assets industry, that “traditional finance had won”. I pushed back on this, as what we were saying was not that legacy institutions were no longer interested in blockchains; rather, blockchains were now practical tools rather than a hot new technology.

Then again, I didn’t hear any institution say that digital assets were a “key pillar” of their growth strategy – it’s too early for that, and there are still so many unknowns (infrastructure, regulation, etc.). But the vast majority do have digital asset projects under way, run by knowledgeable and enthusiastic people who see the advantages and are willing to work within the system to move adoption forward. Meanwhile, the non-institutional digital asset space continues to evolve, education is spreading, new onramps are emerging. Digital assets are not only still here; they are part of the exploration of capital market infrastructure evolution happening at the highest levels. Given that the move to a more efficient market is a marathon not a sprint, I’d say digital assets have won.

Coinbase smart wallets: a new type of identity?

Crypto may offer financial independence for millions around the world, but this is likely to remain elusive as long as users have to worry about self custody, which even today is complex and daunting even for crypto natives such as myself.

Last week, Coinbase launched a “smart wallet” that perhaps signals a type of solution, while suggesting a path toward a much bigger online concept: that of identity.

A smart wallet is essentially a smart contract that can reflect balances and interact with apps but that does not require a unique recovery phrase. It uses “passkey” authentication technology, which stores a key on a user’s device, avoiding the need to share it with third parties (like when you use a fingerprint to authenticate an action on your phone). This key is used to sign smart contract transactions, such as sending tokens to an application.

I’m not going to pretend to fully understand how the cryptography works, nor how cloud backups can mitigate the risk of losing your passkey device. What interests me is the usability, and where this could go.

For now, it seems to give a glimpse of how online identity could evolve. It’s not a huge stretch to imagine smart wallets holding key identification data, such as accredited investor status, an NFT holding, age verification, etc., each of which could automatically grant access to certain apps and smart contract privileges. Imagine DeFi services handling the KYC part at the wallet level rather than the app level. This could become especially interesting as the range of acceptable “devices” evolves in coming years to include wearables such as watches, rings, maybe glasses.

Another intriguing usability feature of Coinbase’s smart wallet is the option of sponsoring fees. Coinbase and other validators can offer to cover a user’s transaction fees through their sequencing revenue or other income, essentially making certain applications fee-free for users. This could overcome the impracticality of some gaming apps, for instance, where each on-chain movement requires payment of a transaction fee. Users will not want to have to pay a fee each time they “like” a comment on a blockchain-based social platform. Fee-free transactions could unlock new types of on-chain experiences.

HAVE A GREAT WEEKEND!

Scotland lost to Germany in the Euros yesterday. I am sad about this. No offense at all meant to my German readers, but I have a soft spot for Scotland, not just because my ancestors are from there and I’ve had some of the best vacations of my life in the Highlands, but also because my daughter is an Edinburgh resident.

All that may go some way toward explaining how much I love this Scottish Euros video – catchy, hilarious, fun, unpretentious and self-deprecating, much like the Scottish themselves.

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.